The game of the exchange after the BCHSV "belowed"

The representative of the BSV community, Craig S Wright (CSW), has always claimed to be Nakamoto, and the people in the rivers and lakes call it "Oban." In fact, for this nickname, the global encryption community does not buy it. Many people call CSW a "swindler", including Hodlonaut, the initiator of the lightning network torch relay. Last week, the two people’s disputes on Twitter triggered a scene in the exchange’s “encirclement and suppression” of the BSV.

Hodlonaut insists that CSW is a liar, and CSW asks it to take back the speech and apologize in person, otherwise it will sue for defamation, and threaten to reward the $500 BSV for human flesh Hodlonaut. But this move made a lot of anger. The encryption community launched the topic "We are all Hodlonaut", "Resist Oban" and "Under BSV" on Twitter to attack.

On April 15th, Binance announced that the release of the BSV would change the incident from a "spoken war" to a "war" of real money, causing the BSV to plummet. Subsequently, Coinbase, Kraken and other exchanges also said that they are considering the removal of BSV, but there are also exchanges such as OKEx that do not consider the BSV.

- Out of the 996 Dilemma: Property Rights, Pass and Productivity

- Hong Kong stock company "Ke Di Agriculture" terminates blockchain cooperation, and the partner "Ba Ping Tianxia" is suspected of pyramid schemes

- Polkadot innovates the Staking economy under the NPoS consensus

Will BSV be "cool" in the "encirclement and suppression" of the university?

