Add or send? TEDA's Ethereum USDT additional issuance strategy and flow analysis in August

On September 3, Beijing time, the ERC20 USDT additional address of TEDA Company, which was silent for nearly one month, was launched again, with an additional 10 million USDT. On September 4, the address was issued another 15 million USDT.

The two additional issuances at the beginning of this month seem to reflect the strategic adjustment of TEDA. We know that TEDA’s previous IPO in the Ethereum network was mostly to issue an additional 100 million USDTs, leaving a margin and gradually distributed, and the recent strategy seems to be facing The “change on demand” strategy changes. In fact, as early as the early issuance in early August, TEDA has already reflected the change in strategy. Let us review the USDT flow that TEDA has issued in the Ethernet network in August.

At 00:23 am on August 6th, Beijing time, TEDA launched the first additional issuance of the network in August in the Ethereum network, and the only additional issuance, totaling 100 million USDT, as of 23:21 on the evening of September 2, On the eve of the first issuance in September, the whole process lasted nearly 27 days. At the same time, the relay address was transferred, and the follow-up was still flowing into the active address of the market such as the exchange. We also carried out a certain degree of follow-up.

- Exclusive | Central bank officials first started the app to explain Libra and central bank digital currency

- Technical Guide | Python Smart Contract Development? It’s enough to read this one.

- 5G Chain Network – New Era Spark Program (Funding) Rural Revitalization Closed Meeting is about to be held

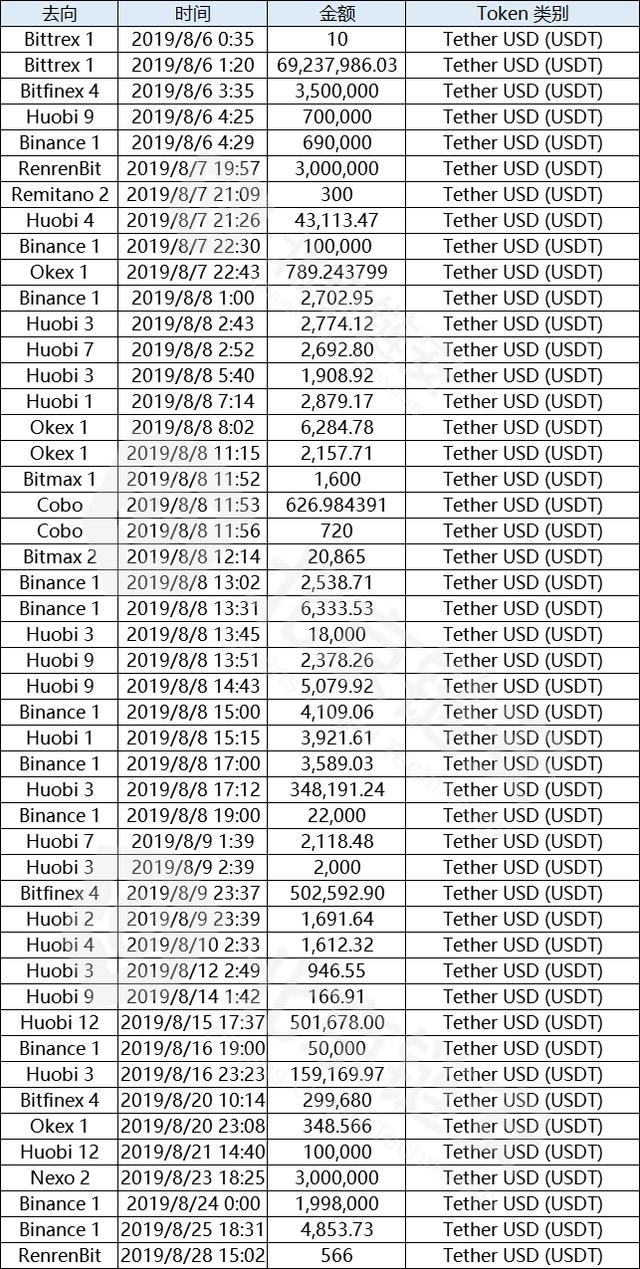

Here, we have made statistics on the transfer operations of the main 48 clear receiver exchanges, the total amount is 84358977.60 USDT.

