A "three-nation kill" incident triggered by a quarterly destruction of BNB

"Actually, I am still not awkward in the morning, just answering the question of the big HT. In the morning, when the big households said that this program is very good to ask the fire coins for their sincerity, I analyzed the essence of this program on a straightforward basis; then tell everyone if they think This program is good and we are very happy to implement it.

Then the user said that I said that no more use, people have a high market value. Then I gave an example of LeTV with indignation. If you accidentally hit the currency, sorry, ha. ”

— Fire coin founder Li Lin

- 0x protocol vulnerability principle analysis: malicious pending orders can disrupt the normal trading order

- Bitcoin is consolidating at a high level, and funds are being withdrawn one after another. How should the market operate?

- The digital sovereign currency is gradually approaching, and China has already prepared for it.

On July 12, Coin Security destroyed 808,888 BNBs (worth $2,3838,000) from the BNB share held by the Coin Security team. And said that from the beginning of this destruction, the coin security team will give up the BNB share held by the team (40% of the total BNB supply, that is, 80 million BNB), and add it to the BNB quarterly destruction plan until the destruction of 100 million BNB.

Subsequently, the program triggered the comments of Li Lin, founder of the Friends of the Fire. Li Lin said: "You can start a vote in the fire coin community. If everyone thinks that this plan is better, we will implement it immediately." But in this case, HT big households do not buy it, and repeatedly emphasize that BNB currency price is higher, the currency market value higher. This led to a series of heated debates between the fire currency and the currency, as well as the subsequent addition of OKex and the currency.

/1/

BNB destruction mechanism modification, what is the motivation?

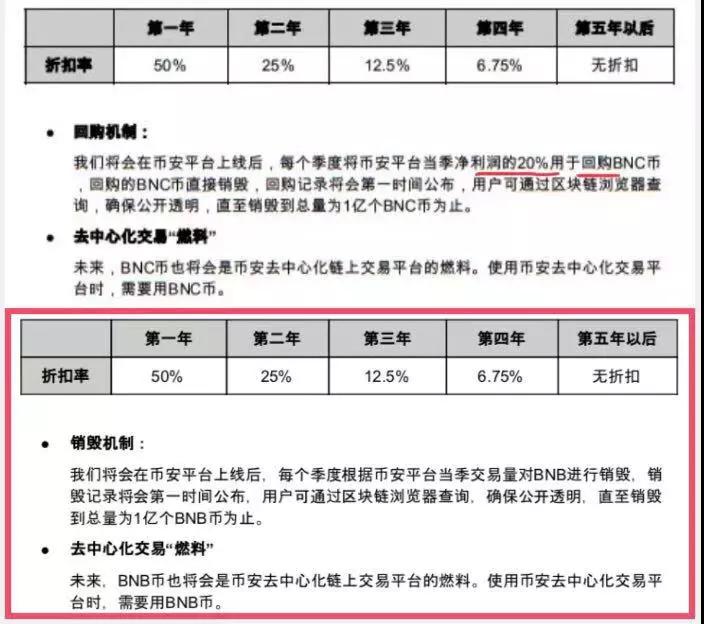

On July 12th, the announcement issued by the company was revealed that the coin security team would abandon the BNB share held by the team (40% of the total BNB supply, ie 80 million BNBs) and add it to the BNB quarterly destruction plan. in. This means that not only this time, the subsequent BNB's quarterly destruction will be from the unlocked part of the coin security team. The previous 7 BNBs were destroyed quarterly, which was 20% of the profit in the quarter, which was mentioned in the white paper of the V1.1 version.

Whether it is destroyed from the unlocked part of the coin security team or directly from the profit of the quarterly currency, the amount of BNB destroyed is 20% of the quarterly profit. The number of BNBs is decreasing, thus ensuring that BNB is an economic model of constant deflation. Why did users and friends not buy it, but it also triggered a big debate on the wheels of fire coins, OKex and coins?

The sounds currently on the market are mainly derived from two factors.

On the one hand, the revision of the BNB destruction mechanism was made by the currency security. It was not announced to the user before, but was officially announced in the quarterly destruction announcement. The user did not buy it, but the destruction of BNB was not fully implemented in accordance with the white paper. The change was changed and the user was not asked for advice. In fact, the operation of the currency revision white paper is not the first time.

