FCoin's self-help campaign

Since February, the price of FCoin platform FT has risen nearly 10 times, and the transaction volume data has once again become the world's number one. The discussion of FCoin by major social media has also increased significantly. From the news point of view, this is mainly due to FCoin's new sustainable mining mechanism and adjustment of the income distribution mechanism, as well as a series of actions such as Fractal public chain, promotion of mining, and wealth management.

Last year, the Chain Catcher (ID: iqklbs) launched a number of articles related to FCoin, such as the FCoin model is in the future of overdraft exchanges , and FCoin Great Defeat, and caused high attention in the blockchain industry.

As FCoin reappears in the public eye and initiates bursts of action, what exactly do these actions mean? Where will FCoin go? Chain Catcher hopes to refocus FCoin's development status and strategic direction through this article, and to discuss the above issues, hoping to enhance readers' understanding of FCoin's recent changes.

- On the fall of a 720 million water Dapp in a single day

- Bitland's 50T new mining machine is coming, I heard that it is a lot cheaper than S15.

- After the bitcoin skyrocketed, the market began to oscillate, and the trader’s heart began to sway.

01

Reform FT

In FCoin's official discourse system, FT has a crucial position in its strategy. It not only carries many interests such as FCoin dividends and voting, but also serves as a basic carrier for exploring the economy and community.

In June 18, FCoin became a hit in the exchange industry. The FT price rose dozens of times in a short period of time and led the industry to enter the trading boom. Compared with the previous exchanges, the fee for each user to trade in FCoin will be refunded in the form of an equivalent FT, and the FT holder will receive a platform fee of 80%, which means that FCoin will develop the majority of the platform. Both are given to the FT, and the interests of the platform holders and the platform have reached a higher degree of unity.

However, just as the chain catcher put forward the idea that the FCoin model is in the future of the overdraft exchange in late June, FCoin does not set a mining mechanism that rewards hard tops, meaning that the long-term development dividend will be released in a short period of time, and the arbitrage will be arbitrarily The team became the main force of the platform and the main holder of FT, which worsened the platform ecosystem.

In this case, speculators' departure, smashing, and even PT currency plunging are happening as predicted by the chain catcher (ID: iqklbs), FI, FCandy, FT warrants, FJ, etc., which are closely related to FCoin. The currency has plunged. Due to its unshirkable responsibility, FCoin is widely considered to be suspected of having a sell-off and “cutting amaranth” in the aforementioned currency markets.

In mid-August 18th, FCoin finally decided to stop trading mining and destroy all unreleased FT. Since then, FCoin has launched leveraged trading, Fractal public chain, etc., but failed to prevent FCoin's overall decline until the sustainable mining plan is proposed.

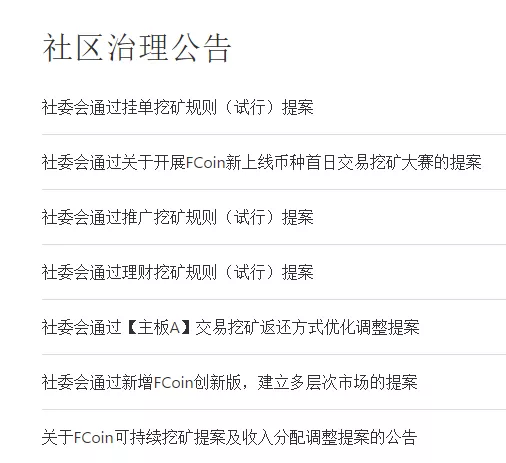

FCoin's bulletin board has been occupied by a series of mining programs

In this plan passed in early March of this year, FCoin decided to restart the trading mining, but unlike the rules of returning all the transaction fee equivalent FT of the user in the past, FCoin will return according to the user's trading volume in the main board (13 currencies). FT, regardless of the total transaction volume, returns a total of 1 million FT per day, and all FTs generated through sustainable mining are automatically locked for one year.

Since then, FCoin has also announced that users who lock more than 10,000 FT can enjoy wealth management mining, and return a total of 2 million FT per week, according to the proportion of the user's interest income in the week as the total interest income of all wealth management users. In addition, FCoin also launched a program to promote mining, pending mining and other mining.

At the same time, FCoin still uses 80% of the fee income for FT dividends, but only 20% of the dividends will be returned to the users daily. The remaining 80% of the dividends will be divided into one-off dividends based on the position of 0:00 on January 1 of each year. And ex-dividend (according to Zhang Jian, ex-dividend is the concept of the existence of the traditional capital market, that is, after a stock distributes profits according to the shareholding, the opening price of the next day will be subtracted from the previous day’s closing price to avoid the dividend amount. The buyer's return on the second day was much lower than the unfairness of the previous day's purchaser.).

