Can DeFi become a solution to the difficult financing of SMEs?

Content: Calvin Xiao; small eyes like a knife; Amber

Editor: Tony Feng

Recently, there have been more paragraphs about companies lacking money.

"Every company that draws money says that the finance is from Hubei, and it has been isolated. It feels that Hubei's finance has monopolized the entire industry. Will the people of Hubei be so convicted that your conscience will hurt?"

- MakerDAO Risk Leader: ProgPoW may do no good to the DeFi industry

- Crypto industry talent demand grows 26%, let's see what new positions are available?

- Before the halving, do you still have the opportunity to join the "Bitcoin 1% Elite Club"?

The boss's heart will definitely hurt, and the wallet must be crying.

Financing for SMEs has been difficult for many years; only this time the situation is more special:

Small and medium-sized enterprises are faced not only with difficult loans, high profits, drawdowns, and loan severances, but also with serious difficulties in getting production and operations back on track, with masks and disinfectants indispensable, and preventing and controlling epidemic problems. Manufacturers dropped the chain, the raw materials could not be delivered, and they could not be shipped; employees could not come to work, and wages, taxes, and rent were not small.

A recent survey report released by the China Association of Small and Medium Enterprises showed that approximately 86.5% of the SMEs surveyed stated that their operations were significantly affected, of which nearly 30% reflected that the impact was "especially serious" and would result in losses. Tight capital is the biggest difficulty for enterprises. Nearly 90% of enterprises have less than three months of funds on their books.

The smart and capable SME bosses have been put to the test and suffering.

Private enterprises have solved 80% of China's employment, which is already a reality of China's economic development. Stabilizing private enterprises and small and medium enterprises actually stabilizes the broad market for China's economic development and stabilizes the broad market for employment growth. In particular, small enterprises have been in the contraction range for more than a year, and they may be under greater pressure under the impact of the epidemic.

Small and medium-sized enterprises occupy a very important position in China's market players. No matter they contribute to GDP, taxation, employment, and patent rights, they have contributed greatly. However, due to their own weaknesses, such as information silos, unclear accounts, and insufficient information transparency, they still have considerable difficulties in applying for bank loans.

Loans are one of the core methods of any economic operation. Loans help the economy grow faster because people can get funding and make it work faster. Under normal circumstances, each loan has an amount that the borrower and lender agree to borrow, the interest rate and the period for which the debt must be repaid. Borrowers usually charge fines for late payments or defaults.

However, in the face of the sudden epidemic, the performance of the blockchain seems very flat, and it has not played a prominent role, nor has it shown a key heroic character in the difficulty of financing.

However, in the long run, because the blockchain is transparent and immutable, it can provide more accurate solutions to the pain points of SME financing. Therefore, no matter in the supply chain finance or in a wider context, the district Blockchain has become an important solution to this problem.

Minor repairs: Blockchain as a plug-in to improve financing

(I) Supply Chain + Blockchain Finance Test of Leading Enterprises

Supply chain finance, as one of the hot spots of the financial industry in recent years, aims to allow loans to benefit small and medium-sized enterprises upstream and downstream in the supply chain through guarantees from core companies in the supply chain.

Due to the huge discourse power of core enterprises in supply chain finance, it is likely that they will attach harsh conditions to small and medium-sized enterprises in financing for their own benefit.

Therefore, the blockchain has had a more mature application in supply chain finance earlier.

Ant Financial's "Double Link" is a supply chain collaboration network based on blockchain development. Its essence is an alliance chain jointly formed by Ant Financial and its partner institutions (including loan institutions and corporate parties).

Shuangliantong takes the account receivables between enterprises in the supply chain as a digital entry point, and puts the entire life cycle of accounts receivable including confirmation, circulation, financing, and clearing on the chain, and the circulation and confirmation of assets The conversion of rights is based on the data on the chain, which is no longer a simple business certificate.

Ant Financial Double Chain Link logical structure diagram / Yunqi Community

The on-chain structure of "Double Link" enables banks in the alliance chain to clearly capture all the enterprises and their business conditions in the entire business chain, so as to perform rapid risk assessment and loan issuance.

