Determining the Digital Frontier: Authoritative Interpretation of the Central Bank Digital Currency to be Issued

event

On August 10, 2019, Mu Changchun, deputy director of the Payment and Settlement Department of the People's Bank of China, said at the Third China Financial Forty Forum that the central bank's digital currency would be ready to use a two-tier operating system.

Risk warning: progress is less than expected

text

- The competition coins have rebounded, and they still have to look at the BTC complexion.

- Analysis: Is the price of bitcoin driven entirely by speculation?

- How difficult is food traceability? Teach you to write a blockchain + IoT traceability system

2 What is a two-tier system, what is the significance of the two-tier system?

China's CBDC will adopt a two-tier operating system, that is, the upper layer is the People's Bank of China, and the second layer is the commercial organization.

-

The central bank's digital currency is bound to face the retail scene and face the public, while the performance of Bitcoin and Libra cannot meet the high concurrency. After a period of research, it decided to adopt a two-tier system. -

The issuance of central bank digital currency by big countries is a complex system engineering. -

The IT infrastructure application and service system of commercial banks and other institutions has been relatively mature, the user base is huge, the service habits have been developed; the talent reserve is relatively full, and there are many IT experts; the system has strong processing capacity and has accumulated in the application of financial technology. A certain experience. -

Through the design of two-tier operation, it is possible to avoid excessive concentration of risk on a single individual. -

Single-tier placement will trigger “financial disintermediation”. Directly placing the digital currency on the public by the central bank will have a crowding out effect on commercial bank deposits, affecting the ability of commercial banks to lend; in extreme cases, it will also subvert the existing financial system, and the central bank will fight the world's “great unity” situation. -

The double layer will not change the creditor-debtor relationship of the currency in circulation, and will not change the existing money delivery system and the dual account structure; it will not affect the existing monetary policy transmission mechanism. -

The central bank will not presuppose technical routes. Any advanced technology may be used for central bank digital currency research and development; electronic payment and central bank digital currency boundaries are blurred; it can fully mobilize market forces and achieve system optimization through competition.

Although the current specific information on the central bank's digital currency is still limited, it is enough to see that the central bank's emphasis on CBDC research and development and the development of CBDC after years of research and development have made considerable progress, many details of the operation have been taken into account, CBDC landing is just around the corner.

3 Defend the digital frontier and promote the internationalization of the RMB

The research and development of China's CBDC has been widely concerned by the market. We believe that the launch of China's CBDC is of great significance in at least three aspects:

