Blockchain Economic Panorama and Future: Fintech Evolution Engine (Part 2)

Blockchain + Supply Chain Finance: Dawn of Supply Chain Finance for SMEs

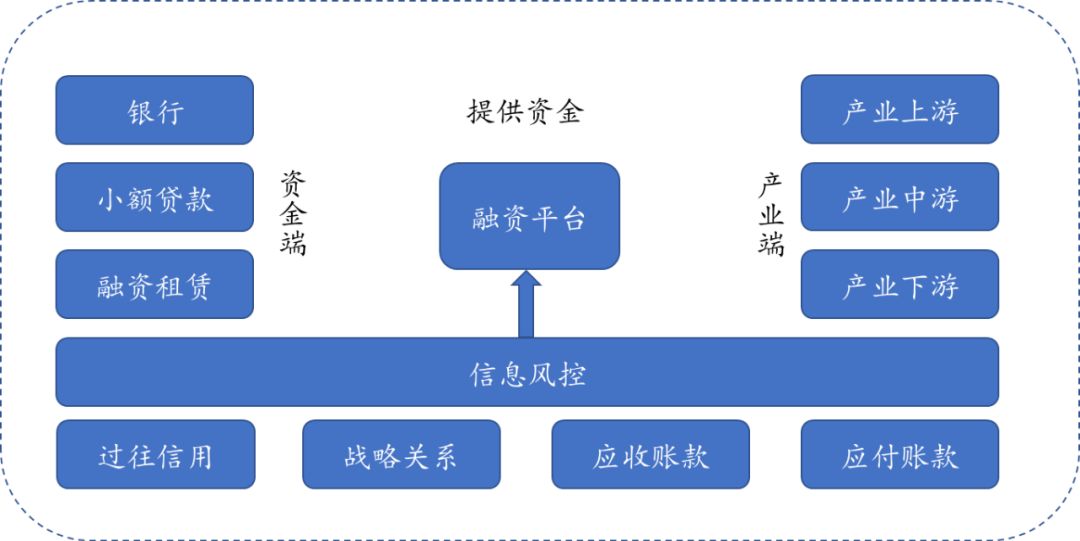

Figure 1 Schematic diagram of supply chain finance, BlockVC industry research

Under the traditional supply chain financial model, factors such as the speed disadvantage and lack of transparency of information transmission make it difficult for SMEs to quickly and cost-effectively obtain funds. The main reasons are as follows: The main funder, that is, the bank is highly dependent on the supply chain and sales capabilities of core companies in the supply chain. Due to the risk control of opaque information and difficult to penetrate, banks are often only willing to provide accounts receivable to upstream core suppliers and distributors. Loan and prepayment factoring business, which has led to the end of the supply chain of suppliers and dealers, that is, the financing needs of the majority of small and medium-sized enterprises cannot be met, which not only restricts the overall market of supply chain finance, but also makes the supply chain Due to limited financing, SMEs affect production progress and product quality, thereby hurting the entire supply chain. According to the calculation of the manufacturing giant Foxconn, the financing costs of its Tier 1 suppliers may be 5%, while the financing costs of Tier 2 and Tier 3 suppliers are 10% -25% or more. The smaller.

- Bitcoin Positions Weekly Report | Multiple types of accounts throw early warning signals ahead of time

- In 2019, 518 blockchain projects have died, and there are only 200 left on tens of thousands of public chains

- Perspective | Open Source Currency and Open Source Ecosystem

On the other hand, current commercial bills of exchange and bank drafts are the main financing tools and payment methods for supply chain finance. The use scenarios are limited and the transfer is difficult. In practice, banks are often very cautious about the legal effects of signing similar "receipt notices" of receivables, and even require legal representatives of core companies to sign in person at the bank, making the transfer operation extremely difficult. The blockchain-driven digital assets can effectively optimize many of the disadvantages in the above process.

In the typical solution of blockchain + supply chain finance, all levels of suppliers, distributors, logistics companies, banks and other institutions can access the blockchain platform. By using distributed shared ledgers, Multi-level tracing and confirmation of related transactions of enterprises promote efficient capital flow, and they can clearly understand the true information of the risks and operating conditions of various related companies, thereby reducing the non-performing loan ratio and financial risks and operating costs. The open sharing of information on the blockchain will also significantly reduce the cost of collaboration and credit risk between various links, and the effective integration of business information, logistics, and information flow will help the emergence of synergies and improve the overall competitiveness of the entire industry chain.

