Bitcoin Position Weekly: Does the retail bullish sentiment reach a historical high? Will the truth belong to the majority?

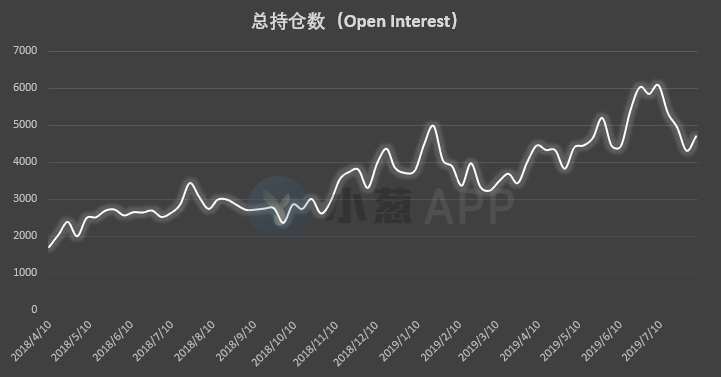

On August 10th, the CFTC announced the latest issue of the CME Bitcoin Futures Weekly (July 31-August 6). The market's total number of positions has been frozen for three weeks, and the BTC price volatility has ended. The return has made the market participation heat increase, but the situation of long and short-term balance sawing has not changed in terms of the performance of the sub-data.

The total number of positions (total open positions) ended three weeks in a row. The latest week's data ushered in a long-lost rebound performance. Since the beginning of May this year, the new low level of 4302 has risen to 4,692, recovering. It was the majority of the previous week's decline, but it is still relatively low in the past two months.

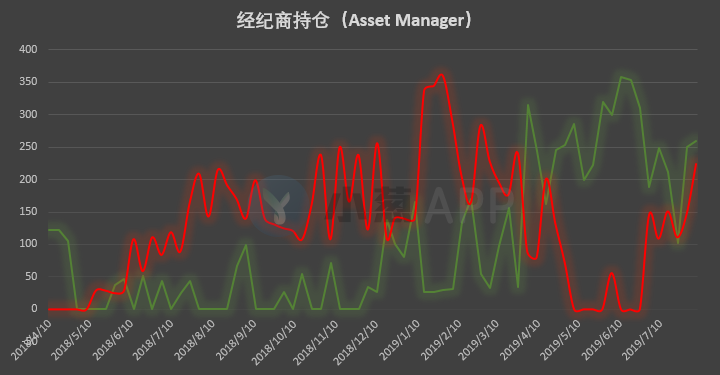

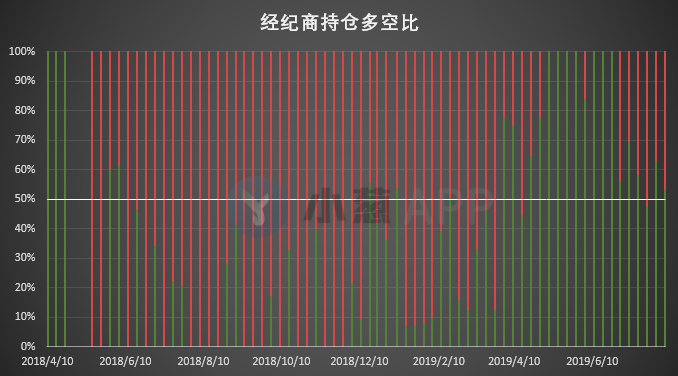

According to the sub-item data, the larger brokerage positions continued to be maintained this week after returning to the net long position last week. This part of the long and short two-way positions have risen, but the short position increase is much larger than the long position. According to the specific data, the broker's long position has risen from 251 to 260 in the latest week, and the short position has increased from 147 to 224. Although the net long position is still maintained, the gap between the long and short sides has narrowed sharply. The reversal of the long-term reversal in the next period of data has laid the groundwork, indicating that the bullish confidence of large institutions in the market outlook is not as strong as expected.

- Why do you believe that Bitcoin is worth nothing, no matter how you say it?

