Bitcoin’s block rate is at a new high, and miners’ competition is getting fiercer

One of the most ingenious aspects of Bitcoin designed by Nakamoto is the algorithm for regularly adjusting the difficulty of mining. This setting is to ensure that new Bitcoin enters the market at a relatively steady pace and is independent of market demand.

Bitcoin mining difficulty is adjusted every two weeks to integrate the new miners' calculations to maintain the average ten-minute excavation of a block as described in the original white paper.

This is actually the first time we have encountered a currency with these features. Even gold, described as a “scarce” asset, does not have these characteristics even if the amount of gold mined globally continues to grow over the past 100 years.

The scarcity of Bitcoin has allowed it to experience three to four rounds of bubble in just a decade. Bitcoin prices fluctuated sharply as market demand weakened and dispersed, while supply remained relatively stable.

- Mars Finance held the "POW'ER Global Blockchain Developers Conference" in August, and Babbitt was invited to become the premier cooperative media.

- How do KuMEX kill the bleeding road when the digital currency derivatives market enters the market for more than half a year?

- The most legendary bitcoin mining machine: once the moon landing hero, it takes 1 billion times the time of the universe to dig a block

However, this algorithm of maintaining bitcoin supply at a constant state is not perfect. Sometimes the need to dig up new bitcoins will be large, and it will be difficult to maintain the original speed even if the difficulty is upgraded. This is also what is happening recently, just like the bull market in 2013 and 2017.

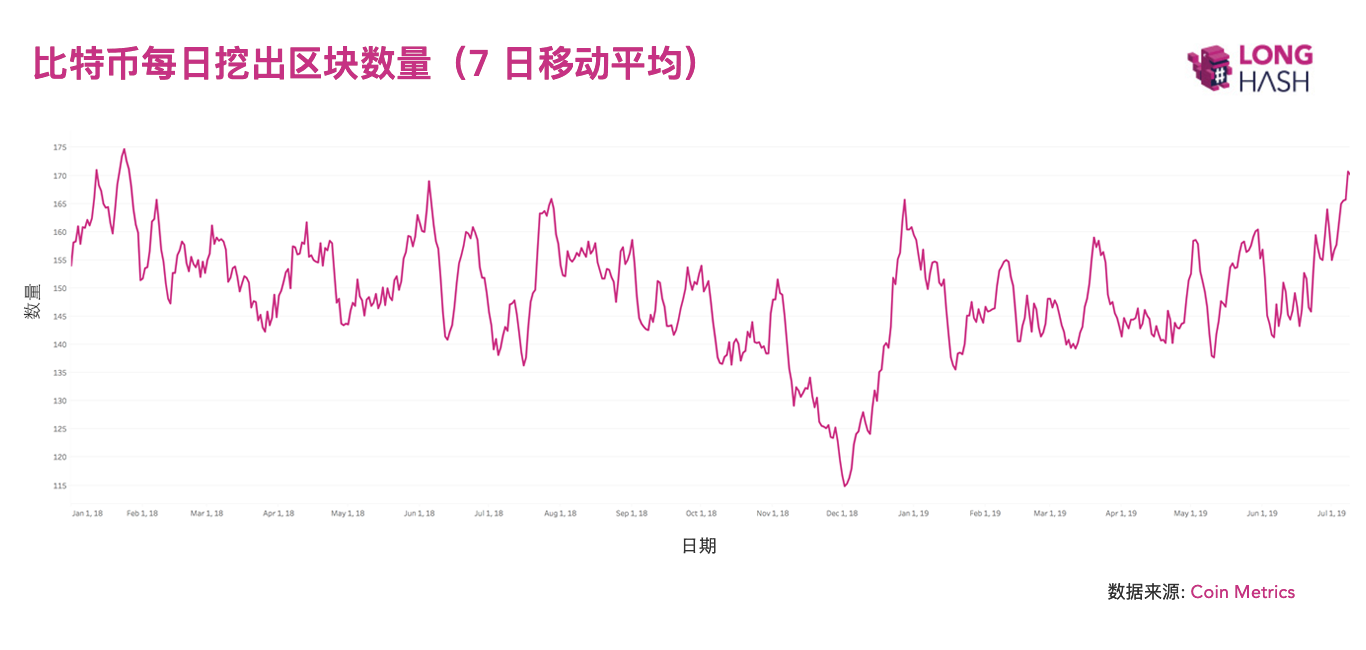

As can be seen from the above figure, the average number of blocks excavated daily in the past 7 days exceeds 170 (that is, the price of by-products of computing power has reached a record high), setting the highest daily average number of blocks per day since January 2018. According to the original speed of ten minutes, about 144 blocks can be dug in one day. But in fact, the current speed of the block is getting faster and faster, which is enough to illustrate the urgency of the current market.

It’s less than a year since the Bitcoin mining award was halved, and the price is expected to rise, so it’s not hard to explain why the miners can’t wait to dig new blocks.

Ordinary investors are afraid of stepping on bitcoin, but for those miners who have spent millions of dollars buying equipment that will quickly depreciate, this fear of FOMO is even more real.

Source: Longhash

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- GoWithMi Heavyweight: Future Map Black Technology "Open Space AI Integration" Solution

- Matrixport is online, who is fighting? Bit Continental has woven a giant network

- India is out, where is Libra's main battlefield to choose?

- Polkadot blockchain governance is a big secret, the board members are only 6-24

- IBM is relying on stable currency? Executives say that several IBM organizations have studied using stable coins in World Wire.

- Research Report | Research on the Draft of Bahamas Digital Assets

- Strength on the list! Babbitt Viking author released the influence list in June 2019