Figure 2 Comparison of Supply Chain Finance and Blockchain + Supply Chain Finance, BlockVC Industry Research

Blockchain + Credit: Solving "Island of Information" to Realize Data Confirmation

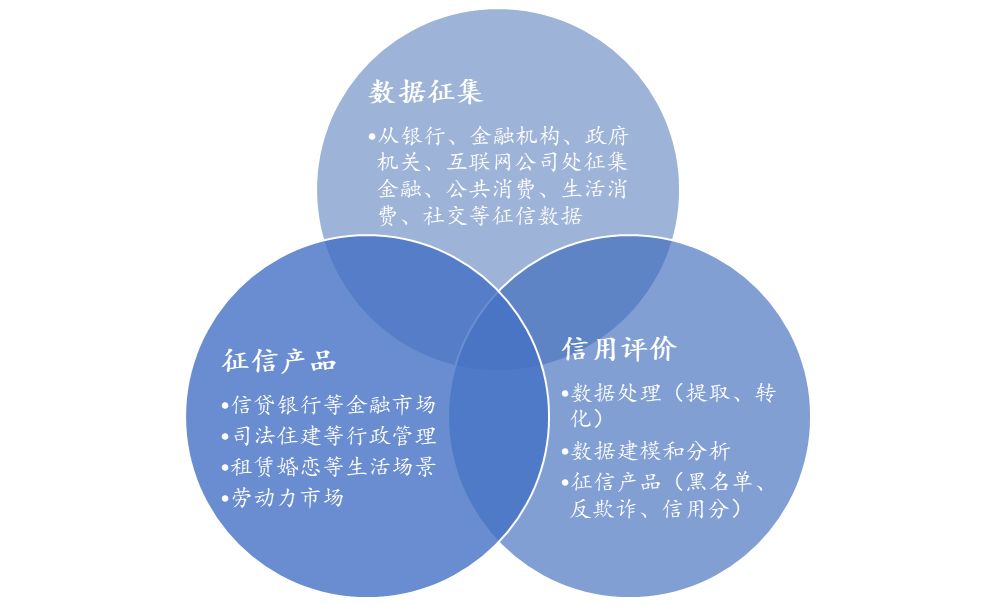

Credit reporting is the activity of collecting and processing credit information of natural persons and other organizations in accordance with the law, and providing external services such as credit reports, credit evaluations, and credit information consulting to help customers judge and control credit risk and carry out credit management. Credit information records individuals' past credit behaviors, which will affect their future economic activities. These behaviors are reflected in personal credit reports, which are often called "credit records". The construction of the credit reporting system plays an important role in the prevention of credit risks and the expansion of credit transactions, thereby improving the operating efficiency of the entire economy. The Tsinghua research group has released a report. According to its calculations, the credit reporting system improved the quality of consumer loans of 498.6 billion yuan in 2012, bringing 80.16 billion yuan of revenue to the bank, and driving about 0.33% of GDP growth.

However, the current "credit information island" problem of the credit information system is serious, and the information belongs to the wrong place. At present, China has implemented a license system in the field of credit reporting. The credit reporting market for individuals and enterprises is mainly dominated by government-based credit information service agencies and social credit reporting agencies. With the increase in data volume and credit reporting dimensions, each credit reporting agency can only be professional in one aspect. For example, Sesame Credit has more payment data, but lacks social data for Tencent Credit Reporting, and data in the public sector. Slightly insufficient. As a result, the same customer may have different credit data in multiple credit agencies, and there is a serious "information island" problem. The data of a single credit agency cannot fully show the credit of a certain customer, resulting in One-sided decisions and risks. And the data of the current credit reporting system is misplaced. The credit information of individuals and enterprises should be owned by individuals and enterprises. However, in the existing credit reporting system, the ownership of the relevant confirmation information belongs to the credit reporting agency, which brings data security and privacy issues.

Blockchain + credit information can be constructed through the information sharing of each node of the system to build a complete "credit evaluation system", which is evaluated based on the degree of influence of personal behavior on credit (such as higher impact on credit data and lower impact on non-credit data) The overall credit level of the individual, and according to the contribution of the affiliate to the credit evaluation, the income generated by the query of the credit user's query data is distributed, thereby solving the "island of information" problem.

