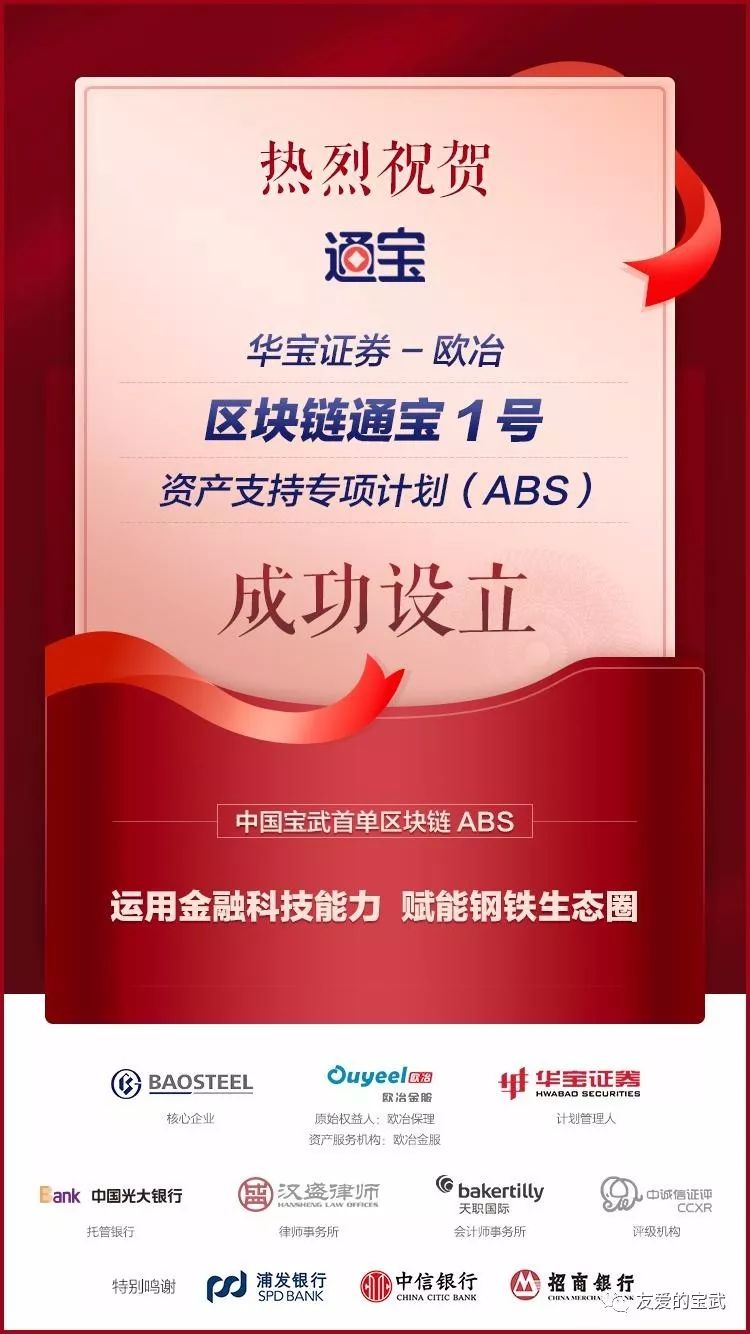

China Baowu's first single-chain ABS "Tongbao No. 1" was successfully established and will be listed on the Shanghai Stock Exchange.

Source of this article: You Ai Baowu (Official Weibo of China Baowu Iron and Steel Group Co., Ltd.)

On December 27, 2019, China Baowu's first single-block chain ABS with Huabao Securities as its manager-"Huabao Securities-Ouye Blockchain Tongbao No. 1 Asset Support Special Plan" was successfully established. This is the first time that China Baowu and its metallurgical platform company Ou Metallurgical Services applied blockchain technology to digitize, standardize, and securitize high-quality assets in the industrial chain through the Shanghai Stock Exchange.

