Are the safe-haven assets in the economic crisis in the US dollar or bitcoin?

But if you ask Ray Dalio, the chief executive of the world's largest hedge fund: "When is the next recession?" He might say: "There is a 55% probability in the last two years."

During the 2008 financial crisis, investors circumvented asset risk by shifting the exposure of stocks and real estate to low-risk investment fields such as US Treasury bonds and gold. This is the so-called “risk aversion” environment. Since 2009, our risk tolerance has been gradually increasing.

Investor behavior in the field of cryptocurrency also confirms this. Many people think that Bitcoin is a risk-bearing asset, which means that investors may turn their investment exposure to bitcoin during high-risk periods, thus pushing up the price of the currency.

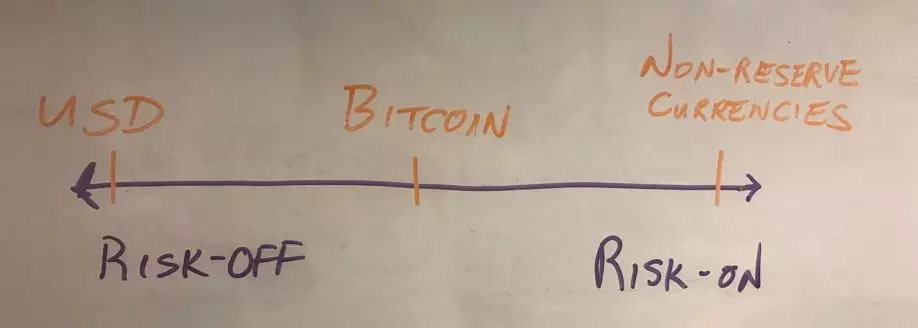

But the key point is that “risk tolerance” and “risk aversion” are not black and white, but exist in the middle.

- The plagiarism is near: the end of the Qin, paper, Annie, Baidu, four blockchain copyright product evaluation

- "Common Chain Head" EOS Social Transformation

- [AMA] Can Ethereum use DeFi to detonate the next bull market? | MakerDao & imToken

With the continuous evolution of Bitcoin, which position is in the middle of “risk tolerance” and “risk aversion”?

I am increasingly convinced that after nearly 10 years of liquidity growth and constant supply, the risk of Bitcoin is currently between the US dollar and other non-reserve currencies (such as the renminbi).

In this particular period, funds began to flow into the US dollar from high-risk markets such as the stock market, partly because investors can get higher returns from the dollar, and partly because interest rate hikes indicate that we are entering the later stages of the economic cycle.

Bitcoin has also plummeted from $6,000 to around 3,000. Is this just a coincidence? It's hard to say, but I bet that raising interest rates may be a contributing factor. Of course, Bitcoin is still more risky than the US dollar.

The second event is the recent depreciation of the yuan against the US dollar. At present, the RMB exchange rate is approaching 7:1, which is an important psychological line of defense for many Chinese.

In addition to the depreciation of the renminbi, the recent Sino-US trade war is also very important. Many people speculate that the latter is one of the reasons for the recent rise in bitcoin. But the link between the trade war and the bitcoin market is weak. Factors such as trade wars have led to the depreciation of the renminbi, but the depreciation of the renminbi itself is more likely to have a direct impact on the demand for bitcoin.

In the above incidents, we have seen that as investors turn “risk aversion” into “risk tolerance”, the direction of the cryptocurrency market will also change.

During the rate hike, investors believe that Bitcoin is too risky for them, so they switched from Bitcoin to US dollars.

When the renminbi depreciated against the dollar, investors felt that the renminbi was more risky than bitcoin, so they switched from renminbi to less risky assets such as bitcoin and the dollar.

So what will happen to Bitcoin during the next financial crisis? I suspect that this will depend to a large extent on the nature of the crisis.

- 1. If the crisis is mainly confined to developing countries with non-reserve currencies, this could push bitcoin prices higher.

- 2. But if the crisis occurs in developed countries, especially the United States, then two things can happen:

(1) If people continue to believe in the US government and the Federal Reserve, as they did during the entire US recession of the last century, it is likely that funds will flow from Bitcoin to the US dollar. (2) However, if a rare, catastrophic financial crisis occurs and people lose confidence completely, they are likely to purchase the world's most reliable hard assets, such as gold and bitcoin.

We are not yet able to make any judgments, but Bitcoin now feels safer than in the past.

Produced | Coin Kaqi (ID: bikaqiu_official)

Compilation | Ticky Proofreading | Pan Zhixiong

Original: https://messari.substack.com/p/the-us-china-and-bitcoin-unqualified

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- The same is the breakthrough of 8,000 US dollars, what is the change in the bitcoin fundamentals between 2017 and 2019?

- “Blockchain+Government”: “Great enthusiasm” for a blockchain in a small city

- QKL123 Blockchain Leaderboard (May 2019)

- BTC plunged more than 10%, the bull market ended? – Blockchain Weekly 0602

- Market Analysis: EOS is exhausted and is expected to lead a wave

- Detailed explanation of the EOS First Anniversary Conference: Is it not up to expectations or underestimated?

- Focus Analysis | Digital currency goes out of the cold ahead, but this is not necessarily good news