Is the bear market gone? Less than half of the cryptocurrency price is higher than last December

2018 was a bad year for all cryptocurrencies. According to Messari's OnChainFX data, all of the 134 cryptocurrencies listed in the 2018 ROI data show a negative return on investment. And not just a slight negative return on investment. Compared with last year, more than half of the tokens fell by more than 90%.

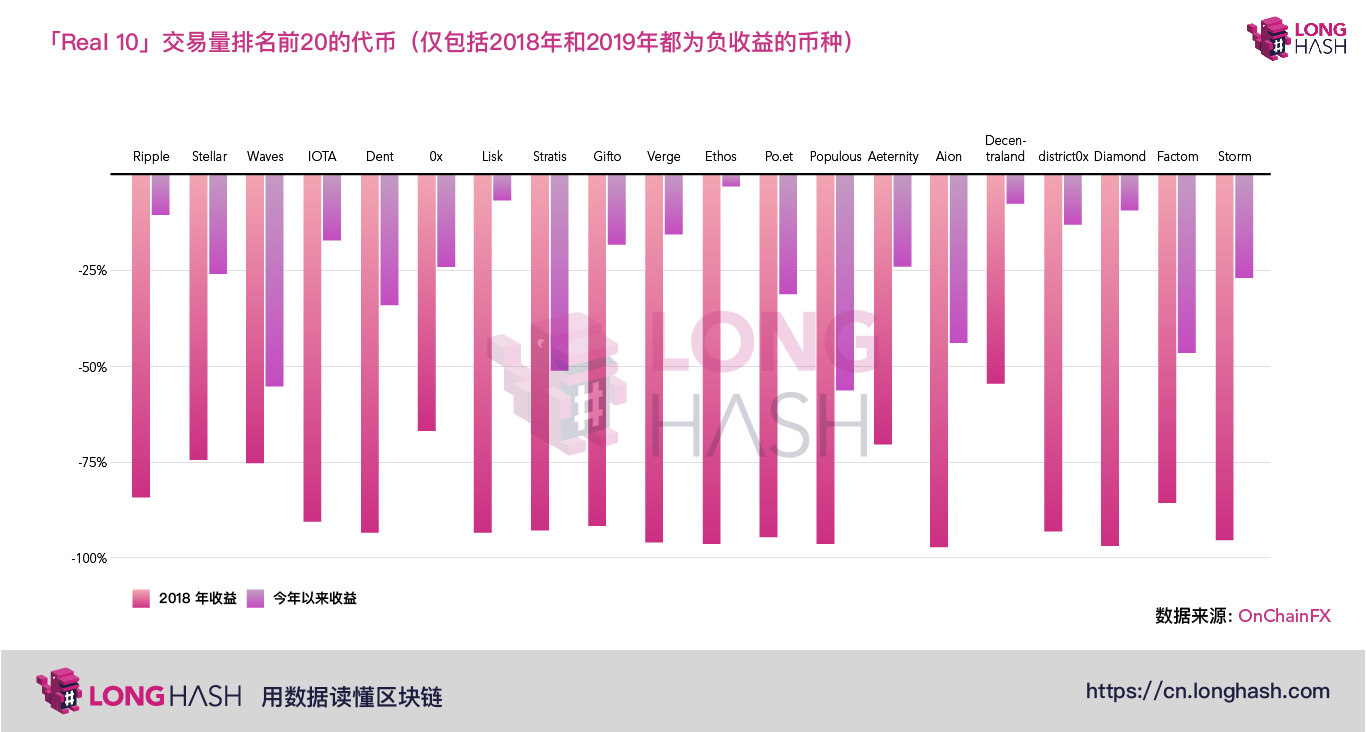

Although the collapse of cryptocurrency in 2018 is undoubtedly uncomfortable and unpleasant for some in the community, there are some who believe that this is a signal that prices have bottomed out. After the first half of 2019, we can confirm that this is not the case. More than 50% of cryptocurrencies are even cheaper than at the end of 2018. Among some of the more well-known cryptocurrencies, stellar coins, XRP and IOTA are among the tokens that continued to fall in 2018 and 2019 – and the list is still expanding.

As bitcoin prices have fallen in the past week, the competition has suffered the same or even greater losses. Currency such as Litecoin and Bitcoin SV have now fallen by about 50% from their 2019 highs, and these highs were only established a few weeks ago.

- From the dream of Nakamoto's "electronic cash", what is Libra's biggest problem?

- Indian government organizations recommend a total ban on bitcoin, or will affect legislation

- Adding 5 million users in 10 months, the increase in new Coinbase users indicates that the bull market is back.

Although 2019 is always full of volatility and lack of investment performance for competitors, there is also a good lesson to learn from. Many investors have a prejudice that it is a more cost-effective deal when the price of an asset begins to fall. Their idea is that they can get a "more favorable" price in the next buy order. While this idea applies to consumer goods, the same approach can be fatal for investors.

The price of crypto assets falls by 90% and the 90% discount on your favorite store is not the same thing. And there is nothing that can stop the value of crypto assets from falling again by 90% from current prices. Everything depends on the needs of investors. At present, in addition to tokens like BNB and Bitcoin, investors don't have much demand for most other cryptocurrencies—the two tokens still rose more than 100% in 2019.

This article Source: LongHash , read the blockchain with data. Please indicate the source

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Ethereum's additional issuance proposal was ridiculed, and community members said it was a disaster.

- 2019 second quarter cryptocurrency report: Why does BTC stand out?

- Bitcoin's total network computing power plunged 10% every day? That is the lucky value at work.

- "Bitcoin's biggest benefit this year" finally started.

- Platform development, protocol upgrades, code delivery – 2nd anniversary of the birth of BCH

- Why can Libra fight against Alipay and WeChat?

- Getting started with the blockchain | Luo Yonghao: Most people don't understand the blockchain, so can't talk to the blockchain with friends?