Bitcoin's soaring population: the mining giant ushered in the spring exchange to die in the cold winter

After experiencing a downturn last year, the price of the world's largest digital cryptocurrency bitcoin began to rejuvenate in the new year, rising to $14,000. Although it has recently fallen back, it still recorded a huge increase from the beginning of the year. As of press time, the digital currency is still above $10,000.

The price fluctuations of Bitcoin are huge and staggering. Bitcoin prices once climbed above $19,000 in December 2017, but after that they fell all the way down to a little above $3,000 in December 2018. Since the beginning of this year, bitcoin prices have risen by nearly 200%, and most of them have been harvested in the last three months, indicating that bitcoin prices are extremely volatile in a short period of time.

Regarding the reason for the skyrocketing price of Bitcoin, the mainstream market believes that this is mainly related to the launch of Facebook's own digital currency Libra by social giant Facebook. Facebook recently announced its social network cryptocurrency Libra. The launch of this cryptocurrency project has ignited the enthusiasm of the market because the market believes that cryptocurrencies are likely to go mainstream.

However, Facebook's launch of Libra is not enough to push Bitcoin to such a large increase, and its safe-haven property is another factor. Analysts pointed out that in the recent Sino-US trade dispute, the global economic slowdown and the warming of the geopolitical situation in the United States and Iraq, a large number of investors bought Bitcoin as a safe-haven asset to hedge against the turmoil in the global financial market.

- What will be the martyrdom of David Marcus at the upcoming two Libra hearings?

- BTC fluctuates at a high level, and the short-term market is exhausted.

- Bai Shuo commented that the face of the letter is blocked: to prevent financial risks, but also to retain innovative living water

Bitcoin's roller coaster market is accelerating heartbeat and bloody spurts. This trend of opening and closing has also made many people unable to understand. The violent fluctuations in the value of Bitcoin, a cryptocurrency, are not only tied to the hearts of every investor, but the companies and industries associated with it are experiencing their own ups and downs.

Some ushered in spring, and some died in the cold winter.

The mining giant Bit China has recently launched another impact on the listing. Last year, it was prepared to go to Hong Kong for listing. Because of the low price of bitcoin, it was stranded. This time, Dongfeng, which was riding the bitcoin, changed its listing location to the United States. It is reported that Bitcoin has submitted a prospectus to the US Stock Exchange (SEC), but it has not been announced on the NYSE or Nasdaq.

From the large fluctuations in bitcoin prices, I feel very deep that there is a bit of mainland China. In the process of the continued decline in bitcoin prices last year, Bitian’s application for listing in Hong Kong failed. In addition, the mining machine developed by the company is also unattended, and the company's revenue is also plummeting.

When people are still worried about when the winter of the mining industry is over, the reversal of bitcoin prices has dispelled the haze over the industry. Since the end of March this year, bitcoin prices have risen from $4,000. After entering June, the upward momentum has further intensified, directly breaking through the $10,000 mark and rising to as much as $13,000. In the process, Bitian's mining machines began to become popular, and even became difficult to find a machine, which is in stark contrast to last year's deserted market.

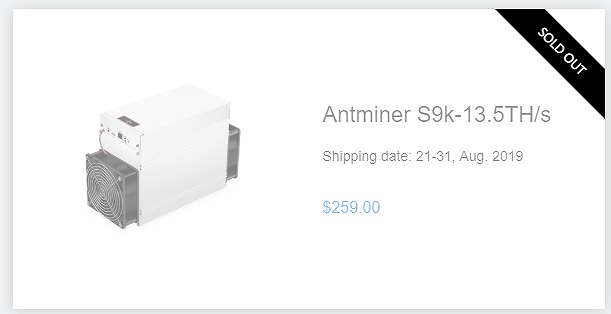

According to the official website of Bitcoin, the mining equipment provided by Bitland is called Antminer (ant mining machine), which can not only dig bitcoin, but also dig other cryptocurrencies. Bitland offers different types of ant mining machines, and their calculations are not the same, and the prices are different. At present, the major models of mining machines have been sold out, and the shipping date of some models of mining machines has been scheduled for August and September. In addition to the mining machine, some hardware components have also been sold out, which is enough to illustrate the current hot market for mining machines.

