Babbitt column | Libra: Premature baby in the context of Facebook innovators

The article about Libra has been dragging on for a long time because it really doesn't interest.

Unlike the domestic group, which is full of people's discussions and learning about Libra, most people in the foreign industry have long known about the drugs sold in Libra's gourd. Libra's provocativeness to supervision is far greater than its innovation, and it is pessimistic. On the other hand, the foreign core encrypted digital currency circle is very disgusting with Facebook's issue of currency, because Facebook as a player who “steals user data to form a monopoly business” has long been the evil representative of the punk.

The biggest misunderstanding in the digital currency industry is to use the Internet analogy to understand digital currency or blockchain in a linear and parallel way , thinking that this is a technology or a "product." It is as if we always think that the process of biological evolution is linear and continuous, and there seems to be other monkey relatives between us and the Beijing monks. Evolution is a process that is discrete, discontinuous, and random. High-handedly high-handedly, ecologically opposed, and a fierce operation, often the final end is like a dinosaur.

There is no more writing about Libra's design analysis or white paper. After all, Facebook doesn't have a good grasp of what Libra is. What to do, many external analysis is actually the author's own brain. To know that Libra is a product that has been hurriedly researched for a year and a half, in addition to the four teams led by David Marcus, systemic and comprehensive may not be as reliable as some of the more reliable stable currency projects and public chains.

- Rereading classics | Bitcoin and Libra, perhaps not the competitive currency that Hayek envisioned

- Bakkt saved Wall Street, not a cryptocurrency

- Halve = rise? Research tells you that the truth does not seem to be the case

Below the text, enjoy

What is Libra?

From the beginning of design, Libra decided to endorse it with the Facebook brand and need to trust the strong trust tone of the early creation nodes. This is one of the biggest reasons why Libra has been repeatedly questioned in civil, media and congressional hearings: Can Facebook and its represented interest groups be trusted? The word "Trust" was mentioned at least a hundred times at the two-day hearing. Many members of the two parties directly said that "Facebook is not worthy of the trust of the American people." From the past, Facebook's invasion of user privacy and data scarcity, Facebook is not trustworthy. Why facebook is basically a question that was repeatedly raised at the first day of the hearing.

The exemption is also a point of repeated suspicion at the congressional hearings. Several hearing members directly attacked "Why didn't I be invited to become a node, why is the node generated as an invitation system?" and Libra black paper on his white paper. In white, it is stated that “only authorized dealers have the right to sell Libra tokens to Libra Association in exchange for mortgage assets”. Well, not only the operation of the book is an invitation system, but the repurchase of the token is also an invitation system .

As for the anti-censorship, there is no need to expect it. David Marcus surrendered his hands on the first day of the hearing and repeatedly expressed his loyalty to embrace the review. “Libra will put some national security related and the existing US sanctions on the highest review. priority"

Libra is what Bitcoin is not. What is bitcoin, Libra is not what.

Libra is not a "super sovereign currency"

Libra does not anchor any currency exchange rate, and there is no 100% legal currency reserve. Libra's approach and 100% US dollar reserve guarantee that the 1:1 dollar conversion compliance category is more stable than TUSD or USDC. Libra's “printing process” is actually a kind of foreign exchange reserve that converts the corresponding legal currency into a basket and national debts with sovereign risks. Its back-end as a money fund (such as Yu'ebao) is to transfer the user's legal currency into the investment, and to ensure the value of Libra reserve is stable by investing in low-risk assets. Therefore, the value of Libra itself will fluctuate with the value of the assets behind it, and the depreciation of Libra depends on the fluctuation of the foreign exchange market.

So in summary, Libra's issuer can't be compared with any central bank, and even the work of the Hong Kong Financial Bureau's currency cloning by anchoring foreign exchange rates is not enough, and it relies heavily on the existing banking system. And sovereign assets. "Super-sovereignty" is even more difficult to talk about

Libra is not a Western Alipay

Saying that Libra is Alipay really overestimates Libra's completion and ambition. Alipay and WeChat payment are not limited by some reasons we all know. It is estimated that there are many foreign exchange settlement channels, and MoneyGram has already been bought to the world. Behind Alipay is the world's largest money fund (Yuebao), although the return is not high, but can continue to create stable income gains for users under such a large amount of funds.

Unlike the monetary fund's absorption of private idle capital, the fund's income is allocated to the principal body. Any benefit of Libra's reserve assets will not have anything to do with Libra users. The purchase of Libra users is spent on real money, wasting the opportunity cost of their own cash. Not to mention (for example, there is now a US bank with 1% -2% interest income per year), and does not enjoy the return on investment of the reserve… The risk of exchange rate fluctuations is borne by the user, and the income has nothing to do with the user. This is really Facebook . And back 10,000 steps to say Libra as a payment institution, not to mention the Reserve Bank's reserve account (the US Federal Reserve is composed of 12 local Federal Reserves, the New York Federal Reserve acts as a central bank's many functions), estimated to even the San Francisco Federal Reserve Clearing account accounts are not touched. To know that Alipay is also the owner of the clearing account in China's industry (the central bank will run? World War III), which means that Libra's credit for sovereign assets cannot be surrendered. As for the high-line availability of Alipay and WeChat payment established under the fierce competition, Libra has been unable to find it for a long time.

