After the listing of Jianan Technology, it broke on the same day, the main business is single, the performance is less than the industry leader 10%

Author: Xi breeze

Source: Finance and Economics Network on Finance

The cryptocurrency mining machine manufacturer has repeatedly suffered an impact on IPO, and with the successful listing of Jianan Zhizhi, the first domestic listed company has finally got its first listed company.

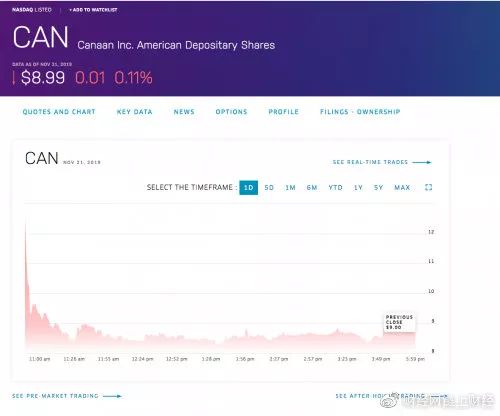

At 9:30 am on November 20th, US Eastern Time, Canaan Inc., the ultimate holding company of mining machine manufacturer Jianan Zhizhi, was officially listed on NASDAQ under the ticker symbol "CAN". The price is $9 per ADS (American Depositary Shares). The opening price on the first day was $12.6 per ADS, a 40% increase from the issue price of $9/ADS and a maximum of $13.

- The $5 trillion brokerage giant will be born, and the bitcoin price may be unexpectedly affected.

- $ 383 million! The Korean government will provide huge incentive funds for blockchain development

- Thoughts on the Development of Stabilizing Coins and the Repositioning of DEX

After a short pause, the price plummeted and fell below the issue price at 12:07 am on November 22, Beijing time. At the close, the lowest touched $8.21/ADS, temporarily reported at $8.99/ADS, down 0.11% from the issue price, and the current market capitalization is $1.422 billion.

If you do not calculate the over-selling portion, the Jianan Technology US stock market will officially issue 10 million shares of ADS, which is consistent with the fundraising scale of 10 million ADSs (Note: ADS=15 shares of Class A common stock) announced in the previous prospectus. The issue price is finally locked at the lowest price per ADS quote range (ie $9 – $11) published in the previous prospectus, at the issue price of $9, for a total of $90 million.

The IPO has been hit by many times and it has been successfully listed on the US stock market after several setbacks. The process of applying for the listing of US stocks by Jia Nan Nan Zhi Zhi is particularly high-profile.

Since the “invalidation” of Jianan’s IPO application to Hong Kong in November last year due to unapproved, it has been reported in January this year that Jianan Zhizhi will go to the US to apply for IPO listing.

At the end of July this year, the public number "IPO knows" broke the news that "Jia Nan Zhizhi has submitted a listing application to the SEC secretly."

At the end of October, Jia Nan Yu Zhi officially submitted the F-1 prospectus to the US Securities and Exchange Commission (SEC). After the promulgation of the prospectus, there have been repeated reports that “November 20th” will be the final date for Jianan’s official listing on NASDAQ.

Judging from the background of this round of listing of Jia Nan Zhi Zhi, compared with the previous application for Hong Kong stock IPO, Jia Nan suffered a significant shrinkage in the revenue and profit of the last round of the market. Although the market's overall situation has improved in the second quarter, the overall revenue of Jianan Zhizhi has also improved, and this is considered to be one of the main reasons for mining machine manufacturers to rekindle the hope of IPO, but if combined risk In terms of factors, Jianan’s listing of US stocks in this round is no more advantageous than the previous application for Hong Kong stock IPOs.

With the Nasdaq bell ringing, Jia Nan’s IPO journey was settled, but Jia Nan still faces a downward adjustment in the amount of funds raised, but after the opening of the market, it has broken down and broken… and so on. How much reference value does the first share leave for the industry?

The amount of fundraising was lowered before the listing, and the roadshow effect was questioned.

In the preliminary prospectus document of Jianan Technology on November 13, the number of planned issuances and the pricing range were announced for the first time. The total amount of funds raised was between 90 million US dollars and 110 million US dollars, and the maximum total fundraising amount was 400 million US dollars. Later, on November 18th and November 20th, Jia Nan Zhizhi updated the two editions of the prospectus documents and changed the total amount of the proposed maximum fundraising of 400 million US dollars to 126.5 million US dollars. The official fundraising amount of 90 million US dollars is lower than the market expectation, and there is a certain gap between the initial fund-raising total of 400 million US dollars in the prospectus.

Earlier on November 14, Caijing.com and Chain Finance reported that the amount of funds raised was lower than market expectations. Some sources close to Jianan Zhizhi told Finance Network and Chain Finance that the amount of funds raised was lower. The main reason may be that the roadshow on November 12th in the United States may not be as good as their expectations, and the response is not very good.

