Exploring the evolution of the stablecoin market structure: Why can USDT always dominate the first place?

Exploring stablecoin market evolution: Why does USDT dominate?Original author: Conor Ryder, CFA

Translation: LlamaC

(Portfolio: FORM 2016, about Tomo: illustrator for the Ethereum Foundation)

“Recommended message: The stablecoin competition is an endless topic. In the second decade of the industry’s stumbling, we hope that the market can give an answer, and ultimately we should have what kind of stablecoin.”

After all the events of 2023, Tether, despite being the least trusted, has become the dominant stablecoin. In this week’s Deep Dive, we explore whether this proves that trust is no longer important for cryptocurrency investors, who seem to prefer anchored stability, liquidity, and versatility.

- Evolution of demand, yield, and products in the ETH Staking market after Shanghai upgrade

- How to search and join some popular events, using Bitcoin Pizza Day as an example?

- Exclusive Interview with Arbitrum Founder: One Whiteboard, Three “Zhuge Liangs”, Creating the King of Billions in Layer2

➖ Although USDT is the least trusted, it has become the dominant stablecoin.

➖ USDC and DAI were uncoupled during the banking crisis, while BUSD had an expiration date set by regulators.

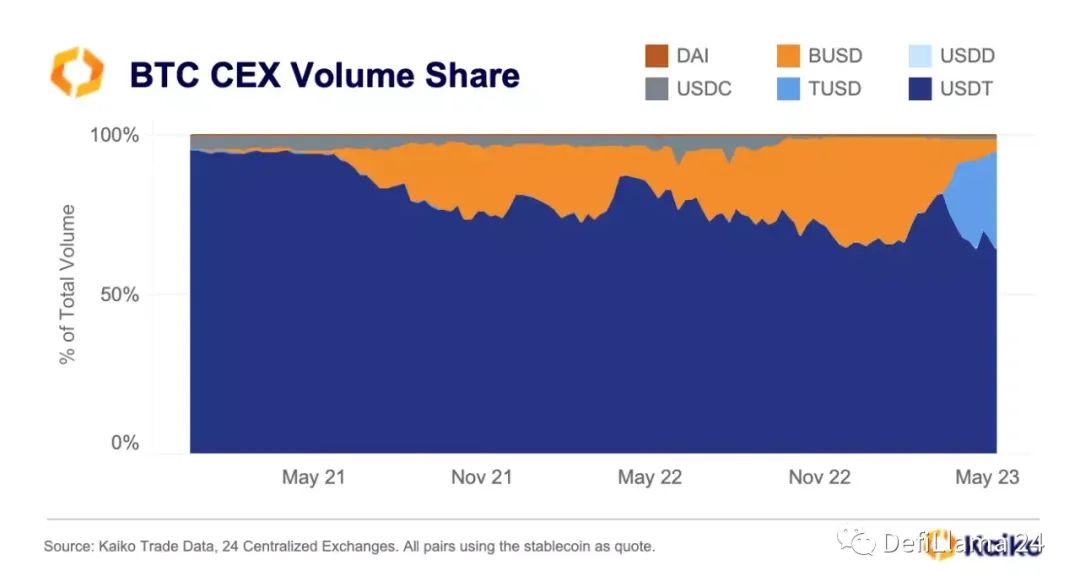

➖ CEX and DEX trading volume shares show different stablecoin preferences.

➖ Investors seem to value the anchored stability, liquidity, and versatility of USDT more than its opaque reporting.

The stablecoin market underwent a seismic shift in 2023. At the beginning of the year, BUSD had an expiration date of 2024, the banking crisis in March hit USDC and DAI hard, and Binance chose TUSD as its preferred zero-fee BTC pairing stablecoin. All of these events had a huge impact on the structure of the stablecoin market. BUSD was gradually phased out, USDC and DAI were uncoupled after the banking crisis, and TUSD rose to prominence. In all of this, USDT became the most trusted stablecoin in the industry. This article will explore the evolution of the stablecoin market structure over the years and delve into how one of the most opaque companies in the industry was crowned the king of stablecoins.