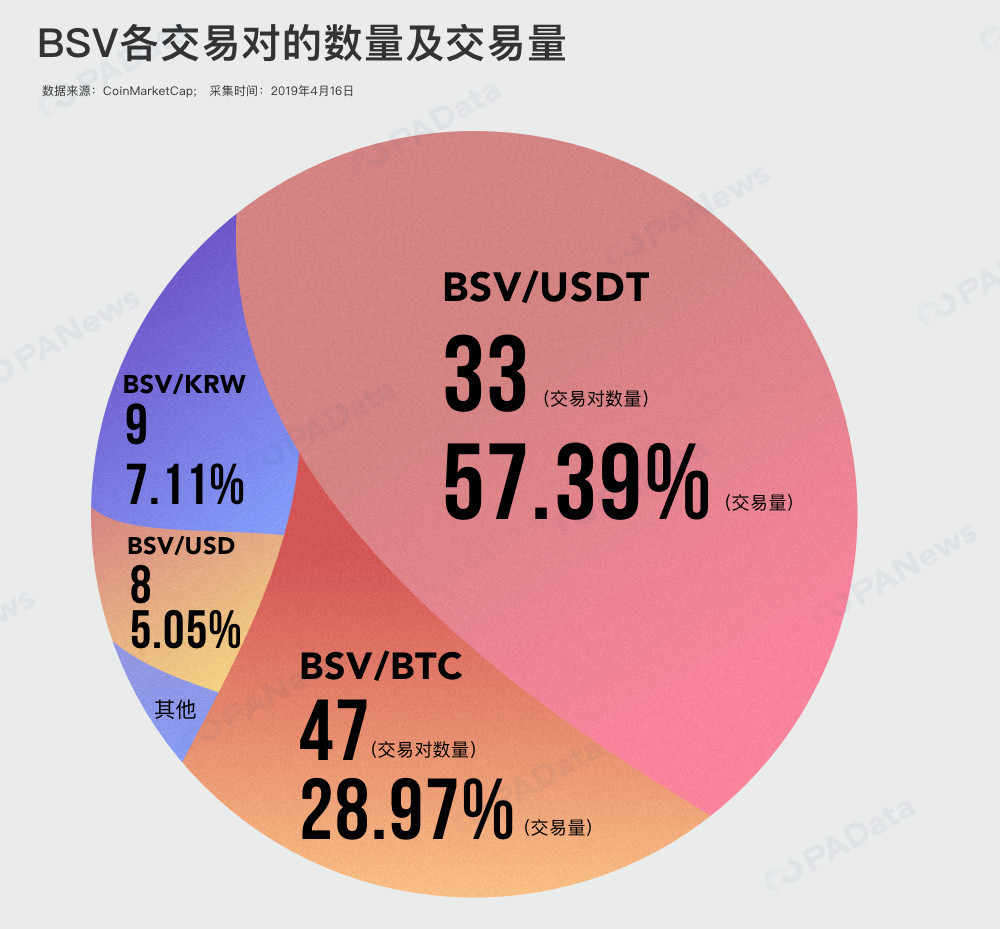

As of April 15, the market value of BSV is about $1 billion, ranking 14th in CoinMarketCap's market capitalization, compared to a month ago (when the statistics on March 25th, BSV's market value ranked 12) 2 places. BSV has a total of 74 exchanges, including 6 trading mines. A total of 21 trading pairs were opened on all exchanges. Among them, SouthXchange is the exchange with the most transactions, with 7 pairs of transactions, followed by Binance, with 5 pairs of transactions. Of the 21 transaction pairs, the number of exchanges opened was the largest for BSV/BTC transactions, with 47 pairs. Followed by the BSV/USDT trading pair, there are 33 pairs. In addition to these two, BSV and other cryptocurrencies form a small number of transactions, mostly as an example of an exchange.

From this perspective, although the BSV is a cryptocurrency with a market capitalization of Top 30, it also has 74 exchanges, and its liquidity has a relatively good breadth, but lacks depth. This can also be seen from the proportion of daily trading volume contributed by each transaction pair. BSV/USDT accounts for 57% of the daily trading volume of BSV, while the daily trading volume between BSV and /BTC only accounts for less than 29%. %.

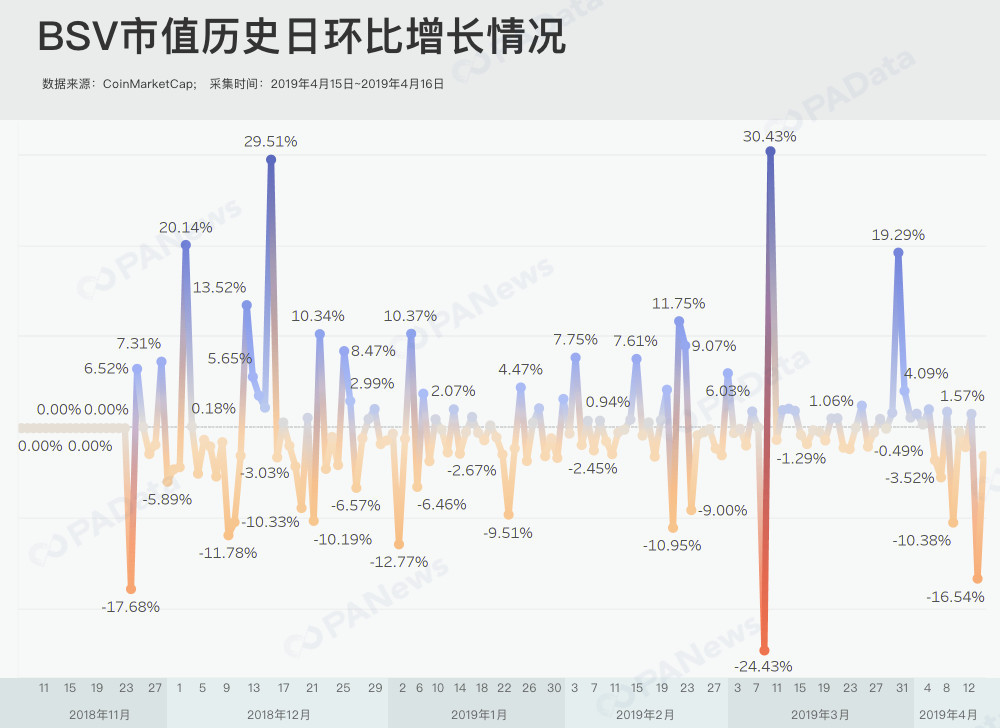

After Binance announced on April 15 that it would be removed from the BSV, the market value of BSV on that day fell by 16.54% from the previous day, and it evaporated 200 million dollars in just one day. Binance announced that the news of the removal of the BSV did cause heavy losses, but it is still impossible to judge whether the negative impact is permanent or temporary. On the one hand, the 16.54% market-to-day decline is not the biggest decline since the birth of BSV. March 11, 2019 was the day when the market value of BSV was the most evaporated, and its market value fell by 24% from the previous day. On the other hand, the decline in market value has now narrowed. On April 16th, public opinion continued to ferment. The market value of BSV fell to around $1 billion, down 3% from the previous day. The announcement of Binance's announcement of the BSV has caused the market value of BSV to fall by nearly 20% in two days, a total of about 240 million US dollars.

