Blockchain-based lending AAVE protocol simplifies DeFi

AAVE protocol simplifies DeFi lending with blockchain.Author: Uniera, translated by: Shanooba, LianGuai

Technological advances have brought about a new way of financial processing: DeFi (Decentralized Finance) protocols based on blockchain technology. One key aspect of this financial revolution is the ability to obtain loans directly on the blockchain in a fast, secure, and transparent manner. Among the various available DeFi protocols, AAVE stands out as an easily accessible and user-friendly alternative.

In this article, we will explore how lending works on the blockchain and demonstrate how the AAVE protocol simplifies and streamlines this process. If you are curious about obtaining loans using crypto assets or want to learn more about the possibilities of DeFi, continue reading to take your first step into this innovative field.

We will illustrate the lending process on the blockchain by comparing it to a traditional pawn shop and highlighting the advantages of using AAVE as a lending platform. Additionally, we will discuss the risks associated with such loans and how to mitigate them.

- Blockchain Capital Why did we lead the $40 million financing for ZK infrastructure company RISC Zero?

- The daily transaction volume has exceeded 20 million. Is the blockchain game Sui 8192 really that fun?

- Launching a coin without financing in blockchain entrepreneurship, pay attention to these three points

If you have heard of decentralized finance but have not yet explored all its opportunities, this article is for you. Get ready to delve into the world of decentralized lending and discover how the AAVE protocol can revolutionize your financial transactions.

Many people have concerns about obtaining loans directly on the blockchain using DeFi protocols, but nowadays, it has become a relatively simple task. There are now numerous DeFi protocols with user-friendly interfaces that can undoubtedly compete with major centralized financial products, and one of them is AAVE.

How does lending on AAVE work?

The operation is simple; it is similar to a pawn shop. You leave a watch worth $2,000 as collateral. The pawn shop then lends you $1,500. When you return, you need to repay the borrowed amount plus interest and retrieve your watch.

For cryptocurrencies, the situation is similar. You offer your accepted assets as collateral, typically WBTC, ETH, etc. There will always be an over-collateralization. For example, if you provide collateral worth $2,000, you will have approximately $1,600 available for borrowing, which can be stablecoins or other assets, depending on your strategy.

You earn income by providing $2,000 and pay interest on the borrowed $1,600.

What are the risks?

The assets you provide as collateral may fluctuate. For example, if you offer ETH worth $2,000 and due to volatility, the value of the collateral drops to $1,700, your operation will be liquidated. Liquidation penalties occur when the collateral reaches a minimum threshold. Therefore, monitoring operations to maintain healthy profitability is crucial. Before being liquidated, you can add more ETH as collateral to keep the operation running. In this case, the risk would be liquidation and payment of fees.

Under what circumstances is there interest in loans?

Using ETH as an example, suppose you need $1,000 for an emergency but own ETH worth $2,000 and have a positive outlook on the market. You do not want to sell your ETH at the moment. Therefore, you provide ETH worth $2,000 and borrow $1,000 in stablecoin. If ETH appreciates and the provided ETH (originally worth $2,000) doubles in value to $4,000, you only need to repay the borrowed $1,000 plus interest to retrieve your ETH, now worth $4,000.

How to use the AAVE protocol to obtain a loan?

Now that you understand the loan mechanism in DeFi protocols, let’s follow a step-by-step guide to get a loan.

-

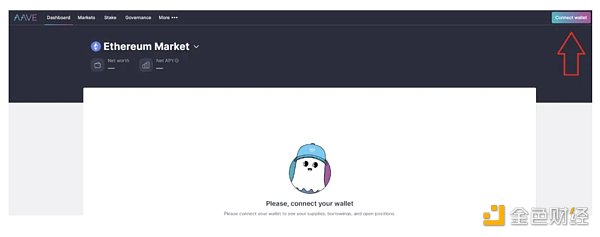

Visit the AAVE website.