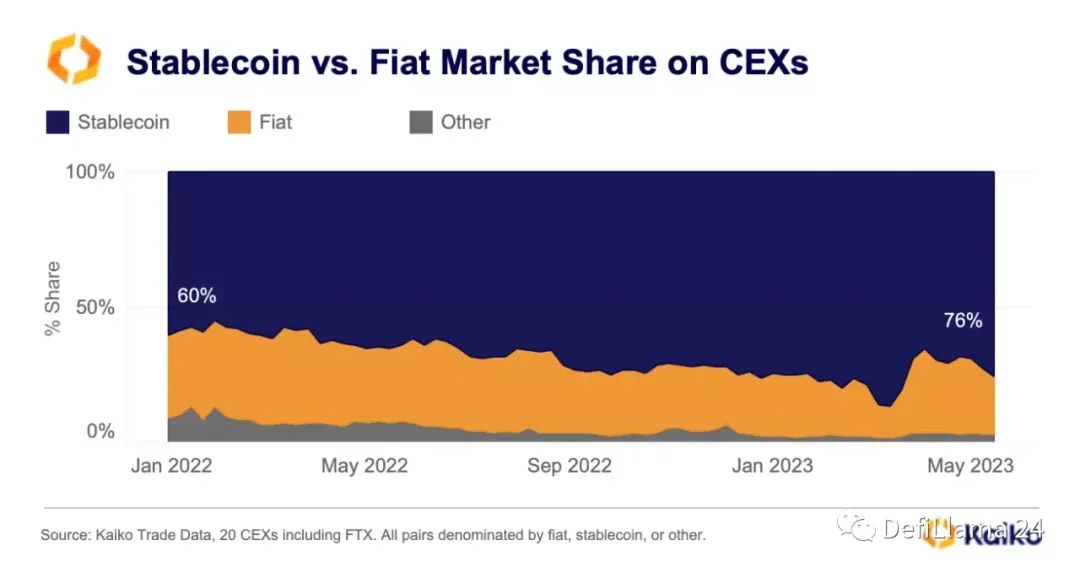

The importance of stablecoins to the crypto industry has never been as important as it is in 2023. With the disappearance of fiat channels, the stablecoin trading volume share has risen from 60% in 2022 to 76% today.

The United States’ strict regulations and the closure of legal payment channels have made the use of stablecoins for trading in cryptocurrency exchanges more efficient. Therefore, dominant stablecoins currently have a greater impact on market health than ever before.

Stablecoin Landscape

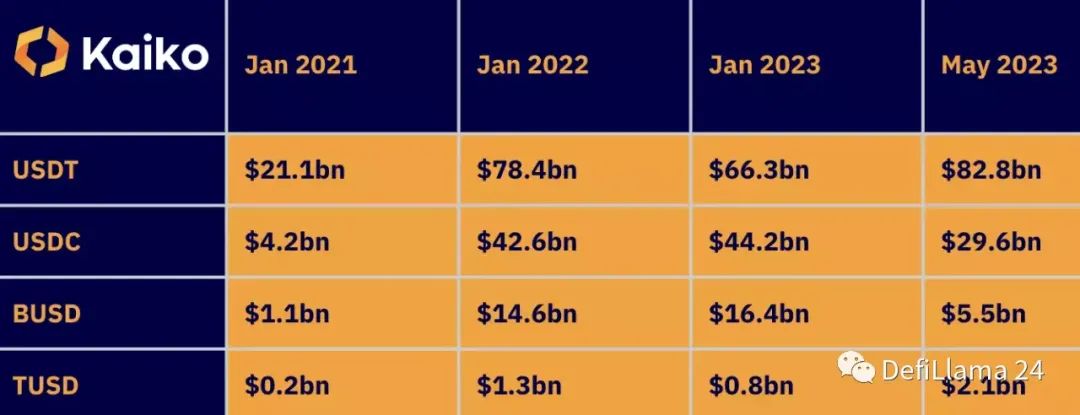

The snapshot of stablecoin market capitalization helps us understand the ebb and flow of stablecoin competition more intuitively.

➖ At the beginning of 2021, Tether was by far the largest stablecoin, more than 5 times larger than USDC, with BUSD and TUSD lagging behind. The bull market in 2021 witnessed a significant increase in stablecoin market capitalization, as USDT grew nearly 4 times, USDC grew 10 times, BUSD grew 14 times due to Binance’s strong performance, and TUSD broke through the $1 billion mark.