- 15 countries will jointly develop global digital currency monitoring system with international organization FATF

- Technical point of view | Changan Wanglou? This is just the tip of the ancient Chinese cryptography application.

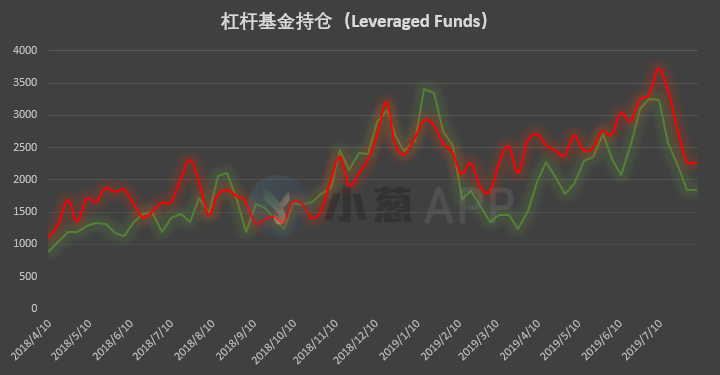

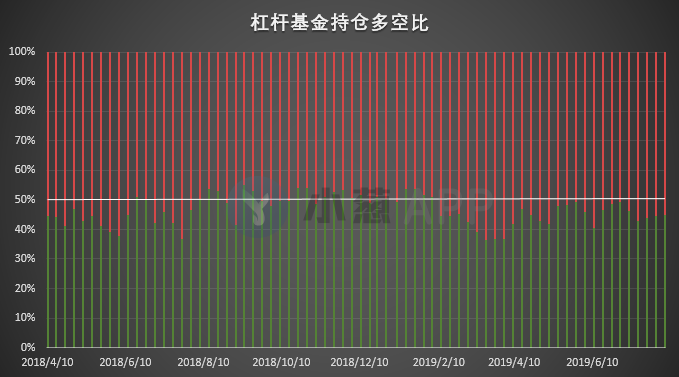

In terms of leveraged funds, the changes in long and short positions in the latest week are very limited. Long positions have risen slightly from 1843 to 1,847, and short positions have dropped slightly from 2,288 to 2,264. Although the leveraged funds showed a very clear net attitude this week from the perspective of data performance in both directions, the long-term sentiment was not strong because of the limited change in the value, and the guiding effect on the market outlook was relatively strong. weak.

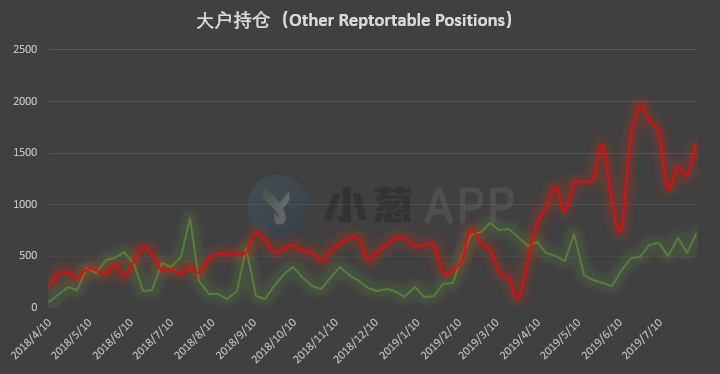

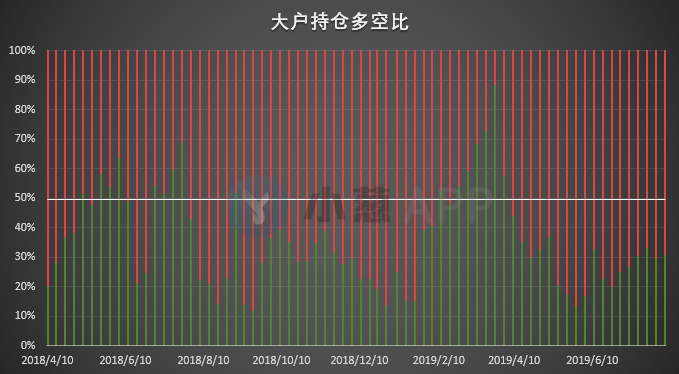

The long-term and long-term positions of large and large positions continued to change in the same direction. Last week's simultaneous reductions were once again turned into synchronous holdings this week. Long positions increased from 533 to 713, and short positions rose from 1,280 to 1,586. This part of the account still maintains a clear headroom attitude. The latest data did not show signs of a reversal of attitude.

