Before you prepare to "bottom bitcoin", please answer these 4 questions

Source of this article: BlockBeats, the original title "Are you thinking of buying Bitcoin?" 》

Author: 0x22

"Broken 8000! I exploded." Wechat chat records flashed discussions in the speculation group.

On the morning of March 9, 2020, Bitcoin continued to fall without resistance. It continued to plummet from a high of $ 9,150 two days ago. The minimum fell below the $ 7,700 mark. Although there has been a small rebound, as of now, Bitcoin quotes on mainstream trading platforms are still Under $ 8,000. With the plunge of Bitcoin, more and more people are talking about when to make a bottom.

- Opinion | Traditional finance enters turbulent cycle, Bitcoin and financial bubble will start the first historical confrontation

- Is it time to buy the bottom? Tether has added 60 million USDT inventory

- Ethereum 2.0 client Prysm interacts with Lighthouse, multi-client testnet release is a step closer

However, most people who want to make a bottom copy have not even figured out the first question: Why should they make a bottom copy?

The nature of the dip is that investors believe that the downtrend will reverse, or that the price is already at the bottom of the historical cycle. For Bitcoin, however, this is not the case.

Let's first review the rise of Bitcoin this round. In January 2020, the entire cryptocurrency market quietly bottomed out in despair. With Bitcoin continuously receiving three long shadow lines below US $ 6800, bullish funds broke through the US $ 7800 box shock with the excuse of the Iran event. Cryptocurrencies, which are rich in "half (production)" speculation, are being continuously pulled up by funds.

The characteristics of the entire market are summarized by the following sixteen words: upside down, stock leverage, small retracement, and high mood.

The upside down refers to the fact that in the spring market of 2020, the rise of junk coins and mainstream coins is significantly higher than that of Bitcoin, and Bitcoin does not have the general "vampire effect" in 2019;

Stock leverage refers to the absence of any effective incremental funds for the current round of market entry. All the funds entered are a wave of liquidity without belief. The stock funds have been leveraged to cause price illusions. When Binance spot borrowing USDT is sold out, it is exactly the day The highest point of the price, the borrowing of USDT means that the potential longs have all been on the car. Once the off-site funds are not enough, they can only kill more;

The slight retracement refers to the fact that there is not much retracement in the rise of mainstream currencies, and the sense of trend trading is extremely smooth in the first half of February;

The high sentiment refers to the amazing USDT borrowing market. Quarterly contract premiums have intensified as the delivery deadline approaches. Attempts have been made to force a short play, and the long-term capital rate of perpetual contracts has once exceeded an annualized rate of 150%.

Therefore, the high-level departure of this round of funds is exceptionally firm: In a market where incremental funds are insufficient and stock leverage is used to make up, the part of the arbitrage strategy paid by Bitcoin will be sold by the arbitrageur in the form of Bitcoin As such, the logic of "drawing blood" is doomed to the decline of Bitcoin.

In short: the script may have been wrong from the start.

Against this backdrop, the tenacious Bitcoin still found support near $ 8,400 and quickly broke after attempting to break the 20-day moving average. Behind this are both the direct reason for the escape of funds itself, and the implication of excessive disturbances in the international financial market and the plunge of commodities such as crude oil.

Here we try to discuss an old topic: Is there any correlation between Bitcoin and traditional financial markets?

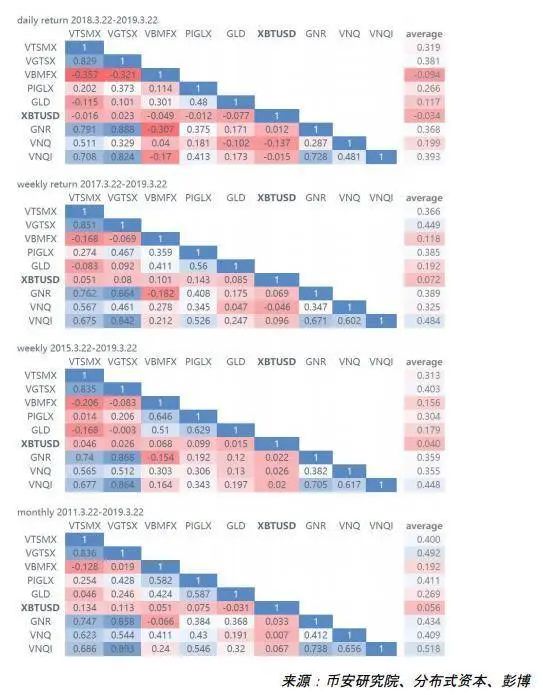

From the perspective of statistical analysis, btc is not much related to macro assets, which is corroborated by the mathematical method of correlation test.