On April 16, the company announced that BNB had completed the destruction in the seventh quarter, and the amount of destruction was 20% of the profit from the beginning of January 2019 to the end of March. This time, a total of 829,888 BNBs were destroyed (valued at $15.6 million). ). If it weren't for this destruction, few people might find that the BNB's “repo” destruction rules were actually modified as early as two months ago when the currency update white paper.

The top and bottom images are respectively screenshots of the currency white paper V1.1 version / V1.3 version

From the comparison of the two versions of the white paper, it can be found that the "20% of the quarterly profit for repurchasing BNB" part has been removed. If you no longer buy back BNB, does it mean that the BNB in the secondary market will no longer be reduced, and the growth expectation of BNB will be gone, which will cause users to discuss it. Subsequently, in response to the revision of the white paper, Zhao Changpeng, the founder of the currency, explained on Weibo on the same day: “The regulatory authorities in some countries do not like BNB and profit-linked. We listened to the opinions of relevant departments and removed this description. “Repurchase” The use of the term is not accurate, and the income of the currency security is originally BNB. If you sell BNB to USDT and then buy back BNB with USDT, it seems that this operation is more than one move. The word was used in the white paper because it was not clear. "Repo" is not important. What is important is how much is destroyed. The total amount of BNB is reduced. ”

On the other hand, the BNB, which is worth 20% of the profit per quarter, was originally intended to destroy the market circulation. Now the part of the team is destroyed, and the 20% circulation is the same as that of the user. Regardless of where it is destroyed, the amount of destruction remains the same. And the follow-up is due to the maintenance and operation of the currency security platform, the salary payment of employees, etc., and this part of the profit of 20% BNB will still flow to the coin security team and flow to the secondary market, thus affecting the market price. The coin CEO Global Co., also known as the left pocket guide right pocket game.

He Yi, the co-founder of the currency security company, explained: First, the destruction team held 40% of the total unlocked BNB, which solved the problem that this part of BNB flowed to the market after unlocking, forming a huge selling pressure. risks of. In addition, this rule changes the loss of the team's personal interests, guarantees the strength of the currency security, ensures the stability and continuous fighting spirit of the community, and reduces the risk of the team retiring after four years.

To put it simply, this quarter, the currency destroyed more than 800,000 BNBs, 3.2 million a year. This is a reduction of 80% of the selling pressure compared to the 16 million releases released each year from the unlocking team.

And one by one, it is also emphasized that in order to create history, the Qian’an team gave up the opportunity for the original BNB to stay in the villa after unlocking the cash. Now, the cash-out will not appear again, and the money security team can only make better efforts to ensure that the BNB held by the company continues to increase value, thus making up for the losses caused by the abandonment of cash. At the same time, He Yi said: 20% of the original profit for destruction is still BNB, not given to the team, all profits are attributed to the company, and will continue to invest in the long-term construction of the currency security.

In addition to the above two factors, the revision of the BNB destruction rules will result in the destruction of all BNBs in the future, almost all from the share held by the money security team (40% of the total BNB supply, ie 80 million BNB), until Destroy 100 million BNBs. After seven previous destructions, BNB has destroyed 11,654,359 pieces. Although the modification of the rules eliminated the impact of the new selling of the Qian'an team, it undoubtedly also fixed the circulation of BNB in the secondary market and lowered the deflation expectation of BNB in the secondary market. Some investors even said: At present, the price of BNB mainly depends on the secondary market. When retail investors invest, they may not consider the problem of the holding of BNB by the money security team.

/2/

Li Lin, who rarely commented on friends, why he couldn’t sit still.

On July 12th, in response to the HT major, the plan for the revision of the platform currency destruction rule was very good. After the sincerity of the fire currency, Li Lin, the founder of the fire coin, also joined the dispute. Li Lin said: The amount of money destroyed in the quarter is 50% of the fire coin. At the same time, the example of LeTV is listed. One company will focus on the PR and rely on the fundamentals of the company.

After Li Lin, the CEO of Firecoin Global also issued a question about the revision of the BNB destruction rules. Qiye believes: "The money security server needs to spend money every month to operate, to sell BNB at that time; employee wages, and to pay for rent every month, but also to sell BNB; BNB can not eat, or will It is consumed. Whether it is selling the part that the team should have unlocked, or 20% of the profit per quarter of the currency, it will cause a certain amount of BNB to flow to the market."

After a fierce "mutual enthusiasm", the chat records of the Daxie group in WeChat group were quickly forwarded, causing heated discussion in the industry. After a day, after receiving a lot of questions about the incident, on July 13, Li Lin responded in a targeted manner and talked about some of his own thoughts.