Taking a car company's loan as an example, an end supplier with less than 10 employees in the supply chain took only 1 second to obtain a 20,000 yuan financing loan from the bank.

In scenarios that do not use blockchain technology, companies at the end of the supply chain often need to face up to three months of account periods.

The same is true of Tencent's "micro-enterprise chain", which has now served 71 core companies and reached strategic cooperation with 12 banks.

According to iResearch's "Blockchain + Supply Chain Finance Industry Research Report" forecast, and by 2023, blockchain can increase the supply chain financial market penetration rate by 28.3%, bringing an increase of 360 million market size.

(II) Blockchain financing plan for government-enterprise linkage

On January 2 this year, the Guangdong Provincial Small and Medium Enterprise Financing Platform (hereinafter referred to as the "small and medium financial platform") was officially launched. This platform is the Guangdong Province's use of "digital government" data resources and Financial OneAccount on blockchain, artificial intelligence, Finance in the fields of big data and other means can submit a solution to the difficulty, cost and slowness of financing for SMEs.

At the launching ceremony, three small and medium enterprises successfully applied for loans from Industrial and Commercial Bank, Ping An Bank, and Construction Bank through the blockchain.

In addition to the application in the supply chain, the "Small and Medium Financial Platform" also includes intelligent financing and intelligent direct financing functions. By opening up tax, judicial, administrative data and data on warehousing and logistics, finance, and product structure, multi-dimensional portraits of companies can be chained. Facilitate the evaluation of financing institutions and reduce the financing cost of SMEs.

New technological change: DeFi solves financing difficulties

(1) The market is calling for DeFi

Decentralized financial / distributed financial DeFi is a scenario where blockchain technology is applied to financial and value markets.

At the end of 2018, in the article "Distributed Financial Networks under the Application of Blockchain", Dakura Think Tank pointed out that decentralized finance / distributed financial system will become one of the trends and hot spots in 2019. Financial services present risks of unequal financial service audiences and counterparties. The distributed financial system has effectively improved the above-mentioned problems in financial services because of its advantages such as transparency, detrust, financial inclusiveness, and programmability. Some blockchain startups will emerge in the next two years.

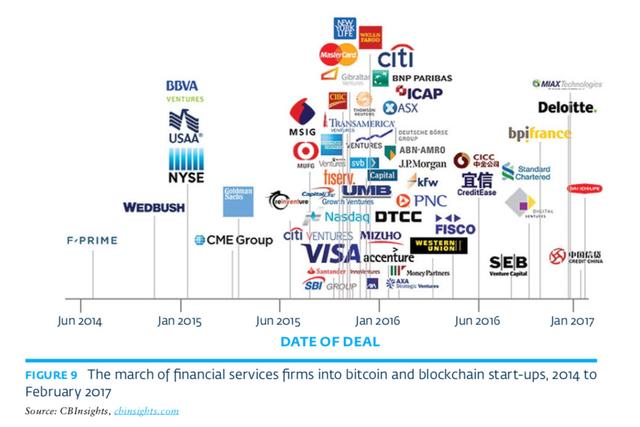

Looking back on the report two years ago in 2020, the original judgment is still valid after two years. In 2017, IFC pointed out that many financial institutions have entered the field of crypto assets and used blockchain technology to carry out technological transformation of certain links in the traditional financial industry and achieved results.

Image source: IFC

Consumers, businesses, and governments now face huge debt markets, all of which require funds to fund their operations. Common examples include simple protocols such as mortgages and car loans, and more complex use cases such as debt financing, credit derivatives, and municipal bonds.

Although many people ignore or think that the innovation of new technologies will not be so fast, from the perspective of market logic, a large-scale impact is coming.

