Analysis: How does the value chain of the blockchain industry work?

Over the past few years, blockchain technology has evolved from a purely technology to a multi-billion dollar industry. However, we do not understand who plays the role in the blockchain industry. And how do they create value? When looking at value alone, there are still many people who want to know how many services in the blockchain industry can benefit from decentralization.

. . .

The blockchain industry still lacks a clear framework for understanding how blockchain technology can be adopted by users (people think this is the most important goal in blockchain technology). The lack of a common framework for understanding the market can lead to public confusion and serious information asymmetry between professionals and non-industry professionals in the industry. This is also the problem that blockchain technology most wants to solve. This also lays the foundation for finding answers to some questions. For example, why do the participants in the blockchain industry maintain their own interests while claiming that they are using decentralized services to earn less than before?

- The most commonly used cryptocurrency in the world is not bitcoin?

- Strong supervision is coming? UK FCA will review 87 companies related to cryptocurrency

- Read the role and development direction of aggregation applications in DeFi

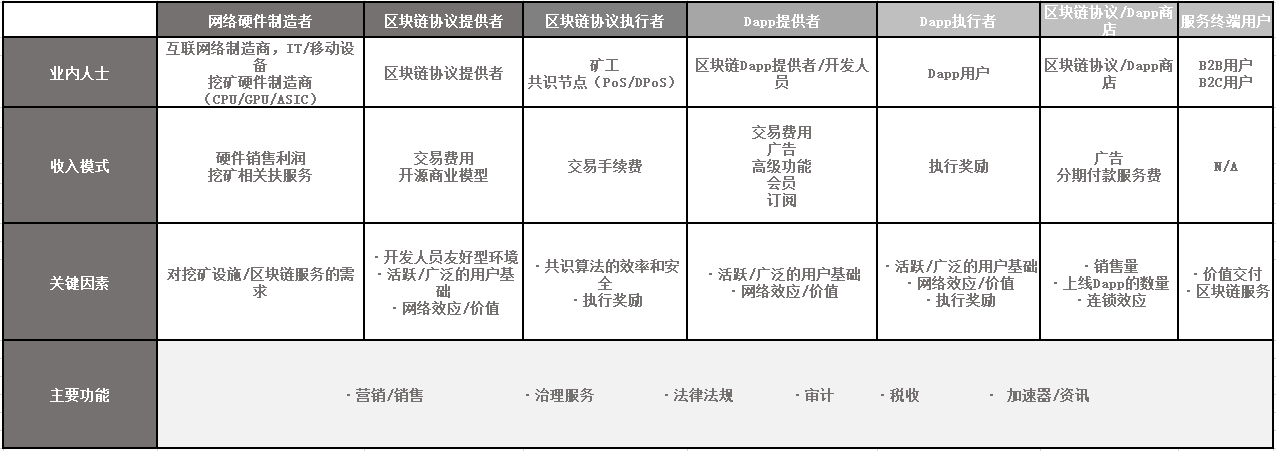

This research report aims to address the lack of consensus on the way the blockchain industry value chain operates. This report consists of three parts: 1. Industry segmentation; 2. Blockchain industry value chain; 3. Conclusion. The second chapter is the focus of this report. It analyzes the industry value chain in detail, and summarizes the industry participants, income model, key success factors and key functions of each stage of the value chain.

1. Blockchain industry segmentation

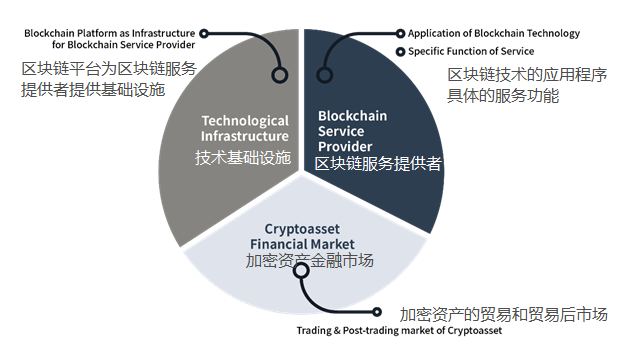

Since the industry of blockchain technology is not yet fully mature, the rules for segmenting industries must be determined. Market segmentation provides a way to determine the direction of the market. The blockchain industry can be broadly divided into three categories: technology infrastructure, blockchain service providers, and crypto asset financial markets. The above picture briefly summarizes the industry breakdown.

Since the industry of blockchain technology is not yet fully mature, the rules for segmenting industries must be determined. Market segmentation provides a way to determine the direction of the market. The blockchain industry can be broadly divided into three categories: technology infrastructure, blockchain service providers, and crypto asset financial markets. The above picture briefly summarizes the industry breakdown.

