Can the "leverage" of the currency security shake the BNB up again?

The path of the currency security is quietly changing.

The long-established currency-based derivatives platform is finally on the line. On the evening of September 2, Coin Ann announced the acquisition of JEX, a digital currency derivatives trading platform. JEX will join the currency security ecosystem as Binance JEX, providing users with services including derivatives such as futures contracts and options.

At 14 o'clock on the afternoon of August 28, the currency officially launched the new product coin Anbao, which sold out in less than a minute on the line, quite a bit of the taste of the IEO share. This new wealth management business was exposed from official exposure to official announcement, with an interval of less than one week. The Qixing plan, which was announced only a short time ago, was only less than 10 days old.

In the past two months, Coin Security has frequently launched new services on its platform.

- Li Lihui, former president of Bank of China: Is digital currency another reconstruction of the global monetary system?

- Research | Blockchain thinking and intellectual property pledge financing industry

- ECB Executive Board member: Libra poses a threat to European monetary policy and weakens central bank control

From this plan to open the contract business to the opening of leveraged trading today, to the Libra as a regional token to start the star, to open the wealth management product coin Anbao … … currency security began to incorporate some of the previously unwilling to engage in the business of their own strategic layout, business The layout continues to expand.

At the same time, the currency security that has always focused on overseas markets has also been exerted in the domestic market a few days ago, and the domestic users are more fluent in Binance.net.

People commented that today's currency security seems to be taking the "people-friendly route" compared to the currency that was sitting on the head and slightly "cold".

Behind all kinds of actions that are inconsistent with their temperament, Qian’an is trying to cope with an undercurrent stock market killing.

This time, can the currency still write myths again?

IEO money making effect fades

IEO money making effect fades

“The IEO project of Coin’s is as bad as the ICO in 2018 – it’s still in the bull market, it’s really impressive.” After the new IEO project Perlin went online, analyst Alex Krüger sent out Such a sigh.

On August 25th, Perlin was on the line, and the investors did not wait for the high yields. According to ICO Analytics data, the Perl token PERL has an ROI of only 1.7 times in the first hour.

For investors who are accustomed to opening 5 or even 10 times, Perlin's gains are like a cold water.

In the year of 2019, the IEO game created by the currency was alive and well, and the BTT was up 5 times on the day. The transcripts that were immediately robbed on the line attracted a lot of exchanges to follow.

If you want to participate in the IEO rich story and get the IEO subscription quota, you must hold the platform currency of the exchange. This led to the rise of platform coins, the popular IEO provided application scenarios for platform coins, and the platform coins also attracted more real money.

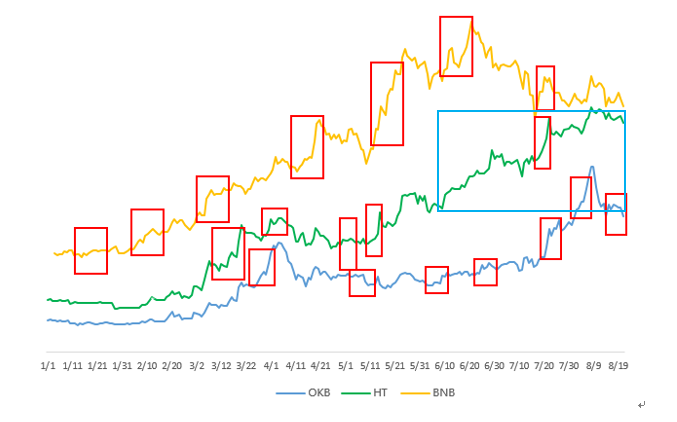

“Bint performance of the platform currency in the IEO promotion cycle shows that BNB is the best linkage.”

OK Group's senior researcher Deyun Lora analysis believes that BNB is the biggest beneficiary in this IEO boom.

(Data image available: OK Group Senior Researcher De Yun Lora)

Since the beginning of the 2019 year, BNB has soared from $5 to a maximum of $39. According to the BNB reversal of the quarterly currency destruction, the profit of Q1 and Q2 in this quarter was as high as US$78 million and US$1.1919 billion respectively.

The high-yield IEO is also very demanding on the project side. Today, blockchain technology and applications are still being explored. There are not many good projects that are obvious, and investors are not as enthusiastic as they used to be. As the market weakens, the benefits of IEO are even difficult to fill the loss of platform currency prices during the period.

Only if the average position in the 15 days is greater than or equal to 500 BNB, the user can get the sign (chip) to participate in the IEO shake.

The BNB position snapshot of the latest IEO user starts from 8:00 am on August 9th. The coinmarketcap market data shows that the price of BNB is stable at around US$30 on August 9 and the highest price is US$31.17, while August 9-8 BNB prices fluctuated during the month of the 25th, and by August 25th, the BNB price fell to around $26.

"The full warehouse number is about 100,000 yuan, (IEO income) gives you six or seven hundred yuan, not enough (BNB during the position), what is the meaning of playing new?" An investor said.

Investors also regard IEO as the “low-income” and “welfare” that can be obtained by holding platform coins.

