Has the long-standing resentment towards VC finally erupted? After falling out with LianGuairadigm, Reflexer bought back tokens and put on a mocking face.

After a falling out with LianGuaradigm, Reflexer has bought back tokens and is now mocking VC.Author: 0x26

LianGuairadigm, the investment institution that best represents the cryptocurrency industry today, has been “mocked” by projects in its own investment portfolio.

LianGuairadigm, as the recognized top venture capital fund in the cryptocurrency industry, and possibly the top native cryptocurrency fund, has two founders with backgrounds from Coinbase and Sequoia Capital. These two well-known individuals have made different moves, and their lead investments in projects such as Uniswap and Blur have caused collective anxiety among VC firms in the cryptocurrency industry: Investments not only need to provide capital, but also strong support for project mechanisms and token economies.

- US CFTC Commissioner Proposing the Establishment of Fraud Database to Identify Bad Actors

- Intent The Starting Point of Web3 Interactive Intelligence

- Principle, Current Application Status, and Risk Response of Intent

Everything changes when endorsed by LianGuairadigm. Source

It is extremely rare for a top VC like LianGuairadigm to have disputes with its investment portfolio. The last time a fight with a top institution occurred was probably with Binance, when it went to court against Sequoia China. During that time, CZ tweeted that all projects applying to list on Binance in the future would need to disclose whether they had direct or indirect associations with Sequoia Capital.