First of all, Li Lin said: Ideal and constructive "怼" is conducive to common progress, and the truth is more and more clarified. At the same time, when asked whether the currency security is the first in the exchange, or the fire currency is the first, Li Lin said: "Evaluate a company, there are many different indicators, such as market value, income, profit, customer volume. On the exchange The industry, as well as important indicators of trading, trading volume, asset volume and liquidity. Most companies say that they are the first, referring to the first in a certain indicator. In a strong and effective market, the market value usually reflects the comprehensive strength, and In a weakly efficient market, the market value does not necessarily fully reflect the overall strength."

Secondly, Li Lin deeply analyzed the strengths and weaknesses of both the fire currency and the currency in the exchange field, and said that the currency security is a very respectable and successful peer, greatly affirming many innovative work done in the industry. . As long as both sides can improve their own deficiencies, they can achieve even greater development.

From Li Lin's response, it can be found that the current advantage of the fire coin is mainly due to the stability of its technology, the phenomenon of theft of the exchange has not yet exploded; it has been actively seeking digital asset compliance, for which the fire coin is Hao Hook 200 million to buy a building in Hainan, the headquarters moved to the Hainan Free Trade Zone (Hong Kong) blockchain test area; and also compared to the advantages of the contract transaction of the currency has not opened. In addition, in terms of products, the user interface, the use of fluency, Fire Coin App is also better in several trading platforms used by the author.

The disadvantage of the fire currency is that the innovation ability is seriously insufficient and needs to be improved; in terms of globalization, there is also a gap with the currency security; and in the United States, the world's largest market, how to have a place in compliance is also a long way to go.

The main advantage of the currency security is its strong innovation ability. Whether it is the first launch of the platform currency, and the destruction mechanism; or the release of the first IEO project, once triggered the IEO boom in the exchange, bringing the industry from the bear market to bring a lot of warmth;

Even the first public online exchanges and decentralized exchanges on the main online line have been at the forefront of several major trading platforms. In addition, in terms of globalization, the currency security is also doing a good job. The currency official website currently supports a total of 13 languages. At the same time, in the identification and mining of non-mainstream assets, the currency security also has great advantages.

The disadvantage is that: in terms of security, the currency security has been stolen by the exchange, resulting in loss of platform user assets; compliance, currently mainly overseas, domestic progress needs to be further strengthened; product, lack of OTC transactions, contract transactions, At the same time, the user interface and smoothness of use also need to be improved.

Finally, when asked how to improve the HT unlocking solution, Li Lin mentioned that 20% of the repurchase is unchanged, and the amount of team unlocking is linked to the amount of destruction. According to the current quantity evaluation, you can consider the 1/3 of the number of destroyed teams in the year. This not only ensures deflation, but also protects the interests of the team. This program will get the community to discuss.

/3/

Is the exchange big brother OKex still ok?

On the evening of July 12, in the chat group of Daxie, after the OKex trading platform rights protection incident was mentioned again, OKex staff members also officially joined the debate on the incident.

Compared to the two exchanges of Firecoin and Coin, OKex's platform currency OKB does not seem so satisfactory. Since the launch of OKB, there has been no major improvement, and it has often been criticized by the holders. The total circulation of OKB is 1 billion, and the team locks 700 million to 2022. The follow-up will be adjusted. Of these, 300 million will be distributed to OKEx users via the card, and 400 million will be owned by the OK Blockchain Foundation and the operation team for the better and more effective construction of the OKB ecosystem. In addition, the total circulation of the OKB market is also 300 million.

In terms of incentives for platform coins, OKB first adopted the “Happy Friday” incentive incentive system. That is, the platform user receives the OKB, and the weekly incentive money is 50% of the total income of the OKex currency transaction and contract transaction. In addition, the incentive money corresponds to the total amount of OKB of 1 billion, but only 300 million pieces are circulating in the market, so the actual reward is multiplied by 0.3. It is equivalent to the actual amount of incentives that OKB holders get in the early weeks, which is 15% of the total income of OKex currency transactions and contract transactions; and is distributed to users in the form of BTC.

In terms of incentives for platform coins, OKB first adopted the “Happy Friday” incentive incentive system. That is, the platform user receives the OKB, and the weekly incentive money is 50% of the total income of the OKex currency transaction and contract transaction. In addition, the incentive money corresponds to the total amount of OKB of 1 billion, but only 300 million pieces are circulating in the market, so the actual reward is multiplied by 0.3. It is equivalent to the actual amount of incentives that OKB holders get in the early weeks, which is 15% of the total income of OKex currency transactions and contract transactions; and is distributed to users in the form of BTC.