The attribution of credit information will also be properly addressed under the blockchain model: credit behavior records generated by individuals are fed back to the blockchain by the institution, and recorded on the individual's "account books", broadcast to the entire network, Records are made through the consensus mechanism. When checking for credit, you need to obtain the permission of the user to query personal information.

Figure 3 Blockchain + Credit Report, BlockVC Industry Research

Blockchain + Asset Securitization (ABS): Open and transparent information on the chain

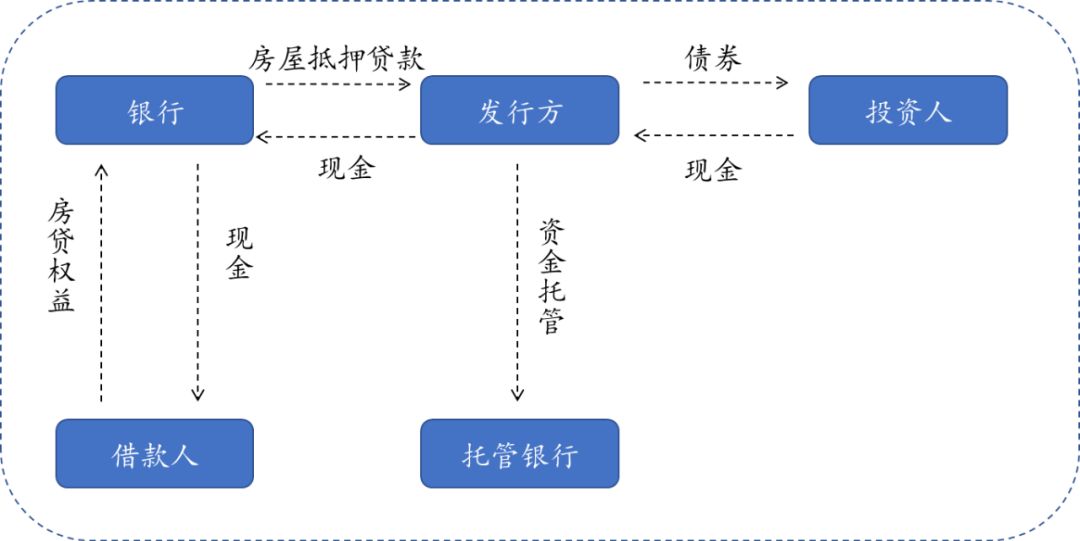

Asset securitization refers to the process of issuing asset-backed securities (ABS) on the basis of credit enhancement through structured design based on the future cash flow generated by the underlying assets as a payment support. A portfolio or specific cash flow is a form of financing that issuance of tradable securities. The asset securitization service agency plays an important role in the process, and needs to provide multiple services such as risk control, pricing, product design, issuance, and duration management for assets in the market. Typical ABS scenarios include home purchase mortgages and more.

Figure 4 ABS Mortgage Schematic, BlockVC Industry Research

The biggest problem with current ABS is that it is difficult to penetrate the underlying assets actually represented by securities equity due to information asymmetry and opacity, etc .: Investors lack effective means to identify and ensure the authenticity of the underlying assets, and if there is a problem with the intermediary, the account is Reimbursement follow-up issues often do not have a proper aftercare plan. In addition, there are more and more categories of ABS product design, increasing complexity, and various risks superimposed, which has caused violations of investor interests.

The smart contract function in blockchain technology can effectively implement real-time monitoring of the ABS underlying assets and simplify the management process: When an accelerated settlement or default event is triggered, the built-in settlement terms stored in the form of code will be automatically enforced, thereby avoiding Problems that are difficult to enforce during manual liquidation; with the help of smart contracts, ABS can maximize automated management processes such as automatic reconciliation and reduce management costs.

JD Hakujo ABS has achieved certain practical results in this field: In June 2018, the “JD.com Finance-Huatai Asset Management No. 19 JD Hakujo Receivables Credit Assets Support Special Plan” was established and listed on the Shenzhen Stock Exchange for transfer. JD Finance opened the ABS cloud platform to all technical teams to improve the underlying technology of the blockchain. Together with Huatai Asset Management and Industrial Bank, it established a multi-party independent deployment alliance chain to achieve data fidelity and real-time sharing on the underlying assets. , Realizing efficient and transparent transmission of information, reducing credit risk, and will gradually add automated management processes at the level of special plans to improve management efficiency, and ultimately realize the technical upgrade of the entire chain of ABS products.