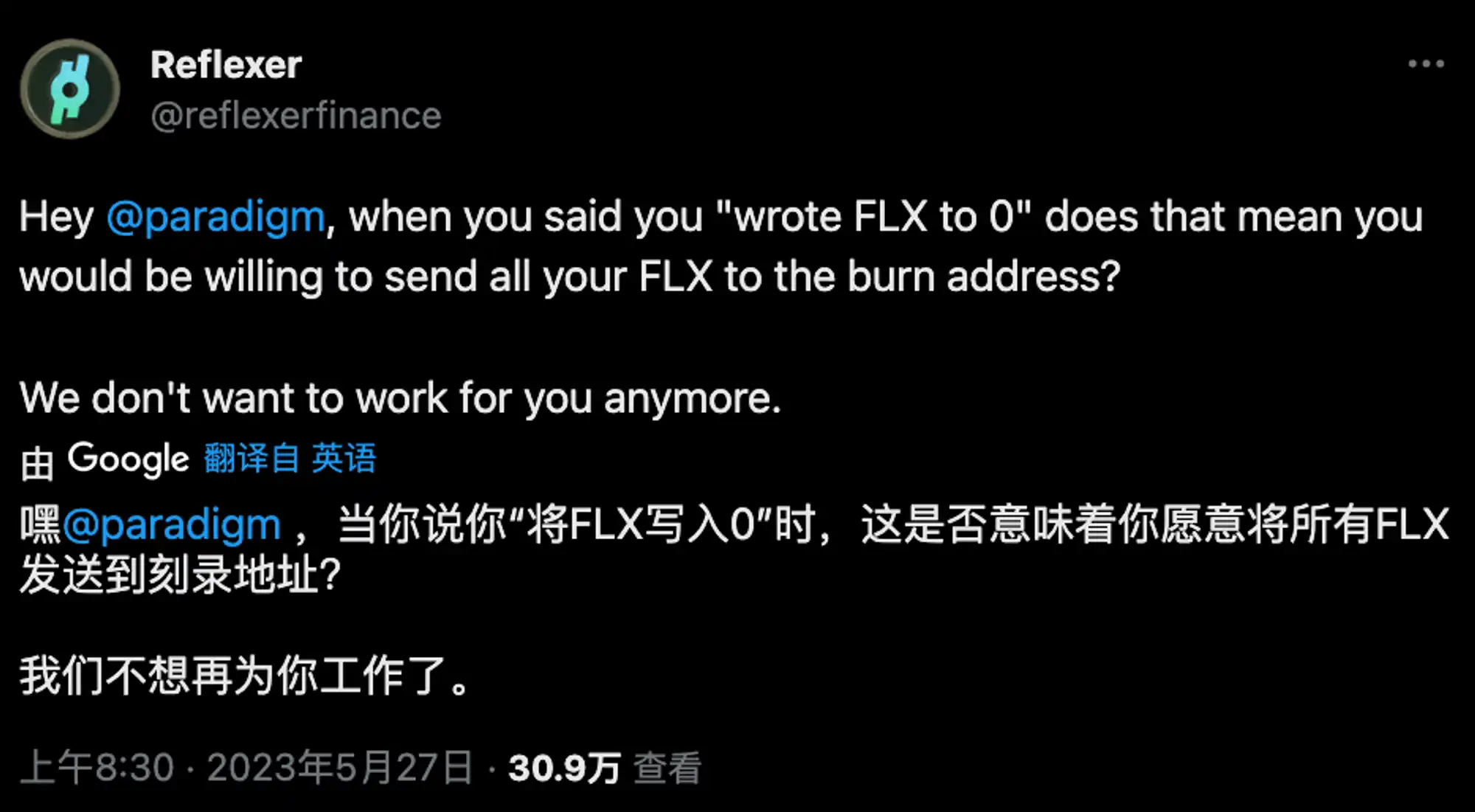

This time, the other protagonist of the story, Reflexer, which had received a seed round led by LianGuairadigm in 2020, chose a simpler and more direct approach. It directly bought back the FLX tokens held by LianGuairadigm and permanently destroyed 50% of the bought-back tokens.

This token buyback could be seen as putting an end to Reflexer’s criticism of LianGuairadigm in its first post in May 2023.