2. The value chain of the blockchain industry

Why is the value chain of the blockchain industry important? According to a recent survey, global companies believe that "new business models and value chains will be the biggest advantage of blockchains over existing systems." The diagram below outlines the process by which products flow from the value chain, showing the value-added flows within the blockchain infrastructure and service markets. The value chain consists of four distinct components: hardware infrastructure, blockchain protocol development, Dapp development, and product sales. This report summarizes some of the core elements of each step throughout the value chain, including participants, profit factors, and the necessary factors for business success, combined with standard peripheral functions such as marketing, sales, compliance, auditing, Taxes and advice, etc.

2-1. Hardware infrastructure

(a) Insiders (industry participants)

The hardware foundation is the starting point of the value chain. It consists mainly of two parts: IT/mobile hardware provider and mining hardware manufacturer. Since the blockchain network service is software, it relies on hardware tools and user connections. A notable trend is that leading handset manufacturers, including Samsung, Lenovo and HTC, have launched the latest versions of mobile phones with embedded blockchain services such as crypto asset wallet or private key management. While these tools may not be able to lock users as a convenient gateway to blockchain services, this suggests that hardware (not just software) has begun to focus on data privacy and security. One of the challenges facing blockchain services is the high threshold and technical complexity. However, as more and more hardware devices enter the "blockchain-ready" state, they may provide shortcuts for large-scale adoption.

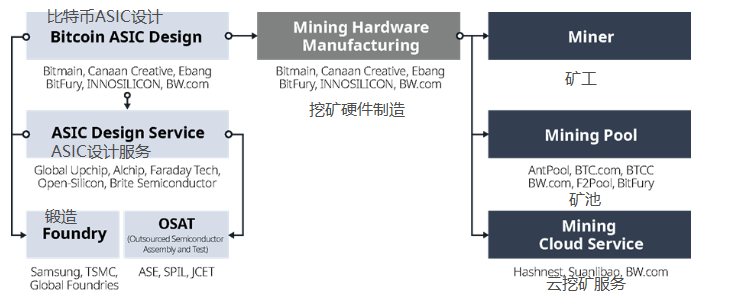

(b) Like IT/mobile hardware, mining equipment is part of the value chain. Since the rise in bitcoin prices in 2017, crypto assets have been mining (although most of them are exploiting bitcoin) and have experienced explosive growth. CPU, GPU, FPGA and ASIC hardware are used for mining and are produced by some famous mining equipment companies such as Bitmain, Canaan, Creative and Ebang.

(b) Income model

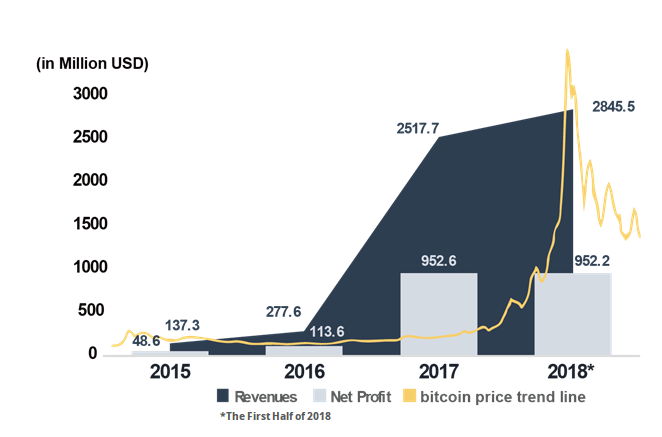

In most cases, the profit structure of hardware manufacturers is simple, mainly from hardware sales, and the profit model of mining hardware manufacturers is similar. Bitmain, the world's largest miner manufacturer, submitted its IPO prospectus in September 2018. According to the prospectus, Bitco's mining machine sales accounted for about 75% of the market share. The net profit for the first half of 2018 was $952 million, and the profit margin exceeded 35%. In addition, the report also shows that in addition to hardware sales, there are three other types of income: mining services, mine services and professional mining services, which account for 5.6% of total revenue in 2018. Diversified income also shows signs of positive integration in the value chain.

(c) Key factors

Consumer demand is a major factor driving growth and success in the hardware infrastructure industry. As far as IT/mobile hardware is concerned, so far there are not many users who have enough reasons to choose embedded blockchain service gadgets. In the short term, the industry is expected to pay more attention to the compatibility of blockchain services and crypto asset management, rather than launching new models for specific blockchain users.