However, from the perspective of actual disks, especially when Bitcoin becomes more and more like a commodity and cryptocurrency becomes more and more like a trading game, Bitcoin is often a reflection of global liquidity preferences and market sentiment.

For example, at the end of the 18th, the consensus in that circle was nothing more than a hash war that caused panic in the field and broke the long-term chip area near $ 6,000. But in fact, this may not be the truth of the matter. At that time, the entire global commodity was falling sharply, and Brent crude oil reached a low of 30, which was more than Bitcoin.

The memory of this wave of decline is exactly the same. Let us first review the falling segment from $ 9,500 to $ 8,400: When all global assets are falling, the VIX index is approaching the 2008 financial crisis, but when you look at the time when various assets stabilized, Bitcoin It fits perfectly with everyone. Below 8500 that night, it was exactly when Brent crude ended its 4-hour downtrend. The Dow Jones and Nasdaq also recorded historic rebounds, and bull sentiment in the entire market recovered.

Looking back at the decline of $ 9,200 to $ 7,700: the crude oil market has plummeted, global finance has entered a new panic, and Bitcoin has continuously broken through multiple support levels. In this case, it is difficult to completely understand the relationship between Bitcoin and large assets from a mathematical perspective, especially when you understand that Bitcoin is not part of the energy industry, and when you understand that Bitcoin is not a safe-haven asset but a risky asset when.

Here, I want to put forward a hypothesis: the current bitcoin is mathematically not related to macro macro assets, and short-term fluctuations are determined by the reflexivity of market participants, but once the global disturbance occurs, the peripheral market will fall. Coins will have a strong correlation with other large assets.

Having said so much, we still want to understand one thing: What is the logic that supports the rise?

Most people blurt out: "Half!" But their understanding was wrong.

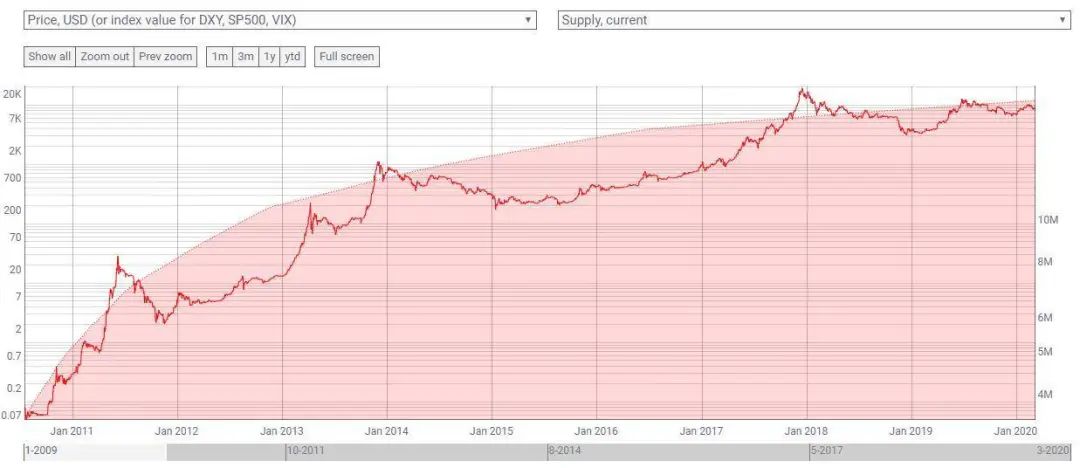

Bitcoin has a large amount of trading and speculative demand, a small amount of stored value demand, and a small amount of use demand. Therefore, under the condition that the overall demand level is unchanged for a long time, the supply rate will be halved, which will have a positive impact on the price. Note that there is a precondition here, "the overall level of demand remains the same." Obviously, from the perspective of 10-30 years, this condition can't be true all the time. You can't expect everyone in the world to buy Bitcoin, but also they buy more, use more, save more each time. There must be a cap on demographic dividends.

There is a saying that is true, retail investors who can buy btc in this life have entered the market in 2018. Compliance and non-compliance will only affect the organization's configuration. There are only so many in the world with this level of recognition and investment purchasing power. So since Bitcoin is just a chip game with cognitive dividends, it may still have room, but the Sharpe rate must be more and more uneconomical.