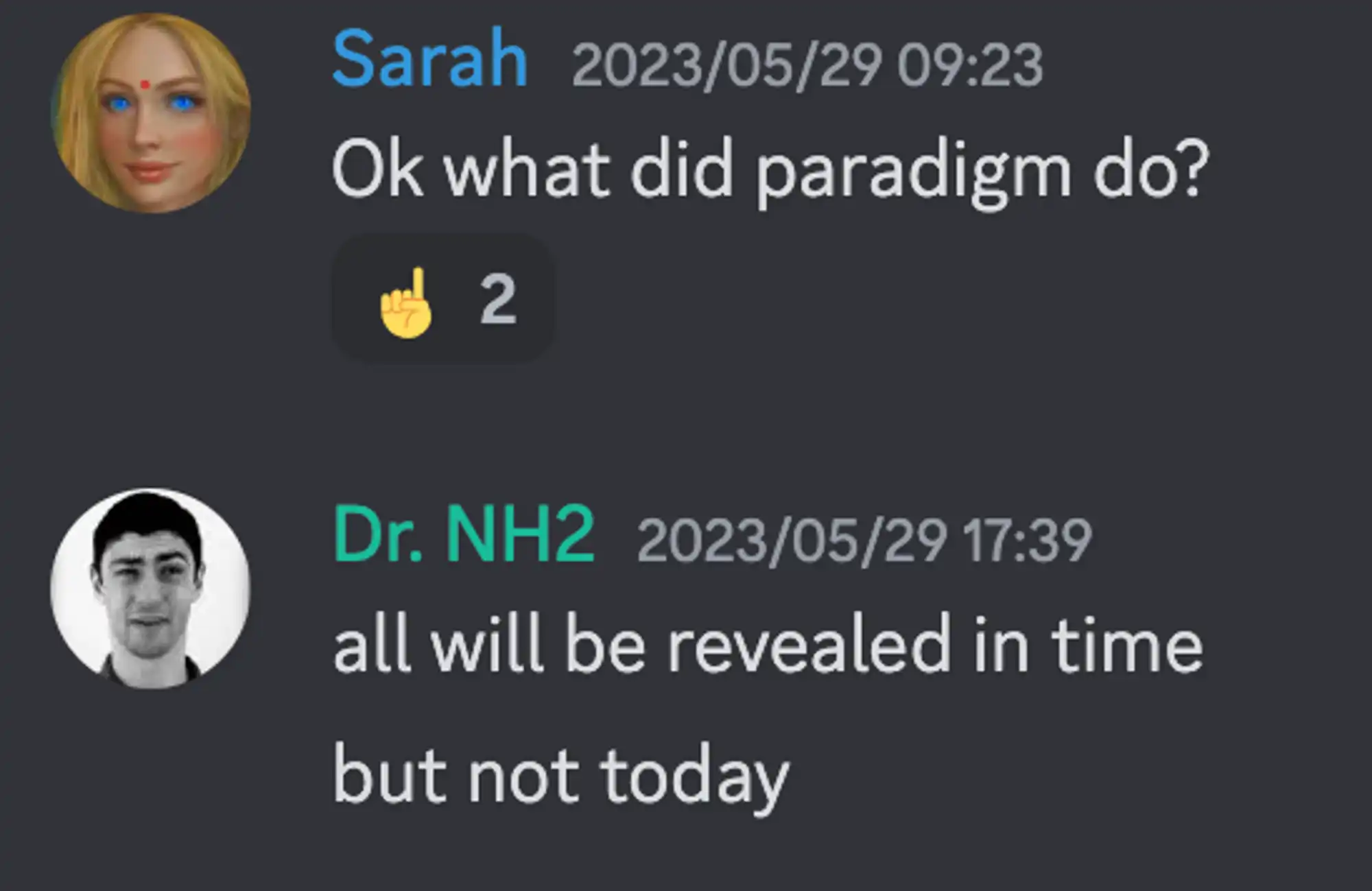

Sarah: What did LianGuairadigm do? Ameen: They will disclose, but not now. Source: Discord

In Reflexer’s “condemnation article,” it mentioned that LianGuairadigm’s investment in FTX had caused a setback in the cryptocurrency industry, and after LianGuairadigm’s official website was updated, it deleted descriptions of many crypto and web3 projects and shifted focus to “cutting-edge” technologies, including AI.

Although there was no response to Reflexer and no apology was given, LianGuairadigm chose to return to the cryptocurrency industry in July and included crypto back on its website. Matt Huang, one of the partners at LianGuairadigm, even posted that the previous website update was a mistake and they had never left the cryptocurrency industry.

Perhaps for Hayden from Uniswap, working with the elite and enthusiastic LianGuairadigm was enjoyable. But for Ameen Soleimani, the co-founder of Reflexer, who has been immersed in the Ethereum community for many years, the private reduction of FLX tokens to 0 undoubtedly infuriated this “unrestrained” Ethereum OG.

Maverick Ameen Soleimani

Ameen Soleimani is not only the co-founder of Reflexer, but also an active member of the early Ethereum community. As early as 2017, he created the Ethereum financial platform SLianGuainkChain for the adult industry. Furthermore, he often personally participates in adult film shoots and shares them on his social media.

Community members often leave comments on his Twitter, jokingly saying that Ameen’s unconventional tweets are a way to spice up their “boring” crypto lives.

However, it would be a big mistake to think that Ameen is just a playboy. The reason Ameen created SLianGuainkChain is to protect the rights of adult industry practitioners. He has also traveled to Washington to meet with representatives from the Washington DC Free Speech Alliance and discuss the discrimination issues faced by the adult industry with members of both the Democratic and Republican parties.

Source

He also initiated the FreeVirgil campaign to show support for Ethereum developer Virgil Griffith, who has been charged by the US government with “assisting North Korea in evading international economic sanctions”.

After the mixer Tornado Cash faced strong sanctions from the US government, Ameen continued to support Tornado in various occasions. He not only showed support for Tornado, but also set his social media avatar to Tornado’s logo. He further developed Privacy Pools based on the Tornado Cash protocol, aiming to protect user privacy in a compliant manner. Based on Privacy Pools, Ameen and co-authors including Ethereum co-founder Vitalik Buterin, Chainalysis researchers, and researchers from the University of Basel jointly published a paper titled “Blockchain Privacy and Regulatory Compliance: Towards a Practical Equilibrium”.

During the bull market, there is no need for a “maverick” because the entire industry is likely already in a state of frenzy. However, Ameen’s more fervent defense of the crypto industry during the bear market showcases the core spirit of an Ethereum believer.

Ameen Soleimani also co-founded Moloch DAO, which provides significant reference value for DAO organizations. The first members of Moloch DAO included Vitalik and ConsenSys founder Joseph Lubin. At the same time, Ameen joined MetaCartel DAO as a founding member, which is a fork of Moloch DAO. Other members include Scott, the founder of Canto and Slingshot, Peter LianGuain, the founder of MetaCartel who joined 1kx, Hugh Karp, the founder of Nexus Mutual, Bobby, the founder of Coingecko, Calvin Liu, the former CSO of Compound and current Eigenlayer, and Julien, the founder of StakeDAO and rekt, and many others.

