Citi Private Bank: Looking to 2020, Fintech Unstoppable (full text)

Despite facing unfavorable factors such as international trade tensions and widespread political uncertainty, the global economy remains healthy. The timely interest rate cuts and other monetary easing policies of important central banks have successfully maintained economic growth.

We believe that the significant resilience of the global economy will continue, supported by strong consumer activity and a rebound in manufacturing. The improvement in economic activity will drive steady revenue growth and moderate profit growth in 2020, boost the stock market, and make long-term interest rates rise slightly higher than market expectations.

For these reasons, we have a clear and simple message: stay optimistic!

Of course, many investors and pundits still seem to disagree with us.

- Introduction | ZK Sync: a key part of the popularity of Ethereum

- Read through the blockchain series: Key role in the blockchain world Token

- "Death sentence" on Telegram? Interpretation of the latest interview of the SEC "crypto old godmother"

Although the U.S. economy has shown resilience in 2019 and the market has shown a strong rebound, we still hear the argument that the U.S. recession is coming. By focusing on solid economic facts, data and significant trends, we believe it is possible to avoid falling into fear and paralysis, which prevents many investors from participating in the 2019 rise.

In short, stay positive in a negative world .

While excluding negative factors, the bigger challenge in 2020 comes from negative bond yields. We believe that the current unprecedented shortage of yields across the globe requires major adjustments to most portfolios. We don't consider bonds with very low or negative investment yields.

Our recommendation is to avoid such assets and seek portfolio returns by relocating to a range of other investments.

In the context of today's negative and negative interest rates, our goal is to help you stay positive and focus on real economic facts on top of daily news.

1) As we enter 2020, depressed mood and negative yields will continue to exist.

2) In contrast, if policy makers just choose to avoid the escalation of the trade war in 2020, global corporate profits may increase by 7% or more.

3) We recommend maintaining full investment and selectively preparing for stock market rises.

4) Market timing attempts may prove to be as expensive in 2020 as in 2019.

Negative OR Positive: Don't Miss 2020

In 2019, as global stock markets climb against the backdrop of low volatility and falling interest rates, investor anxiety has intensified. Retail investors' outflow of funds from the stock market continued throughout the year, and market sentiment continued to be significantly bearish.

At the same time, interest rates have fallen so much that by October, more than 25% of developed-market investment-grade bonds had negative yields.

The rampant trade tensions, populist anger spread to street protests from east to west, and the impeachment investigation of President Trump all provide worrying backgrounds. In last year's outlook, we believe that growth will continue into 2019.

However, many others don't think so.

Although the Fed has cut interest rates to help sustain economic growth, pessimists continue to convince themselves that "the end is coming."

These factors include the length of the U.S. economic expansion record, lack of trade agreements with China, U.S. trade threatening European and Mexican production, economically chaotic populist leaders, half of Saudi Arabia's oil supply being phased out in drone attacks, and imminent The coming 2020 US elections.

Of course, there are some solid data to support the negative views of some pessimists. The global economy has indeed slowed and manufacturing has weakened. The U.S. yield curve is reversing, a traditionally reliable signal that a recession may be imminent. The slowdown in industrial production has led to a decline in earnings per share and has led some observers to declare profits peaking.

Looking back, 2019 is similar to 2017. Investors can be sure that 2016 is the beginning of the end of the economic recovery.

One of the main reasons for 2019 to end well for investors is the Fed's decision to make a complete turn. In just a few weeks, it has shifted from trying to stop potential inflation to seeking to alleviate anti-inflationary pressures, global trade tensions, and political conflicts, which are more pressing threats to economic growth.

Its policy reversal also illustrates another perception: its limited ability to respond to economic contraction and the potential for deflationary forces triggered by the global recession. Therefore, we believe that it is wise for the Fed to preemptively extend the recovery.

With that in mind, "math still works"-or at least the high correlation between earnings and stock prices. With unemployment low and currencies still cheap, consumers around the world continue to buy despite these news.

Demand for the global economy, which accounts for 76% of global GDP, remains strong. Earnings growth has slowed, but revenues have continued to show modest growth. As of the third quarter of 2019, global revenues have increased by approximately 4%. By historical standards, the unemployment rate remains low. Inflation remains calm and there is no threat.