Later, OKex began to make adjustments and issued an “OKB Repurchase Destruction Plan” on April 28, 2019, and received advice from more than 1,000 community users around the world. It is scheduled to suspend the original “Happy Friday” on May 4, 2019 to encourage the release of the blonde. Instead, 30% of the OKex platform transaction fee will be used to repurchase the OKB and destroy it. According to past experience, the release of the platform currency repurchase and destruction policy should have been good news, which often led to a rise in the price of the currency; but since the announcement of the day, it has caused huge controversy, and the price of OKB has also fallen.

On the one hand, the original incentive system can bring regular dividend income to the OKB holders, and the repurchase and destruction policy is to make OKB a deflationary economic model, and give the holder the price increase of OKB. Bring the corresponding benefits. However, compared with the real-time benefits of the incentive system, the repurchase and destruction policy is obviously dwarfed. Because in the high-risk digital currency market, whether OKB will definitely rise in the future is somewhat unpredictable.

In addition, OKex is one of the world's major contract exchanges, and the revenue from contract transactions is an important support for its platform profit. In the rule changed to only destroy 30% of the OKex currency transaction fee as a repurchase, the user clearly felt that OKex lacked sincerity, so he voted with his feet, and some holders began to sell.

As an established exchange, OKex is also gradually deploying the exchange's public and decentralized exchanges OKDex. However, why the price of OKB and HT and BNB are getting bigger and bigger, and gradually losing competitiveness. This is also the place where OKex should reflect.

On July 13, Xu Xing, the founder of OKex, made a public response to Weibo’s problems exposed on the OKex platform. Xu Mingxing said that he would reflect on himself and improve the technical problems of product roots, and will serve users with better and richer products and technologies. OKex will not give up, will not back down, and continue to shoulder the dream of changing the world by blockchain. At the same time, Xu Mingxing reminded investors that investment has two important attributes, namely long-term investment and return on investment.

However, some investors did not buy it. They directly pointed out that the investment return rate of OKB long-term investment is the lowest among the three major platform coins, and the Qian’an team has given up short-term cash and bet on the long-term rise of BNB. For long-term investment, BNB will be more appropriate. In addition, the contract version of the currency security test will also be officially launched. Today, as the demand for digital asset financial derivatives is growing, I believe that some of the users of the currency have long been waiting. At the same time, this is another major challenge for the OKex contract transaction since the launch of the contract trade at the end of last year. And whether OKex can sweep the current haze, and whether its public chain and decentralized exchange OKDex can be launched as soon as possible, will wait for time to verify.

postscript

Today, near two o'clock in the morning, Coin's co-founder He Yi once again released Weibo, and responded to the dispute caused by the BNB destruction incident. He Yi said that since the handling fee of the currency security is exactly BNB, no part of the destruction of the profit before the adjustment, or the part of the destroyed team after the adjustment, does not involve the secondary market repurchase. At the same time, the unlocked 48 million and the un unlocked 32 million accumulated 80 million BNBs will not flow to the market.

As well as the deficiencies in the currency security products, He also made the following reflections. In terms of product experience, it is expected that the July contract trading beta will go live; the user experience, especially the smoothness of Chinese-language visits, will increase as soon as possible. The huge investment in the field of security and compliance also needs to be popularized as soon as possible. In addition, the currency security will continue to maintain the sincerity and respect for the users, and the focus on the project is transparent.

Finally, although the revision of the BNB destruction rules and the expression of the announcement contents are not appropriate, the coin security team is boldly innovative, and the pioneering spirit of continuous innovation is worthy of recognition and learning by the industry. Only by not falling, the development of the entire industry will be more prosperous and healthy.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Sudden! The US Congress drafts a plan to ban technology giants from releasing digital assets

- Canadian natural gas company turns waste gas into treasure, and Bitcoin Mining once again acts as the ultimate buyer of energy

- The United States approves the Blockchain Promotion Act to standardize the technology

- Making BTC stronger, Bitcoin No. 5 maintainer received $60,000 in donations

- The next cleanup object trading platform in the US

- Analysis of the market: the market is low and the market is rebounding.

- The volume of transactions using Segwit hit a record high, accounting for more than half of the total trading volume of Bitcoin