Issuance Elements of Blockchain Tongbao No. 1 ABS

The special plan has obtained the letter of no objection from the Shanghai Stock Exchange, and the asset-backed securities (secret abbreviation: Tongbao No. 1) issued will be listed on the Shanghai Stock Exchange for transfer in the near future. Different from the previous supply chain ABS, which was dominated by core companies, with the feature of “putting the power to the front” on the Tongbao platform, no additional operations are required during the securitization process. This special plan was initiated and led by the original equity owners. The financing clients involved in the underlying assets are SMEs with real financing needs, and they practice the concept of inclusive finance.

- Past: Pioneer Reveals How Bitmain S9 Becomes "One Generation King"

- Denial of service (DoS) attack: Chengye miner, defeated miner

- Blockchain Concepts 2019: restlessness and embarrassment

At the same time, compared with other ABS, the arrangement of this special plan in bankruptcy and isolation is a step forward. In terms of the transfer of basic assets, the Tongbao assets transferred by the original equity owner to the special plan are directly transferred to the business account opened by the special plan on the Tongbao platform, held by the manager on behalf of the special plan, and the assets are separated from the original equity owner. In terms of the management of basic assets, a third-party asset service organization, namely, the blockchain technology service organization, Ou Metallurgical Service, is innovatively introduced. As the only asset service organization, it provides asset management services for special plans. With regard to the repayment of basic assets, Tongbao's claims are redeemed through Dongfang Paytong, and the repayment is directly transferred to the special plan account, without the need to go through the account of the original equity owner, to achieve capital isolation from the original equity owner.

What is "Tongbao"?

The basic asset of this special plan is "Tongbao" creditor's right. "Tongbao" is an electronic voucher based on its trade payables and opened online by its core suppliers to its receivables claims. Its birth and large-scale application reflect the process of credit creating value. Tongbao holders can transfer Tongbao, online financing or hold to maturity receipts. Utilizing the characteristics of Tongbao's easy circulation and convenient financing, it has achieved the extension of high-quality credit of core enterprises to the end, solving problems such as difficulties in loan financing faced by SMEs, difficulties in bank risk control, and department supervision.

As of the end of November 2019, more than 1,100 small and medium-sized enterprises have enjoyed inclusive financial services, and the total scale of Tongbao's transactions has exceeded 20 billion yuan. The minimum financing cost can reach 4.35%, and the smallest single financing is only 3800 yuan.

At present, China Baowu's units and upstream and downstream strategic customers already have nearly a hundred high-quality enterprises, which have become core companies on the chain to conduct business. Among them, the flagship subsidiary Baosteel Co., Ltd. has realized the normalization of the application of blockchain Tongbao external payments.

How does Tongbao platform show the advantages of blockchain technology?

As mentioned in the headline report of Jiefang Daily on December 8, 2019, “Tongbao born in Shanghai is not a digital currency, but a kind of currency that circulates in a specific physical industry and takes credit as the core. Digital vouchers. Tightly tied to the physical industry … After de-emerging and integrating into the entity, people find that blockchain technology really reduces risk, not increases risk … "Blockchain technology has distributed accounting and information The advantages of anti-tampering can effectively solve the problems of poor credit information flow and difficulties in cooperation between different corporate entities. It has an important role in restructuring the industrial chain credit system and reducing the financing cost of small and medium-sized enterprises.

With the Tongbao platform and digital certificates using blockchain technology, the credit points on the steel industry chain are linked into a chain and network, and a credit-based ecosystem is beginning to form. In this ecosystem, credit is like a bond, one end is connected to small business financing, and the other end is supervision and risk control. Leading companies in the steel industry can easily transfer their credit resources to SMEs in the industry chain. Relying on the endorsement of credit from the blockchain, the supervision and risk control of financial institutions can make the real trade background of the industry chain clearer, so that small enterprises can take advantage of large corporate credit ratings like Baosteel and enjoy low-cost financing.

In addition, when credit is on the chain, financing is easy, and the risk is greatly reduced. Over the past year, the Tongbao platform has integrated information on the chain through multiple dimensions, enabling financial institutions to better understand the real business transactions and operating conditions of SMEs, thereby preventing financial risks. The person in charge of Ou Metallurgical Service introduced: "In the past, it has been difficult to supervise the whereabouts of funds, and now through the application of blockchain technology, there are more effective means."