As a result, the signs of recession highlighted by the decline in bond yields have not appeared, as we think.

There is still room for the current economic expansion.

In our opinion, if policy makers simply avoid escalating the trade war in 2020, corporate profits may increase by 7% or more. Global purchasing managers' indexes (PMIs) may rebound as commodity inventories are already unsustainably low.

Moreover, at least for now, the Fed has achieved its goal of maintaining economic recovery. In this context, our Global Investment Commission predicts that by 2020, the returns on the US and global stock markets will reach about 7%.

We are not particularly concerned about valuation. The stock price has really not gone up that much. Over the past two years, global stock markets have risen by only 11% and US stocks have risen by 21%. The S & P 500's price-to-earnings ratio in 2020 is about 18 times. Considering the current low interest rate level, this multiple is not high. Therefore, by entering the right markets and industries, we see meaningful appreciation opportunities.

In short, we don't want you to miss 2020.

Of course, we acknowledge that there will be a recession someday or somewhere. However, when the recession comes, we cannot imagine that the long and severe contraction of 2008 will repeat itself. By that time, you'd better have a fully diversified global portfolio, thanks to your smart investment in 2020 and before.

Past vs Future: Lessons vs Prospects

Negative sentiment remains widespread during the ongoing economic expansion in 2019. Many individual investors cut their holdings or wait and see, waiting for "suitable" entry points.

Various empirical studies and our decades-long observations of client portfolios clearly show that this timing effort is stupid.

They proved it again in 2019, and prices at the end of the market will be much higher than at the beginning of the year. But investors in most market opportunities miss the recovery rally.

Monetary easing by the Federal Reserve and other central banks helped sustain economic growth and boosted returns in 2019. It should continue to support the market in 2020, albeit less aggressively. However, it is important to recognize what monetary policy can and cannot do now.

We believe that we are at or near the end of a global currency easing cycle, which has done its best to promote lending and investment globally.

We can see the limitations of these loose monetary policies in the private sector, as real growth and capital investment have only increased slightly. Inflation is still too mild.

In addition, cheap money can cause market anomalies, and we need to be vigilant.

For example, in the field of venture capital (VC), there are many cases where companies are actually forced to accept funds because they think they can provide a competitive advantage.

We have also seen that from one round of venture capital to the next round of venture capital, corporate valuations have grown faster than their financial performance. We are very wary of companies that burn money quickly because they can neither guarantee market share nor the long-term profitability they seek.

Cheap money also affects the acquisition space of private equity (PE). In 2019, many large corporate transactions are transactions between private equity firms. The incentives for private equity firms to put new funds into operation and concrete performance fees should make investors in these funds cautious.

Given the limitations of monetary policy, we are increasingly hearing that fiscal stimulus may be the government's response to future economic slowdowns. Given the high levels of debt in many countries and the record high levels of US corporate borrowing, it is shocking that no discussion of the need for fiscal constraints has emerged.

For example, in the 2020 US election, few candidates will talk in detail about the risks posed by the current annual US deficit of nearly $ 1 trillion. Instead, they are talking about how and where to increase spending and the need to increase taxes on the rich to fund redistributive policies.

We explored the significance of populism and politics in the challenges of deglobalization and populism, and avoided group madness.

Strong long-term power is changing the way we live and do business globally.

These forces affect almost every industry, and they represent a fundamental challenge to the status quo. They include technological advances, demographic developments and new behaviors.

Many of these projects have gradually accumulated over the years, but are now at a turning point and may accelerate development. In addition to changing our daily lives and economic transformation, they also have a significant impact on investor portfolios.

We call these forces "unstoppable trends."

Three unstoppable trends for 2019

In Outlook 2019, we identified three unstoppable trends.

The rise of Asia has resolved the steady shift of global economic power from the west to the east, driven by the region's urbanization, the growth of the middle class, and the advancement of indigenous technologies.

Life extension explores how the ageing of the world's population will affect future growth and consumption patterns.

Digital disruption looks at how digital innovation can bring revolutionary changes to companies and industries, shaking up the long-established way of doing business. Not only will we explain their performance over the past year, we will also explain why we believe they will last long.