From the above measures, FCoin is now emphasizing the total amount of mining control and user locks to achieve the so-called "sustainable mining". This also means that FCoin completely negated the earlier mining mechanism and returned to the original form of trading mining, that is, the mining mechanism with hard top, and the mechanism of locking the warehouse to form higher arbitrage speculators. Threshold, incentive platform users to hold for a long time.

The mechanism seems to be healthier and more sustainable than FCoin's original mining mechanism, but there are many precedents in the industry, whether it is hard top mining or lock bin dividends, and it has not caused much positive feedback. FCoin has almost lost its reputation. Try these mechanisms again, and their impact and actual effects may be quite limited.

Zhang Jian’s live broadcast in the community in early March also pointed out a meaningful message, starting from the highest price of FT and ending the mining of FCoin. Each FT is about $0.70. "Everyone may not care how much your dividends are distributed. Everyone will care about how much the price of the currency has fallen. In fact, if the dividends are counted, FT should be regarded as the least price drop in this bear market." Zhang Jian said quite unevenly.

Due to the huge amount of historical data and the amount of calculations, the chain catcher has not been able to confirm the data for the time being. However, if Zhang Jian’s statement is true, the disputes and accusations of FCoin and FT may be too strict. FCoin has indeed achieved the platform dividend to a certain extent. Share to FT holders, especially long-term holders.

However, as far as the reality is concerned, it is also true that FCoin has caused huge losses to a large number of retail investors. Few users can hold FT for three months and enjoy these dividends, and because of the high volume of FCoin's early transactions, the FT circulation is still high. Low, these dividends are also concentrated in the early stages of the platform. Even if the holders in the middle and late period hold 3 months, the dividends will be much lower than 0.7 dollars.

It should be pointed out that FCoin upgraded FT from FCoin Token to FToken after the release of Fractal's public chain strategy. Officials said that FT will become the foundation of the public chain Fractal, achieving Token's issuance, circulation, dividends, and voting. A variety of community governance functions, and aim to become the infrastructure of the future pass-through economy.

It is not uncommon for the exchange to develop a public chain. Firecoin, currency security, and OKEx have all publicized their own public chain plans. The currency has even released a public chain testing network. FCoin may be comparable in popularity to the aforementioned exchanges. However, there may be several differences in the number of active users and the level of technology, and the market competitiveness of the public chain is questionable. However, from the relevant expressions of FCoin, scenarios such as “community governance” and “voting” may be the main objectives of Fractal and serve the FCoin ecosystem.

The importance of FT for FCoin is also reflected in its important role in community governance. FT holders can hold a referendum on major FCoin issues, such as electing community members, deciding whether FOne will be split, and FCoin's community operations. More moves.

02

Exploring community

Communityization has always been an important goal of FCoin and Zhang Jian and even obsessed. Of course, it is also considered by many to be an excuse for "team running." At the end of July last year, Zhang Jian issued an open letter saying that he would change FCoin from personal governance to community governance within three months and return FCoin to the community.

Since then, the FCoin Basic Law and the FCoin Community Committee have been formulated or formed. Although the overall decline of FCoin and the massive loss of users have not been retained, the basic framework of the community has basically been completed in the second half of the year.

In the FCoin system, the positioning of the Social Council is equivalent to the highest decision-making and executing agency. It is responsible for drafting, discussing and making decisions on all matters of FCoin. The major issues will be referred to the decision-making decision of all FT holders. The committee concentrates on appointing and appointing teams. It is understood that the FCoin Social Committee has a total of 15 people, 5 of whom are officially appointed by FCoin. In addition, 5 community users and 5 business representatives are elected by FT holders.

In FCoin's community structure, there are also two advisory committees, two supervisory committees and community committees, and a number of subordinate institutions such as the proposal management committee and the merchant service committee.

FCoin hopes that these specific mechanisms will create and spread the concept of "FCoin belongs to the community" and effectively protect the rights and interests of FT holders and realize the scientificization of decision-making.

From a practical point of view, FCoin basically implements the mechanism it claims, at least in form. In the FCoin forum, most users' suggestions can see the official staff to follow up the progress; in addition to the common work weekly, FCoin will also announce the content and voting of each regular meeting; Communicate with ordinary users to answer various questions and questions from users.

