Arthur Hayes Post Even if my judgment on the Federal Reserve is wrong, I still believe that cryptocurrencies will rise significantly.

Even if my Fed judgment is wrong, I believe cryptos will rise significantly.Compiled by: GaryMa Wu Blockchain

American market participants are not so patient on the journey to accumulate more wealth. As we endlessly search for the next bull market, we often ask ourselves, “Have we arrived?” In the cryptocurrency market, we often ask ourselves when the junk coins in our wallets will once again approach the high point of November 2021.

Smarter traders are looking for leading indicators that may indicate the approaching bull market, with the goal of determining when to fully enter the cryptocurrency market. Like a Pavlovian dog, we are trained by our central bank masters to buy financial assets whenever they cut interest rates or engage in large-scale money printing to expand their balance sheets. We focus all our attention on every word spoken by these scammers, hoping they will provide free funds to drive risk asset returns.

Federal Reserve balance sheet (white) and Bitcoin (yellow), with an initial index value of 100

- NEAR’s number of users and transaction volume skyrocketed, possibly influenced by the token reward program of KaiKai, a chain upgrade.

- LianGuaiWeb3.0 Daily | LianGuai Launches Cryptocurrency to USD Exchange Service

- ABCDE Why We Invest in GasZero

In the midst of the Federal Reserve’s massive money printing spree, Bitcoin has outperformed the growth of the Federal Reserve’s balance sheet by 129%, confirming that our reflexive investment based on the erroneous predictions of Federal Reserve Chairman Powell has been quite profitable.

Since the Federal Reserve began raising interest rates in March 2022, a group of macroeconomic analysts have been trying to guess when the Federal Reserve will stop. I have presented a series of reasons why I believe the Federal Reserve’s interest rate hike cycle will eventually lead to some kind of financial disaster that will require them to cut interest rates and expand their balance sheet.

On March 10th of this year, Silicon Valley Bank and Signature Bank experienced serious balance sheet problems under the Federal Reserve’s policies. By Sunday night, it was clear that these banks were hopeless, unless the Federal Reserve and the U.S. Treasury really wanted to uphold the values of free-market capitalism and allow a poorly managed traditional financial company to go bankrupt, some form of bailout was imminent. As expected, the Federal Reserve and the Treasury intervened and provided relief in the form of the Bank Term Funding Program (BTFP). The BTFP provided unlimited vitality to the U.S. banking system, allowing banks to hand over their junk U.S. Treasury bonds to the Federal Reserve and receive new dollars in return. These dollars were then provided to depositors, who chose to flee because money market funds (MMFs) offered interest rates above 5%, while bank deposit rates were close to 0%.

This is a critical moment. I and many others believe that the Federal Reserve has definitely stopped raising interest rates. The Fed’s real top priority is to protect banks and other financial institutions from failure, while the pervasive rot of underwater bonds threatens the entire financial sector. It seems that the Fed’s only choice is to cut interest rates, restore the health of the U.S. banking system, and then watch Bitcoin quickly rise to $70,000.

But that’s not the case. Instead, the Federal Reserve has raised interest rates three times since March.

When your predictions have consistently been wrong, it’s time to reassess the facts you believed and explore scenarios of “what if I continue to be wrong”. In this case, it means starting to think about whether my investment portfolio can survive in the event of further interest rate hikes by the Federal Reserve.

Last week, I gave a keynote speech at the Korea Blockchain Week conference, discussing the question of whether Bitcoin can still rise if the Federal Reserve and other major central banks continue to raise interest rates. For those who were not present or thought I was progressing too quickly on certain concepts, this is an article exploring this issue.

What if?

What if the United States doesn’t go into recession?

What if inflation doesn’t decrease?

What if the US financial system doesn’t collapse?

If these are all true, then we can expect the Federal Reserve and other major central banks to not cut interest rates, but rather to further raise them.

Past and present real yields

What is a real yield? Real yield is a rather vague concept that varies from person to person. My (slightly simplified) definition is that if I lend money to the government, I should at least get a return that matches the nominal Gross Domestic Product (GDP) growth rate. If I get a return less than this value, the government is profiting at my expense.

Clearly, the government wants to finance itself at a rate lower than the economic value generated by its debt. Using financial repression to ensure that the nominal GDP growth rate remains higher than bond yields has been the policy of all the most successful export-oriented Asian economies since the end of World War II. Japan, South Korea, and others have used this strategy to escape the devastation their countries experienced after the end of World War I. The government must use its banking system to implement this type of financial repression. Banks are instructed to offer low rates to depositors. Then, the government imposes restrictions to prevent them from transferring funds out of the system. Then, the banks are told to lend to state-supported or government-affiliated large heavy industries at low rates.