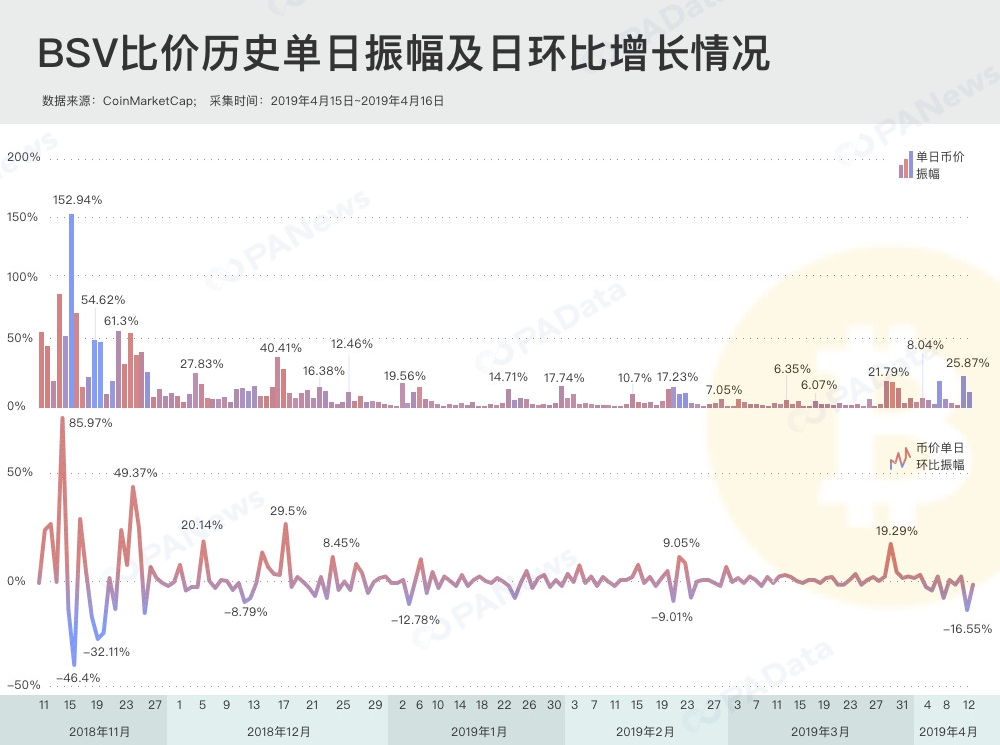

Similar to the market value data performance, BSV's currency price also showed a sharp fall on April 15, but then the decline narrowed, and the single-day currency price amplitude and day-to-day decline did not hit a record high. On April 15, BSV opened higher and lower, CMC closed at 59.29 US dollars, the intraday large amplitude was 25.87%, and the closing price fell 16.55% from the previous day. On April 16, the currency price continued to fall. The intraday maximum amplitude was 13.24%. The closing price fell by 3% from the previous trading day, and the decline narrowed.

Since Binance announced on April 15 that it will be removed from the BSV, the total amount of single-day transactions on the exchanges included in CoinCarketCap on April 15 was $255.96 million, compared with $188.29 billion on April 16, a decrease from the previous month. Nearly 26%.