Blockchain + electronic bills: landed widely across space

E-bills are the frontier areas where blockchain development empowers the real economy. Tax invoices and financial bills represented by medical fee bills can take advantage of the non-tamperable and traceable features of the blockchain to achieve tamper-proof electronic transaction, traceability of transactions, and so on. There are many problems with traditional electronic bills, such as the trust of receiving bills. Due to the independence between the billing subject and the billing subject, the two parties cannot directly obtain the transaction details related to the other party. It is difficult to identify the authenticity of the bill and information due to technical reasons It also plagues users of electronic tickets. At this stage, the regulatory bodies such as the taxation department cannot fully grasp the transaction behavior of the invoicing entity, which leaves a living space for the phenomenon of false open and false credit, tax evasion and tax evasion. At the same time, the receipt of invoices, tax copy uploading and other procedures are complicated, reducing the business efficiency of the enterprise.

The advantages of blockchain electronic bills and traditional electronic bills are distributed storage and traceability. Each related party will access the distributed ledger, and the tax bureau, billing party, and reimbursement party can jointly maintain the blockchain and participate in bookkeeping. From the application, invoicing, circulation, accounting, reimbursement and other links, the status of the certificate deposit and the bill can be traced completely, which has largely solved the problem of trust among the subjects. And the bill system on the blockchain can set different levels of authority for different types of institutions. Only the main nodes such as tax authorities and social security departments have full data, and other nodes can only view information related to themselves.

For issuers and collectors, automatic invoice quotas achieved through real-time data on-chain and smart contracts, information such as orders, logistics, and capital flows are automatically written into the blockchain, and relevant transaction details are open and transparent to verify invoices. Authenticity will significantly improve the efficiency of financial operations. For the taxation bureau and other regulatory authorities, real-time status monitoring of all aspects of the invoice and mastery of relevant transaction information can effectively ensure the authenticity of the invoice and reduce tax evasion.

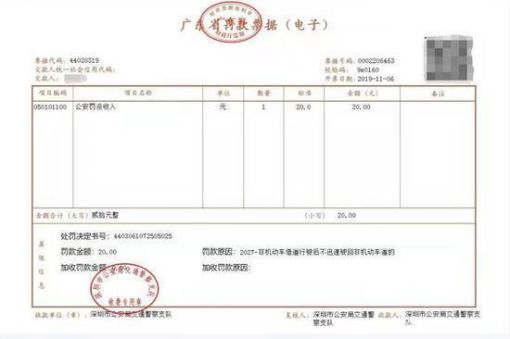

Figure 5 China's First Transportation Financial Blockchain Financial Electronic Bill, Shenzhen Public Security Bureau

In August 2018, with the technical support provided by Tencent, the Blockchain Electronic Invoice System of Shenzhen Taxation Bureau issued the nation's first blockchain electronic invoice. As of August 2019, Shenzhen has issued over 6 million blockchain electronic invoices, with a cumulative invoiced amount of RMB 3.9 billion. For deployment across the country, Tencent has proposed a "main chain + side chain" distributed architecture solution: the country is divided into several regions, which are interconnected by the main chain for consensus and sharing of national data; provinces and cities in the region Can establish side chains independently and be responsible for local data management; the State Administration of Taxation, as a super-supervision node of the main chain, is responsible for the global management of the blockchain electronic invoice system. The invoice data information of each province and city can be checked and exchanged. The operation and maintenance of the nodes are decentralized to the provinces and cities, which is easier to manage than the traditional national unified data center.

Fintech companies embrace blockchain technology

Entering the second decade of the 21st century, China's Fintech companies have developed rapidly and their technological capabilities have increased rapidly. The revenue and profit scale of leading fintech companies such as Ant Financial, Ping An of China are leading the world, making high-intensity technology investment possible, and reaching global leading levels in some areas (such as mobile payments) . Blockchain-based technologies and products developed by such fintech companies have gradually been used in some markets inside and outside the mainland (such as Ant Financial's global remittance business, and the Hong Kong Monetary Authority's trade financing platform based on Ping An fintech technology) .