By its very nature, an unstoppable trend is a multi-year phenomenon.

Because these trends are long-term and powerful, they can continue throughout the business cycle. For this reason, we believe that investing in a long-term portfolio of those who may benefit from an unstoppable trend may provide flexible growth potential.

Similarly, we have emphasized the importance of avoiding overinvestment in companies and industries that are most likely to be adversely affected by unstoppable trends.

Just as our unstoppable trend is a multi-year phenomenon, we see it as a long-term investment proposition.

Rise of Asia

By 2019, the US-led trade war and Hong Kong's political struggle will inevitably become the first consideration for investors. But these challenges have not stopped the 3.7 billion people from real GDP growth of more than 6% in 2019.

As we emphasized last year, the high savings, investment growth, and population growth of emerging markets in Asia are unmatched by any other region.

Inequality within and across countries poses a challenge to stability in the region, as it does to all other countries. However, fast-growing revenues and technological developments remain a lasting driver of potential growth.

This is evident in the region's growth figures, even though the region's trade with the United States has fallen the most since 2009.

Growing Asia's emerging middle-class consumers are still opportunities for a strong global business. A pressure point. US-China relations are led by Chinese companies. The potential for the rise of communications technologies and standards, especially 5G. Seeing the digital shock, anti-global And populist challenges.

Just before the United States imposed restrictions on these companies, Huawei and ZTE were the first to obtain patents for such technologies in the United States. The United States does so for a variety of reasons, including broad national security issues and interactions with Iranian businesses.

Although the Hong Kong stock market rose slightly in 2019, since the protests began in May 2019, its performance is still 25% lower than that of mainland China.

This highlights why international investors need to invest in the region as well as diversify in the region, including other countries in Greater China, India, and ASEAN countries.

Asia's population accounts for nearly half of the world's population and GDP accounts for more than one-third of the world's, but in the global stock market benchmark, this region accounts for less than one-fifth of the market value of the US stock market. This lower share is due to the lack of investment by international investors in companies in the region and their low valuations.

Doubts about the rise of Asia remain, as reflected in the widespread underestimation of the region across the globe.

We see potential opportunities in Asia, whether recent or longer-term.

extend your life

The ups and downs of political concern continue to dominate the short-term relative performance of the medical industry.

In the United States, the performance of the medical industry exceeded 10.9% during the 2018 market downturn. But during the full rebound in 2019, it was 15% behind the S & P 500.

Globally, as people ’s confidence in cyclical industries picks up, our preference for health care stocks is greater, but this year the industry ’s performance lags behind our 6.6%, a smaller decline.

We prefer strategies that focus on medical technology and under-penetrated emerging markets. Nevertheless, even in the United States, we believe that compared with cyclical industries, the growth of the medical industry is more stable and sustainable, but its valuation is not high.

This growth is partly driven by a growing elderly population, which is increasing spending on what is considered a medical necessity.

Digital disruption

There have been many drivers of the Internet connection revolution, but the proliferation of connected devices and faster data transfers on the network have been key. We believe that due to the deployment of 5G wireless networks, the speed of digital connections may accelerate again.

5G is expected to be put into use in 2020, and will be popularized in the next five years. 5G networks may be 100 times faster than current 4G LTE and 3G networks, with much higher reliability, lower energy consumption, and much larger capacity.

As a result, many of our existing digital activities may become faster and more valuable. The most obvious are clearer voice calls, faster search speeds, and smoother streaming.

But the real potential of 5G lies in implementing functions that are difficult or impossible to achieve with existing networks.

The combination of high speed and low downtime 5G should enable more industrial, urban and home functions to be reliably connected and automated.

These include self-driving cars, almost completely automated factories, thousands of machines and processes communicating wirelessly with each other, and operations performed on the human body by robots remotely controlled by surgeons.

A race is underway to see who will provide the winning 5G standard, or there may be two standards, one being the "Oriental" standard and the other the "Western" standard.

Regardless, the real winner may be the best application provider for consumers and businesses with broadband content.

In addition to artificial intelligence, blockchain and robotics, we are also attracted by 5G technologies in the coming years.