-

Connect your wallet in the upper right corner, as shown in the figure below:

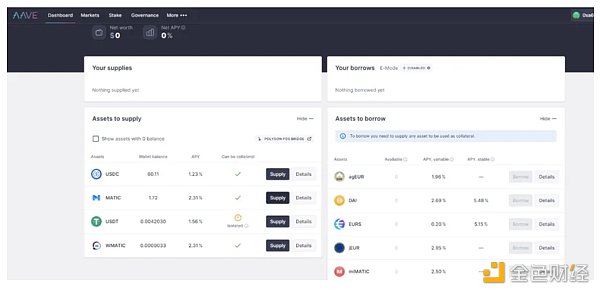

3. On the screen below, you will see the assets you can provide as collateral on the left and the assets you can borrow on the right.

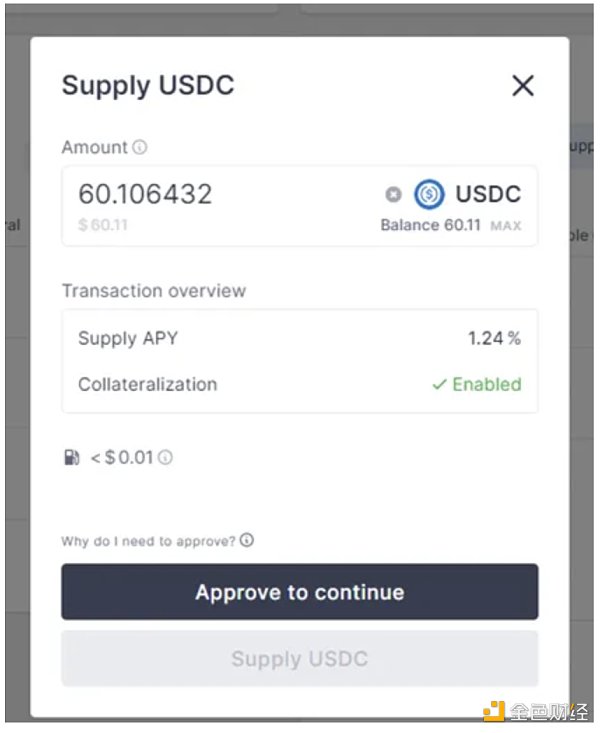

4. Choose the asset you want to provide as collateral, then click “Supply”. Then, select the quantity you want to provide and approve the transaction, as shown in the figure below.

4. On the right, choose the asset you want to borrow, click “Borrow”, select the quantity you want to borrow, and approve the transaction.

Congratulations! You have now provided collateral and made your first loan directly on the blockchain.

By elucidating the functionality of loans on the blockchain and using the AAVE protocol as an example, we hope to provide you with a clear and understandable perspective on the possibilities of DeFi. Now you are ready to explore this fascinating world on your own.

With the emergence of increasingly user-friendly and complex DeFi protocols, decentralized finance is clearly making progress and competing on an equal footing with centralized financial products. AAVE is just one of the many available options, each offering unique opportunities to maximize your financial potential.

Please remember to manage the risks involved, as while blockchain loans can bring significant benefits, monitoring asset fluctuations and maintaining healthy collateral to avoid unnecessary liquidation is crucial.

As you make progress, develop strategies, and explore new opportunities on this journey, always stay tuned to the changes and innovations shaping the cryptocurrency market.

Now that you have the tools, knowledge, and confidence to embark on a journey of blockchain loans, we wish you successful trading and encourage you to take full advantage of the benefits of DeFi. Become part of the financial revolution and discover a new world of financial freedom and autonomy.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Who is Arkham? A free Nansen exploring tokenized business models.

- CZ Binance’s Six-Year Anniversary Handwritten Letter Defending the Right Thing, Even if It Means Going to Court

- Millions of fans internet celebrity’s “textbook-like rights protection” after being falsely accused of pornography. Can blockchain solve the problem of online violence?

- Full text: US announces first criminal case involving attack on DEX smart contract.

- What is Web4.0 mentioned in the EU’s “Initiative” document? What is its relationship with Web3.0?

- Interpreting Google Play’s Digital Assets Policy: NFTs are allowed to appear in apps and games, but mining on devices is not allowed.

- After Arkham, which data tools still haven’t released their own tokens?