How does the Tongbao platform solve the problems of SMEs?

In the traditional supply chain financing service model, financial institutions always look at the many small and medium-sized enterprises in the steel industry chain, and they are always separated by a layer of yarn. In the steel industry, core companies like China's Baowu always know the industry better than financial institutions. Through the Tongbao platform built by China Baowu, it is easier for financial institutions to find service entities that they want to connect with upstream and downstream along the steel industry chain.

China Baowu's Exploration in the "Blockchain +" Field

China Baowu is one of the central enterprises that was involved in the research and practice of blockchain earlier. Since 2017, China Baowu has begun to explore the application of blockchain technology to commodity trading and supply chain financial services, and has continued research and application in its industrial internet platform company Ouye Cloud. In the process of piloting the development of blockchain platform services, China Baowu worked with regulators to study the use of financial technology to establish a more effective regulatory approach.

By building an industrial blockchain platform, China Baowu will connect the dots to form a chain and link up to form a network, until a high-quality ecological circle that combines production and finance and enterprise symbiosis is formed. Taking the blockchain Tongbao as a carrier, Baosteel and other large high-quality enterprises under China Baowu successfully passed and shared their credit resources to small, medium and private enterprises. SMEs enjoyed low-cost financing relying on China Baowu's high-grade credit. In the process of building a co-constructed, shared, and trusted third-party platform, it once again played a leading role, reflecting the responsibility of central enterprises. In the near future, it also plans to use the Shanghai Free Trade Zone's open policy, carry out international cooperation, promote the facilitation of cross-border trade in commodities with blockchain technology, and explore cross-border applications of blockchain technology.

At present, Ouye Yunshang has begun to target Shanghai's advanced manufacturing industry chain such as automobiles and equipment manufacturing to expand the application scenarios of blockchain technology. In such a scenario, core manufacturing companies can use the advantages of blockchain technology to better realize industrial synergy, export credit resources, make financial resources more accurately allocated, and target policies more targeted.

As a fintech service platform company of China Baowu, Euro Metallurgical Services has been supervised and guided by the People's Bank of China's Shanghai Headquarters on policy compliance and technical rationality of the central bank during the platform construction and business operation process. Through continuous comparison of practice, summary of experience, and continuous optimization between the traditional model and the new model, substantial progress has been made in smart contract applications and other aspects.

At present, the industrial development of the blockchain is booming, and the relevant technological innovations and industrial practices of China Baowu have also entered a critical stage of comprehensive development from partial experiments. The technical characteristics of the blockchain's distributed ledger and consensus mechanism determine that the construction of an industrial blockchain platform requires multiple parties to participate. China Baowu always adheres to the open concept of co-construction, sharing and co-governance, and is committed to continuously accelerating in-depth cooperation with leading enterprises, financial institutions and universities in various industries, relying on the advantages of Shanghai's high-end industries and financial resources to jointly create "financial services The development paradigm of high-quality industrial blockchain driven by entities, leading small and medium-sized enterprises, and Shanghai radiating the whole country.

The successful establishment of this special plan is based on the achievements of China Baowu's "blockchain + supply chain finance" platform construction over the past three years, and the scale of issuance will further expand in the future.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- The man behind Cosmos's $ 1 billion valuation: Jae Kwon

- There are pictures and the truth! Events of China's public chain Yuanjie DNA2019

- South Korea's Ministry of Finance: Current tax law does not impose income tax on cryptocurrency transactions

- List of 18 golden sentences Ling listening to the 2020 New Year's Essence

- After listening to this New Year's Eve speech, I was in tears: this is the 'good voice' entering 2020

- Funky and useful: these 12 new Ethereum things you can't miss

- Blockchain Weekly Report | 12 exchanges within 60 days are affected by strong supervision of virtual currencies; Shenzhen Stock Exchange 50 Index debuts