What is Libra?

Libra is a small Zaza an unfinished payment dream

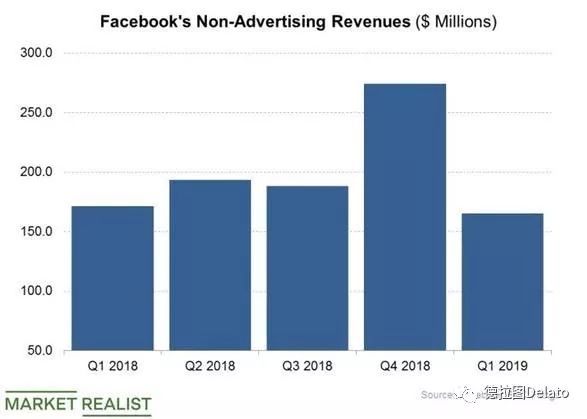

Since the acquisition of Instagram and Oculus, Facebook has long been unable to conceal the decline in product innovation and new business development. Strong and radical acquisitions are often the last path for companies to break through their ceilings. For example, they have repeatedly broken through my Amazon in core business, which is known as a cautious acquisition. Facebook Messenger's user growth has broken through 1.3 billion monthly users after being split into independent applications, and has been positioned as the next commercial large vault by Xiaozha. After taking office, David Marcus launched peer-to-peer payments and group payments in the app, as well as merchant access (similar to WeChat customer service and location), as well as AI smart assistants. Unfortunately, each feature has a small thunder and a small amount of rain, and the user's response is average, with little increase in usage frequency and revenue for Facebook. In the first quarter of 2019, Facebook's non-advertising revenue (mainly due to payment) also experienced a sharp decline, and the payment business was blocked in the market expansion, and it was far lower than expected to withdraw from the UK and France.

Libra is an attempt by Facebook to bypass American commercial banks

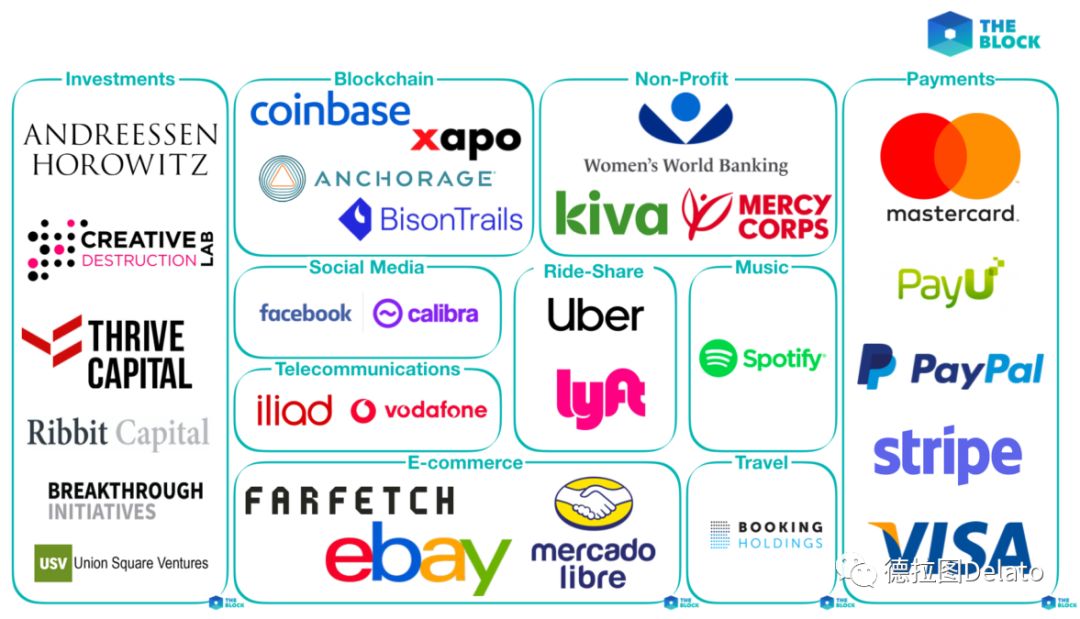

Of Libra's 28 founding nodes, there is no commercial bank. Some licensed financial institutions are also payment institutions like Visa and Mastercard, and none of the licensed banks. Stripe has been on the way to applying for a banking license, and it has been broken.