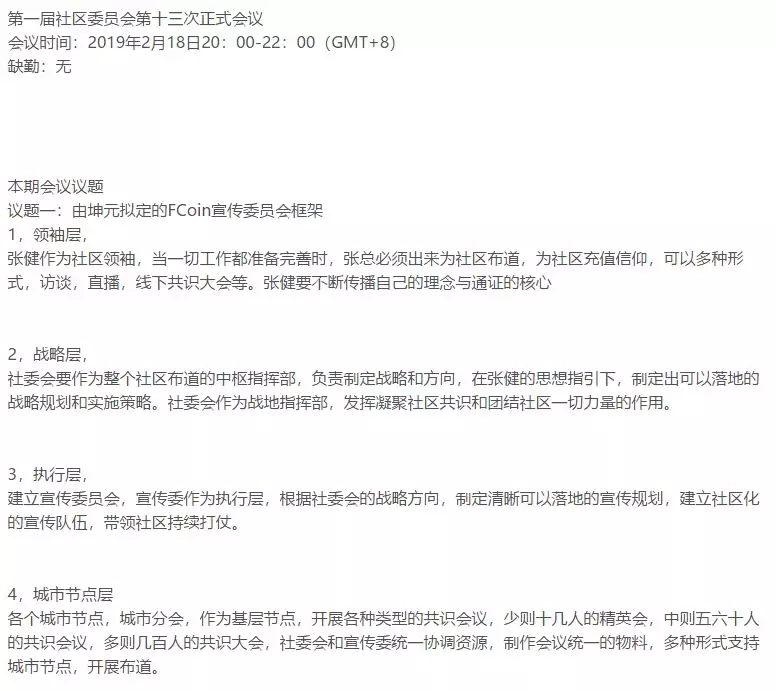

One of FCoin's public meeting details records

Community autonomy is actually one of the basic spirits of the blockchain industry. However, due to the lack of users in the early stage of project development or the desire of the founding team to control, only a few projects such as Bitcoin and Ethereum truly achieve community autonomy. As a centralization project, FCoin's exploration of community autonomy is a useful supplement to the development of the industry to a certain extent, and it is also conducive to stimulating more users to participate in community promotion and construction.

After harvesting a large number of clusters, FCoin recently launched several new programs to further promote the publicity value of these clusters. On the one hand, FCoin launched a promotion mining mechanism to encourage users to release FCoin-related promotional content on major media platforms, and to obtain a certain number of FT rewards based on screenshots of published readings; on the other hand, FCoin promoted in a community mode. FToken City Node Construction, trying to expand the scope of FCoin's influence through various offline activities.

However, it should be pointed out that although Zhang Jian, the chairman of the Social Welfare Committee, rarely participates in the specific affairs of FCoin, he retains one veto, indicating that he is still the absolute authority and leader in this autonomous community.

03

Problems and prospects

Through a series of measures, FCoin is as far as possible to bind the two concepts of “passenger economic paradigm” and “community autonomy” to itself, and accelerate the pace of communityization and certification.

At the same time, based on the popularity and influence of last year, FCoin has once again laid out a new concept of “sustainable mining”, which has reversed the long-standing trend and renewed its life.

However, this does not mean that FCoin will be able to go smoothly afterwards, and it still faces many internal and external problems.

In July and August last year, FCoin was once called "announcement madness" because of frequent announcements or even revision of rules. Now, FCoin's habit of releasing new rules and announcements is still the same, and the rules are more and more, which will undoubtedly Form a cognitive threshold for most ordinary investors.

Although in the traditional capital market, its rules may be more complicated and cumbersome, but for special reasons such as compliance, investors have no other choice, and the cryptocurrency market also has competitors such as fire coins and currency security. Most users only prefer The rules are simple and clear, relatively fixed platforms.

In addition, the core competitiveness of the current stage of the exchange is actually the quality of assets, the currency review mechanism is particularly important, and the FCoin official has almost given up the dominant position in the currency.

FCoin's current trading area mainly consists of the main board trading area and the FOne trading area. The former is determined by FCoin whether it is in the currency, but there are only more than ten mainstream currencies in the long run, and more currencies are distributed in the FOne trading area.

The trading area is composed of dozens of trading areas operated by sponsors. The sponsors have full right to own currency and relevant rules to their trading areas, but the quality of these institutions is uneven, and a large number of barbaric coins are played. This is the kind of landing of FCoin.