Similarly, mining machine demand is also a major profit point for mining hardware manufacturers. The market is affected by complex industry dynamics, and mining machine demand is mainly affected by cryptocurrency prices. Since 2017, as the price of cryptocurrency has risen, the overall demand for mining machines has also increased, which also indicates that the demand for mining machines has changed with the price of encrypted assets. In addition, in terms of Bitcoin, after every 210,000 blocks are mined, the reward is halved, the period is four years, and the total amount of bitcoin is limited. By 2036, the mining reward will be reduced to 0.78125 bitcoin/block, bit The currency will end mining in 2140. Moreover, many Bitcoin blockchain networks have adopted POS (Proof of Equity), DPOS (Certificate of Entrusted Rights) and other consensus mechanisms that do not require competitive computing capabilities, so the sustainability of the mining industry is not yet clear.

2-2. Blockchain Protocol Development

(a) Industry participants

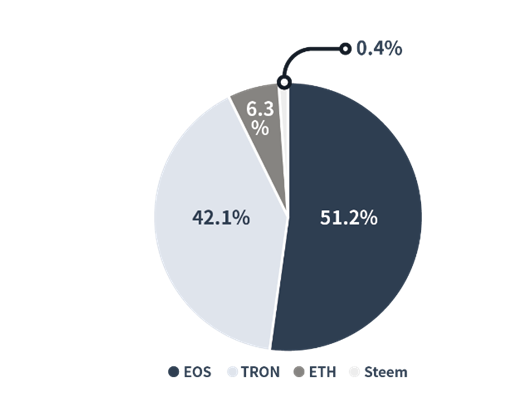

The next step in the development of the blockchain industry is the development of a blockchain network platform. A blockchain network platform, often referred to as a blockchain protocol, provides an operating system that can develop applications on the platform. The volume of transactions within Dapp is an important indicator of the activity of blockchain agreements and market dominance. According to the 2018 market report, EOS, Ethereum, TRON and Steem are the four most blockchain platforms in Dapp. The Dapp total transaction volume market share based on the blockchain protocol is more dispersed than the mobile operating market. Although most Dapps on the market are built on the Ethereum network, the report shows that almost half of the Dapp based on Ethereum is inactive and its users are inactive.

The blockchain agreement market is unique in that providers and performers are two separate individuals within a market. While the blockchain protocol provider designs and builds the blockchain platform, the executor acts as a miner to handle transactions, as a consensus node, and other network participants maintain a secure network. When the executor successfully processes the transaction and connects the new block to the chain, a certain percentage of the total transaction amount is awarded as a reward, which is the basic process of producing a new cryptocurrency. Therefore, the transaction fee earned by the network performer can be regarded as the coinage tax, which is the difference between the newly created token face value and the encryption cost. For the cryptocurrency, the difference is very unstable.

The blockchain agreement market is unique in that providers and performers are two separate individuals within a market. While the blockchain protocol provider designs and builds the blockchain platform, the executor acts as a miner to handle transactions, as a consensus node, and other network participants maintain a secure network. When the executor successfully processes the transaction and connects the new block to the chain, a certain percentage of the total transaction amount is awarded as a reward, which is the basic process of producing a new cryptocurrency. Therefore, the transaction fee earned by the network performer can be regarded as the coinage tax, which is the difference between the newly created token face value and the encryption cost. For the cryptocurrency, the difference is very unstable.

(b) Income model

Roughly speaking, the blockchain platform classified as a “public chain network” does not seem to require a long-term sustainable income structure, because network operations are the responsibility of network performers, and network performers are profitable through block rewards. However, in terms of protocol providers, there is a strong need for stable profits to cover the cost of network management, provision of client services and technology updates.

In addition, due to the increased intensity of supervision, financing costs have increased to several million yuan. For example, BlockStack is a public-chain agreement that facilitates the development of Dapp. It has been licensed by the SEC to launch a securities-licensed product (STO). The company disclosed that it has spent more than $2 million on product licensing. Although users pay for transaction fees on the network, most of the costs are paid by network performers who process transaction verification, so in order to pay for operating expenses, many foundations rely on so-called donations from users or by burning their cryptocurrency. Maintain the quantity and value of its tokens.

Unlike private-chain platforms, developers of public-chain platforms have no copyright and control over the platform. Many public-chain platforms are registered as non-profit companies or foundations, which is ironic in terms of profitability, but the basic idea of the blockchain. So how do blockchain platform providers profit from their products? Let us introduce these two types of revenue models that can be applied to the blockchain protocol: charge a certain percentage of transaction fees and B2B business models. The initial design of the blockchain network only allowed “anonymous and random” miners to charge a full transaction fee.

