BitMEX Founder Arthur Hayes’ Token2049 Speech Fiat Debt and AI-Driven Next Bull Market (with PPT)

BitMEX Founder Arthur Hayes' Token2049 SpeechCompiled by: LianGuai

The cryptocurrency industry event Token 2049 will open on September 13, 2023. LianGuai will provide live coverage of the conference.

The keynote speaker for the morning of September 13th is Arthur Hayes, the founder of BitMEX. His speech titled “Money Printing, AI, and Crypto: Fueling an Epic Bull Market Mania” was quite impressive.

Therefore, LianGuai has organized the content of Arthur Hayes’ speech and attached the presentation slides.

- Full Text of Arthur Hayes’ Token2049 Speech in Singapore The Next Bull Market Will Start in Early 2024

- Opportunities and Limitations of Stablecoins Supported by LSD

- NEAR user count and transaction volume skyrocket, potentially influenced by the token reward program of KaiKai, the chain upgrade.

The Cryptographic Formula: Cryptocurrency Industry = Fiat Liquidity + Technology

We already have one, but not both.

This speech is a broad framework for me to discuss the value of cryptocurrencies, specifically in relation to fiat liquidity and technological progress. In the past decade, either fiat liquidity or technological progress has always been the reason for initiating a bull market, but we have not yet experienced a bull market created by both.

First, let me explain why I believe a new bull market will begin in early 2024. This will be the biggest bull market in the cryptocurrency field and even in the realm of risk assets since the Great Depression and World War II.

What is Gross Domestic Product (GDP)?

GDP Growth = Population Growth + Productivity + Debt Growth

This comes from the famous economist Robin Paul, which states that GDP growth equals population growth, productivity, and debt.

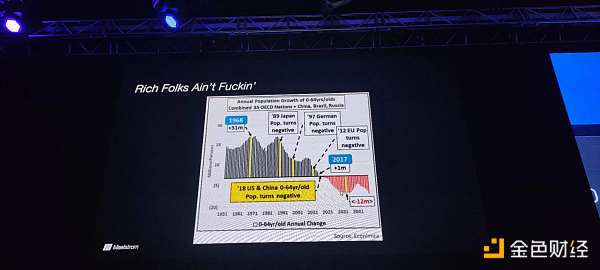

Pay attention to the baby boom (population structure) and debt (currency issuance). People are no longer having sex (not fucking) and no longer having children. There are many reasons for this phenomenon. As shown in the following graph, we are entering a period of population growth deficit, which is a significant problem. We are incurring debt for the future, building the present, and hoping that more people will fill this growth in the future to sustain economic activity.

But if there aren’t enough children, how can we repay the debt through economic growth? What solutions do central banks and governments have?

The secret to maintaining GDP lies in printing money.

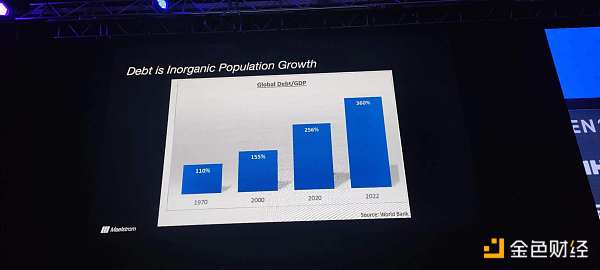

As shown in the graph below, this is a chart from the World Bank on global debt and GDP, which has risen from 110% in 1970 to 360% in 2022. The terrifying part is not just the 360% figure, but the acceleration. The growth rate has increased from 256% in 2020 to 360% in just two years.

From a global perspective, we are in the late stage of a debt crisis, and we are accelerating the issuance of debt to compensate for nonexistent economic growth.

Although we are meeting in Singapore, we are all within the US dollar system. The monetary policies of most countries reflect the US monetary policy. Therefore, I spend a lot of time discussing the Federal Reserve and US financial policies.