The layout of the international financial companies in the field of blockchain has equal emphasis on both hands. On the one hand, they are investing in blockchain startups. Since 2015, mainstream international financial institutions such as Fidelity Asset Management have started blockchain-related investments. The aspect is the blockchain business practice based on open source architecture or self-built architecture. The blockchain introduced above enables fintech's cross-border payments, trade financing, ABS, electronic bills and other fields to become key areas for fintech companies at home and abroad.

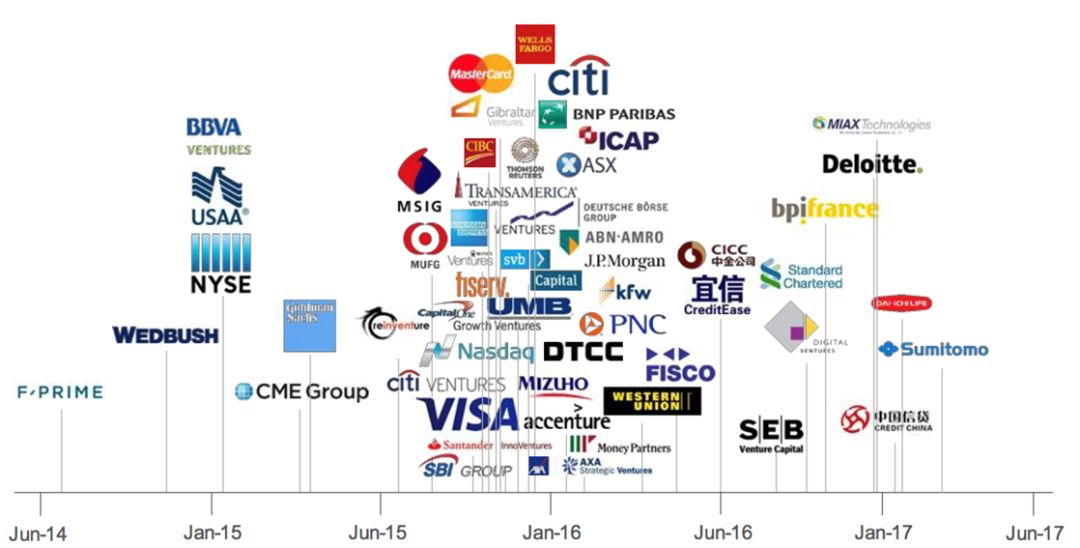

Figure 6 Fintech companies' entry schedule for the blockchain field, CB Insights

· JPMorgan: In the cross-border payment field, Quorom-based interbank information network platform is launched to solve cross-border payment compliance issues; in the field of trade financing, it cooperates with the National Bank of Canada and other countries to use blockchain technology to test bond issuance;

· Citibank: In cooperation with Nasdaq, use distributed ledgers to automate cross-border payment processing; participate in the trial run of the IBM LedgerConnect loan collateral management platform;

· BOA: applied for 53 patents related to blockchain, involving risk monitoring, transaction verification and other aspects;

Goldman Sachs: Uses CLSNet, a blockchain-based payment settlement service; uses the BDS blockchain platform to back up transaction settlement records and the transfer of assets managed by its financial network.

At the level of the blockchain technology platform, international fintech companies mainly build their own technical teams and combine existing open blockchain architecture platforms to achieve their own business upgrades, efficiency gains, and external empowerment, and ultimately form technology output path.

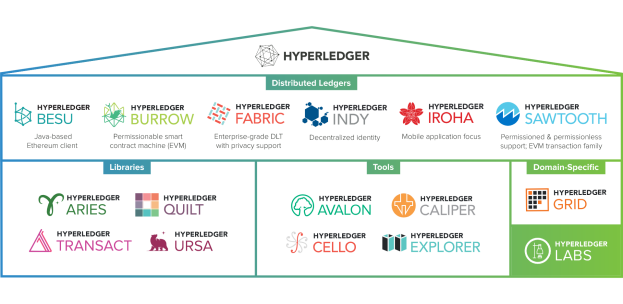

Most companies use open source blockchain frameworks to develop their own blockchain projects for the underlying protocols. The current mainstream frameworks include public blockchain-based Bitcoin (such as using the Omni Layer protocol), Ethereum, and HyperLedger Fabric based on the alliance chain and R3 Corda, etc.