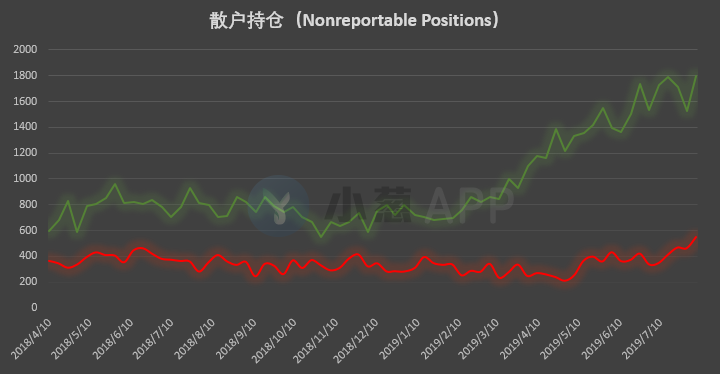

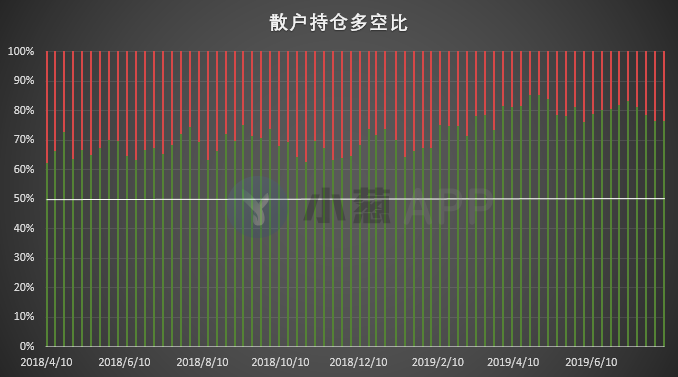

The optimism of retail investors has returned. The decline in long positions in the past two weeks has been fully covered in the latest data. Currently, retail long positions have risen to the highest of 1800. Although the short positions have risen from 459 to 546, the net-multiple advantage of this type of data is very obvious, and retail investors have a strong bullish attitude towards the market outlook.