Three unstoppable trends in 2020

We have identified unstoppable trends and we believe these trends may increase the return on your portfolio. These include cybersecurity, fintech and renewable energy. Some leading companies in these areas may be able to achieve sustainable double-digit revenue and profit growth over 10 years or more.

For 2020, we propose three other unstoppable trends:

Cybersecurity : Protecting the Data Revolution has raised the urgent need to protect the fast-growing digital information that people and companies have been creating.

Fintech : Disrupting financial services explores how technology innovators break into the mainstream of industries that have traditionally been immune to new competition.

The future of energy: We look forward to how advanced technologies are driving global adoption of alternative energy sources, while fossil fuels are gradually disappearing into their twilight.

Unstoppable trends are changing the way we live and do business, creating long-term opportunities for your portfolio.

Disruptors and Disrupted

Fintech disruptors come in many shapes and sizes.

They include online payment platforms, digital lenders, microfinance providers in developing countries, mobile stock trading applications, regulatory and compliance software manufacturers, and cryptocurrency providers.

Although many traditional financial services groups provide a wide range of products and services, many fintech disruptors focus on only one market segment, such as a specific area of corporate lending.

The most affected by fintech disruptors are traditional financial service providers. The threats they face come not only from fintech startups, but also from established Internet retailers and large technology companies.

New technology may eliminate the need for many customer-facing staff, payment processors, and compliance staff in banks and call centers. The reduction in labor will in turn lead to savings in existing office space, including physical bank branches, call centers and back office space.

This process is already well underway.

As customers increasingly move their banking operations online, banks in Northern Europe and the Netherlands have cut branches by about 50% from their recent peak levels.

Innovative automation in areas such as regulatory compliance may also save money. Since the global financial crisis, banks have had to invest billions of dollars in these areas in order to cope with increasing regulations.

Having said that, the relationship between fintech and traditional companies is not always the relationship between predators and prey. Many fintech companies are actually seeking cooperation with existing companies.

After all, every company has what each other wants: new entrants need customers and data, and existing ones need innovative technological and cultural changes.

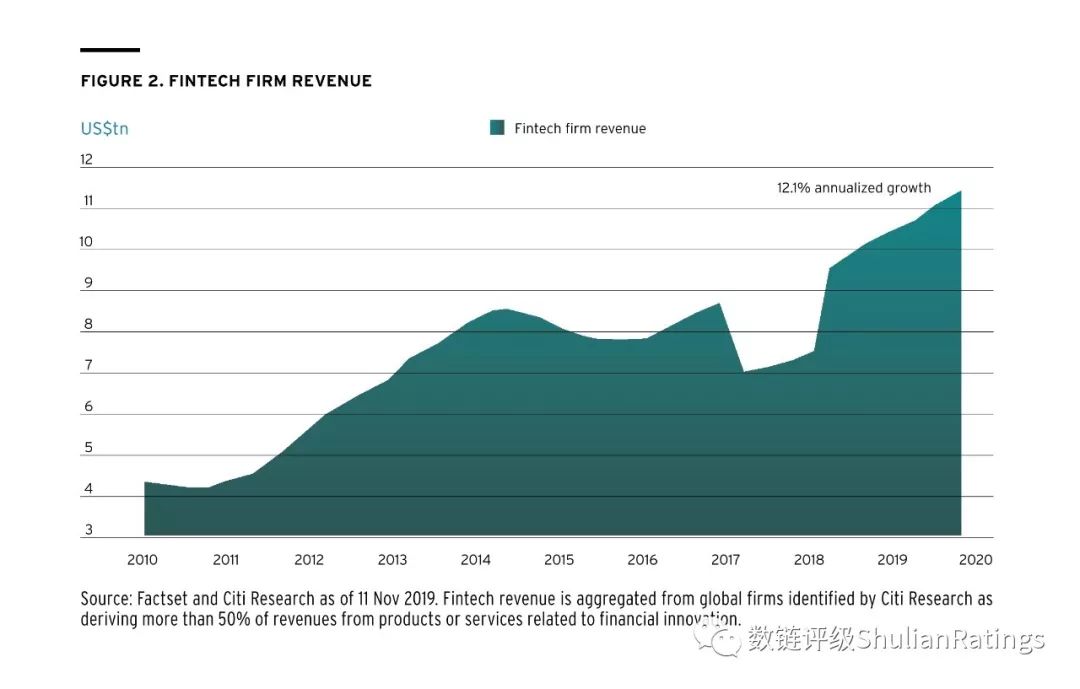

The chart shows fintech company income. As of November 11, 2019, Fintech revenues come from global companies identified by Citi Research, of which more than 50% of revenues come from products or services related to financial innovation.