HyperLedger is the world's first open source distributed ledger platform for enterprise-level application scenarios. It was led by IBM and was transferred to the Linux Foundation at the end of 2015 and became an open source project. It has now developed into multiple sub-projects, including the HyperLedger Fabric sub-project. Currently the most widely used alliance chain development framework. Fabric's application scenarios are very rich, including trusted supply chains, asset custody, business contracts, point exchange platforms, product identity traceability, food safety, and more. Unlike public blockchains such as Bitcoin and Ethereum that use the PoW consensus mechanism, members of Fabric need to be authorized to join, which improves the efficiency of block processing to a certain extent and significantly reduces resource consumption; and Fabric uses a modular architecture , Consensus algorithms, cryptographic algorithms, member services, etc. are all encapsulated into relatively independent modules, which can be replaced, plug and play according to the needs of the business scenario.

Over 60% of the members of HyperLedger's alliance are technology companies. Technology-driven development has a wider range of application scenarios, including finance, healthcare, manufacturing, and the Internet of Things. At present, five types of distributed ledger platforms have been developed. The common feature is to create an open source, distributed ledger framework and code base to support the business transactions of various enterprises and reduce the actual operating costs. In addition to FABRIC (modular architecture, allowing plug and play), HyperLedger also includes SWTOOTH (modular platform with POET as consensus algorithm), IROHA (simple infrastructure platform), and BURROW (licensed smart contract machine) , INDY (tools for creating and using independent digital identities, code libraries, and reusable components), and more.

Figure 7 Blockchain project rooted in the HyperLedger framework, HyperLedger

R3 is one of the few blockchain alliances that has performed multiple experimental operation verifications. At present, it has completed testing of more than 5 different blockchain technologies. The experimental objects are participating members to evaluate and analyze each smart contract pair. The possible impact of the process of issuance, trading and redemption of financial products. The main work is to launch Corda, a blockchain distributed ledger platform for the financial field, to implement applications such as cross-border payments; implement the Observer Node Functionality to ensure that nodes work efficiently and transparently, and are friendly to supervision.

China's Major FinTech Companies Practice

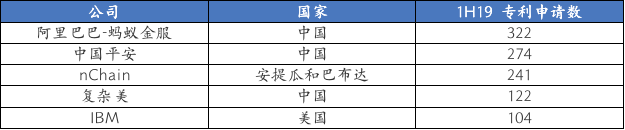

Alibaba-Ant Financial: In August 2018, Alibaba Cloud announced the launch of an enterprise-grade blockchain service BaaS platform to enable cross-enterprise and cross-region blockchain applications. Alibaba Cloud BaaS currently provides three blockchain technology frameworks: self-developed ant blockchain, HyperLedger Fabric, and enterprise Ethereum Quorum. Alibaba Cloud and Ant Financial have actively cooperated with the government and financial institutions. Currently, dozens of projects have been launched in areas including cross-border payments, electronic bills, supply chain finance, retail, justice, transportation and logistics. Currently, Alibaba and Ant Financial have applied for a total of 322 1H19 patents related to blockchain technology, ranking first in the world.

Figure 8 Number of patent applications for global company blockchain 1H19, IPRdaily

Tencent-Weizhong Bank: Tencent established a dedicated blockchain team in 2015, and in April 2018, Tencent Cloud launched the blockchain service TBaaS to provide users with one-click blockchain deployment services and provide business Channel management, smart contract management, and other functions have been implemented in multiple scenarios such as supply chain finance, game assets, and digital government. In December 2017, the Golden Chain Alliance where Weizhong Bank launched the financial branch version of BCOS, Fisco BCOS platform. The full name of the Golden Chain Alliance is the Financial Blockchain Cooperation Alliance (Fisco). It is a blockchain alliance whose main participating members are domestic financial institutions and fintech companies such as Anxin Securities, Baoshang Bank, and Chengdu Chain Security. By the end of 2018, It has covered a total of 117 companies in more than 32 cities.

Ping An of China-Ping An One Account Chain: Ping An Group's fintech platform One Account Connect uses its self-developed FiMAX S3C blockchain framework and has deployed multiple blockchain use cases in trade finance, ABS, supply chain finance, reinsurance and other fields . FiMAX is characterized by high throughput, quasi real-time, and efficient access to national secret algorithms. Unlike traditional BaaS on-chain services, One Account Chain adopts the BNaaS multi-account networking model and supports offline deployment, which will allow customers to more quickly open their own blockchain network or join other development networks. The 2018 annual report shows that Ping An Group has created the nation's largest commercial blockchain platform through Financial OneAccount, providing services to more than 200 banks at home and abroad, 200,000 enterprises and 500 governments and other commercial institutions. Financial OneAccount has been listed on the NASDAQ Stock Exchange on December 3, 2019.