The Mars Finance report on November 15 said that sources close to Jianan Zhizhi Investment Bank revealed that the company’s first-day roadshow exceeded expectations, over-subscription was nearly three times, and investors were positive.

Afterwards, the financial network reporter had conducted a verification on Jia Nan’s wisdom about the reasons for the downward adjustment of the amount of funds raised. Jia Nan’s wisdom responded at the time: “At present, we are not giving information on various information about Jia Nan. Comment."

In addition, it is also believed that Credit Suisse, which was the first underwriter of Jianan Technology in the first two prospective prospectus, has withdrawn from the underwriters, which is one of the reasons for the downward adjustment of the amount of funds raised.

What is the effect of the road show? What is the reason for the downward adjustment of the amount of funds raised? This series of questions is still doubtful.

Regarding the reasons for lowering the amount of funds raised before listing, industry insiders analyzed that there are usually two possibilities:

First, the listing of new shares is generally a dilution of the original shareholder shares. The company may feel that it does not need to raise so much money and sell so many shares. For the current Jia Nan, perhaps the “famousness” obtained by the listing is more important than the “money”;

Second, it is likely that the effect of the listed road show is lower than expected, resulting in the company's lack of confidence in the listing. As far as the “mine machine manufacturer” is concerned, the industry ceiling is not high. The business structure of Jianan Zhizhi still relies heavily on the sales of Bitcoin mining machines. Some external investors may not be particularly optimistic about this. Jianan itself is also striving to upgrade its positioning by transforming “semiconductor companies that develop and produce AI chips” or “supercomputing solution providers”.

The common business of the miner’s “main business single” has not affected the listing process.

Jianan Technology's income structure includes three parts: product income, mining machine rental income and service income, but the most important part is product revenue. The product income is mainly divided into two parts: blockchain products and AI products. Blockchain revenues account for the vast majority of product revenue.

Blockchain product revenue mainly refers to the sale of Bitcoin mining machines and other parts and accessories of mining machines. According to the prospectus information, in the nine months of 2017, 2018 and September 30, 2019, the proportion of Bitcoin mining machines in total revenue was 99.6%, 99.7% and 98.3% respectively. In the income data of the past three years, it is obvious that the mining machine revenue has always occupied an absolute proportion, and the main business is considered to be one of the main reasons why the mining machine manufacturers have repeatedly failed to attack the IPO.

In addition to advertised "the first block of the global blockchain", Jianan will also position itself as "the first share of China's independent intellectual property rights AI chip", but the relatively high-profile AI business is still flat, with the main There is a big gap in the mining machine business of the camp. Jia Nan has been developing ASICs for AI applications since 2016. In June 2018, the AI chip was released. In September 2018, the first generation AI chip Kendrye K210 was released, which means that it will not be until 2018. Half a year after the AI business began to generate revenue. As of September 30, 2019, Jia Nan has sold more than 53,000 K210 chips and development kits, most of which are from overseas. For the nine months ended September 30, 2019, AI revenues accounted for only 0.1% of total revenue.

The consequences of a single business are directly reflected in the revenue data. In 2017, in the first nine months of 2018 and 2019, as of September 30, 嘉南耘智 sold 294,523 units, 559,137 units and 410,346 bitcoin mining machines, providing 2,114,637 Th / s, 7,158,666 Th / s and 7,597,925 Th / s computing power, blockchain products generated 1.303 billion yuan, 2.698 billion yuan (about 37.75 million US dollars) and 944.6 million yuan (about 132.2 million US dollars) of income.

At the end of 2018, the sharp drop in bitcoin prices led to a sharp drop in the sales volume of miners and the average selling price of the machine, which directly affected Jianan’s business performance and financial situation. According to previous financial report data for the first half of this year, the income for the six months ended June 30, 2019 was 288.8 million yuan (about 42.1 million US dollars), compared with the previous 6 months ended June 30, 2018. Revenue of 1.947 billion yuan (about 278.7 million US dollars) fell by 85.2%. In the first half of 2018, Bitland's revenue reached 2.85 billion US dollars. Jianan's revenue in the same period only accounted for 9.8% of Bitian mainland, less than 10%. And for the six months ended June 30, 2019, Jianan Technology's net loss was 330.9 million yuan (about 48.2 million US dollars).

In the second quarter of this year, the price of the currency rebounded, and during the period of the wet season, the supply of mining machines was in short supply. From the third quarter onwards, the revenue situation has indeed recovered significantly from the first two quarters of this year. But this change is not immediately reflected in revenue data. According to the previous Secretary of the Block Chain Club of Peking University and the founder of Bit Blue Whale, Chen Lei, who was interviewed by Caijing.com, said that the current production capacity of the mining machine is generally determined three to six months ago when the manufacturer’s chip was placed. The response to capacity is generally lagging. And because bitcoin prices only began to recover in the second quarter of 2019, Jianan's revenue growth rate generally lags behind the increase in bitcoin prices.

