Weekly Highlights Review | Russian Central Bank Tests Stablecoin, Sichuan Regulates Bitcoin Mining

Summary

Event: Recently, Russia ’s central bank, Russian Bank, has begun testing stablecoins linked to real assets in a regulatory sandbox, and is closely monitoring its potential and impact. Sichuan Ganzi has issued a plan to regulate Bitcoin mining activities. The Shenzhen Stock Exchange released the Shenzhen Stock Exchange 50 Index on December 24.

The Russian central bank has begun testing stablecoins in a regulatory sandbox, paying close attention to the potential and impact of central bank digital currencies. Russian news agency Interfax reported that Russia ’s central bank, Russian Bank, has begun testing stablecoins linked to real assets in a regulatory sandbox, but Elvira Nabiullina, the governor of the Russian central bank, said the bank does not believe that the stablecoins will be used As a means of payment or alternative currency, it is learning the potential uses of stablecoins. The Russian Central Bank is also continuing to explore the possibility of issuing its own central bank digital currency (CBDC), the digital ruble, but is also paying close attention to possible problems and consequences. Stablecoin is a cryptocurrency linked to another asset. The purpose is to prevent fluctuations related to the crypto market. At present, the typical representative is the USDT linked to the USD issued by Tether. With the launch of Facebook's Libra development plan, digital currencies represented by stablecoins have received high attention from global financial markets. The People ’s Bank of China also actively proposed the digital currency DCEP plan this year. Later, the central banks of France and other countries have also clearly expressed their interest. We believe that the central bank ’s digital currency and stable currency linked to various assets are expected to receive greater attention from the global financial market.

Sichuan further regulates Bitcoin mining activities to ensure the healthy development of the industry. On December 24th, the Ganzi Tibetan Autonomous Prefecture of Sichuan Province published a paper entitled “Our State Actively Doing a Good Job in Protecting Peaks and Protecting Winter Power” and issued a “Working Plan for Ganzi Prefecture Cleanup and Remediation of Bitcoin Mines” to regulate electricity. The direct power supply behavior of enterprises urges power generation enterprises to give priority to ensuring unified adjustment indicators and social power supply during the dry season. This move aims to further regulate Bitcoin mining activities and promote the healthy development of the industry while ensuring the stability of social power supply.

The Shenzhen Stock Exchange launched the Blockchain 50 Index, and the focus of the capital market has continued to increase. The market will look forward to more new indexes and fund products to broaden the path for capital entry. On December 24, the official website of the Shenzhen Stock Exchange announced that it would release the Shenzhen Stock Exchange 50 Index on December 24, 2019. The announcement shows that the Shenzhen Stock Exchange 50 Index is based on companies listed in the Shenzhen Stock Exchange, whose business areas involve the upstream and downstream of the blockchain industry as a sample space. The 50 stocks constitute sample stocks. The index is weighted by free float market value, and the sample stocks are regularly adjusted on the next trading day of the second Friday in June and December each year. Ping An Bank, Midea Group, Suning Tesco, Annie Shares, SF Holdings, Sifang Jingchuang, BGI, etc. have all been selected as the 50 blockchain samples. With the successive launch of Bitcoin futures by the Chicago Board of Options Exchange (CBOE) and the Chicago Mercantile Exchange (CME) in December 2017, the capital market's focus on blockchain-related assets has continued to increase; on September 23 this year, intercontinental trading The Bakkt platform under the ICE launched the world's first Bitcoin futures settled in kind, followed by the US Securities and Exchange Commission's (SEC) 's increased attention to Bitcoin ETFs and Ethereum (ETH) futures, and the market has set considerable expectations. . This time the Shenzhen Stock Exchange released the Blockchain 50 Index, which provides a platform and tools for the capital market to participate in supporting the development of the blockchain industry. In order to help the development of the emerging technology industry, the Shenzhen Stock Exchange has released the Shenzhen Stock Information Technology Index (399620) and the Shenzhen Stock Telecom Index (399621). It can be expected that more blockchain-related sector index products and even ETFs are expected to accelerate their landing. Facilitate capital entry.

- Blockchain ecological "river and lake": are listed companies developing technologies or hot spots?

- Year in review: Killer apps have not yet appeared, compliance is still insufficient, 2020 still needs work

- Citi Private Bank: Looking to 2020, Fintech Unstoppable (full text)

Risk Warning: Uncertainty in regulatory policies, and the development of blockchain infrastructure is not up to expectations.