Figure 9 FiMAX BNaaS product advantages, financial one account link one account chain

FunChain: Hangzhou FunChain Technology Co., Ltd. was established in 2016. The main blockchain products include the self-developed blockchain underlying platform Hyperchain. This platform is the first batch in China to pass the standard tests of the Ministry of Industry and Information Technology and the Information and Communication Technology Institute ’s blockchain standards and meet Blockchain core technology platform of national strategic security plan; BitXMesh, a distributed data collaboration network, provides services such as data storage and data sharing for enterprises; and FiLoop, a BaaS platform, provides services such as blockchain deployment, monitoring, operation and maintenance to help users Achieve fast business on-chain. Its representative application cases include China Agricultural Bank United Taiping Pension Insurance Co., Ltd.'s first domestic pension alliance chain; Zheshang Bank's blockchain enterprise receivables chain platform, with a cumulative business scale of 140 billion in 2018.

Opportunities and Challenges Coexist: Industry Outlook

· Standards have not been unified, and regulatory policies are incomplete: At present, there is no universal and unified standard in the blockchain field at home and abroad, which will lead to subsequent application compatibility and interconnection issues, which is not conducive to the improvement of overall efficiency. Important alliances at home and abroad, such as HyperLedger, R3, ChinaLedger, BCOS, etc., are committed to developing unified standards. In October 2016, the Ministry of Industry and Information Technology of the People's Republic of China formulated a technical roadmap for national blockchain technology standards.

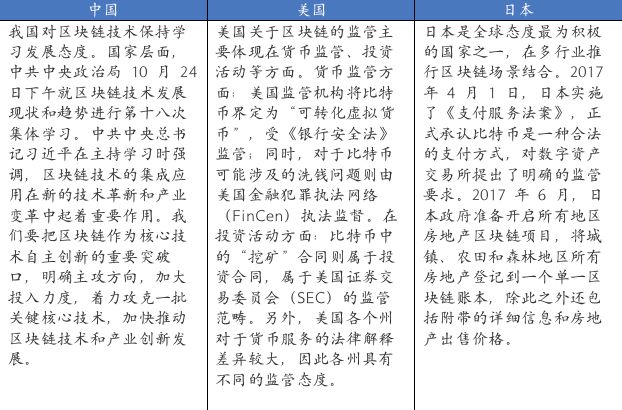

Policies and attitudes: legal and orderly, embrace innovation

In general, countries attach great importance to blockchain technology. On the one hand, they maintain an attitude of encouraging support and active exploration; on the other hand, they speed up the development of normative guidelines as an effective regulatory basis; summarize in eight words: legal and orderly, and embrace innovation.

Figure 10 Overview of China, US, and Japan's policies on blockchain technology and crypto assets, BlockVC industry research

Prospects: Technology convergence and smart contracts will be future trends

As an upgrade and supplement of traditional information technology, the development of blockchain will be integrated and promoted with other emerging information technologies. The current blockchain is still in its early stages of development. It not only requires governments, industry alliances, and enterprises to work together to formulate technical standards and consensus mechanisms, but also requires support from 5G, Internet of Things, artificial intelligence, and big data.

5G: Large public blockchains have limited transaction throughput per second and long transaction confirmation time. In addition to the sidechain and lightning network technologies led by Bitcoin technology development company Blockstream, future large-scale commercial application of 5G networks will greatly increase data. Transmission speed, reducing network congestion, the performance of large public chains will be improved and gradually applied to commercial application scenarios with tens of thousands of transactions per second;

· Internet of Things: The current blockchain technology can only solve the problem of trust on the chain, but it is almost powerless for the authenticity and accuracy of the data off the chain, especially the cooperation of hundreds of millions of IoT devices for data acceptance. After the further development of the Internet of Things technology, the observation, collection, processing, transmission and update of off-chain data will be automated, authenticity and accuracy will be strongly guaranteed, and the application scenarios of the blockchain will also be expanded;

· Artificial intelligence: The proof-of-work mechanism has been criticized for wasting a lot of power and hardware resources. In the future, if the artificial intelligence technology is further mature, it can be combined with hash calculations, which can be transformed into matrix calculations for deep learning, which will significantly create larger Economic and social values.