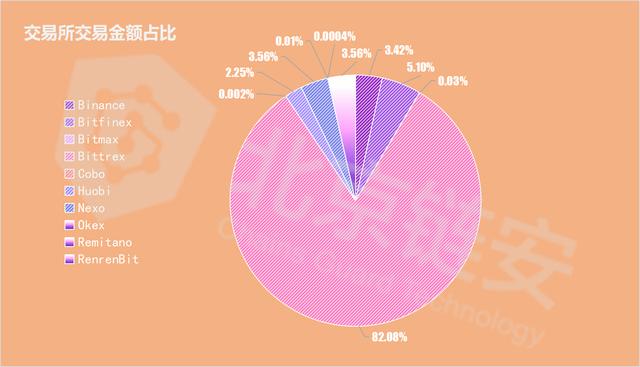

Overall, the USDT of this additional issue involves more recipients, and the wallets of 10 business entities participated in the distribution process, namely Binance, Bitfinex, Huobi, Bittrex, Bitmax, Cobo, Nexo, Okex, Remitano, RenrenBit. However, as a related exchange of the USDT issuer TEDA, Bitfinex accounted for a small proportion in the distribution process.

In terms of the inflow of exchanges confirmed by a limited number of transfers, Bittrex received the most amount, totaling 69,237,996.03 USDT, accounting for 82.08%, and the number of transfers was 2, accounting for 4.17%.

The total amount of Remitano is 300 USD, the amount is 0.0004%, the number of transfers is 1 time, and the number of times is 2.08%.

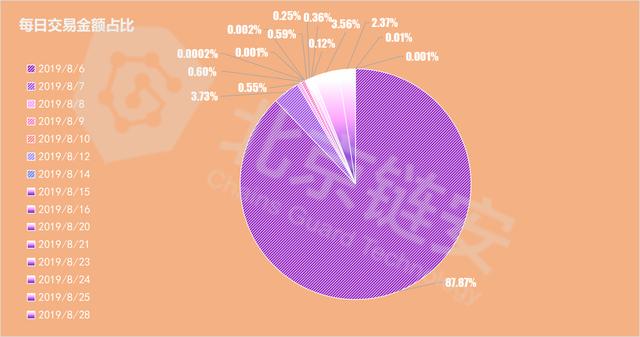

From the active date of the transfer transaction, the transfer transactions on August 8 were the most frequent, with a total of 21 transactions. The total amount accepted by each exchange was 461,353.79 USDT, accounting for 0.55% of the total, and the transaction count was 43.75%.

In the 18 days from August 10 to August 28, the number of transfers was relatively small, with a total of 13 transfers. The total amount of 6117022.04 accounted for 7.25%, and the transaction counts were 27.08%.

Below we further list the target exchange transfer list that can be confirmed as follows:

We turn these to the USDT summary of the different wallet addresses of each exchange and show them further graphically:

We can see that through more than forty transfer operations (since some transfers involve relay addresses, the actual number of transfers is more than listed), the USDT issued in August is basically distributed, and this is not only during the issuance process. More participants, more wallets with the same subject.

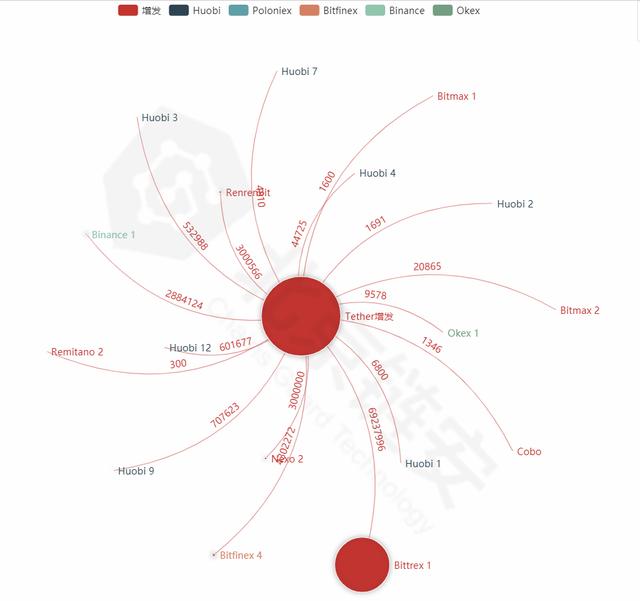

A special feature of the USDT issuance in August is that, according to TEDA's standards, the actual amount of additional issuance has not reached 100 million, because the USDT of this additional issuance to Bittrex is a bitcoin OMNI standard USDT to Ether. Square ERC20 standard USDT switch.