I. Russian central bank tests stablecoins and Sichuan regulates bitcoin mining

The Russian central bank has begun testing stablecoins in a regulatory sandbox, paying close attention to the potential and impact of central bank digital currencies. Russian news agency Interfax reported that Russia ’s central bank, Russian Bank, has begun testing stablecoins linked to real assets in a regulatory sandbox, but Elvira Nabiullina, the governor of the Russian central bank, said the bank does not believe that the stablecoins will be used As a means of payment or alternative currency, it is learning the potential uses of stablecoins. The Russian Central Bank is also continuing to explore the possibility of issuing its own central bank digital currency (CBDC), the digital ruble, but is also paying close attention to possible problems and consequences. Stablecoin is a cryptocurrency linked to another asset. The purpose is to prevent fluctuations related to the crypto market. At present, the typical representative is the USDT linked to the USD issued by Tether. With the launch of Facebook's Libra development plan, digital currencies represented by stablecoins have received high attention from global financial markets. The People ’s Bank of China also actively proposed the digital currency DCEP plan this year. Later, the central banks of France and other countries have also clearly expressed their interest. We believe that the central bank ’s digital currency and stable currency linked to various assets are expected to receive greater attention from the global financial market.

Sichuan further regulates Bitcoin mining activities to ensure the healthy development of the industry. On December 24th, the Ganzi Tibetan Autonomous Prefecture of Sichuan Province published a paper entitled “Our State Actively Doing a Good Job in Protecting Peaks and Protecting Winter Power” and issued a “Work Plan for Ganzi Prefecture Cleanup and Remediation of Bitcoin Mines” to regulate power The direct power supply behavior of enterprises urges power generation enterprises to give priority to ensuring unified adjustment indicators and social power supply during the dry season. This move aims to further regulate Bitcoin mining activities and promote the healthy development of the industry while ensuring the stability of social power supply. The National Development and Reform Commission's industrial restructuring guidance directory released on November 6 this year will delete the virtual currency mining listed in the consultation draft as a phase-out industry. We believe that due to the fact that a lot of abandoned mining is used in Bitcoin mining, regulators are expected to further regulate related industries and ensure the overall healthy development of the blockchain industry.

The Shenzhen Stock Exchange launched the Blockchain 50 Index, and the focus of the capital market has continued to increase. The market will look forward to more new indexes and fund products to broaden the path for capital entry. On December 24, the official website of the Shenzhen Stock Exchange announced that it would release the Shenzhen Stock Exchange 50 Index on December 24, 2019. The announcement shows that the Shenzhen Stock Exchange 50 Index is based on companies listed in the Shenzhen Stock Exchange, whose business areas involve the upstream and downstream of the blockchain industry as a sample space. The 50 stocks constitute sample stocks. The index is weighted by free float market value, and the sample stocks are regularly adjusted on the next trading day of the second Friday in June and December each year. Ping An Bank, Midea Group, Suning Tesco, Annie Shares, SF Holdings, Sifang Jingchuang, BGI, etc. have all been selected as the 50 blockchain samples. With the successive launch of Bitcoin futures by the Chicago Board of Options Exchange (CBOE) and the Chicago Mercantile Exchange (CME) in December 2017, the capital market's focus on blockchain-related assets has continued to increase; on September 23 this year, intercontinental trading The Bakkt platform under the ICE launched the world's first Bitcoin futures settled in kind, followed by the US Securities and Exchange Commission's (SEC) 's increased attention to Bitcoin ETFs and Ethereum (ETH) futures, and the market has set considerable expectations. . This time the Shenzhen Stock Exchange released the Blockchain 50 Index, which provides a platform and tools for the capital market to participate in supporting the development of the blockchain industry. In order to help the development of the emerging technology industry, the Shenzhen Stock Exchange has released the Shenzhen Stock Information Technology Index (399620) and the Shenzhen Stock Telecom Index (399621). It can be expected that more blockchain-related sector index products and even ETFs are expected to accelerate their landing. Facilitate capital entry.

