15 countries will jointly develop global digital currency monitoring system with international organization FATF

According to Japanese media NIKKEI news on August 9th, about 15 countries will jointly develop a new system with the Financial Action Task Force on Money Laundering (FATF) to conduct cryptocurrency transactions. Individual implementation supervision.

Founded by G7 countries in July 1989, the FATF is headquartered in Paris, France. It is one of the world's most important anti-money laundering international organizations. It aims to develop policies to combat money laundering and terrorist financing, and to coordinate national anti-money laundering units. .

Countries participating in the project include the G7 Group (Canada, France, Germany, Italy, Japan, the United Kingdom, the United States), as well as countries such as Australia and Singapore.

- Technical point of view | Changan Wanglou? This is just the tip of the ancient Chinese cryptography application.

- The market temporarily stabilized and rebounded, and the volatility continued.

- Data Analysis: Demystifying the Real Status of DeFi Lending Products

It is understood that most countries in the world have not yet established a sound regulatory system for cryptocurrencies, and the actions of international organizations can help to establish a common system and system, so that more countries can apply to their own fields according to local conditions. Encrypted currency activity.

At the same time, the project aims to prevent funds from being used for money laundering, engaging in terrorist activities, or being used in other illegal situations. According to the NIKKEI article, the goal of the project is to develop detailed measures by 2020 and to start using the entire system on a large scale in the next few years. Once the system is implemented, it will be managed by the private sector.

Previous FATF release guidelines required cryptocurrency service providers to provide information about their customers.

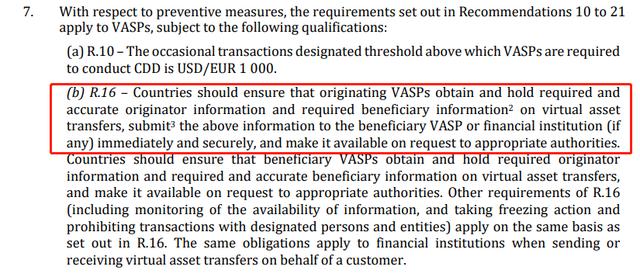

The FATF is increasingly regulating the cryptocurrency industry. It is reported that the FATF issued a document on June 21 this year, which made a series of specific regulations for cryptographic assets and crypto asset service providers. In the second point of Article 7 of the “Interpretative Note to Recommendation 15”, the FATF requires the cryptocurrency service provider to collect customer data and hand it over to the authority when necessary. mechanism.

The treaty is also known as the "Travel rule". According to Jesse Spiro, director of policy at Chainalysis, in the long run, the guidance "will help the cryptocurrency industry move." Mature and let more mainstream investors adopt it; but in the short term, “the industry needs to develop technologies and solutions to comply, and this will require a lot of investment.”

But this rule has also caused a lot of controversy. For example, this rule does not stipulate what individuals must do. This brings up a technical problem: how to distinguish between individuals or institutions behind the code? In addition, there are questions about the delay in submitting information, the different names of providers registered with the same identity.

Since the cryptocurrency industry itself is private in conducting financial transactions, the most widely criticized rule is about user privacy.

In addition, according to 31QU's previous news, the FATF urged its 35 member states to tighten the supervision of the cryptocurrency exchange as early as March this year, requiring the cryptocurrency exchange to be regarded as a commercial bank for supervision.

The country most eager to regulate the cryptocurrency industry – Japan

Among the countries participating in the FATF project, Japan has always been at the forefront of cryptocurrency industry regulation. As early as 2017, Japan established a registry of cryptocurrency service providers, and Japan was the first country to establish a legal framework for cryptocurrency exchanges.

On July 18 this year, Reuters reported that a person familiar with the matter said that the Japanese Finance Agency intends to establish a SWIFT-like cryptocurrency international payment network to combat money laundering criminal activities. The FATF also approved the plan in June this year. .

In June of this year, the Japanese House of Representatives also passed a new cryptocurrency bill. The requirements in the bill include:

1. Recommend a feasible system that meets the requirements of international standards such as G20 regulatory trends and anti-money laundering measures; 2. Require regulatory agencies to review actual conditions and take measures based on the results of the review; 3. Work hard to fully cooperate with self-regulatory organizations; 4. Review Encrypted asset transfer, the right to check the electronic records of transactions, the taxation of income taxes, and the income associated with the use of encrypted asset transactions, and take the necessary measures based on the results of the review.

In addition to changing the name of the virtual currency to "encrypted assets", the bill also requires the use of a cold wallet to manage encrypted assets, etc., and the Act also grants ICO the right to receive income distribution.

But in fact, even if Japan is very keen on cryptocurrency regulation, the scope is limited to Japan; in many other parts of the world, cryptocurrency is still in a state of barbaric development and unregulated, so it is necessary to formulate a unified international rule. A huge challenge.

Reference source link: https://asia.nikkei.com/Spotlight/Bitcoin-evolution/New-global-cryptocurrency-system-set-to-fight-money-laundering

The original link to the regulatory rules issued by the FATF: http://www.fatf-gafi.org/media/fatf/documents/recommendations/RBA-VA-VASPs.pdf

Source /31QU

Text / small shell

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Investing $500 million is still not stimulating waves? Twitter users expect XRP to reach $1 this year, or expect to hit $5

- Google Privacy Intersection and Technical Analysis 1 – Application Scenario Analysis

- Google Privacy Intersection and Technical Analysis 2 – Technical Overview

- August 11th market: Bitcoin continues to fall, mainstream currency rebounds, market trend is clear

- Babbitt column | Gu Yanxi: the beginning of Libra, the end of the public chain

- The market ushered in a counter-offensive yesterday, or did not have too strong continuity

- Recruiting the central bank digital currency countdown