(II) Blockchain development is creating conditions for basic expansion

1. Blockchain-related activities in the financial field have been continuously tested and advanced in recent years

Source: CBinsights

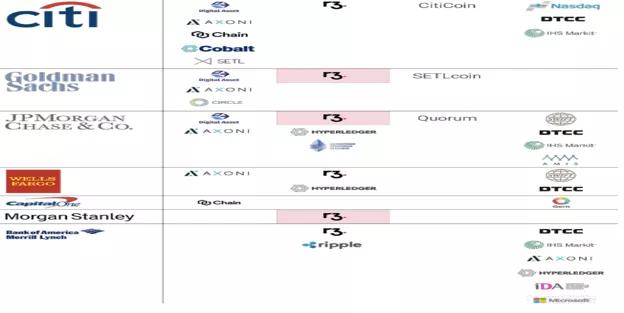

2. Investment institutions promote distributed value production factors for SME financing

Image source: PAData

Investment institutions have strong plans for the layout of the underlying blockchain, ecological applications and trading platforms. This creates social conditions and boosters for production value, storage value, and exchange value.

The above-mentioned three values are considered as the basic elements for SMEs to use DeFi loans.

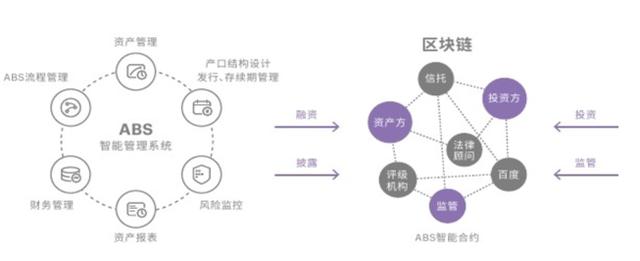

3. Utilizing the characteristics of the blockchain will give more asset liquidity premiums

Image source: Baidu Du Xiaoman Financial White Paper

Once everything has a price, after completing the asset and data on-chain, circulation becomes the largest market demand.

(3) Ways of distributed lending

The essence of financing is loans. DeFi restructures the way of loans from distributed and smart contracts.

Although loans are an effective aid to economic activity, they also face most of the problems that plague centralized financial services: individuals in developing countries cannot effectively access basic financing.

Many loan agreements are opaque in design. Whether it is a predatory high interest rate or a purposeful confidentiality clause like the one people saw in the 2008 mortgage loan, the system is still developing in the wall, and the risks are bred.

Moving basic debt protocols to the blockchain can provide many efficiency improvements, including open access to information, transparency, and programmability.

Anyone with an Internet connection in the world can access blockchain-based loan services. All protocols created on the public blockchain are transparent, and the programmability of blockchain loans makes the system more powerful.

The use of smart contract protocols is a decentralized protocol, and anyone in the world can easily issue and crowdsource debt in the form of digital assets.

This means that anyone can use their development tools and smart contracts to initiate, underwrite, issue and manage debt agreements without the need for a specific central third party.

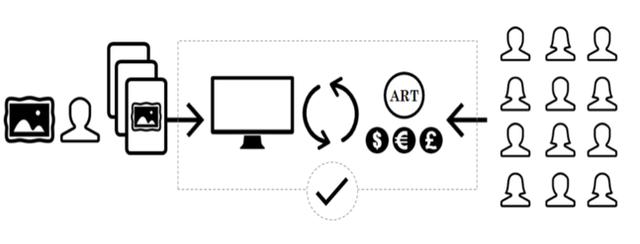

Distributed lending model for artworks, image source: IFC

Bitbond is a lending platform that provides loans to small businesses around the world and earns interest. Bitbond allows lenders to invest in Bitcoin. Given that the investment target belongs to a small business and has certain risks, the return rate is relatively high. Currently, a basket of diversified loans is expected to have an average annual return rate of about 10%, but there is a risk of losing all of the principal.

Image source: Bitbond's official website

Generally speaking, these loan services require the use of crypto assets as collateral in exchange for liquidity of funds, which means that such services do not require a large number of credit records. As long as users hold crypto assets, they can obtain fiat currency loans at the corresponding platform .