Fintech : Impacting financial services

The financial services industry is facing continued chaos. We recommend establishing portfolio exposures to some innovators while avoiding potential victims. Key Information:

(1) For the first time, the financial services industry faces real and continuous interference from fintech;

(2) Payment companies are one of the most attractive investment targets in fintech.

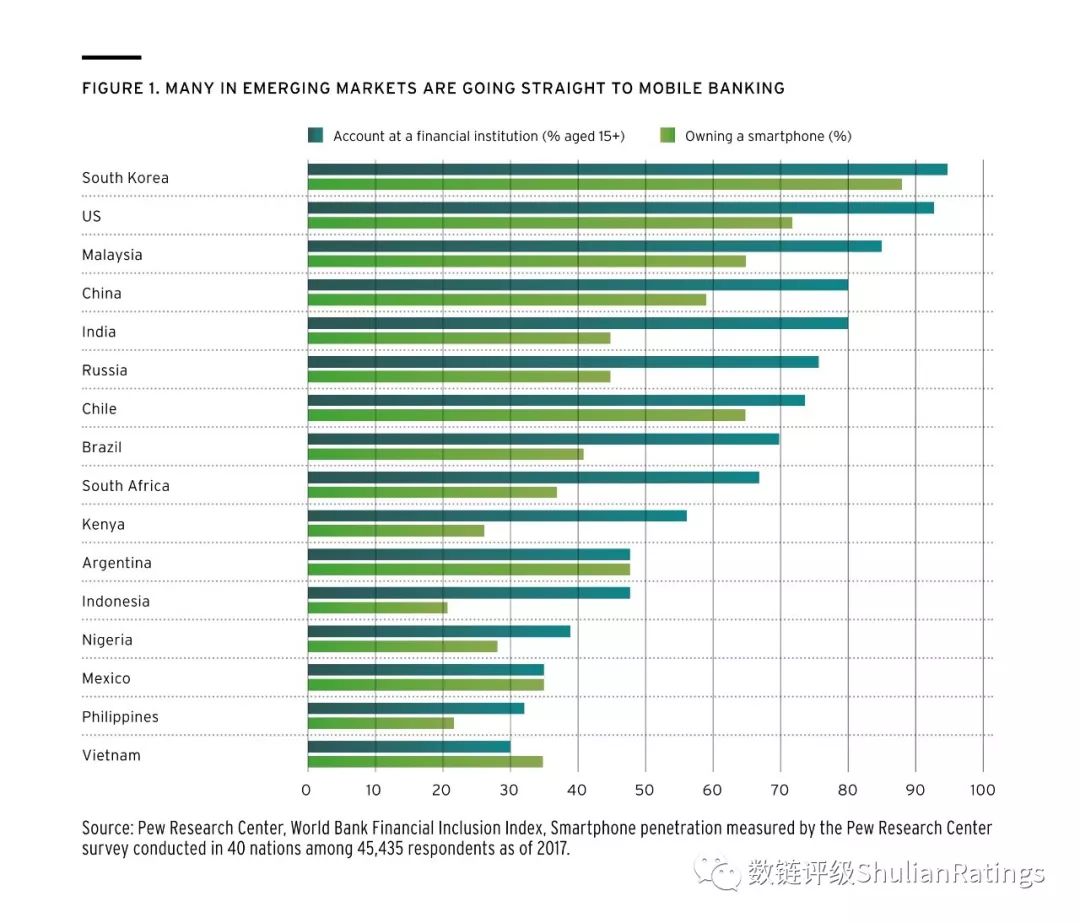

The chart shows that many emerging market countries are pouring directly into mobile banking. A 2017 Pew Research Center survey of 45,435 respondents in 40 countries revealed that China's smartphone penetration rate has reached 40%.