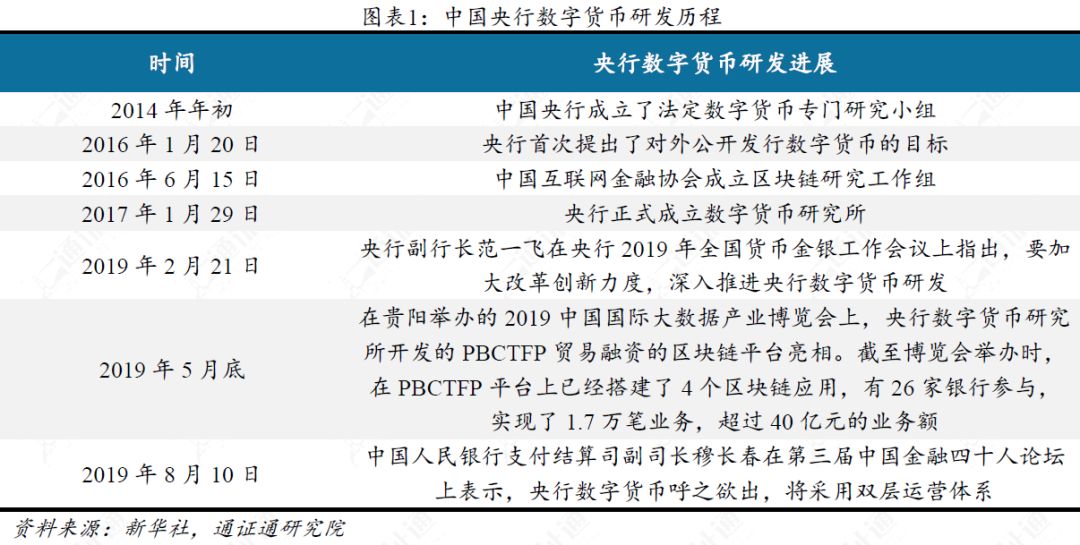

4 China's R&D is accelerating, and the digital war is on the verge?

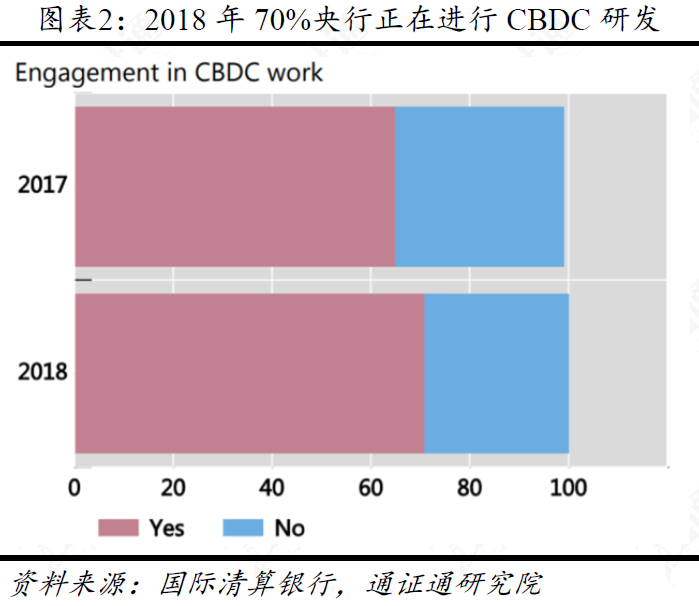

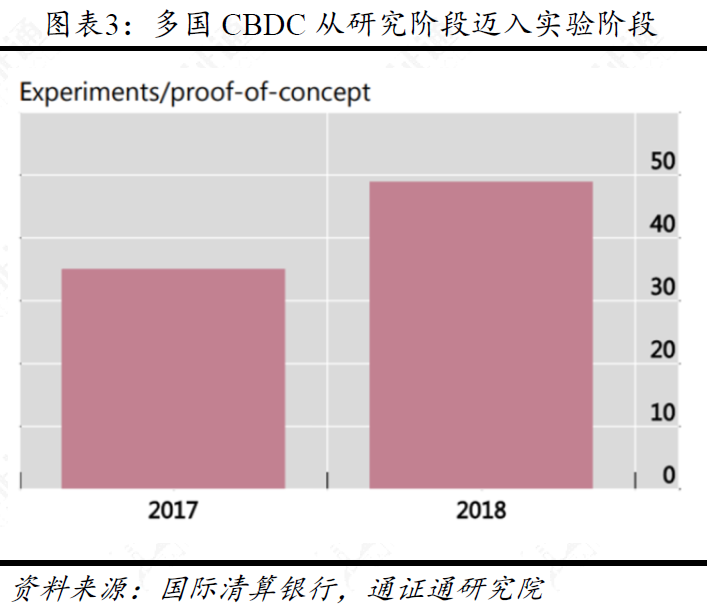

The research and development of CBDC in various countries has accelerated, and it has gradually entered the experimental and pilot stages from the research stage. At the beginning of 2019, the BIS survey of 63 central banks including central banks such as China, the United States, Japan, Korea, Britain and France showed that 70% of central banks were conducting research and development on CBDC in 2018, compared to 2017, although Most are still in the research or experimental phase, but many countries are moving into the experimental phase from the research phase.

Prior to Libra, the development of CBDC in the world was not bad. The countries that have launched CBDC are all third world countries. The main purpose is to achieve dollarization or reverse the domestic economic difficulties. After the release of the Libra white paper, major powers have shown sufficient attention. In 2019, especially after the release of the Libra white paper, the development of CBDC in various countries seems to have accelerated.

In March 2019, the Central Bank of the Bahamas announced a pilot project called Project Sand Dollar, which aims to serve the upcoming central bank digital currency in the Bahamas;

In April 2019, the Deputy Governor of the Swedish Central Bank said that the possibility of issuing the digital currency e-krona in the next decade would exceed 50%;

On May 2, 2019, the Singapore Monetary Authority and the Bank of Canada issued a joint announcement that the two sides had conducted a successful payment test for cross-border and cross-currency payments of encrypted digital currencies;

On May 8, 2019, the Thai central bank's technology partner Wipro announced that the Bank of Thailand is advancing its digital currency project by establishing a blockchain-based prototype solution;

On July 11, 2019, Turkey’s eleventh development plan talked about the creation of a central bank’s digital currency;

On July 19, 2019, the Deputy Governor of the Bank of Thailand announced that the central bank digital currency research project in cooperation with the Hong Kong Monetary Authority is entering the third phase.

As one of the world's major economies, China's launch of CBDC is of great natural significance. The digital war around digital currency is already on the verge. China's CBDC has accelerated the launch or the first shot of defending digital sovereignty in various countries, and there is no smoke in this. Seize a certain opportunity in the war.

Note: For some reasons, some of the nouns in this article are not very accurate, such as: pass, digital pass, digital currency, currency, token, Crowdsale, etc. If you have any questions, you can call us to discuss.

Source: Tongxuntong Research Institute

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Xiao Lei: The central bank’s digital currency has a clear target, but underestimates the American thinking.

- Coinbase: How we managed to stop an attack, billions of dollars in cryptocurrency survived

- The awakening of global regulation? Developed economies such as G7 and other 15 countries jointly develop cryptocurrency transaction tracking system

- If India continues to ban cryptocurrencies, it will lose a market worth $12.9 billion.

- Market Analysis: BTC low adjustment to retain rebound ability, mainstream currency countercurrent and upside differentiation to repair long-term sentiment

- Shao Fujun, Chairman of UnionPay: Most worried about the spread of digital currency, the payment clearing institution may no longer exist

- Analyst: Bitcoin is a hedging tool under the quantitative easing and negative interest rate policy, which can solve the "Triffin problem" in the United States.