The stock market has experienced its biggest crash since 2009. Can Bitcoin be a safe haven?

On Monday, the S & P 500 index fell 7.6%. The decline in early trading was so great that trading was temporarily suspended earlier in the day. This is a rare phenomenon, the purpose of which is to prevent a stock market crash. At the same time, the Dow Jones Industrial Average fell 2,000 points, or 7.8%.

The VIX Volatility Index, the main risk indicator for the stock market, spiked to 55 on March 9. This is the highest level since 2009. At the same time, Saudi Arabia's consultations with OPEC member Russia failed, which in turn triggered competition for oil price cuts. This led to the international oil price benchmark Brent crude oil trading price of 36.20 US dollars, down 20% from the previous trading day. This caused the international oil price benchmark (Brent crude oil) to drop to 36.20 US dollars, a 20% drop from the previous trading day.

The fire broke out in the east, and the west smoked. The yield on the 10-year Treasury fell below 0.5% for the first time in history. This number reflects investors desperately looking for a safe haven.

Gold and Bitcoin in a global panic

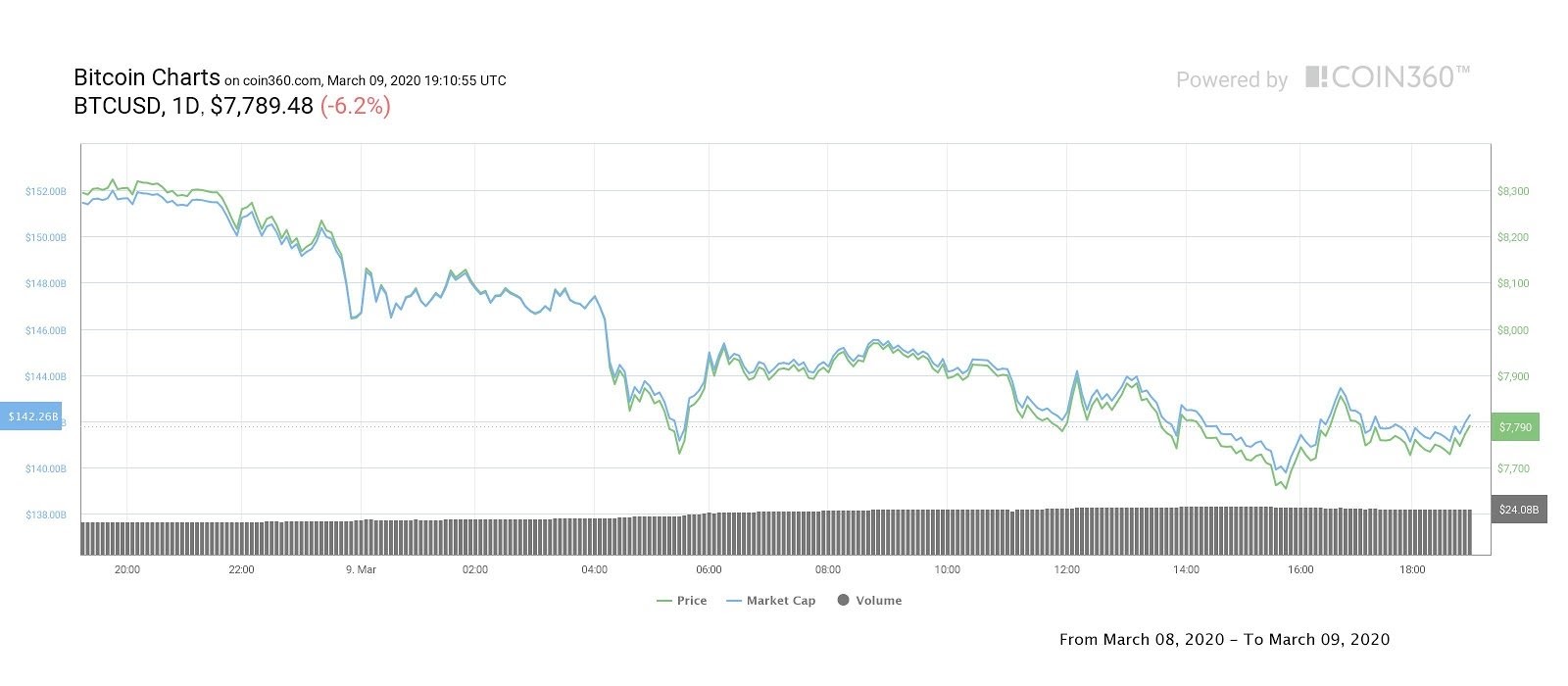

The price of gold started at $ 1.673 per ounce yesterday after reaching an all-time high of $ 1,700. In March of this year, the price of gold rose by 5.6%, performing well during the current global epidemic of the new crown virus. At the same time, Bitcoin fell 13% in 48 hours, to its lowest level of $ 7,750 since early January.

- 23 Listed Companies' Blockchain Subsidiary Surveys: 4 Parents Relying on Parent Companies

- Perspective | Why isn't Bitcoin a safe-haven asset?

- JPMorgan executives: cryptocurrency hard to appreciate when other assets plummet

Coinbase co-founder and CEO Brian Armstrong also tweeted that he was shocked by recent bitcoin price volatility and wrote: "It is surprising that we have seen Bitcoin fall in this situation, I thought the opposite would happen. "

BlockTower co-founder Ari David Paul also tweeted, "Although the price of Bitcoin has fallen by 25% in the last 30 days, it has maintained a 7.5% increase so far this year."

Analysts warn financial crisis could intensify

In response to the potential crisis in the current market reaction, Dennis Dick, head of market structure and proprietary trader at Bright Trading LLC, sent a red flag. The possibility of a sharp drop in oil prices over the weekend has also begun to be valued by the public. "

As the price of Bitcoin has risen, altcoins have also suffered huge losses. Ether (ETH) was down 8.86%, and Bitcoin Cash (BCH) was down 7.72%. At the same time, Litecoin (LTC) fell 10.42% and was trading below $ 50.

As of now, the total market value of cryptocurrencies is $ 222.2 billion, and Bitcoin's market dominance is 64%.

Compilation: Lin Shihao

Image source: Cryptoslate

This article is from bitpush.news. Please reprint the source.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Bitcoin fell more than 10% during the session, and the four major exchanges closed nearly $ 700 million in intraday trading. Is "digital gold" a false proposition?

- Beijing progress in blockchain applications: from "directory blockchain" to the first blockchain electronic invoice

- Vitalik Buterin: PoS has higher efficiency and security than PoW

- PayPal CTO: The development of cryptocurrencies must focus on consumer demand, and digital currency is inevitable

- Venture capital observation: after the epidemic "test", the development of the blockchain industry can be expected

- DeFi Weekly Selection | DEX scale has increased nearly 4 times in 3 months, and the centralized platform is gradually diminishing?

- Babbitt weekly election 丨 Global crisis triggers bitcoin avalanche, but frequent supervision is good for long-term trends or unchanged