April cryptocurrency financing monthly report: IEO replaced ICO as the main mode but the total amount still dropped by 70%

Author: According to the inter-chain pulse issued on April 3rd, "ICO monthly report (probably the last issue): financing amount of only $15 million", we judge that the ICO financing model has almost come to an end, so from May Initially, the interchain pulse expanded the financing statistics for encrypted assets to include IEO and STO. The market is also controversial about these two models, but we try to reflect objective data and provide relevant information to the industry. Welcome to continue to pay attention to the pulse of the chain.

After the Spring Festival this year, IEO became a means of self-help by the exchange and triggered a round of hype. However, in April, in the past, the IEO model did not make any substantial changes to the ICO, and it was quickly abandoned by investors.

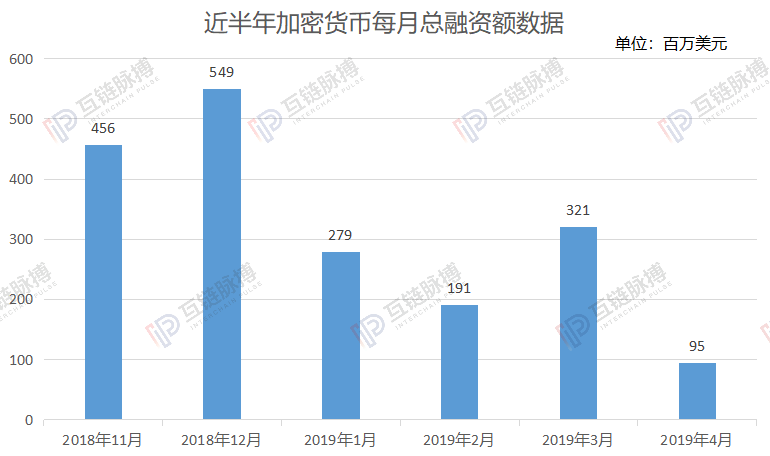

Mutual chain pulse According to the statistics of Coin Schedule, in April, the total financing amount of ICO, IEO and STO in the cryptocurrency market totaled US$95 million, a decrease of 70.4% from March.

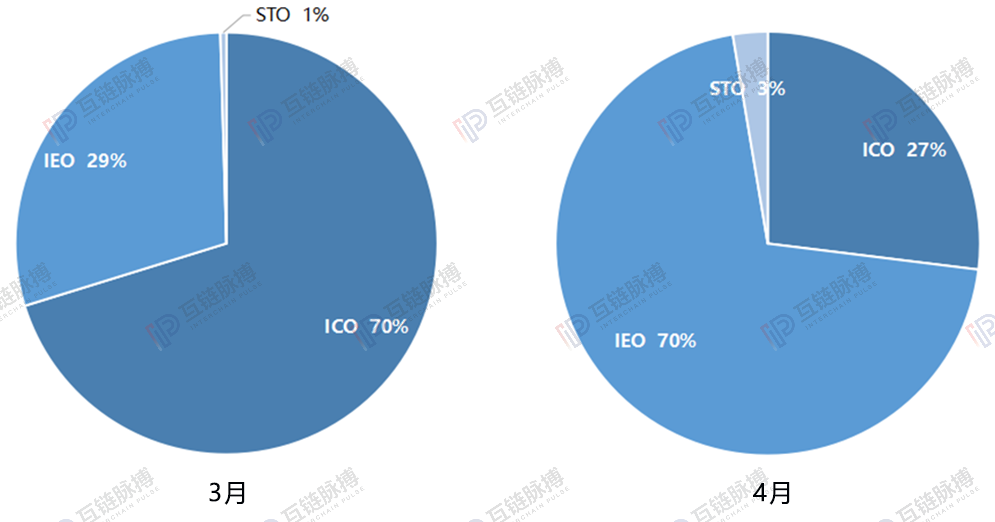

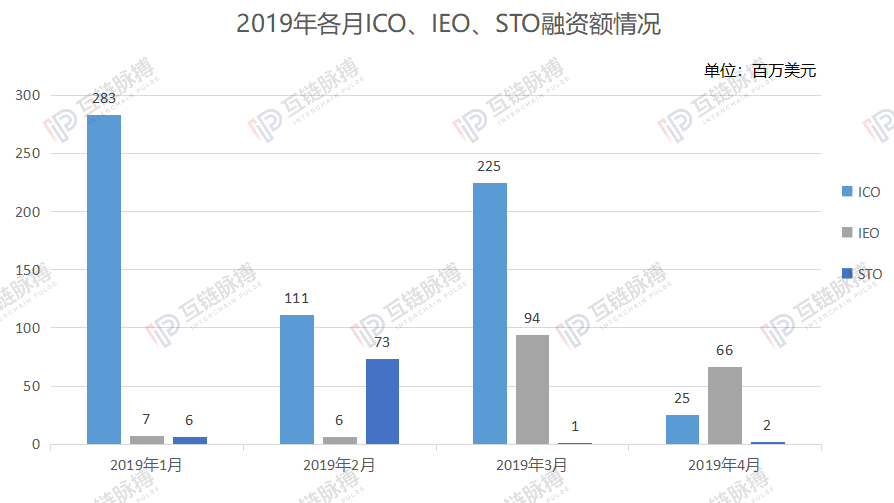

Among them, IEO's financing amount is US$66 million, accounting for 70% of the total; ICO's financing amount is US$25 million, accounting for 27% of the total; STO's financing amount is only US$2 million, accounting for 3%.