➖ In 2022, as the bear market developed, the stablecoin landscape changed again. Interestingly, the market capitalization of USDC and BUSD actually grew year-on-year, while Tether’s market capitalization lost more than $12 billion due to the decoupling after the FTX crash. The anchored exchange rate of USDC remained impressively stable in the turbulent end of 2022, resulting in an increase in its market share, and it was considered the safest and most transparent centralized stablecoin in the cryptocurrency market at that time.

➖ However, all of this will change in 2023, as the banking crisis leads to a sharp drop in the trading price of USDC. This led to a large-scale redemption by Circle, resulting in a loss of $14 billion in USDC market capitalization. BUSD has a set maturity date by Blockingxos, and its market capitalization has shrunk by more than 66% this year, while TUSD’s market capitalization has been boosted by Binance’s preferential treatment.

Volume Share

Market capitalization highlights the dominant position of stablecoins, but volume share is also worth a look to see which stablecoins are leading in terms of trading volume. The significant difference between market capitalization and trading volume is TUSD, whose trading volume share has increased from 0% two months ago to over 30% now.

The rise of TUSD and the fall of BUSD demonstrate Binance’s influence on the stablecoin market. It is unclear why Binance crowned TUSD as their favorite stablecoin, but in any case, TUSD has been pushed to prominence. USDC trading volume on CEX has almost dropped to zero, and another centralized stablecoin, USDD, has almost no trading volume on the exchanges it covers.

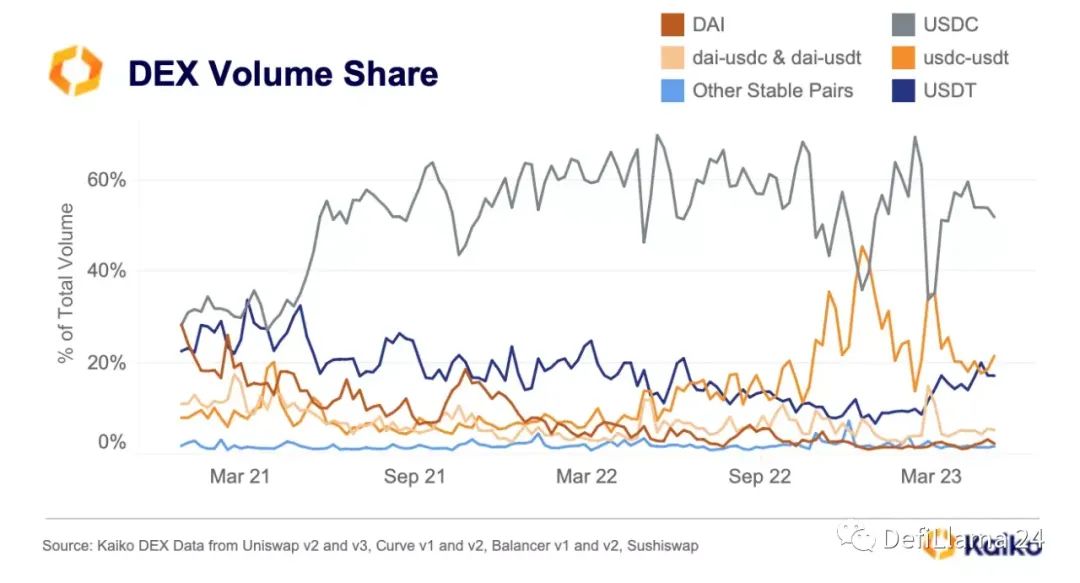

The DEX market share highlights a slightly different landscape, with some more interesting narratives emerging:

DAI’s fall from grace. DAI has always lacked direction. It’s called a decentralized stablecoin, but it’s in a murky position due to its over-reliance on USDC reserves. Its share of DEX trading volume has consequently been affected, dropping from market leader status with 28% of trading volume in 2021 to just 2% today. DAI is becoming increasingly irrelevant, and the market seems to have matured to offer another decentralized stablecoin option. The DAI-USD Coin and DAI-Tether currency pairs also accounted for 11% of total trading volume in 2021, but have dropped to 5% today.

USDC rising as the market leader, USDT’s share of Defi trades falling. In an interesting contrast to centralized exchanges, DEX traders tend to choose USDC as their stablecoin of choice, opting for a more transparent stablecoin rather than USDT, a stablecoin pegged to the dollar.