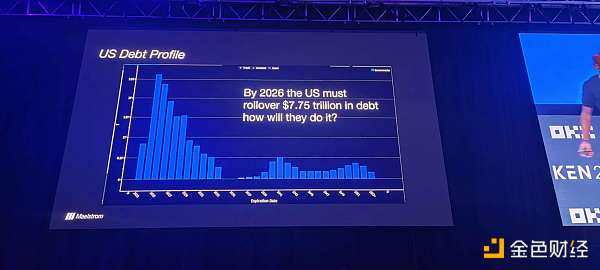

Future Maturity of US Debt

The above chart shows the future maturity of US debt. By 2026, the rolling maturity of US Treasury bonds will reach $7.75 trillion. The US will have to find people or countries willing to buy such a huge amount of debt.

If the world is facing such a problem: too much debt, insufficient population,

then who will buy these debts?

When the government has a large amount of debt to issue, but there are not enough people or countries willing to buy the debt, the government will solve the problem by printing money.

Therefore, from a global perspective and the perspective of the global reserve currency issuer (the US government), this is the largest currency issuance, and no one is willing to buy these bonds.

I will now shift the topic from fiat currency to technology and explore AI.

Yesterday I attended a luncheon where global asset management companies, home offices, and wealth sellers were present. The most confident topic should be AI, with about 75% of people mentioning AI, as AI is the future trend.

Every era has its own topic: in 2000, the Internet ruled the world; in 1929, radio and railways ruled the world. In different cycles, we pay attention to emerging technologies that will completely change people’s lives. AI is the same. Since the invention of computer internet, the popularization of computers has prompted rapid upgrades in human civilization, which can also explain why investors are so concerned about AI.

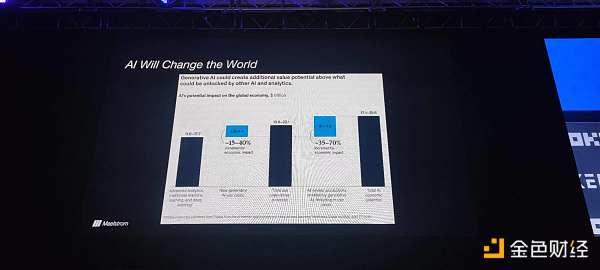

AI Will Change the World

What changes will a thinking computer bring to human civilization? Generative AI will unlock more potential economic value. The potential size of the entire AI economy can reach $17.1-25.6 trillion.

ChatGPT

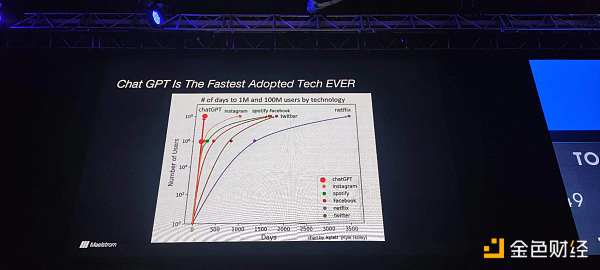

ChatGPT is the fastest-adopted technology in human history.

Why are startups talking about adopting large language models (LLM models) in specific fields to increase the productivity of their company’s products?

The leader in the AI field is NVIDIA. Currently, NVIDIA’s stock price-earnings ratio is 100 times. This is absurd. How much profit does NVIDIA need to make in the next 5 to 10 years to reach its current valuation?

Therefore, I agree with some people’s claim that NVIDIA’s stock price is a bubble, and this bubble will only get bigger.

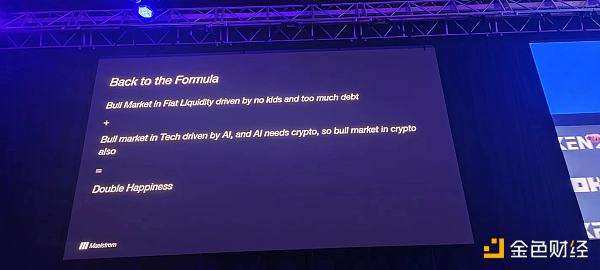

Back to the Cryptocurrency Formula: Double Bull Market

The cryptocurrency industry = fiat currency liquidity + technology. Insufficient birth rates and a large amount of debt drive fiat currency liquidity, while AI drives technological progress and AI requires cryptocurrency. Therefore, for the cryptocurrency industry, the future is a double bull market.