Perhaps for the first time, the financial services industry is facing real, ongoing chaos.

Many key developments make this industry more vulnerable than it was a thousand years ago. This includes demographic changes and greater availability of funds, especially from resource-rich investors such as sovereign wealth funds and venture capitalists.

"Millennials"-the generation born in the early 1980s to the early 21st century-now make up a larger percentage of the population. With the development of digital technology, millennials are more open to non-traditional banking services.

In addition, government and regulators have increased their support for innovation. The popularity of surfing the Internet through smartphones has also opened the door to banks for those who have never had a traditional bank account. Although the World Bank estimates that 1.7 billion adults worldwide still lack access to financial services, this number is rapidly declining.

Given these powerful demographic and technology drivers, certain financial technology (or "fintech") companies have now successfully entered the mainstream of financial services.

So far, they may only occupy a small portion of the consumer banking market.

However, we see huge room for disruptors to grab a larger share.

Tipping point

Many aspects of the banking industry have hardly changed over the centuries.

In medieval Italy, the Medici family collected data about customers and used their judgment to decide whether to provide them with loans. Essentially, today's banks are doing the same.

One reason for this continuity is that the financial services industry is relatively unaffected by disruptive technological forces that would otherwise shake many business practices of the financial services industry, as well as its workforce and size.

Similarly, high entry barriers prevent new competitors from entering the industry.

There are still many obstacles today.

They include capital adequacy requirements, licensing and heavy compliance costs. In the decades before the global financial crisis, these barriers kept banks' average return on equity high. The advent of the Internet and the prosperity of the Internet at the turn of the century have indeed tested the resilience of financial services to technological disruption. But the industry was unscathed in its initial encounters, and few new companies entered the industry during this period. However, things are different now.

We believe that as we enter the 1920s, sufficient investment and independent challengers have entered the field, creating a turning point. In countries lacking regulatory and government barriers in the Western world, the entire new financial ecosystem has been established so quickly and with such great success that the term "bank" may not make much sense to many local consumers.

In China and Africa, payments are mainly digital.

We are now seeing the mainstream of these technologies into developed markets. Citi Private Bank believes that fintech represents an irresistible trend given the constant flow of funds into the fintech space, the huge disruption of traditional financial services, and the development momentum achieved so far.

Investment portfolio should be included in fintech

To date, fintech companies have largely filled the market gap. They focus on new businesses, such as peer-to-peer loans or improving the customer experience when selling. Therefore, for the disrupted, it is more about giving up opportunities than actual loss of profits. However, this does not mean that its employees can sleep peacefully.

It's important to keep in mind that disruption is usually gradual.

In the beginning, disruptors aimed at new market segments to annex industry developments while coexisting with existing players. After reaching a certain scale and building their reputation, they finally began to compete for the core business income of existing enterprises.

Over the past decade, Fintech companies' revenues have grown at a rate of 12.1% per year. In comparison, the overall revenue of the S & P 500 companies increased by 4.2%.

We expect that fintech will continue to experience strong growth as the industry has reached a tipping point.

We believe that this growth can drive stock prices and valuations of private fintech companies. Fintech companies come in a variety of forms and sizes, from relatively new startups to large tech companies that are involved in financial services.

We see the most attractive potential in the payment space.

At the same time, we are closely monitoring the response of traditional providers to fintech. Our goal is to reduce or avoid contact with the most susceptible people.

The impact of fintech will further expand.

Investors should pay attention to this irresistible trend as early as possible.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Perspective | How will Facebook Libra affect the banking industry?

- Electronic invoice blockchain application survey (below)

- Industry Blockchain Weekly 丨 The Supreme Law issued a document supporting the blockchain, adding 3 more group standards in China

- What happened to Bitcoin and Ethereum in 2019? What does it bring to 2020?

- Conversation | Bitcoin halved, is it really good or fake?

- Free and easy weekly review 丨 Three minutes to understand the new zero-knowledge proof solution Virgo (Virgo)

- Long Baitao | Central Bank Digital Currency-Global Consensus and Division