Deposit rates < corporate loan rates < nominal GDP growth rate

As a result, these industrial companies that require large capital expenditures receive cheap financing to rapidly build modern manufacturing bases. Then, the government uses these manufacturing bases to accumulate sovereign wealth, which is reinvested in US Treasury bonds and other dollar-denominated financial assets. It is said that these funds can be used in times of economic difficulty. Ordinary people can get high-paying blue-collar manufacturing jobs, which provide lifelong security. Compared to their previous lives as agricultural farmers, when their living standards were extremely difficult, they now work in large companies, enjoy full benefits, and work eight hours a day. This is a significant improvement for them.

The real yield = government bond yield – nominal GDP growth

This financial repression strategy only works when funds cannot leave the banking system. This is why countries like South Korea have closed capital accounts. Or in the case of Japan, where the government can hardly allow foreign financial companies to advertise or accept Japanese depositors, ordinary Japanese investors are trapped in a situation where they cooperate with Japanese banks and have negative real yields. However, in the current digital age, this strategy becomes more difficult to execute, especially considering the rise of alternative, decentralized financial systems like Bitcoin. When the real yield is consistently negative, depositors can now leave before the door closes (or at least they think they can).

Let’s take a look at the real yield in the United States from 2022 to the present.

US two-year Treasury yield minus US nominal GDP growth rate

I use the 2-year US Treasury yield to represent government bond rates because it is the most popular and liquid instrument for tracking short-term rates. As you can see, when the Federal Reserve began raising rates in March 2022, the real rates did become negative. Despite the unprecedented speed at which the Fed raised rates, the real rates are now only a weak positive. If you substitute the 10-year or 30-year yield for the 2-year, the real rates are still negative. That’s why it’s foolish to buy long-term bonds with your own money. Institutions still do it because when you’re a trustee playing with other people’s money and earning hefty management fees for average intelligence and ability, financial responsibility no longer exists.

When I consider the chart above, my next question is, “What can we expect the real yield to be in the future?” The Atlanta Federal Reserve Bank publishes a “GDPNow” forecast, which is a real-time estimate of current quarter GDP growth. As of September 8th, the Fed predicts an incredible huge growth of 5.7% for the third quarter. To arrive at the nominal growth rate, I added 3.7%, which I calculated by looking at the average difference between nominal growth and real growth over the past six quarters.

GDP now grows by 5.7% + GDP deflator grows by 3.7% = 9.4% nominal GDP growth for the third quarter

Predicted real yield for the third quarter = 2-year US Treasury yield of 5% – 9.4% nominal GDP growth for the third quarter = -4.4% real yield

What is going on here! Traditional economic theory states that when the Fed raises rates, growth in credit-sensitive economies slows. Common sense tells us that in this scenario, nominal GDP growth should decrease and real interest rates should rise. But that is not the case.

Let’s take a look at why.

No money, no happiness

The government makes money through taxation and then spends it on various things. If spending exceeds tax revenue, they will issue debt to fund the deficit.

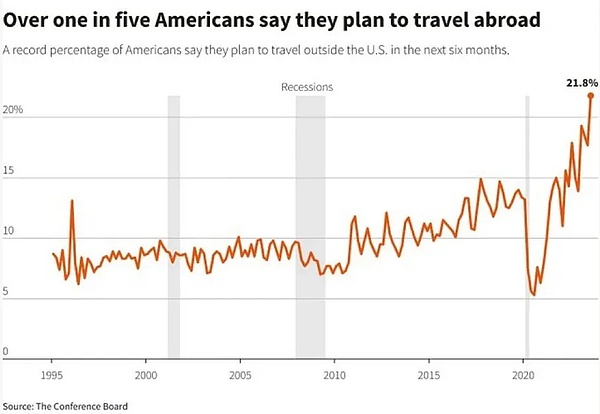

The main export of the United States is finance. Therefore, the government earns a lot of capital gains tax revenue from the stock and bond markets.

The pandemic bull market from 2020 to 2021 generated a lot of tax revenue from the wealthy. However, starting in early 2022, the Federal Reserve began raising interest rates. Higher rates quickly impacted the financial asset markets. This is the main reason why good guys like Sam Bankman-Fried and crypto entrepreneurs like Su Zhu and Kyle Davies fell.