"So many people hold positions instead of gambling luck. They are (coming) taking advantage of the BNB positions that they should have. Now BNB positions are gambling luck?" Investors bluntly said, "IEO's low insurance is not good. Eat it, stuff it."

The end of the IEO money-making model allowed investors to finally believe that IEO is not sustainable. It is already a past glory to hit the line ten times. Nowadays, platform holders have to bear the risk of platform currency fluctuations and bear the risk of falling IEO revenue.

If the IEO does not exist, will the platform currency be attached?

If the IEO does not exist, will the platform currency be attached?

Once the myth of IEO's riches is shattered, the market value of this wave of platform coins blown up by IEO is also faltering.

Some users not only did not win the game, but also watched the price of the currency fall below their psychological expectations. As a result, the market has gradually appeared to bid farewell to BNB, the sound of selling.

When BNB fell to around $25, some investors couldn't sit still.

Investor joesnow has been investing in BNB since last November. He told the Odaily Planet Daily that since the last IEO (Elrond), he has thrown most of the BNB. After another IEO test, he bluntly said: "BNB is over, only to this."

Another analyst believes that the IEO boom of platform coins has basically come to an end. It is unlikely that the platform currency will double in the future. In the long run, platform currency is a very good investment target, but from the perspective of making money, platform currency has accumulated a lot of money in the currency circle, and the market value is already very high, and the follow-up is weak.

Someone directly commented on the platform currency in the currency microblogging, and some people ran to the microblogging rumors, saying that IEO is 'destroying users', it is recommended to suspend:

"The wave of the currency circle is already the end, there is no net entry funds, only a little stock of funds in the mutual cut, it is recommended to suspend IEO."

"The value of platform currency is supported by the heat of the platform. Users will not look at the financial report and profitability of your exchange in detail. The heat is up and some people actually make money in some activities. I think this platform is ok. continuous." An exchange practitioner Luke analyzed this.

The new currency Cocos online coin security motherboard broke, but also let users see that the coin security brand is no longer a gold sign, the negative news of KYC identity leakage, low investment income of IEO project in the same period, and even magnified pessimism.

If the user ships a lot, the trend of the platform currency will be weaker, and the most fear is that a vicious circle will appear.

Having said that, the market has not seen much new ideas and new growth points. If there is no loss in the short term, IEO will continue to continue. In July, He Yi also revealed that in the next three months, the currency security will be at least 5 IEO projects.

Stocks fight, the currency is short-term to push a number of new business

Stocks fight, the currency is short-term to push a number of new business

“The platform currency has fallen, indicating that the market really has no new funds. At present, the stock funds are in the game.”

Some analysts analyze the current market situation.

When asked about the current state of the exchange industry, the exchange practitioner Luke summed up to the Odaily Planet Daily:

“The entire market has encountered bottlenecks and the frequency of user transactions has decreased.”

Blockchain Transparency Institute statistics show that the transaction volume of the currency has decreased by 35.63% in the past 30 days, and only 7 of the 39 exchanges listed have a positive growth in the 30-day trading volume.

Platform currency and IEO are one of the highlights of the exchange's profitability since 2019. The IEO pushed the platform currency up, and the rise of the platform currency lowered the concerns of users participating in the IEO.

Today, the exchange is in desperate need of new scenarios to support platform currency prices.

In a research report of the OK Research Institute, it was analyzed that there are two ways to increase the value of the platform currency – to expand the application scenarios and the richness of rights and other ways to encourage buying; to lock the warehouse, destroy and other means to reduce circulation.

If the road to encourage buying is used, IEO's driving force is almost exhausted, but the rules of reducing circulation and repurchasing make the platform currency long-term bullish.

However, the analysis believes that on the road of reducing circulation, the platform currency has basically peaked, and the way to increase the value of the platform currency needs to be changed from reducing circulation to encouraging buying as soon as possible. The so-called encouragement to buy is to increase the platform currency scene and increase demand.

After the IEO's gameplay was overdone, the exchanges set off a wave of grabbing contract highlands.

The movement of the currency has also begun to increase frequently.

A year ago, He Yi also vowed in the online media Q&A that he would not touch the contract. A year later, Zhao Changpeng took the initiative to announce in public, saying that he would soon provide futures contract transactions. In a short period of time, the leverage and wealth management products of the currency were quickly launched.

"There is definitely a bottleneck, otherwise it will not hit your face." Damon analysts in the circle analyzed.

Analyst Deyun believes that the contract market is the battlefield for the currency to gain new gains:

"The fee income of the contract is definitely larger than that of the spot. The global market expansion of the currency security is also very good. It is also difficult to increase the globalization in a particularly strong way, so simply drop the contract cake."

“People are ambitious. Even today, everyone feels that the flow of money is very good and there are many users, but the way to make money is reduced. And even if the existing business makes money, it can’t always keep the fixed business. If OK stand out Say, I made 50 billion in futures. Who wouldn’t be jealous?" Almost everyone thinks that the contract is a good business. Instead of giving up the cake, it is better to enter the market.