From Nick Saab's first smart contract concept in 1994 to Ethereum's implementation of smart contracts on the blockchain in 2015, smart contract technology has become the most revolutionary potential application in the history of blockchain development. Throughout history, the development process of the world economy is essentially a crisscross of vertical development driven by the industrial and technological revolution and horizontal expansion driven by globalization of the world economy . The industrial revolution promoted the division of labor and specialization and production scale, which ultimately led to a significant increase in production efficiency and a significant reduction in production costs. Globalization is the ultimate manifestation of the division of labor and cooperation in the R & D, production, and sales of various industries in the industrial chain.

In Web 2.0, people use the Internet to search for information and materials, which has greatly improved efficiency compared to before, but still has to rely on organizational forms such as companies in the physical world to build trust, organize production and cooperate with division of labor. In the future Web3.0 value Internet, it has become possible for the first time for people who have never met to complete the above tasks and complete collaboration in the form of writing. Through the extensive use of smart contracts, the blockchain is also expected to upgrade from a "trust machine" to a core "engine" of the economic industry wave.

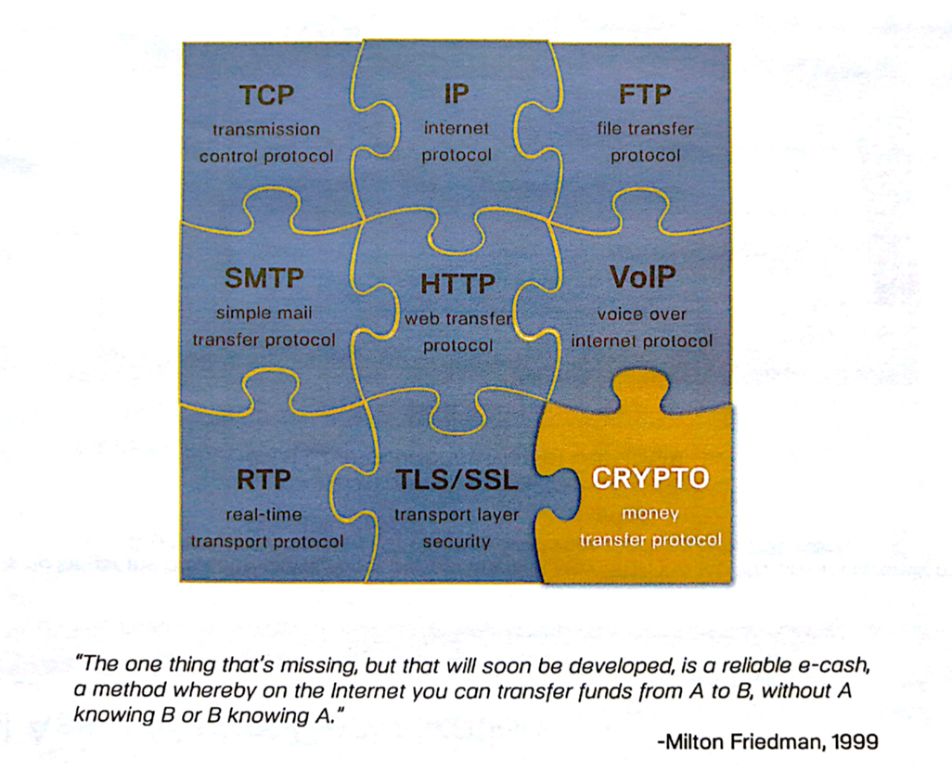

Figure 11 Blockchain technology is the last layer of the puzzle of the underlying protocol, Pantera

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Wanxiang Blockchain Zou Chuanwei: The Balance of Finance and Technology

- Industry Blockchain Weekly News 丨 Unprecedented! 22 provinces write blockchain into government work reports

- Babbitt weekly selection 丨 Bitcoin hits new high in 2020, blockchain financing wave may be coming

- Ten years of dormancy entered the eve of the outbreak of applications, Hangzhou's blockchain industry is at the forefront of cities across the country

- Viewpoint | The story of the public chain is not finished yet

- The compliance exchange is about to appear in Singapore?

- Viewpoint | Blockchain's "shock" in the financial field is not as big as expected