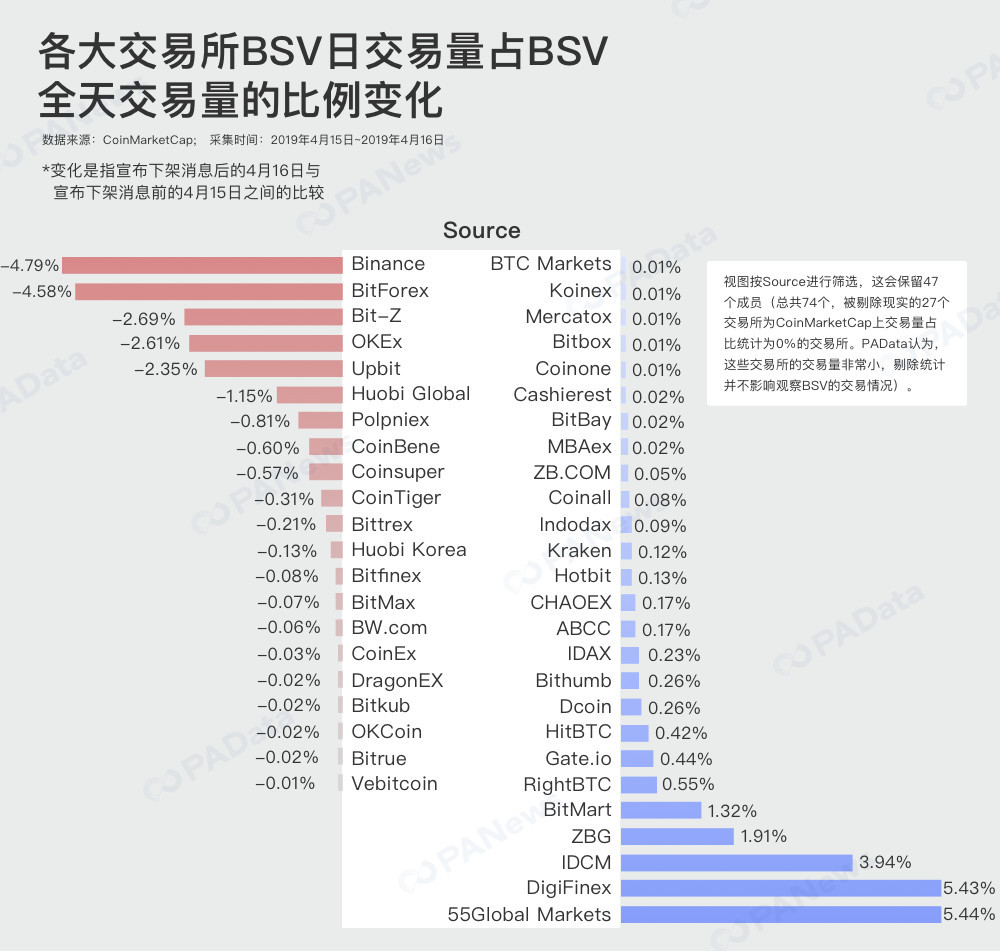

From the internal vertical comparison of the exchanges, except for the four exchanges that are not included in the 74 exchanges (the daily trading volume of the CMC is 0, the statistics are temporarily excluded), and the trading volume of 47 exchanges on the 16th is higher than the previous one. On a day-to-day basis, the average decline was about 40% (including 95% confidence interval). The biggest drop was Cobinhood, which was 100% lower than the day-on-day, but considering that its trading volume on April 15 was only $60, it was fixed. Deviation. If the statistics are narrowed down to an exchange with a daily trading volume of more than $100,000 on April 15, then Coinsuper is the exchange with the most decline in the day-on-day, and its 16-day trading volume decreased by about 69% from the previous day. After the announcement of the removal of the BSV by Bince, which provoked the exchange and the BSV "war", the trading volume on April 16 decreased by 52.51%.

Although the BSV faces the “encirclement and suppression” of most exchanges, it cannot be denied that there is still speculative demand in the market. Among the 74 exchanges, the trading volume of the other 23 exchanges on the 16th was higher than the previous day, with an average increase of 164.77% (including 95% confidence interval). The highest increase was Coinbit. The trading volume on the 16th exceeded 260,000, and the daily increase was more than 2000%, but considering that its trading volume on April 15 was only about 10,000 US dollars, there was a certain deviation. If the statistics are narrowed down to an exchange with a daily trading volume of more than $100,000 on April 15, then DigiFinex is the exchange with the largest increase in the day-on-day, and its 16-day trading volume is about 255% higher than the previous day.

From the horizontal comparison of the exchange's daily trading volume ratio, Binance is the largest channel of BSV before Binance announced the removal of BSV. On April 15th, the daily trading volume of BSV on Binance accounted for about 13% of the total trading volume of BSV. %. On April 16 after the announcement of the removal, BSV's daily trading volume on Binance only accounted for 9% of the total transaction volume of the BSV, but Binance is still the largest "flow source" of the BSV. The daily trading volume of BSV on 55 Global Markets and DigiFinex has increased significantly, from about 2% to about 7% and from about 1% to 7%, both of which are more than 5%.

In fact, the exchange between the exchanges has formed a game relationship between the BSVs. This means that as long as not all exchanges announce the removal of the BSV, the BSV will not "die", regardless of the user's willingness to invest. In the willingness to speculate, in order to purchase the BSV, they will switch from the BSV exchange to the exchange where the BSV is not removed. The announcement of the removal of the BSV is detrimental to both the exchange and the BSV, but the loss of the BSV will be even worse under the current situation of the exchange's control of the traffic channel.

(Source: PANews)

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Gu Yanxi: The near-term and long-term value of Bitcoin derivatives trading services

- Market Analysis: Short-term risk in BCH

- The mysterious miner dug up 1.8 million BTCs, is it Nakamoto?

- Opinion: Why is Ethereum important?

- Can I empty the trash without a counterparty? DeFi is really getting more and more interesting

- The central bank's digital currency became a hot topic in the IMF Spring Conference, and many countries indicated that they will promote the development of digital currency.

- April 18th market analysis: IEO's continued will make more small coins into zero