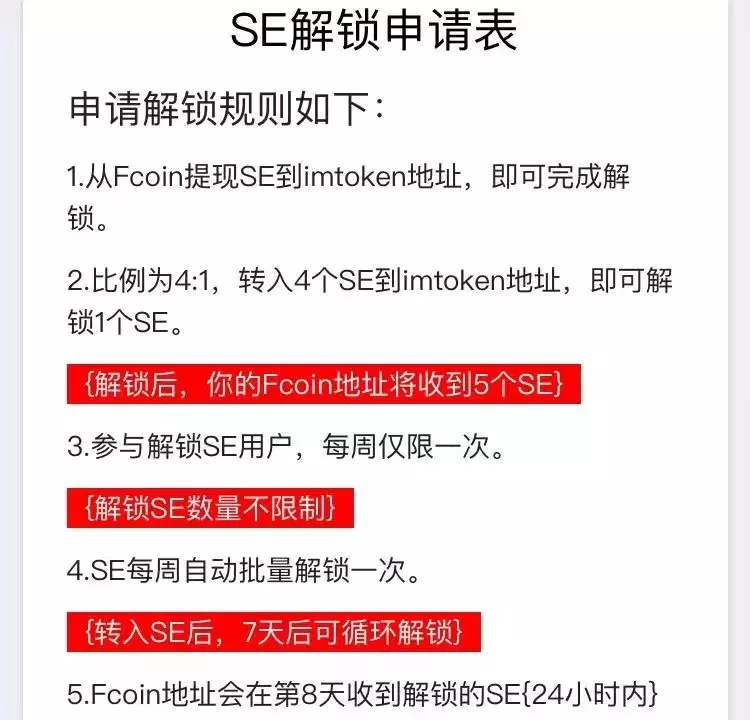

For example, at the end of last year, the online logistics chain SE, the currency was heavily aired in the first few months of the launch, but after that, the holder of the currency tried to recharge the empty coin to the FCoin transaction and failed the transfer. The SE official said that the user needs to purchase the FCoin first. The SE of the multiple ratio is applied for unlocking. The specific rules are as follows:

It can be inferred from the above picture that this is an obvious "Pinzi scheme", which uses the "snake wool" mentality of investors to unlock the empty coin to increase the demand for the currency, but in fact, the users are connected to each other and unlocked. The decrease in demand and the decline in the price of the currency will make the users who enter the market become "Pictures". Judging from its initial multiplier increase in currency prices and the subsequent plunge, its strategy has clearly defrauded many users.

There are still many such inferior projects in FCoin's FOne trading area. These assets may attract a considerable number of speculators in a short period of time, but they are not conducive to building reputation and brand in the long-term competitive market. From the perspective of community autonomy, FCoin may have the logic to hand over the currency to the community, but in this way it is partly responsible for the user and the platform or "lazy" performance.

At the compliance level, FCoin has no relevant news, and it lags behind many mainstream exchanges.

Whether it is a pass-through economy or community autonomy, FCoin is essentially a digital asset trading platform. Perhaps FCoin doesn't care too much about how much it can be as a trading platform, whether it can surpass the fire currency, but more to explore and be famous, and the above problems will obviously limit FCoin's long-term. Develop the foundation and influence the quality of communication and community.

At the same time, FCoin's most explorations such as mining and referendum have precedents in the blockchain industry. It is more like a master, but still lacks an innovative mechanism that is truly healthy and sustainable. The mining mechanism seems to be too dependent, and FCoin's recent scale and industry influence has not yet increased significantly, and it still focuses on existing currency users.

Of course, FCoin's exploration and practice in terms of citation and communityization also has many merits. It has indeed embarked on a special development path that is different from almost all exchanges and has achieved certain results. If this path is feasible, FCoin may be able to establish a highly democratic and autonomous community in the future, and lead the industry in the exchange business and public chain business, but now there is still a long distance and obstacles from this vision, the difficulty is very high.

FCoin is fortunate to have won the influence of most exchanges since its launch, but it is also the speculators brought by these influences that have expanded the inherent flaws in the trading mining mechanism, which in turn has devastated and even affected FCoin. To the entire exchange industry.

Now that FCoin is trying to make a comeback, whether it succeeds or fails, it may leave a special mark on the history of cryptocurrency exchanges as a complex and diverse sample.

Author / Gong Yuyu

Edit / He Mu

Unauthorized, declined to reprint

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- The Law of Simplicity: McKinsey's Three Advices for Blockchain Innovators

- The evolutionary philosophy of money: every time the evolution of money requires external pressure to advance

- Opinion: Blockchain technology will become an important part of regulatory technology

- Compared with many historical bubbles – is Bitcoin really bottoming out?

- April 8th market analysis: BTC ETH is completed and continues to rise

- Hard fork fork surge effect reappears! ETC announces "Atlantis" hard forks and soared more than 20%

- Quote analysis: ETH, which has been quiet for a long time, is starting to perform today?