Perhaps it is Ameen’s experience with multiple projects and DAOs that has gradually shaped him into a representative figure in the crypto community who has strong opinions. Ameen’s current actions show us what the true crypto spirit is.

The Backing of Reflexer

Thanks to Ameen’s extensive social circle and the solid design philosophy of Reflexer, even in conflict with LianGuairadigm, Reflexer still has high-quality community resources.

After MakerDAO founder Rune Christensen proposed to create a new chain using Solana’s codebase, Ethereum co-founder Vitalik appeared in Reflexer’s Discord community, expressing that since MakerDAO has chosen another path, it is normal for RAI to expand from minimal governance to a broader field, and supporting more liquidity collateral tokens would be a good choice.

Even earlier, Vitalik praised that RAI better embodies the “ideal form” of an overcollateralized stablecoin supported only by ETH. Vitalik himself has pledged ETH to Reflexer multiple times to mint RAI.

Reflexer has also gained support from many projects in the community. Recently, Lido provided $63,000 in funding to Reflexer’s fork project HAI to help it complete the audit. Reflexer also maintains a good relationship with stablecoin projects in the space, such as Liquity and Frax. LianGuairsa from Synapse is also an official member of Reflexer, and Reza, an active member of the community, is also a businessperson at the crypto media Decrypt.

Reflexer, which insists on minimal governance, not only has a relatively streamlined team but also is open enough to provide theoretical and technical support to many community stablecoin projects. Currently known projects include HAI, TAI, and Volt Protocol, among others. These grassroots small-scale community projects provide Reflexer with a certain vitality.

The Community’s Bitterness Towards VCs

Reflexer’s attitude towards LianGuairadigm also reflects the attitude of many community members towards VCs. Sisyphus, an active user in the community, summed up this attitude with a concrete statement,

“This year, you can earn substantial profits from zero to one in cryptocurrencies, all from self-reliant projects without VCs.”

Other users added that this is the only industry where retail investors truly have the opportunity to be ahead of “smart money” with good information. Actively participating in Discord and various social platforms allows one to gain information that others do not have or cannot understand its importance through simple work.

In contrast, many star projects launched in 2023 have performed below expectations. Not only have prices plummeted, but infrastructure and on-chain activity have also fallen below the bottom line. The daily active addresses of some “Ghost Chains” are only in the hundreds. With the slow death of many public chains, the Layer 1 concepts that were wildly pursued by VCs in the bull market seem to have been proven false.