The difference in usage of USDC and USDT on CEX and DEX highlights two different types of investors. CEX traders may not care as much about centralized risk and are more willing to use USDT as their preferred stablecoin. This is despite Tether’s opaque reserve reporting for USDT.

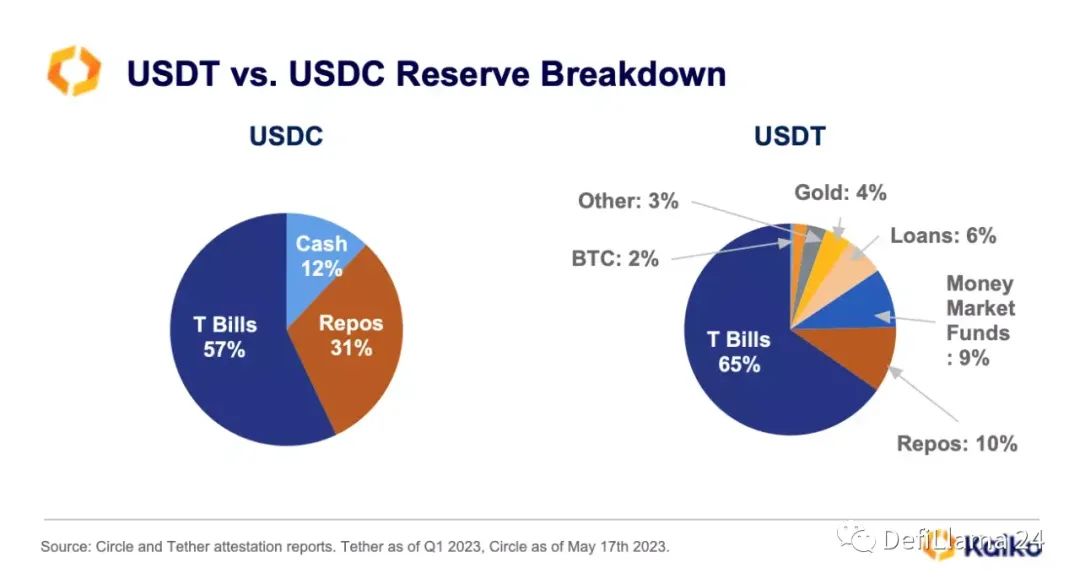

Reserves

Tether’s reserves still include a 3% share of other categories, and we have no idea what assets are in this category. What we can be sure of is that Tether made a staggering $1.48 billion profit in the first quarter. Most attribute this return to their high interest rate on US government bonds. However, Tether’s actual risk-free holdings mean the profit they make is equivalent to a 7.9% annual rate, which is +3.15% higher than the risk-free rate, indicating Tether’s holdings carry an additional 3.15% of risk.

Tether announced it accumulated 1.5 billion dollars worth of BTC in Q1 and pledged to use 15% of its net profit to buy BTC in the future. Currently, this puts BTC at a 2% weight in their holdings, and this number is expected to gradually increase in the future.

Tether defends this move, stating that it is simply using excess profits to buy BTC. However, Tether now has $1.25 billion (15% of its reserves) invested in risk assets (Bitcoin, gold, others, and secured loans). This makes me cautious about their decision to buy even more BTC in the future. I’m not sure why Tether can’t place their excess profits in a more liquid currency market fund that yields close to 5%. The only explanation is that they want to increase their asset base that is beyond the reach of the U.S. government’s oversight. We can see that USDC has a more liquid configuration, is government-backed, and objectively less risky.

From the perspective of collateral, USDC has been affected recently based on where the cash is stored. USDT has risen on the back of BTC purchases and other risky investments. However, to be fair, USDT is currently ahead for three other reasons in the stablecoin race:

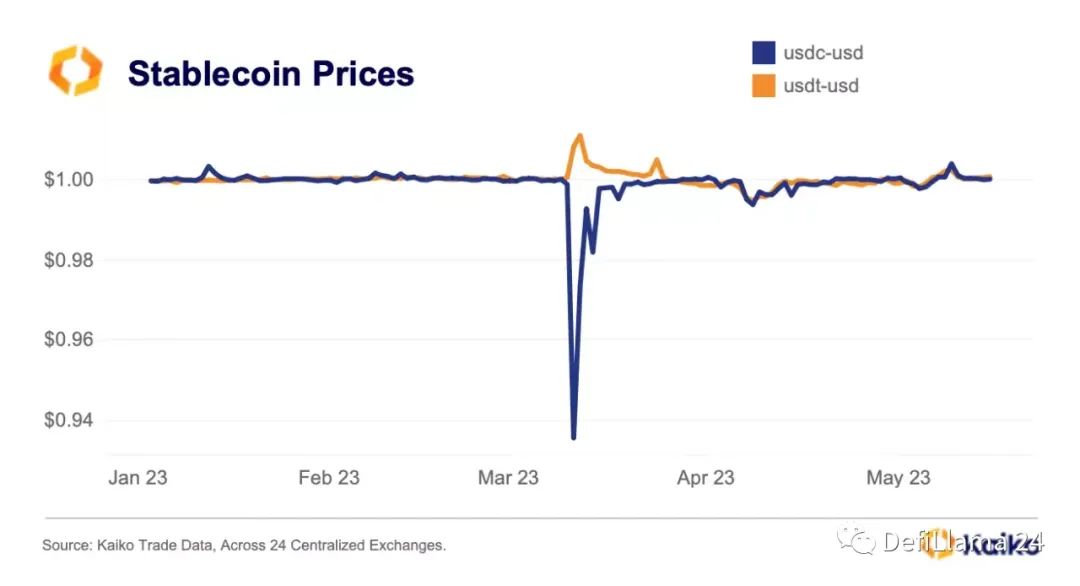

1) Stability of the peg

While other stablecoins struggle, USDT and its peg remain strong. Tether’s rise suggests that anchoring stability is far more important for most stablecoin holders than the transparency of the issuer. USDT can proudly claim at least six months of anchored stability, while most other stablecoins struggle to claim even three months.

TUSD and BUSD’s pegs have recently come under some pressure, while DAI, touted as a more decentralized stablecoin, has become a victim of excessive reliance on USDC and was decoupled from it in March.

Looking ahead to 2023, it’s clear why investors favor USDT. In fact, with USDC decoupling in March, USDT’s trading price has seen a premium.

2) Liquidity

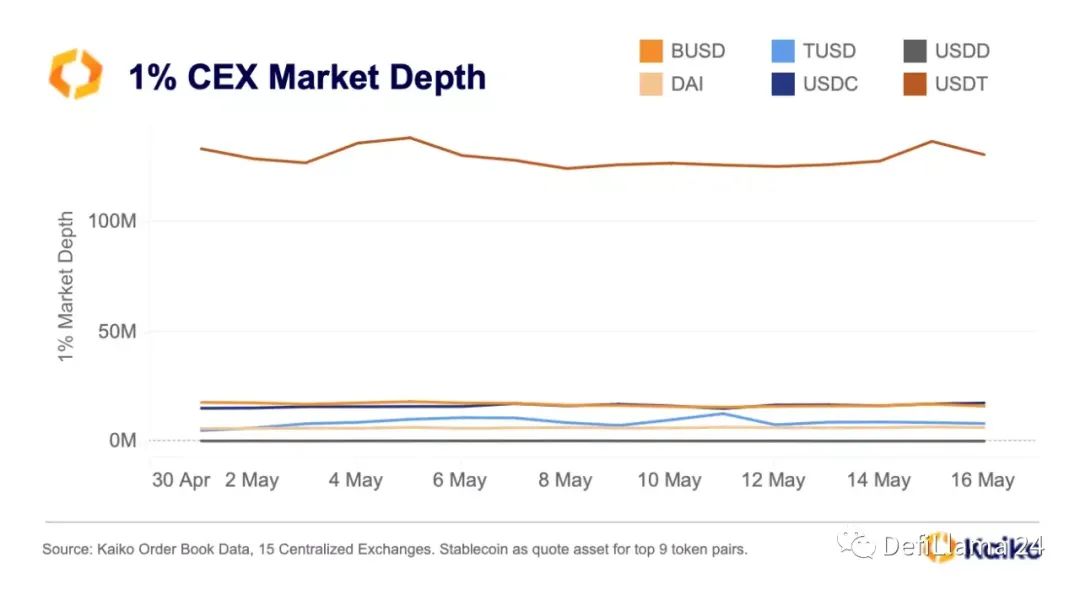

USDT is also the most liquid stablecoin in centralized exchanges to date, with a 1% market depth for top cryptocurrencies exceeding $130 million, compared to USDC’s $18 million. Greater liquidity drives stablecoin-dominated trading volume, and Tether has long been a major beneficiary of exchanges’ super-deep markets.