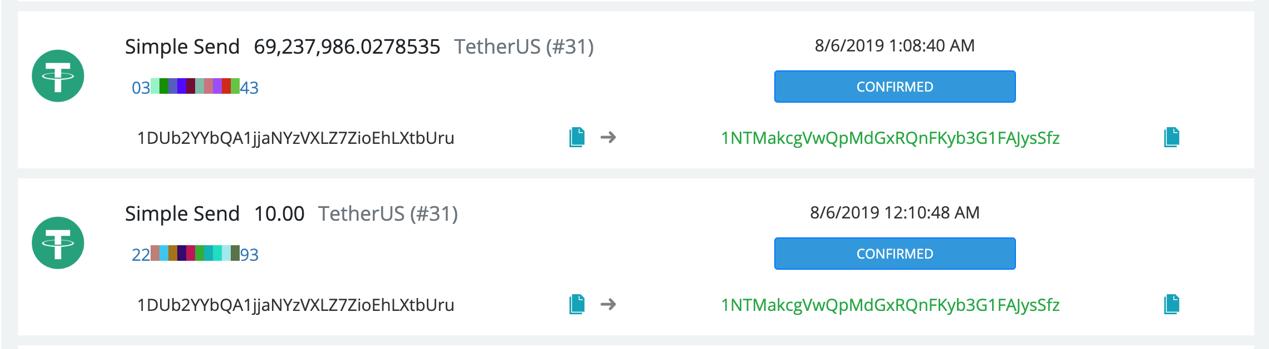

From the perspective of data flow, this is also confirmed:

We can see the address at the beginning of 1DUb2Y in the figure, the Bittrex address. They transferred nearly 70 million USDTs to the USDT official address of the TEDA OMNI standard.

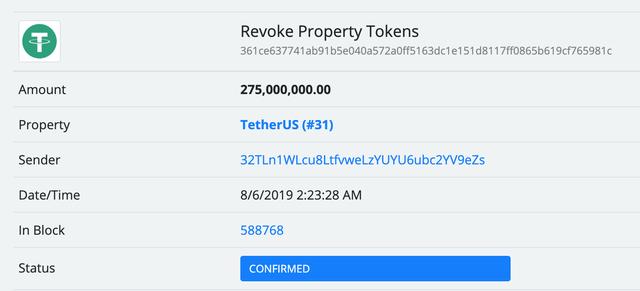

On the same day, TEDA also destroyed up to 275 million US dollars of OMNI USDT, which also confirmed to some extent its recent USDT increase in Ethereum to be more of a different network USDT switch. .

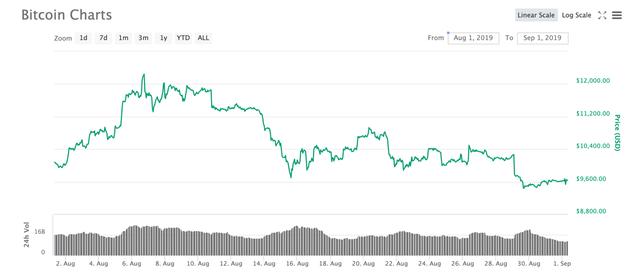

In the whole month of August, especially in the second half of the month, the price of Bitcoin was also in a whole consolidation, the volatility was relatively limited, and the market volume itself had limited demand for USDT. TEDA is at the forefront of legal disputes, and to a certain extent has an impact on TEDA's USDT release rhythm. However, from the end of August to the beginning of September, bitcoin prices once again entered a wave of plunging to a sharp rebound, the market was once again active in the short term, the price of USDT also climbed, and the demand for related stable coins began to increase, facing legal supervision, Market disputes, TEDA's adjustments in the USDT issuance strategy and the market, as well as the impact of public opinion, deserve further observation.

Source: Beijing Chain

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Data observation: Ethereum DApp ecology begins to recover

- Bitcoin rose $1,000 in two days, which may be the three reasons

- A-share blockchain concept stocks "interim examination" handed over: some profits of several hundred million yuan, and some received a million subsidies

- The volume of trading has not been significantly enlarged, and the rebound is suspected to be more attractive.

- After the Bell chain crashes, it is suspected that the new disk will be restarted.

- Legal Daily Report: How to Inherit Digital Assets (I)

- Market Analysis: BTC receives Yang again, short-term cautiously