Therefore, although the total revenue in the third quarter exceeded the total revenue of the first two quarters of this year more than twice, but the total revenue of Jianan for the nine months ended September 30, 2019 was 959.4 million yuan (about 134.2 million US dollars). Compared with the total income of 2,247.6 million yuan (about 339.5 million US dollars) for the nine months ended September 30, 2018, it still dropped by about 60.5%.

In the AI business segment, the revenue of AI products in the second half of 2018 is 300,000 yuan. In the first half of 2019, the profit was only 500,000 yuan. In the third quarter of this year, the revenue reached 900,000 yuan. As of September 30 this year, AI's revenue is 1.4 million yuan, accounting for only 0.1% of total revenue.

In addition, as of September 30 this year, the mining machine rental income was 13.3 million yuan, accounting for 1.4% of revenue; service income decreased compared with last year, accounting for 0.1%; other income accounted for 0.1% .

Shareholder composition adjustment: Zhang Nanyi enjoys actual control

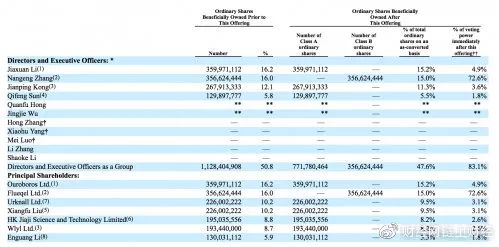

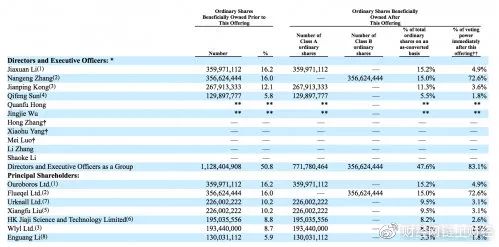

After the initial public offering, the shareholder structure of Jianan Technology has also been adjusted. Previously, the prospectus information showed that before the IPO, Li Jiaxuan held 16.2% of the company's management, Zhang Nanyi held 16%, Kong Jianping held 12.1%, Sun Qifeng's shares were 5.8%, and the other seven management personnel held the total. With a 0.7% stake, the management holds a total of 50.8% of the shares.

In addition, the list of shareholders includes seven major investors including companies and individuals such as Ouroboros Ltd and Flueqel Ltd. Among them, Liu Xiangfu holds 10.2% of the shares through his wholly-owned company Urkanall Ltd. Compared with 17.61% of the previous period of applying for IPOs, Liu Xiangfu is no longer the largest shareholder of Jianan. In June 2019, Urkall Ltd. sold a total of 165,335,556 shares of common stock, including the sale of 54,446,667 shares of common stock to Wlyl Ltd. and the sale of 16,666,667 shares of common stock to Root Grace Ltd. Kong Jianping was the beneficiary of Wlyl Ltd., which purchased a total of 103,440,000 shares of common stock from other shareholders.

As of the publication of the prospectus on November 13, 2019, the total number of common shares outstanding by Jianan Technology was 2,222,222,222 shares, including 52,027,157 restricted shares. After the completion of this IPO, Jianan Technology issued a total of 150 million Class A common shares, and the outstanding common shares included 2,015,597,778 Class A common shares and 356,624,444 Class B common shares.

Li Jiaxuan’s shares fell to 15.2% and enjoyed 4.9% voting rights; Zhang Nanyi’s shares were adjusted to 15% and enjoyed 72.6% of voting rights; Kong Jianping held 11.3% and enjoyed 3.6% of voting rights; Sun Qifeng held 5.5% and enjoyed 1.8 % of voting rights. The management will hold 771,780,464 Class A common shares and 356,624,444 Class B common shares (and Zhang Nanyi owns all Class B common shares without over-allocation), holding a total of 47.6% of the shares and enjoying 83.1% Voting rights.

According to the prospectus, in matters requiring shareholders to vote, each class A common share will have 1 vote, and each class B common share will receive 15 votes. Class B ordinary shares can be converted into Class A common shares at any time by their holders, but Class A ordinary shares cannot be converted into Class B ordinary shares.

Since Zhang Nanyu holds all Class B common stocks without implementing over-allocation, Zhang Nanyi has actual control over Jianan Technology with 72.6% of his voting rights after completing the IPO.