- Blockchain privacy development company QEDIT completed $10 million in Series A financing, Ant Financial

- Switzerland's largest stock exchange SIX plans to issue native digital assets and propose a new concept IDO

- The cryptocurrency version of "Game of Thrones", if BTC is a dragon mother, who is the ghost?

(Cartography: Interchain Pulse Data Source: Coin Schedule)

Compared with the data of March 2019: IEO financing amounted to 94 million US dollars, accounting for 29% of the total; ICO financing amounted to 225 million US dollars, accounting for 70% of the total; STO financing amount was only 1 million US dollars, accounting for 1 %. It can be observed that IEO has replaced ICO as the main financing mode for cryptocurrency.

Proportion of financing amount of three types of financing models in March and April

(Cartography: Interchain Pulse Data Source: Coin Schedule)

Inter-Chain Pulse began to focus on ICO financing since the second half of 2018, and recorded monthly data changes in the form of monthly reports. In January 2019, the ICO financing data platform icodata.io no longer updated relevant data. Inter-Chain Pulse continues to observe changes in ICO financing through the icorating platform. The platform shows that in March 2019 ICO financing fell to $15 million. As of now, the icorating platform has not updated the ICO financing data in April, and many organizations in the market have no hope for the ICO model.

However, it is worth mentioning that STO-securities-type issuance refers to the issuance of legally compliant and issuance of certificates in accordance with the requirements of laws, regulations and administrative regulations under a defined regulatory framework. As an old concept, it was re-introduced in September 2018 and caused a sensation in the market. It was hailed as the next vent of ICO.

However, observing the amount of financing, the amount of financing of STO failed to exceed ICO in the early stage, but failed to surpass IEO in the later stage, and the thunder was loud and the rain was small. Some media summarized, first, because STO's compliance costs are high, and secondly, its fundraising audience is too narrow, and liquidity is insufficient.

(Cartography: Interchain Pulse Data Source: Coin Schedule)

With the heat of STO dissipating, the ICO model failed to return as expected, and IEO made its headlines in 2019.

IEO refers to the act of using the exchange as a fundraising platform to issue tokens to users of the exchange. The exchange will then become the main trading market for the token in the secondary market. For example, a series of projects led by BitTorrent on the Dollar Launchpad.

Unlike ICOs, IEO financing through the IEO model requires a series of reviews by the exchange to finance. Although the exchange can not fully identify the prospects of the project, but to a certain extent, the user avoids the risk and is more likely to gain the trust of the user.

Mutual chain pulse observation, with the exchanges around the IEO in March 2019, IEO's financing amount rose linearly, more than 15 times. In April, there was a certain return to cold, and the amount of financing fell by 29.87%.

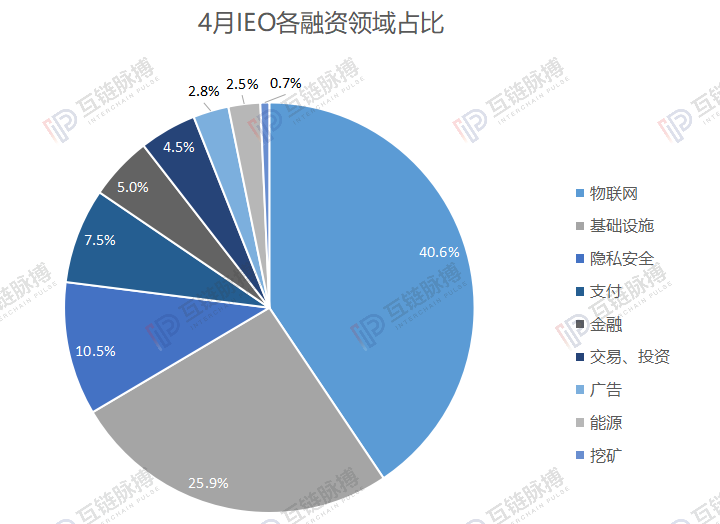

Among them, if the proportion of financing areas in April is calculated according to the amount of financing, the largest proportion is in the Internet of Things (40.6%), followed by infrastructure (25.9%), privacy and security (10.5%), and payment ( 7.5).

(Cartography: Interchain Pulse Data Source: Coin Schedule)

The most important data for the Internet of Things field is the ioeX project, which raised $27 million, the same as the IEO financing ranking in April. This is followed by a $16 million MultiVAC financing and a $7 million VeriBlock financing.

This article is [inter-chain pulse] original, reproduced please indicate the source!

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Blockchain Policy April Report: Domestic support policy information rose by 53.33%, Guangdong, Zhejiang and Guizhou were positive

- In the final battle of "Reunification 4", the winner turned out to be… Lightning Network!

- Research: Bitcoin inflation loopholes still exist, 60% of Bitcoin is or affected by the entire node

- Bitcoin in an old gunhole: The currency system works because people want it to work

- April blockchain application monthly report: new application projects increased by 53.3%, China's landing speed led the world

- Twitter Featured: IDO, Switzerland's largest stock exchange, Coinbase managed token 30+

- After Bitfinex was “broken grain”, the market was polarized: some people cashed in 340 million US dollars, and 700 million dollars wanted to get on the bus.