With the development of blockchain agreements, there have been many changes in design. The consensus mechanism adopted by the new platform is POS and DPOS, which are operated by the network operator designated by the platform provider. It is necessary to establish a contractual relationship between the platform provider and the operator, and to negotiate the allocation of transaction costs. space. Under these types of mechanisms, the platform provider can require the network operator to pay for part of the transaction cost, which will be much less than the centralized network.

Other sources of income may come from traditional open source software business models. Using such models on the public-chain platform to generate profits may violate our expectations, but it should be noted that these revenue models should be strictly separated from decentralized network operations. Although anyone can access the public beta platform, the main users of the platform are Dapp developers and other enterprise clients. As far as the business model is concerned, the open source platform has the same far-reaching significance as the blockchain platform.

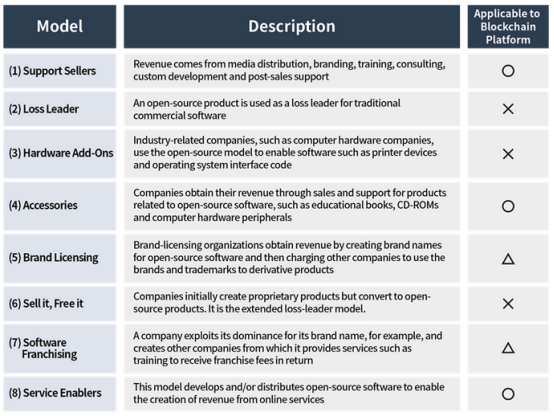

The open source platform has become the actual standard of the software business model, which proves that the lack of proprietary source code does not necessarily mean no profit, and profitability does not violate the open spirit. This is where the blockchain platform is on the way. The following diagram depicts eight different types of open source software business models and their applicability on blockchain platforms.

Among the eight models, the models that can be applied to the public chain platform are (1) support sellers (4) supporting sales (8) service engines. Support for sellers and supporting sales models to serve paid customers, such as education services, training services and custom development. The service engine is a model for charging subscribers to the platform. The blockchain platform NEO belongs to this model, and NEO charges a fixed transaction cost by deploying smart contracts and registered digital assets on its blockchain.

Can public chain platform providers benefit from their brands? The other two modes (5) brand authorization, (7) software franchise may be possible. This part requires a normative understanding of the technology and its description, and there is currently no public chain to do so. The key to the monetization of the public chain platform is to separate the brand from the decentralized network operation.

Such models can only be implemented if the monetization of the brand name and the support of the client service do not interfere with the decentralization of the network. Therefore, we should avoid changing the nature of the public chain platform (resisting centralization authority) in the process of making money. Due to the lack of other commercial product cases, the other three types of business models (2) selling goods at a loss, (3) additional hardware, and (6) selling for free do not apply because the blockchain platform lacks other commercial products and offers The exclusive rights of the platform owned by the business.

(c) Key factors

There are three key factors in determining the growth and profitability of blockchain platform providers: platform user base, network effects and their value. First, the platform's primary revenue model is the B2B model, and platform providers should provide a developer-friendly environment that is scalable and interoperable to appeal to a broadly active user base. The active participation of users will lead to an increase in the supply of derivative products and services, which in turn will attract more end users to pay transaction costs, thus forming a virtuous circle. Moreover, a broad user base will enhance the network effect and its value, which in turn will increase the number of users and increase the value of services and products.

For blockchain protocol operators, the biggest incentive is the return they can get. Remuneration is the cryptocurrency given by the blockchain protocol. Therefore, the cryptocurrency price will seriously affect the participation of the agreement operator, which means that the cryptocurrency price is related to the network effect of the blockchain protocol. Network stability is a key factor in the efficiency and security of consensus mechanisms. When there is no trust in the consensus mechanism, the idea of unfair distribution of operating compensation will arise, which will weaken the public's participation in network operations.

Source: first class warehouse

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- BTC rebounded and rebounded back to $8,200, and the market is expected to pick up

- Babbitt column | Bitcoin is not a good value storage tool

- BM's "Summer Vacation" is finally over, and Block.one releases EOSIO 2 candidate.

- Weekly | One article grasps the national day seven days of industry news

- Market Analysis: Zhongyang Line has not changed the trend direction, the market outlook is still bearish

- Wall Street Journal: Bakkt futures are disappointing, as will Bitcoin ETFs

- Looking at the blockchain from Ripple for ten years: How will the phased revolution of digital finance begin?