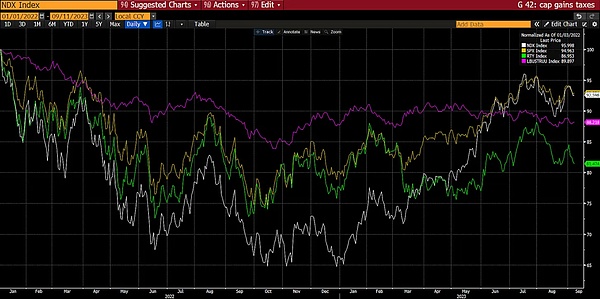

Below is a chart of the returns from 2022 to the present for the S&P 500 index (yellow), the Nasdaq 100 index (white), the Russell 2000 index (green), and the Bloomberg US Aggregate Total Return Bond Index (magenta), with 100 as the baseline.

As you can see, no one has made money since early 2022. As a result, capital gains tax revenue has sharply declined. The Congressional Budget Office estimates that in 2021, realized capital gains accounted for about 9% of GDP. With the Federal Reserve taking action to combat inflation, these tax revenues are decreasing rapidly.

“Data processing from the Internal Revenue Service (IRS) shows that realized income increased significantly in 2021, reaching an estimated 8.7% of GDP, the highest level in over 40 years, according to the CBO.”

Furthermore, it is important to remember that the top priority for any politician is reelection. The older generation of the “baby boomers” has been promising relatively free healthcare, while the average American public enjoys energy consumption levels far higher than anywhere else in the world per capita. Given these two facts, it can be safely assumed that politicians who propose cutting healthcare expenditure and/or defense budgets during their campaigns will not be reelected. Instead, as the population ages and the world becomes more multipolar, the government will continue to increase spending in these two areas. If spending increases while revenue decreases, the deficit will inevitably rise. Since GDP is just a snapshot of economic activity, when the government spends money, it by definition increases GDP – regardless of whether the spending is truly productive.

US government deficit as a percentage of nominal GDP

The rising deficit must be financed by selling more bonds. By the end of the year, the US Treasury must sell an additional $1.85 trillion in bonds to repay old debt and cover the budget deficit. In addition to having to issue these bonds, the Federal Reserve is also raising interest rates, further increasing the amount of interest the US Treasury must pay.

As of the end of the second quarter, the U.S. Treasury spent $1 trillion annually on interest payments to debt holders. Given that most wealth is concentrated in the top 10% of households (meaning these households hold most of the government debt), the U.S. Treasury is effectively distributing benefits to the wealthy in the form of interest payments.

When the aristocracy has accumulated enough money to pay for the most important parts of life (housing and food), what do they buy? They spend money on services. About 77% of the U.S. economy is service-related. To summarize: as interest rates rise, the government pays more interest to the wealthy, who consume more services with their interest income, further increasing GDP.

Circles of mutual praise

Let’s put it all together, step by step, and see how the Fed’s interest rate hikes increase nominal GDP, thus generating more Fed monetary tightening.

The Fed must raise interest rates to combat inflation.

I will never tire of this photo. Powell looks like a fool, while Biden points at him with a pen, instructing the Fed to address inflation.

Financial asset prices fall, and then tax revenues also decline.

Except for some outstanding tech stocks like Nvidia, most companies that manufacture physical products are struggling due to rising credit costs and declining credit supply, which in turn causes their stock prices to fall. In terms of the world’s largest asset market, bonds are expected to suffer losses for the second consecutive year on a total return basis. With broader stock and bond markets still below their 2021 highs, government capital gains tax revenue has plummeted.

As government spending increases while tax revenues decline, the deficit also increases, leading to higher deficits. The more government spending, the larger the deficit. If more spending = higher deficit, and more spending also = higher nominal GDP growth, then logically, higher deficit = higher nominal GDP growth.

Due to high interest rates, the U.S. Treasury must issue more bonds at higher interest rates.

Wealthy savers haven’t had this much interest income in over twenty years.

The wealthy will consume more services with their interest income, further driving nominal GDP growth.

About 77% of the U.S. GDP is made up of the service industry.

Inflation becomes stubborn because nominal GDP growth > government bond yields.

Higher bond yields have not restrained U.S. government spending because the U.S. government benefits from this situation. When the government finances itself at rates lower than the growth of its debt, the ratio of debt to GDP actually decreases. This is exactly the same policy the U.S. government adopted after World War II to repay its massive domestic war debt.

The Federal Reserve must raise interest rates to combat inflation.

As GDP growth continues to outpace bond yields, inflation will rise from its current “sluggish” levels and remain elevated. As long as inflation remains well above the Fed’s 2% target, they must continue to raise interest rates.

The fatal weakness

Mr. Powell can continue to raise interest rates as long as the market is willing to accept rates below nominal GDP growth. However, Mr. Satoshi Nakamoto has brought an alternative financial system to the world, including a fixed-supply currency and a decentralized, almost instant payment network called Bitcoin. Banks are facing unprecedented competition. (Of course, you could always take money out of the bank and buy gold, but using heavy gold in everyday life is impractical.)

