BTC reverse neckline waiting direction volatility implies that bitcoin forward prices will be even higher!

From the perspective of trading strategy, after the double head fell below the neckline and then pulled back to the neckline and the MACD dead fork opening is still down, this would be a short entry point. For short-term investors with long positions, This is also the target of departure.

For the future direction of Bitcoin, we have already discussed it from many angles. When we recently studied volatility data, we found that this data also has some predictive effect on the high and low prices of bitcoin.

- At the Libra Hearing, what is the attitude of the regulator to the digital currency?

- New Bitcoin Tax Regulations Will Drive Encryption Market Growth

- CipherTrace launches "Travel Rule" in response to FATF to maintain user data privacy

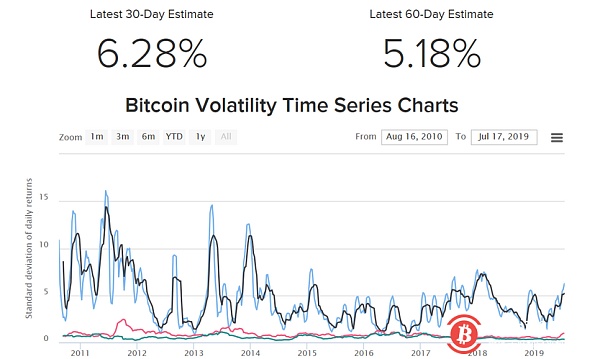

The concept of volatility referred to here is the standard deviation of the daily rate of return for a certain period of Bitcoin. The volatility amplification indicates that the potential income level is increasing, but the risk is also amplifying. From the comparison of the volatility of Bitcoin on the 30th/60th and the volatility of gold and the yen, we can see that the volatility of Bitcoin far exceeds the 60-day volatility of gold and the yen. From this perspective, it is "Bullshit" that all bitcoin is a safe-haven asset, which obviously misleads investors.

Blue line: 30-day bitcoin volatility

Black line: 60-day bitcoin volatility

Red line: gold volatility

Green Line: Yen Volatility

From the historical fluctuation range of bitcoin volatility, with 2014 as the boundary, the previous bitcoin fluctuations were huge, and the extreme value exceeded 15%. However, after 14 years, the bitcoin volatility gradually stabilized within a certain range, and the 30-day volatility high point was around 7%. At present, Bitcoin's 30-day volatility of 6.28% has approached the upper limit of the historical fluctuation range.

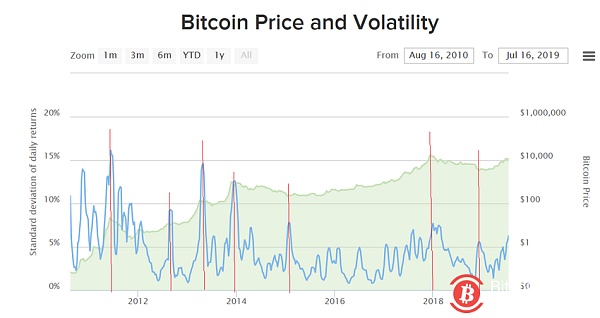

From the corresponding relationship between volatility and bitcoin price, volatility is positively correlated with price. Especially after 14 years, the direction of price and volatility is very consistent. Often the staged highs and lows of the price will correspond to the high point of the volatility. The position of the red line in the above figure reflects this correspondence. If we look at the recent market with this empirical rule, the price high on June 26 does not correspond to the high point of the 30-day volatility, and the recent volatility continues to rise. This indicates that there may be a high point in the price of bitcoin and the volatility may rise again after the recent adjustment.

For other major currencies, since we have consistently adopted trend-following trading strategies, investors are not advised to copy the altcoin currency now. If you must buy some altcoins now, choose the head platform coin (CoinNess)

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Circle CEO wants Libra's unique operating mechanism to trigger positive regulation

- Venezuelan President orders Venezuela Bank to open oil currency trading counter

- Singapore tax authorities propose to remove cryptocurrency transactions from GST taxation

- China's central bank plans to develop its own digital currency to cope with the impact of Libra

- Korean regulators warn that Facebook's Libra may threaten the stability of the financial system

- It is alleged that the US Internal Revenue Service is considering requiring technology giants to announce user encryption activities.

- The circle of friends that shocked you may affect the price of coins. They started to predict through social media.