One year after the Terra-Luna reset: Rebuilding Trust, centralized exchanges will continue to exist

Centralized exchanges will remain despite Terra-Luna reset's focus on rebuilding trust, one year later.Author: coindesk

Translation: BlockingBitpushNews Mary Liu

This month marks the one-year anniversary of the Terra-Luna incident, as well as six months since the FTX crash. These events marked the beginning and climax of a chain of events that severely shook people’s confidence in cryptocurrency and triggered the most terrifying existential crisis in the 15-year history of the crypto industry.

Although there has been a rebound this year, with bitcoin up nearly 65% year-to-date, these historical events are still worth pondering over and considering how the crypto industry can rebuild itself better.

- Inventory of a16z’s Q1 Investment Layout

- Hourglass: What is a time-bound token?

- Nike Embraces NFT Marketing: What Lessons Can Other Companies Entering Web3 Learn?

First, we should acknowledge that these events were not a failure of blockchain technology, but the result of poor risk management and corporate governance, with some failed companies engaging in fraud. The market continues to recognize the integrity and innovation potential of blockchain, with a large influx of funds into decentralized exchanges following the FTX crash and positive reactions to the transition to Ethereum’s proof-of-stake (PoS) and the Shapella upgrade.

However, despite these developments, centralized digital asset exchanges (CEX) will continue to remain relevant and wield significant influence as a key entry point for the asset class, especially with their maturity and institutional adoption rates on the rise. After all, they are still the dominant platforms in digital asset trading.

According to data from DefiLlama, as of mid-May 2023, CEX’s total trading volume accounted for nearly 90% of all trading on centralized and decentralized exchanges. Despite the blow to investor confidence last year, the outlook for CEX is still bright.

However, what the industry does need to address is the many weaknesses brought about by the interdependence and early spirit of “quick action and breaking norms.” To weather this trust crisis, CEX needs to address the need for better investor protection, risk control, and prudent governance structures.

CEX will continue to exist

Managing a digital asset portfolio is operationally complex, requiring investors to have a comprehensive set of capabilities such as custody, trading, investment products, advice, and efficient fiat on/off ramp channels. In this regard, many CEX have integrated these solutions into one platform, greatly reducing the technical complexity of owning and managing different blockchain native tokens. The value proposition here is clear when considering alternative solutions: investors managing multiple wallets and directly participating in multiple liquidity pools across different blockchains. While some investors have the capability to do so, the high learning curve suggests that CEX will still be the preferred platform for many.

Investors who actively manage their portfolios may also want to rebalance their asset allocation frequently between traditional and digital assets. Therefore, the fiat currency deposit and withdrawal infrastructure layer in CEX is crucial, especially during market volatility.

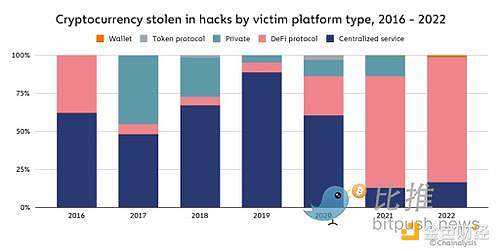

Safety and security are other advantages that CEX can provide. While the saying “not your keys, not your tokens” has been circulating in the industry, according to Chainalysis data, 18% of all cryptocurrencies stolen by hackers in 2022 came from CEX, with the remaining 82% coming from decentralized applications. Although CEX still has a long way to go in better protecting customers from network disruptions, they are relatively more secure. As the industry works to regain trust and strengthen its cybersecurity systems, the security gap between CEX and decentralized applications should continue to widen.

Finally, one often underestimated benefit of CEX (especially those serving high net worth and institutional clients) is the peace of mind that comes with having a “customer service phone number” if something goes wrong. This is particularly true for investors who manage assets on behalf of clients, such as family offices and hedge funds. Horror stories of millions of dollars worth of bitcoins being locked in wallets and unable to be retrieved are not uncommon, and investors will find value in working with centralized exchanges (CEXes) that provide dedicated hotlines or account managers.

Rebuilding Trust Through Asset Segregation

While CEXs may continue to exist, one area these platforms must improve in is the separation of customer and company assets. Now, scrutiny around this point is higher than ever. Policymakers such as U.S. Treasury Secretary Janet Yellen believe asset segregation is a key area that needs to be addressed in future regulatory frameworks, largely to prevent a repeat of the FTX case of commingling customer funds, which resulted in significant losses for many retail investors when the exchange went bankrupt.

Before FTX collapsed, the Monetary Authority of Singapore (MAS) had already proposed new regulations in an October 2022 consultation paper requiring cryptocurrency platforms to separate their assets from clients, with MAS also seeking industry feedback on whether cryptocurrency platforms should appoint independent custodians to protect client funds.

Therefore, CEX should reconsider the notion of “one-stop service”. While having a seamless front-end user interface between custody and trading makes sense, investors’ assets should be held separately by external and qualified custodians, such as banks or registered broker-dealers. CEX should seek and publish independent verification by auditors that assets are indeed segregated, and that robust risk and governance requirements are in place.

Instilling Trust in Trustless Systems

When Satoshi Nakamoto published the groundbreaking Bitcoin whitepaper in 2008, they envisioned a monetary system that no longer relied on blind trust. However, the entry point for most investors to encounter digital assets today—the exchange—still operates in a way that is almost opaque.

The events of 2022 have shown that for the industry to move forward, investor protection, transparency, robust governance structures, and value to the customer must be at the forefront of how exchanges are established and operated. CEX that embrace these values will find themselves with a competitive advantage, as investors increasingly rely on trustworthy centralized platforms to manage their digital asset portfolios.

As we continue to rebuild, the industry may return to its roots: an ecosystem of finance that was born from a vision of a fairer, more transparent, and more efficient system.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- What is “Onion Routing” in the Lightning Network and how does it work?

- Can the fluctuating Worldcoin and the UBI economics of the AI era come true?

- “Tactical” dissolution, division of national treasury assets, new profit model for DAO?

- MakerDAO Core Development Team proposed to increase the DAI savings rate from 1% to 3.33%

- Comprehensive overview of the gaming industry: Pie in the sky or an oasis in the desert

- Mint Ventures Talks with Pendle CEO: Seizing Hotspots to Build Breakthrough Products

- Web3 Social: DID First, DAPP Second