Image source: Bit Continental official website

At the same time as the good days of Bitcoin, some participants in the currency circle are not so good. Last year, the global bitcoin trading platform ushered in a large-scale collapse, and many trading platforms in the bitcoin bear market environment failed to survive the winter. It is reported that the Chinese bitcoin trading platform CATTLEE, which had just been online for less than ten days on June 6, 2018, declared bankruptcy. In the near future, another Chinese trading platform, 86bex, also announced that the platform has been unable to continue operations and will close the channel. Not only China, but also the foreign bitcoin trading platform is not good. In March 2018, Coinbin, the Korean virtual currency exchange, filed for bankruptcy because it was already in financial trouble. At the beginning of this year, Liqui, a Ukrainian cryptocurrency exchange, was unable to operate because of the continued cryptocurrency, and declared bankruptcy.

Bitcoin’s bearish sentiment has also affected the enthusiasm for the establishment of the Bitcoin exchange. According to information published on the CoinMarketCoin website, there is only one of the top 100 bitcoin exchanges in the newly established circulation this year, and this in 2018 and 2017. The number of items is more than 20. In the case of unexpectedly skyrocketing bitcoin prices in the middle of this year, I wonder if it will rekindle the enthusiasm of the exchange.

Is the bull market turning sharply?

In the future, where will the price of bitcoin go, will it repeat the mistakes that followed the sharp rise and then turn around, or open the bitcoin bull market?

It is reported that by May 2020, the “mining” compensation of Bitcoin is expected to be halved, which will reduce the mining enthusiasm of “miners”, which will reduce the supply of Bitcoin and push up the price of Bitcoin.

It is worth noting that if Facebook launches Libra, as some experts predict to promote people's enthusiasm and acceptance of Bitcoin, the halving of Bitcoin “mining” will result in a larger supply gap.

As early as the end of May, the co-founder of blockchain investment company Kenetic believes that bitcoin will rise to $30,000 by the end of this year. In early June, the founder and CEO of the Digital Currency Group pointed out that “it seems that the cryptocurrency will go out of the cold and enter the spring”.

Mark Lam, CEO of CoinFLEX, also expressed confidence in cryptocurrencies, he said. "In the long run, it is obvious that cryptocurrencies will replace some or most of the fiat currency. The question is when this will happen. It is the cause of the volatility of the cryptocurrency, because it is still very early, only tens of millions of people are using it, and the traditional currency has billions. This is my view in 2012, when I fully invested in bitcoin, and even borrowed Money is bought, and my point of view remains the same.” CoinFLEX is the world's first futures exchange for physical delivery of cryptocurrencies.

However, there is no shortage of vigilant voices on the market. Former Wall Street executives and current blockchain senior expert Tone Vays expressed doubts about the end of the cryptocurrency winter.

Fang Gang, founder and managing partner of Sora Ventures-Majority, pointed out that “most of the transactions are conducted off-site. We say that more than 70% of transactions are done through over-the-counter trading. Based on this, you can assume that everything is possible. You can go back to $5,000 or $20,000." He also gave specific investment advice: "If you are an individual investor, don't think about investing in a bitcoin and then quickly withdraw, it is best to put the currency. Considered as a long-term investment and high-risk product."

Source: Forbes Chinese

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Facebook hearing testimony exposure: Libra will not be launched rashly until regulatory concerns are removed

- FB blockchain leader Marcus: Libra will not compete with sovereign currency

- Completely blocked! The most stringent bill in the history of India reveals that the "digital rupee" is emerging

- Popular Science | Bandwidth and Blockchain: How Developers Minimize Overhead

- Trump slams Bitcoin and Libra; the US Congress intends to ban technology giants from digital assets

- "No brain black" or "Frenzy powder"? Check the national politicians who are talking about cryptocurrency and blockchain

- Blockchain Weekly | US SEC issues Trump to question cryptocurrency through two compliant tokens