At this point, we can finally answer the first question: the reason for the bottom is that investors mistake the bear market as a bull market.

The second question followed, what exactly is Bitcoin?

The essence of Bitcoin is a trading asset , with almost no hedging function, and the function of store of value is very small. Bitcoin is also a game of confidence . If the ultimate support for commodities is the physical supply and demand, what Bitcoin has is the consensus of the people. If commodities and the stock market continue to rest and the crisis strikes, Bitcoin will only fall first. International hot money cannot sell stocks, crude oil, gold, and in turn buy Bitcoin.

It needs to be emphasized that the plunge at the end of 2018, the industry's computing power war is just an appearance. Its essence was that global assets were falling at that time, especially the commodity market represented by crude oil. Under the circumstances, Bitcoin had been falsified as a hedge. The properties of the asset. People will only abandon this speculative and highly volatile asset.

The script in 2020 is exactly the same, but this time, the danger is even greater. First, the crude oil and stock market fell no less than that year. Second, in the market, what is more important than expected is the gap between expectations and reality. The semi-default is synonymous with rising. When the investment institutions in the secondary market only explain how to operate next year and do not analyze how to hedge in case of a decline, when the mining industry thinks that the halving must rise, the scale must be expanded. The wonderful story may continue However, what is happening in the global market is already too big. Once it is falsified by macro disturbances, the market's self-correction will increase.

What is expected? It is expected that Bitcoin will definitely rise this year, and it is expected that it will break through the highest point of 20,000 USD next year. What is reality? Global financial turmoil is a reality, and it is a reality for some miners to cash in on "halving" profits in advance, and it is also a reality to anticipate early speculation in 2019.

This is the biggest hidden danger. No one in the market looks at halving the short, as if the "halving" drop probability is 0. Bitcoin and crypto leaders have exhausted all fundamental, technical, and data analysis methods, and finally only discuss the situation where Bitcoin rises from 2020-2021, as if Bitcoin will never enter the monthly level and fall.

Here is an example of the hype of commodities-Apple. The reason why the price of apples in 2018 is crazy is because it was a bumper harvest year. As a result, it encountered extreme weather and the production area in the main production area was greatly reduced. Bitcoin is also the same now. With an overly consistent bullish expectation, it is easy to say that nothing will happen, and an event must be a major event.

Don't believe it, you can take a closer look in the market.

In other financial markets, the one word we hear the most is that this year is the worst year. And in the bitcoin market, the one word we hear the most is that next year is the best year. This also fully proves that the essence of this game is the transfer of confidence.

And an obvious common sense is that in the world, you can never find an asset that only rises and never falls, and you can never find an asset that eventually does not return to the inflation curve. If you find it, it must be time The pull cycle is not long enough.

This is not to say that Bitcoin will definitely fall, but to point out the importance of rational thinking and rational investment. After all, no one but yourself is responsible for the equity of your account.

The third question is, will Bitcoin die?

Never . Bitcoin will never die out but it will not be so cheap in the early days. Its end is a global non-stop trading asset. Looking at Bitcoin 20 years later is just like watching Texas Hold'em now.

The ultimate reason why Bitcoin will not die is to think from the bottom of human nature, the people of the world need something to satisfy the desire for unearned gains and speculative wealth, and this is also Bitcoin's most indestructible investment logic.

But it should be pointed out that not dying does not mean that it will not fall. After all, Bitcoin did not die at the end of 2018.

Fourth question: What do you do now?

It all depends on you. This article does not represent any investment advice. Investment is risky and you should be cautious when entering the market.

* Note: This article only represents a personal opinion of 0x22. The thinking occurred in the last half month, but it is limited to reasons such as length and time rush. Some of the opinions expressed in this article are comprehensive and have limited arguments.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Deputy Governor of the Bank of Japan: The issuance of the central bank's digital currency requires attention to "three constants" and "three changes"

- 4% to 10%, 900 to 8000, the goddess of industry interpreting the blockchain over the years

- The broad market rebounded close to $ 8,000, and the short-term bulls are still weak

- U.S. lawmaker proposes new cryptocurrency bill: clear regulatory body to bring legitimacy to crypto assets

- Babbitt Interview | How Cryptocurrencies Change the World? We talked to the columnist of the international station

- $ 2 billion stock repurchase agreement reached, Bitcoin advocate Jack Dorsey will stay on Twitter as CEO

- Blockchain Weekly Report | Bitcoin drops near mining unit prices again; 13 listed companies disclose blockchain business