If the market demands a yield of at least 9.4% (equivalent to the projected nominal GDP growth rate) for US Treasury bonds, the situation will reverse. The Federal Reserve must either prohibit banks from allowing funds to be transferred to digital financial technology companies that offer physical cryptocurrencies, or it must restart quantitative easing (also known as money printing) and purchase bonds to ensure that their yields remain below nominal GDP growth. I will continue to remind you that buying ETFs will not take your funds out of the traditional financial system. The only escape is to buy Bitcoin and withdraw it to your own wallet, where you will hold the private keys.

It is reasonable to assume that when there is a financial escape route like Bitcoin, the market will grow tired of handing over profits to the government. But for the rest of this analysis, I will assume that the Federal Reserve will be able to continue on its path of raising interest rates without too much capital fleeing the US banking system.

Changing financial climate

We are taught to believe that when interest rates rise, the prices of risky financial assets such as Bitcoin, stocks, and gold should fall. However, due to the government’s continued spending spree and inflated GDP, people seem to be earning actual returns on seemingly valuable government bonds of around 5% that may actually be closer to -4%—meaning that risky assets remain a very attractive choice for investors.

Investors seeking positive returns on real interest rates have fueled the Bitcoin bull market, which officially began on the fateful weekend of March 10, 2022. Since then, the price of Bitcoin has risen by nearly 29%. Although the price has tested $30,000 multiple times without breaking through, Bitcoin is still trading at levels around $20,000 before its bank subsidies.

The market is quietly telling us that if the Federal Reserve continues to raise interest rates, real interest rates will become even more negative and will likely remain visible in the future. If that were not the case, shouldn’t Bitcoin be hovering around $16,000? The reason we haven’t reached $70,000 is because everyone is focused on the nominal federal benchmark interest rate rather than the real interest rate compared to the astonishing nominal GDP growth in the United States. However, this information is slowly spreading through various mainstream media government propaganda channels, such as The Washington Post:

Furman said, “It is indeed shocking to see this in an economy with low unemployment rates. This has never happened before. A strong and robust economy with no new emergency spending, yet such a large deficit. It is so large within a year that it makes you think that something strange must be happening.”

As people become increasingly aware that holding bonds is a fool’s game even with short-term nominal interest rates of 5.5%, marginal capital will start seeking hardcore financial assets. Certain assets, such as Bitcoin, large tech/artificial intelligence stocks, and productive farmland, will continue to rise and perplex most financial analysts (who are actually just average trustees with mediocre intelligence and abilities but can earn hefty management fees by using other people’s funds). They don’t understand why Bitcoin can remain resilient because what they see is a market controlled by the Fed’s asset purchases, such as the yield of inflation-protected Treasury securities (TIPS) – which are (apparently) positive and rising.

Setting aside the erroneous analysis that we will surely read in mainstream financial news, I believe I have proven that Bitcoin can survive even if the Fed has to continue raising interest rates. This reassures me because although I still believe the base scenario is that the Fed is forced to lower rates close to zero and restart the QE printing press, even if I’m wrong, I still believe cryptocurrencies can rise significantly.

The reason why Bitcoin has such a positive convex relationship with Fed policy is that the debt-to-GDP ratio is very high and traditional economic relationships have collapsed. This is similar to raising the temperature of water to 100 degrees Celsius, it will remain in a liquid state until suddenly boiling and turning into gas. In extreme cases, things become nonlinear – sometimes binary.

The US and global economies are in such an extreme state. Central banks and governments are trying to deal with today’s new situation using outdated economic theories; meanwhile, a 360% global debt-to-GDP ratio is creating a reverse situation that requires rethinking the correlation between assets.

Indeed, it is possible to teach an old dog new tricks, but the prerequisite is that the dog must be willing to learn. The scoundrels who rule in our name and whom we tolerate do not have such a desire to learn. Therefore, Master Satoshi will punish them with powerful Bitcoin.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Did airdrops ruin cryptocurrencies?

- Has the long-standing resentment towards VC finally erupted? After falling out with LianGuairadigm, Reflexer bought back tokens and put on a mocking face.

- US CFTC Commissioner Proposing the Establishment of Fraud Database to Identify Bad Actors

- Intent The Starting Point of Web3 Interactive Intelligence

- Principle, Current Application Status, and Risk Response of Intent

- SEC Pierce The US government needs to remember who they serve.

- FTX owns 38 properties in the Bahamas worth over 200 million US dollars.