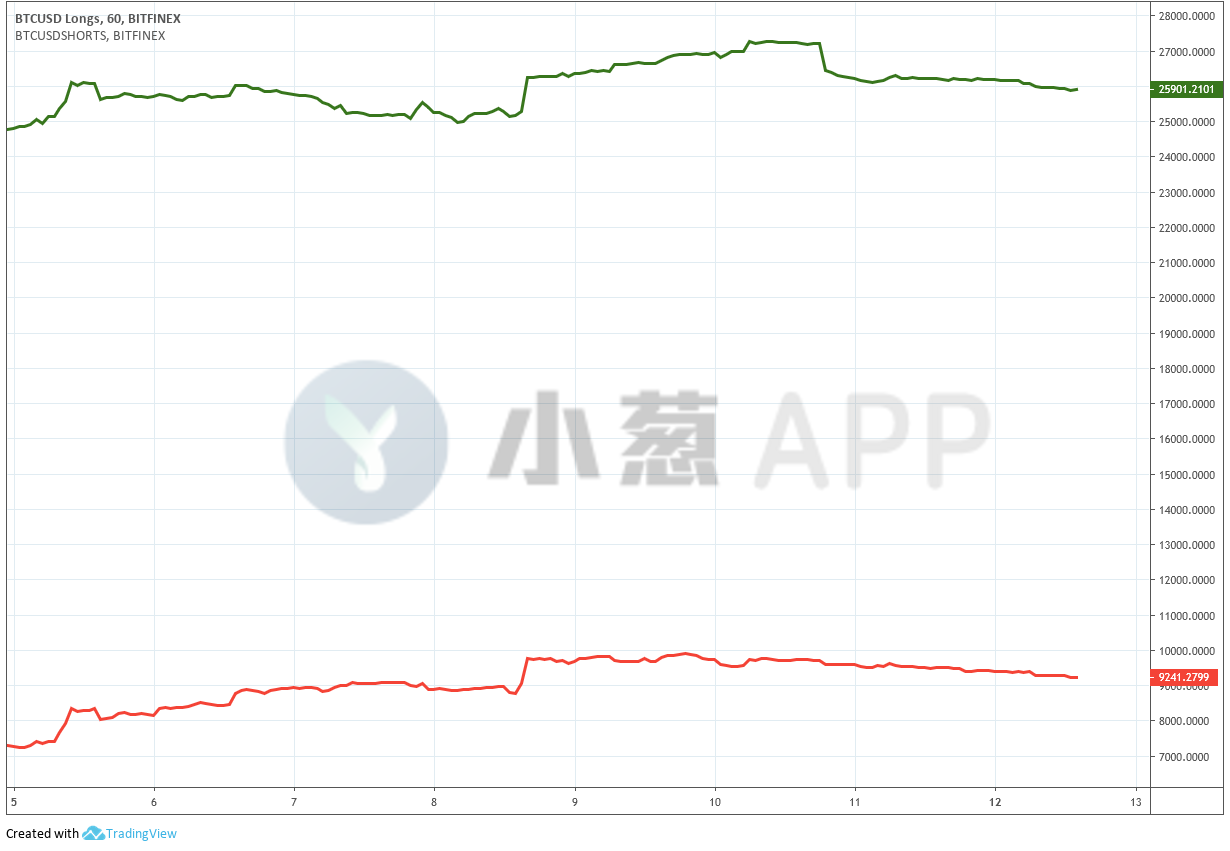

Bitfinex Exchange Bitcoin Position

Bitfinex Bitcoin contract long and short position data is updated by the exchange in real time, so compared with the weekly CFTC position report, the Bitfinex exchange position data can better reflect the immediate market retail market long-term emotional changes.

In the past week, Bitmillex exchanges have seen a certain increase in bitcoin long-and-short positions, but compared to the longer-period data performance, the data is still running in a relatively stable situation. The net long position that has been maintained for more than a month has not shown obvious signs of reversal. The number of long positions is much larger than that of short positions. At present, the value of two-way positions has basically kept changing. Although the market activity has steadily increased, it has achieved long and short reversal. It is very difficult.

OKEx Exchange Bitcoin Position

OKEx official data shows that in the past week or so, the number of long positions in the Bitcoin contract in the OKEx exchange has rebounded rapidly. The situation in which the long and short sides were almost flat in the previous week was broken in the past week, and more than half of last week. The empty position ratio has once rebounded to above 1.40. Although the data has declined somewhat during the weekend, it still remains above 1.30, indicating that the number of positions in multiple positions is 30% higher than that in the open position. The retail sentiment is obviously biased towards the long position. The performance of this data is basically consistent with the results of the CFTC weekly report and the long-term positive response of the Bitfinex exchange long position, indicating that the market bullish sentiment is dominant, and investors are relatively optimistic about the market outlook.

This article is originally written by Shallot APP, please indicate the source. For more information, please visit https://xcong.com/ or download Shallot APP .

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- The market temporarily stabilized and rebounded, and the volatility continued.

- Data Analysis: Demystifying the Real Status of DeFi Lending Products

- Investing $500 million is still not stimulating waves? Twitter users expect XRP to reach $1 this year, or expect to hit $5

- Google Privacy Intersection and Technical Analysis 1 – Application Scenario Analysis

- Google Privacy Intersection and Technical Analysis 2 – Technical Overview

- August 11th market: Bitcoin continues to fall, mainstream currency rebounds, market trend is clear

- Babbitt column | Gu Yanxi: the beginning of Libra, the end of the public chain