3) Versatility

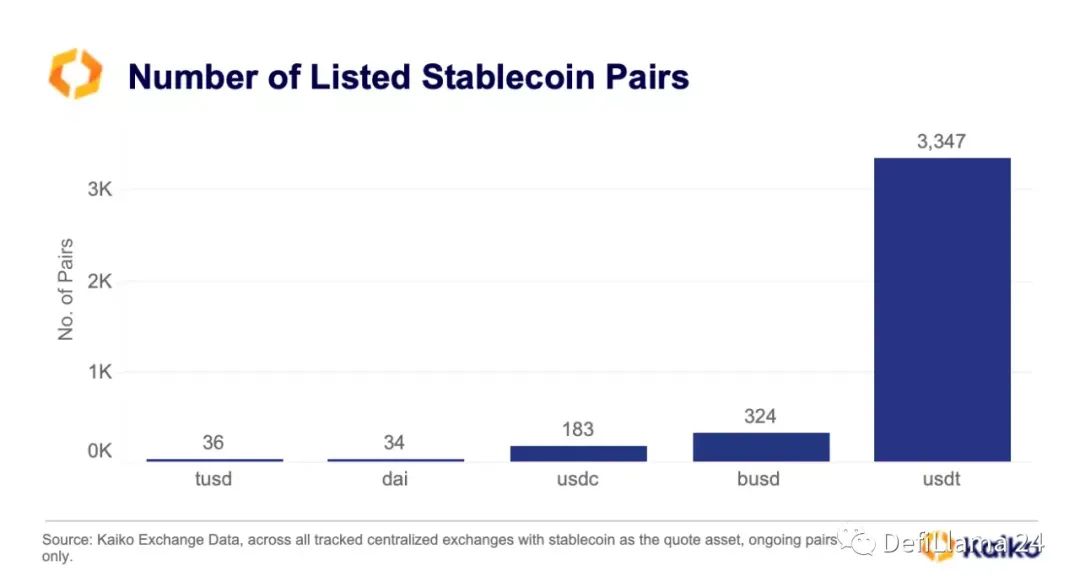

As far as trading pairs go, USDT provides traders with the most trading options, largely due to its large number of trading pairs on centralized exchanges. As of today, USDT is the quote asset for 3,347 trading pairs on centralized exchanges, compared to BUSD’s 324 and USDC’s 274. The reality is that holding USDT allows you to have greater flexibility in CEX trading.

Conclusion

Tether’s defenders seem to be proving that buying BTC as part of its reserves makes sense, given the excess profits. But they ignore the big problem with the reserves mentioned above: ambiguity and risk. However, with stable anchoring, greater liquidity, and greater flexibility for traders, USDT will continue to dominate the centralized stablecoin race. USDC’s greatest hope of improving competitiveness is improving anchoring stability or Tether collapsing, but USDC’s growth itself is entirely dependent on the US regulatory environment in the short term. Regulatory uncertainty makes Tether the big winner in the crypto industry, which should be a concern for an industry that prides itself on transparency and accountability. By default, the least trusted stablecoin has become the most trusted stablecoin.

DeFi actually operates on top of these two stablecoins, and it needs a better, more decentralized solution than DAI to protect itself from any potential issues with USDT or USDC. The problem is that after Terra, decentralized stablecoins have been banished to the dark realm. Hopefully new stablecoins like crvUSD, GHO, or other yet-to-be-launched stablecoins can provide investors with more decentralized, healthier solutions to counter the murky world of centralized stablecoins.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- The RWA vision is promising, but it requires a joint effort from the encrypted market, traditional finance, and regulation.

- Financing Weekly Report | 24 public financing events; Bitcoin financial services provider River completes $35 million Series B financing, led by Kingsway Capital.

- Overview of BTC NFT Ecology: Development Status, Trading Market and Value Analysis

- One year after Terra’s Black Swan event: Market is on the mend, but still struggles to shake off the gloom

- Overview of DePIN Track: Is it Disruptive Innovation or a “Castle in the Air”?

- Bitcoin’s new generation of multi-signature scheme MuSig2: providing better security, efficiency, and privacy features

- Litecoin’s LTC20 protocol: the next speculative market with hundredfold or thousandfold growth?