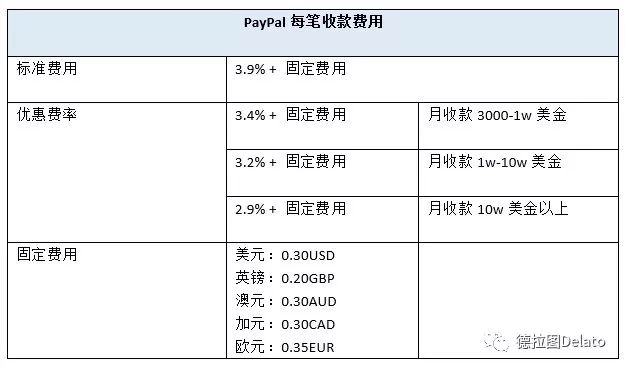

The existing US payment system under the control of commercial banks is expensive. The following picture shows Paypal as an example. Payment based on the banking system, especially cross-border payment, is expensive for merchants. Bypassing commercial banks means at least 3% of merchants' profit increases, which means that for merchants participating in Libra's early founding nodes, it means a profit of tens of billions of dollars a year.

American commercial banks have long accumulated more than just the right to speak in the payment system, and even the entire Fed system is under the huge influence of commercial banks. When the Fed was launched, it was called by Mr. Morgan, the founder of JPMorgan, and found a few of his own banking friends who called for everyone to come up with funds in 1907 to help the banks facing the run, so as to avoid a market crash like 1893. Then JP Morgan played a role similar to the 2008 Federal Reserve that saved the financial market. The "Aldrich Plan", the predecessor and blueprint of the Federal Reserve Act, was brought up by the then members, Aldridge and Morgan for many years, and the daughter married to the richest man in American history, Rockefeller The only son Rockefeller junior. So not only is the payment, the entire US currency is in front of the commercial bank, it must be called a father.

Libra is a premature baby in the context of Facebook innovators

As we said before, the development of the payment business is blocked, and the new functional response of Messenger is flat. The payment of this piece of cake needs to be realized in other ways. So in mid-2018, Marcus announced that he had left the Messenger division and started working with several other Facebook employees to investigate the feasibility of the blockchain and digital currency. From the large company that manages 15,000 people, to the management of a company's internal business department, to the transformation of a company's internal incubation project, it also reflects Facebook's dilemma in the innovator's dilemma. Most of Oculus's acquisitions were unsuccessful, and Marcus's four-year payment product was also very different from what was expected at the time. When there is no more to buy, internal incubation becomes the only way to break.

Marcus left Messenger and took Christina Smedley, one of the earliest foundings of Libra's predecessor. Christina was the only executive who left with Marcus from Paypal. He was responsible for brand and public relations at Paypal, and was also responsible for similar in Messenger. Function. Christina is now the head of marketing and communications for Calibra. In addition to Marcus and Christina, the other two played a key role in the Libra project, Evan Chang and Morgan Beller. Mogran is a small partner in the Silicon Valley venture capital circle. He used to invest in the A16Z. Evan met when the ICO was hot in 2017. He also invested in some projects from time to time. In the middle of last year, about a month after Marcus officially announced that he left Messenger to start the internal blockchain project incubation, I met Morgan and Evan who did privacy research in Zc0 at Zcash 2018. At that time, the Facebook blockchain was going to be What to do, how to do it is completely unsure.

In addition to these core members, the entire Libra project team is no more than 30 people, most of them are joined at the end of 2018, so the whole project is actually planned and formed, which is estimated to be one and a half years. One and a half years is really too hasty for this volume and impact project. At the congressional hearing, this was also criticized by many lawmakers: Facebook has a lot of problems that have not been solved. It has just paid a fine of 5 billion US dollars to the FTC because of the leakage of user privacy. How can we do it so confidently? A “virtual currency” project with extremely high complexity and extremely strict supervision?

The character determines the bottom line, the motivation determines the path, and the pattern determines the outcome.

In the Libra project's motives, breaking through Facebook's own innovator's dilemma is far more real than the various "connecting the world, saving humanity" in its white paper. After the listing, Xiaoza has been limited by the quarterly earnings report, and there is no storytelling story that Amazon founder Bezos wrote to Wall Street for 20 years.

In the digital currency world, the countryside surrounds the city and penetrates the mainstream from the bottom up. It is far more solid than the high. The business of money is a process of establishing a belief system and a process in which a credit subject is recognized by many parties. The biggest meaning of Libra's "Facebook coin" bomb cast on the whole world is to transform the anxiety of one of the world's largest technology companies into a world-class digital currency science drama.

When the wheels of history ran silently, the ants on the wheels were still brave.

Author: Dovey Wan

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- July finale? Bitfinex 850 million pending cases will welcome results

- Bitcoin may really fall to $8500 for the pit of the CME Group futures.

- Is the bear market gone? Less than half of the cryptocurrency price is higher than last December

- From the dream of Nakamoto's "electronic cash", what is Libra's biggest problem?

- Indian government organizations recommend a total ban on bitcoin, or will affect legislation

- Adding 5 million users in 10 months, the increase in new Coinbase users indicates that the bull market is back.

- Ethereum's additional issuance proposal was ridiculed, and community members said it was a disaster.