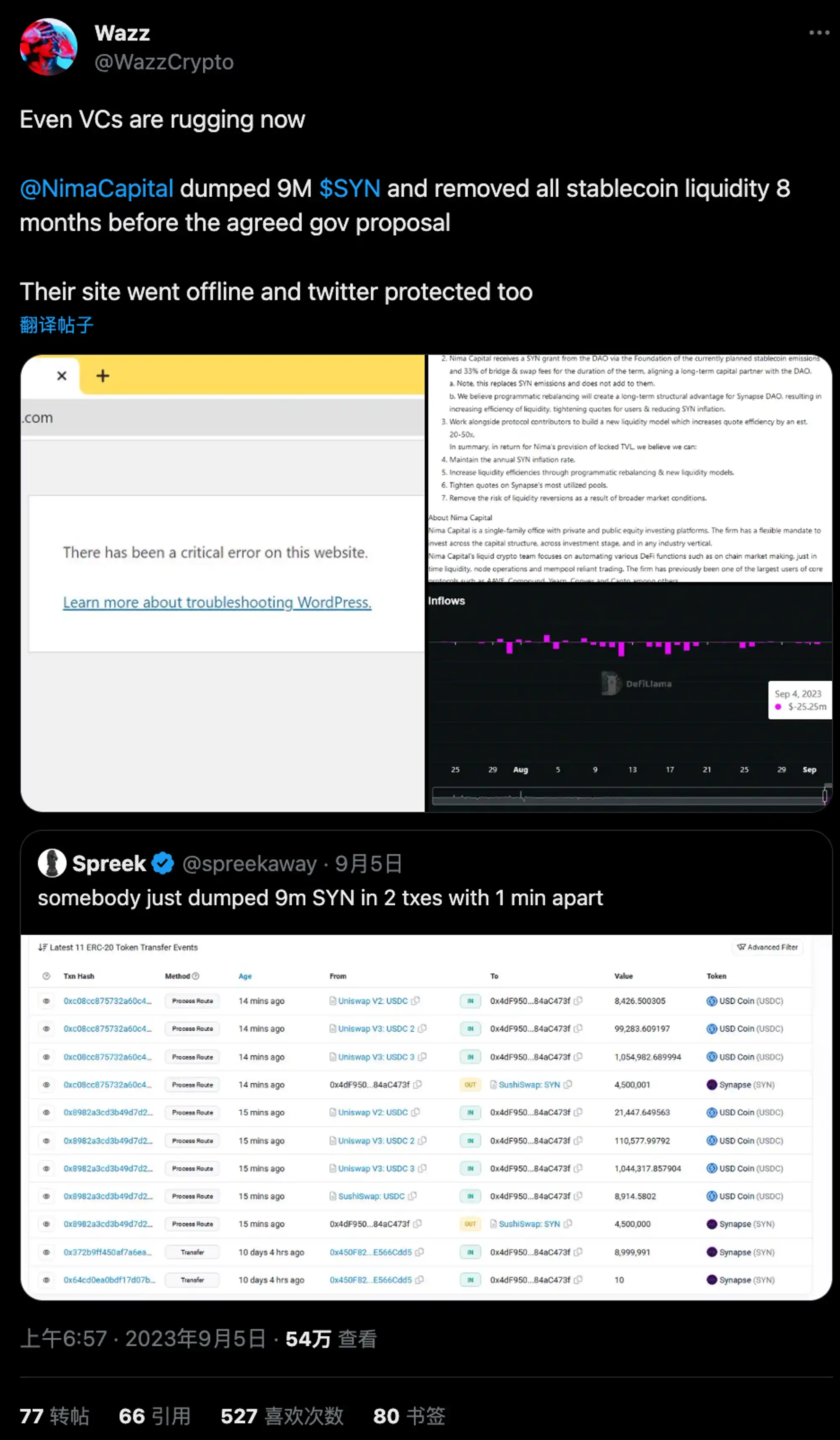

It’s not just the community; there are also accusations within the VC industry.

Nick Tomaino, founder of 1confirmation, who has invested in well-known projects such as Opensea, Coinbase, SuperRare, and dYdX, said that VC is the most deceptive industry in the world, and VC is also the dumb money in the crypto industry because many people in this industry like to go with the flow.

Richard Chen, GP of 1confirmation, said that in the bear market, it is becoming more common for VCs to request refunds from their portfolio companies. A well-known cryptocurrency VC appeared to be very founder-friendly on Twitter, but in the past year, they have withdrawn several investments and requested refunds from several portfolio companies.

Even worse situations have occurred. Nima Capital, supported by a single-family office, violated the governance proposal and sold 9 million SYN coins on September 5th, and withdrew all stablecoins. Their official website is no longer accessible, and their Twitter account is in protected mode. In August, an apartment in New York associated with Nima Capital was sold for $80 million.

In the current context of tightening liquidity and continuously declining VC investment amounts in the crypto industry, when looking back at the crypto circle in 2023, popular community projects such as BRC20, PEPE, BITCOIN-like MEME coins, and TG Bot are not endorsed by well-known VCs. Even the highly popular friend.tech, which ranks at the top of the charts, is rarely seen with institutional and investor participation.

It seems that the community has completed a round of de-VC-ization.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- SEC Pierce The US government needs to remember who they serve.

- FTX owns 38 properties in the Bahamas worth over 200 million US dollars.

- Huobi Ventures’ latest research report Will the Web3 social track be the next bull market engine?

- Former Facebook Executive BTC Will Lead the World out of the Era of Fax Payments and is Expected to Create Trillions of Dollars in Value

- SCP Ventures The State of the Arweave Ecosystem After Arweave 2.6

- Formal Verification – The Ultimate Solution for Contract Security

- Long Push Receiving 1 million ARB airdrop, Summary and Reflections on 2 Years in the Circle