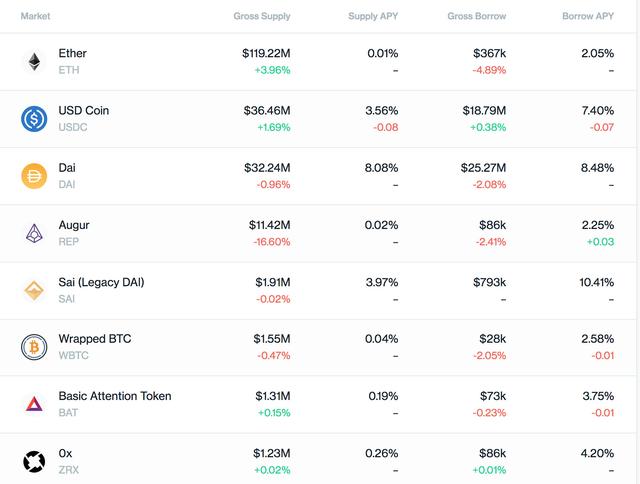

As a representative project in the DeFi field, Compound has always been considered a leader in the decentralized lending industry. According to CrypoDiffer's statistics, in January 2020, Compound's loan size reached approximately $ 105 million.

Image source: compound | Markets

If we can extend this logic of global borrowing to the traditional field of lending, it may be a very interesting thing.

For physical products, the logistics, warehousing, warrants, etc. of the data confirm and justify the data through the on-chain, form a pledge on the information chain, create a platform similar to Compound, MakerDAO, etc., and solve SME financing loans. I believe it will be realized soon.

The role of blockchain technology in actual financing scenarios

I. Opening the "Island of Information" to Realize Information Connectivity

"Island of information" is one of the biggest pain points encountered by SMEs in financing at present. The main reason for the "Island of Information" is that in the operation of small and medium-sized enterprises, due to their own mass, it is difficult to provide complete financial statements, audit reports, and other evidence to support their operations like large companies. Therefore, when financing institutions conduct risk assessments, they will be more cautious about lending to SMEs, which has caused a bottleneck in financing difficulties for SMEs.

Through the data on-chain method, the transaction data of small and medium-sized enterprises can be accessed by financing institutions in an open and authentic way without the need for any third-party audit institution as a guarantee. Therefore, through the openness of the blockchain, the unfavorable situation of the "information island" of SMEs will be fundamentally reversed.

Second, get rid of the dependence on credit authorization of core enterprises

In the context of supply chain finance, the success of small and medium-sized enterprises in the supply chain depends directly on the creditworthiness of the core enterprises and the credit guarantees they provide.

This decisive position allows core enterprises to add conditions such as requiring SMEs to pay for goods in advance or delay settlement of their arrears while authorizing credit guarantees.

However, SMEs are often forced to choose to accept loans because they urgently need loans. This has led to the disadvantage that core companies have a strong voice in the entire supply chain and high financing costs for SMEs.

With the intervention of blockchain technology, small and medium-sized enterprises will be in a relatively equal position with core enterprises; coupled with the fact that financing institutions can directly evaluate the operating conditions and default risks of small and medium-sized enterprises through on-chain data, without Need to rely on core companies to provide third-party credit guarantees.

Blockchain helps SMEs regulate bills

In the actual operation of supply chain finance, due to the defects in the traditional bill management industry, there are occasional violations of business ethics and regulations such as bill forgery and overselling of one ticket. And small and medium-sized enterprises have small physical weight, opaque financial information, and low credit level. Therefore, when applying for transaction guarantees with banks as evidence, the authenticity of transaction notes is difficult for financing institutions to measure. Therefore, in order to avoid the extra cost of bill review, financing institutions often pay more attention to SMEs.

Blockchain is currently one of the most feasible solutions in the field of bill verification. Because the current bills almost always have unique identification numbers, in a non-tamperable blockchain, the one-to-one correspondence between the bills and Ticket numbers will become fully publicly available data.

At the same time, in view of the fact that today's blockchain can successfully solve the "double spend" problem of tokens, the problem of overselling one ticket of this kind can naturally be solved. The reduction in the cost of authenticity of bills is actually an improvement on the commercial credit of SMEs.

Fourth, smart contracts solve the problem of credit rationing

The willingness of financing institutions is also a goal that cannot be ignored.