AI Needs Food: Computing Power + Data Storage

AI food mainly consists of computing power (from NVIDIA and semiconductor) and data storage. Will there be encrypted VC investments?

VC Suffers Defeat

VC may raise billions of dollars and invest in AI startups. These AI startups will find that most of their money will be spent on purchasing GPUs and cloud storage (AI food).

We can profit from lazy investors.

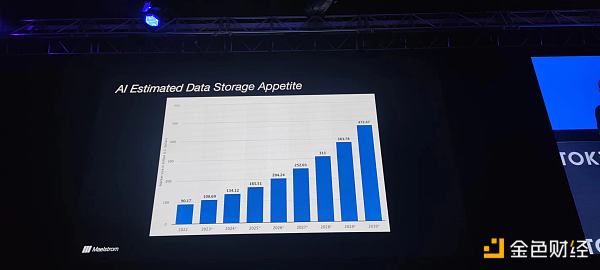

Data Storage Market Size Rapidly Growing

By 2022, the estimated market size for AI’s data storage needs is $90.17 billion and is projected to grow to $472.47 billion by 2030.

Why Does AI Need Decentralized Storage?

Centralized data management has the following issues: poor data management, lack of control/transparency over data, predatory pricing and opaque pricing.

Fundamentally, AI needs decentralized storage and will also create a huge demand for decentralized storage. Filecoin is one solution for decentralized storage.

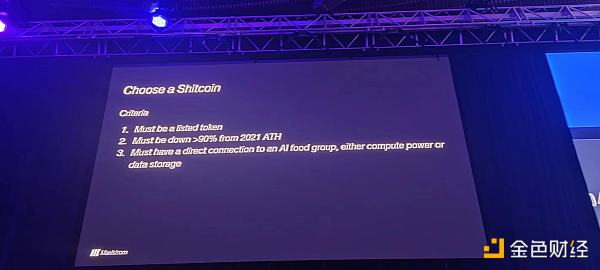

How to Identify Cryptocurrencies with Potential for Significant Growth from Shitcoins

I need a shitcoin that meets three criteria: 1) must be a listed token, 2) has dropped more than 90% from the 2021 peak, and 3) must have a direct connection to AI food.

Filecoin meets these three criteria, so I hold FIL.

Filecoin Dropped Nearly 99% from Its Peak

The chart above shows the price trend of Filecoin, dropping from the peak of $300 in 2021 to the current $3, a decline of nearly 99%, making it considered a shitcoin.

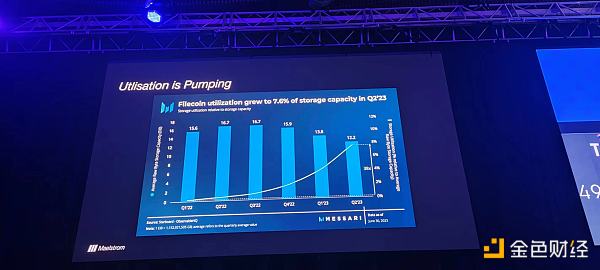

But Filecoin’s Utilization is Growing

In the second quarter of 2023, Filecoin’s utilization grew to 7.6% of its storage capacity.

There are real customers using the Filecoin network, with CERN, UC Berkeley, and other institutions already using the Filecoin storage network.

Although there are centralized solutions like AWS currently, if users value decentralized data in the future, then decentralized storage markets like Filecoin will have greater development potential.

The above is why I believe Filecoin will experience a significant increase in the future. I would like to declare that I hold Filecoin token FIL.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- a16z Dialogues with Solana Co-founders People Should Try to Create Greater Ideas Instead of Replicating Existing Ones

- Arthur Hayes Post Even if my judgment on the Federal Reserve is wrong, I still believe that cryptocurrencies will rise significantly.

- NEAR’s number of users and transaction volume skyrocketed, possibly influenced by the token reward program of KaiKai, a chain upgrade.

- LianGuaiWeb3.0 Daily | LianGuai Launches Cryptocurrency to USD Exchange Service

- ABCDE Why We Invest in GasZero

- Did airdrops ruin cryptocurrencies?

- Has the long-standing resentment towards VC finally erupted? After falling out with LianGuairadigm, Reflexer bought back tokens and put on a mocking face.