Jianan US stock listing apocalypse

Mr. Zhang Wei, a partner of Wanshang Tianqin (Shanghai) Law Firm, had previously accepted the financial network and chain financial interviews and analyzed that the US IPO is a registration system. The basic principle is to emphasize the full truth of the information disclosure and cannot induce , deceive and defraud investors. There is no substantial obstacle to the listing of mining machine manufacturers, and there is no law to make the mining machine manufacturer illegal.

“Although the US SEC will consider the impact of cryptocurrency market fluctuations on the business profit of miners when evaluating applications for miners, the SEC's focus may be more on how companies accurately describe information to investors, specific investments. The risk is up to the investors," he said.

“The difficulty of Jianan’s listing in the US is whether they can accurately assess the benefits and risks that the business brings to investors.”

Realizing the listing is only the beginning. From the perspective of the market performance after the listing, the main factors that caused Jianan to break on the first day of opening are as follows:

First of all, the industry believes that the US stock market has "drained" Jia Nan to a certain extent. According to news from Tencent Securities on November 21, US stocks opened higher on Thursday, as the international situation ushered in an "optimistic" signal, but then the whole line went down. By the close, the three benchmark stock indexes fell, and the Dow and the S&P 500 both welcomed. Come three consecutive days. At the same time, the market is still digesting the minutes of the Fed meeting and economic data.

Secondly, from the perspective of its own risk factors, the growth rate of mining machine manufacturers has not been regular compared with traditional enterprises, and the growth system is relatively fragile. It is more vulnerable to policy factors, the big environment, and the recognition of the blockchain by the market. The extent of knowledge and acceptance, the maturity of the technology itself, regulatory policies and the landing of business scenarios are many factors. From the "risk factors" section of Jianan Technology's prospectus, it can be seen that the profitability of Jianan Zhizhi is still greatly affected by the fluctuation of bitcoin price, the fluctuation of bitcoin network transaction costs, the cost of bitcoin mining, and the bit. The decline in the incentives for coin mining is affected by factors closely related to the expected economic returns of Bitcoin mining.

Before the official listing of Jianan, the founding partner of Primitive Ventures, Wan Hui, said on Weibo on November 21 that the performance of Jianan's stock of $CAN is very important for many US institutional investors who want to enter Bitcoin. Many of them cannot be purchased directly. Institutional investors who enter Bitcoin or think that Greyscale is too costly (or for any other reason) will use this as a bitcoin Proxy (replacement), or a bitcoin productive asset with only cash flow. Bitcoin's listing is estimated to be in the foreseeable future, and this is the only option for a long time to come. On the other hand, if the performance of this “bit blue chip” is flat or collapsed, it will also affect the overall confidence of institutional investors in this industry. I hope CAN can be a cardiotonic agent.

After nearly two days of shock consolidation in the range of 8,000-8,300 US dollars, the bitcoin price fell below the 8000-dollar mark at 16:40 pm yesterday. At 10:58 pm yesterday, Jianan was still immersed in the landing on NASDA. At the time of Ke’s joy, Bitcoin’s price plummeted by nearly 4.5%, briefly fell below $7,500, and hit a low of $7,490 after hitting $7,490. As of press time, it was temporarily reported at $7,660.

As the first block of the “blockchain” is launched, the high risk from the digital currency market will also penetrate into the US capital market.

Third, as far as the profit model is concerned, the problem of revenue structure is more obvious. Except for the large proportion of the main business, which is greatly affected by risk factors, this has caused the company's ability to resist risks to be limited. On the other hand, the focus on AI business is not optimistic about the market, although in the third quarter of this year, Jianan Zhizhi's AI product revenue hit a record high, but overall, AI business revenue is too small The revenue capacity is insufficient. On the contrary, industry insiders suggest that applying for AI business as a new profit growth point or advantage may not help much. Once this business is not done well, the future may bring risks of intentional exaggeration or information. To a large extent, this has limited the imagination space that mining machine manufacturers can bring to the capital market by expanding the AI business.

As the first listed company of domestic mining machinery enterprises, Jia Nan Zhizhi's US IPO has received much attention. However, the establishment of market confidence is a long-term and continuous process, and its subsequent market performance will also affect the direction of other mining companies' listings. Is this just the beginning?

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Babbitt column | Is the currency East a shareholder?

- Exclusive Dialogue with Zhang Nanwei: My Past and the Future of Jianan

- Babbitt column | Xiao Wei: Three cities "virtual currency" risk tips, what is the deep meaning?

- Radio and Television Administration Du Baichuan: Smart society is approaching, 5G and blockchain are supporting technologies

- The Shenzhen Municipal Bureau of Local Financial Supervision has detected 39 illegal enterprises suspected of carrying out virtual currency activities.

- CITIC Bank Xuanqi: Practice and Future of Blockchain Technology in Financial Scenes

- Grayscale Fund: Institutional interest is not diminished, 84% of the capital inflows in the third quarter of this year came from non-encrypted hedge funds