On July 11, the company officially launched the margin trading service, which is a leveraged trading business, allowing all traders to borrow up to three times the amount of their guarantee. About 10,000 traders borrowed $15 million on the first day of opening; July The 26-dollar security line features a block trading function that provides over 10 BTC block trades.

By August, the “new” speed of the currency security was faster, and this new speed was unprecedented.

On August 16, Zhao Changpeng revealed that Binance.US is expected to be launched in the next two months. On August 19th, the company announced plans to build a regional version of the Libra “Star” program; on August 26th, it was decided to introduce the currency to limit digital currency. Financial services; August 27th to modify the rebate rules, the invitee can get up to 40% of the transaction rebate.

For the frequent new business on the line, the internal staff of the coin security company said that it is to complete the business line.

New business has been launched frequently for the currency, and some people have seen the efforts of the currency to expand new scenarios. Some people speculate on the pain behind these choices:

“The rebate is adjusted to 40%. It can be seen how difficult it is to increase the increment. It seems that the user has lost too much.”

Another way to manage your finances, will the market pay for it?

Another way to manage your finances, will the market pay for it?

“Encouraging buying is simply a platform coin that can be done. Deducting the handling fee and taking extra optimization is a good scenario. You can also do mortgage lending on platform coins.”

Deyun analyzes the way in which the platform can continue to hematopoietic in the future.

The regular wealth management coin Anbao was also introduced in a logical way. This to C business has also become a star of the day.

In the rules of the currency Anbao, the currency Anbao assets will be used for the coin-operated leveraged currency business of the currency. According to the coin security product page, the products include BNB 14 days (15% annualized income), USDT 14 days (10 % annualized income), ETC 14 days (7% annualized income).

In simple terms, the currency Anbao is similar to the concept of Yu'ebao, but the annualized income provided is much larger than the balance of only 3%.

However, the way in which coins are earned is not a new business in the currency circle. Similar borrowing financial services have been introduced on platforms such as bitfinex, gate, and okex.

"Now those derivatives that look like bells and whistles are the old way of taking traditional finance." An exchange practitioner told the Odaily Planet Daily that many exchanges are choosing to do wealth management products after the bottleneck in growth.

“There is a lack of newcomers in the circle to contribute, and Qian’an wants to retain users, and at the same time, it can slow down the decline of BNB by using locks.” One analyst analyzed the role of the coin, and if the increase is limited, it is imperative to find maintenance. The way to store users and stock funds.

But can this wealth management product save market sentiment when the platform currency price has not stabilized?

The sale of the day was quite optimistic, but users also lamented:

"Don't think about managing money in the currency circle, it doesn't make sense at all. I feel that the interest rate is quite high, but in fact it may not be enough for a few minutes."

Similarly, the industry has different views on the regular wealth management product “Coin Anbao”.

Analyst Jinma wrote in his analysis article that the previous leveraged currency function has many restrictions. The number of registered borrowing coins is different, and there is often a state in which no currency can be borrowed. It seems that the currency Anbao has no promotion effect on the platform currency BNB. But it makes the currency transaction more complete.

"Loan is a need, and the loan has been completed before the currency security. Now it has completed the loan function. This will take away many users of the loan platform. I think it is a very good function." Jin Ma said.

There are indeed many people who have linked the hot Defi and the money lending services of the day to discuss whether the business of centralization of the currency will divide the decentralized lending market.

“Defi users are basically not coincident with centralized lending users. This centralized asset management business, if not highly regulated, is extremely risky. I don’t know what kind of risk control measures there are. ”

In Hong Yining's view, the currency security Anbao business is more like the C2B2C model. He believes that the currency security does not have enough supervision to endorse; but does not deny the demand for this business. He predicts that this business model will be on fire for a while, and other exchanges will continue to raise interest rates to grab customers.

"If there is no such, is the exchange using customer funds to lend? This is also very good, we can also lend to the exchange." PayPal is very optimistic about the business of the currency, in Yang Zhou's view, the currency is The internal circulation of the exchange, the risk control is internal, and defi is based on smart contracts, there are also many risks, to some extent, it is not as good as the credit of endorsement.

In today's market where it is difficult to stimulate user transactions, exchanges are more or less faced with bottlenecks. The previous currency security was always a stunning market break.

This time, is it still money?

文 | 昕楠

Produced | Odaily Planet Daily (ID: o-daily)

Original article, reprint / content cooperation / seeking reports, please contact [email protected]; unauthorized reprint is prohibited, violation of the law will be investigated.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Bitcoin returned to $10,000 and the market share exceeded 70%. The analysis said that the parabolic rise has been turned on.

- Viewpoint | Blockchain game is not the future

- Analysis: A paper on the impact of the Fintech three-year plan on the blockchain industry

- HSBC completes the first RMB-denominated blockchain letter of credit transaction

- Thinkey: This Tsinghua project "has less financing, not on the big", but has landed dozens of applications | Babbitt Venture +

- Blockchain listed company semi-annual report: 41 enter practical applications and research, 5 target supply chain finance

- Bitcoin has broken through $10,000 and the Bakkt effect has finally appeared?