The smart contract completes the fully automated financing through program setting. After the enterprise and the financing institution sign the smart contract, as long as the trigger conditions are met, the contract can be automatically executed. Programmatic execution of smart contracts can exempt people from risk-averse behaviors under the influence of the "benefit to avoid harm" mentality, thereby solving the phenomenon of loan reluctance due to subjective risk avoidance.

Blockchain exempts third-party credit guarantees, enabling direct financing

Through the characteristics of blockchain transparency and non-tampering, financing institutions can directly carry out risk assessment on the corporate side without the use of third-party financial intermediaries to achieve direct financing, thereby eliminating information asymmetry and reducing risk concerns of the institutional side. Financing costs with corporate parties.

V. Blockchain penetrates all links before, during, and after lending to comprehensively prevent and control lending risks

Financing and lending is a multi-link process. From the risk assessment before the loan, the monitoring of the collateral during the loan, the processing of the collateral after the loan, and the supervision of the documents, all need accurate, secure, and real-time data circulation and monitoring. Blockchain can play a great role in all links.

For example, the supervision of pledged goods in loans. In the traditional model, logistics and warehousing often encounter problems such as mismatched accounts, lost goods cannot be found in time, and the right to goods is not clear. In the context of the blockchain, it is possible to directly detect and record the lowest level of data on the loading and unloading of goods in the warehouse, and to store it on the chain to ensure the authenticity and validity of the data, thereby enabling effective supervision of collateral by financing institutions.

And if the company finds that the company is unable to repay the loan in the post-lending process and needs to process the collateral, it can also reduce the or Offset bad debt losses.

Conclusion

In general, with its inherently superior properties such as total transparency, immutability, and no need for trusted third-party guarantees, the blockchain is very effective in solving the problem of financing difficulties for SMEs.

However, considering that corporate financing behavior is a complex process including risk control, physical pledge, warrant transfer, etc., only risk control requires the use of data from government departments including industry and commerce and taxation as the theoretical support for risk assessment. Therefore, in the field of financing, it is not enough to rely solely on the promotion and empowerment of the blockchain by enterprises.

References:

1. "2018 Blockchain Trends Report", Dakura Think Tank, 2018;

2. "2019 Blockchain Trend Report | Dalian Announces the Industrial Blockchain Valuation Model for the First Time", Dalai Think Tank, 2019;

3. "History of Decentralized Financial Concepts", Bitcoin News, https://www.wwsww.cn/btbwhy/2026.html

4. "Blockchain Technology Helps SME Financing", Chen Shi, Li Chenlu, Zhao Wang, Zhu Zili, China Business Review, 2019 (10) 59-60;

5. "Using Blockchain Technology to Solve Financing Difficulties for Small and Micro Enterprises", Lu Yifeng, Zhang Huan; Journal of Jinling University of Science and Technology (Social Science Edition), 2019 (6): 07-11

6. "Deep Demystification of" Ant Double Link "", Yunqi Technology Community, https://yq.aliyun.com/articles/691420?utm_content=g_1000043203;

7. "Ant Financial completed the first single blockchain loan business. Can the blockchain solve the financing problem of small and micro enterprises?" ", Xin Nan; Planet Daily, https://www.odaily.com/post/5139484;

8. "China's First Blockchain Unsecured Loan Issuance Financial One Account to Help" Guangdong Small and Medium Financial Platform "Construction", Golden Finance;

9. "How to Understand the DeFi Bank Compound", Blue Fox Notes. Https://www.tuoluocaijing.cn/article/detail-78480.html;

10. "Pledged digital currency lending, this DeFi model can really revolutionize traditional finance? ", A blockchain, https://www.bishijie.com/shendu/60130.html.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Market enters the stage of grinding tofu, persistence is victory

- Air currency warning: the market may be entering the sixth cottage season, beware of air players

- Depth | Solve core pain points, blockchain opens up new space for supply chain finance

- Popular Science | Eth2 Beacon Chain: What You Should Know First (on)

- What Bitcoin will look like in 10 years, Satoshi Nakamoto says | Bitcoin Secret History

- Vicious competition causes frequent DDos attacks on exchanges. What is the cost of the attack?

- Organizational form from the future: DAO