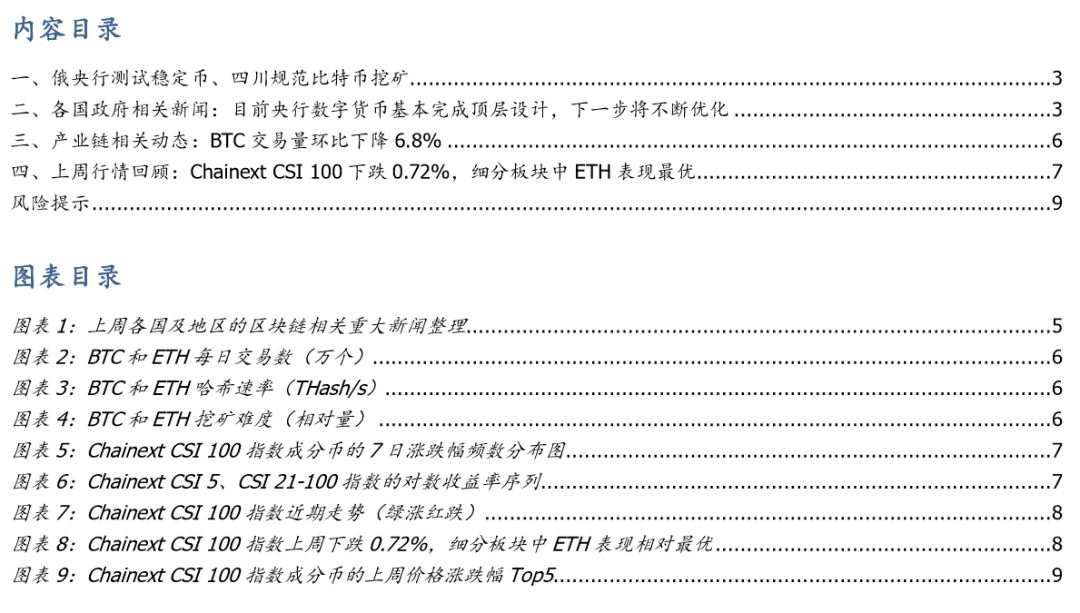

2. Government related news: At present, the central bank's digital currency has basically completed the top-level design, and the next step will be continuously optimized.

United States: The US Fake Financial Reporting Committee sponsors the organizational committee (ie, the COSO Committee and the US Corso Committee) to issue guidelines on internal control of blockchain technology in the first quarter of 2020, aiming to strengthen blockchain technology in supply chain management and Internal control in areas such as financial services. According to The Bock Crypto, the New York Department of Financial Services (NYDFS) is building a RegTech (Regulatory Technology) solution to enhance its regulatory capabilities.

Germany: Under the law, which will take effect on January 1, 2020, Germany will require digital asset custodians to obtain a license, and every company that currently hosts cryptocurrencies and targets German customers must report to Germany before April 1. The Financial Supervisory Authority (BaFin) announced its intention to obtain a permit and submit an application by November 1.

France: The French Financial Markets Authority (AMF) recently issued new regulations on digital asset service provider (DASP) licensing, as well as guidelines for applying for non-mandatory licensing and notifying the AMF of internal network security operations. To apply for a digital asset service provider, they must send to AMF a two-year business plan, a list of digital assets that provide services, a list of regions in which they operate, and an organization chart. This license is optional for crypto companies operating in France. The French government simply requires that for reasons of anti-money laundering and counter-terrorism financing, crypto custodians and any company engaged in fiat and cryptocurrency exchange services must register with the AMF. French regulators have also issued specific rules for cryptocurrency custodians, cryptocurrency exchanges, and cryptocurrency broker-dealers.

Japan: Financial regulator Japan Financial Services Agency (FSA) said in a response to public comments that it is not possible to create and sell virtual currency ETFs in Japan.

South Korea: The Ministry of Planning and Finance of the Republic of Korea stated that the tax items in the current tax law do not include cryptocurrencies. In addition, cryptocurrencies obtained through airdrops are not applicable to the income tax law. However, the Ministry of Planning and Finance ’s position is that it plans to amend cryptocurrencies through tax laws. Taxation. On December 27, the Bank of Korea announced that in order to better study digital assets, it decided to set up a special working group to focus on the research of the central bank's digital currency (CBDC).

Bahamas: On December 24, the Central Bank of the Bahamas announced the launch of a digital currency pilot on December 27. From Friday (December 27) local time, residents of Exuma can join the "Project Sand Dollar" of the Central Bank of the Bahamas. They will receive a mobile wallet, which the Bahamian government believes will be a convenience for the future of island chain payments.

Uzbekistan: On December 24, the National Agency for Project Management of Uzbekistan recently passed amendments to the regulatory system, which significantly restricted the choice of local individuals to use cryptocurrencies. The revised system has banned residents from buying cryptocurrencies on digital asset exchanges licensed in the country. Cryptocurrency holders can only sell their tokens as long as they are not obtained through anonymous transactions.

Paraguay: On December 25, Paraguay's anti-money laundering government agency announced its investigation into the country's cryptocurrency industry and is preparing to implement FATF anti-money laundering supervision. Specific regulations for the first batch of cryptocurrencies in China will be issued in the first half of 2020.

Third, the industry chain related dynamics: BTC transaction volume fell 6.8% MoM

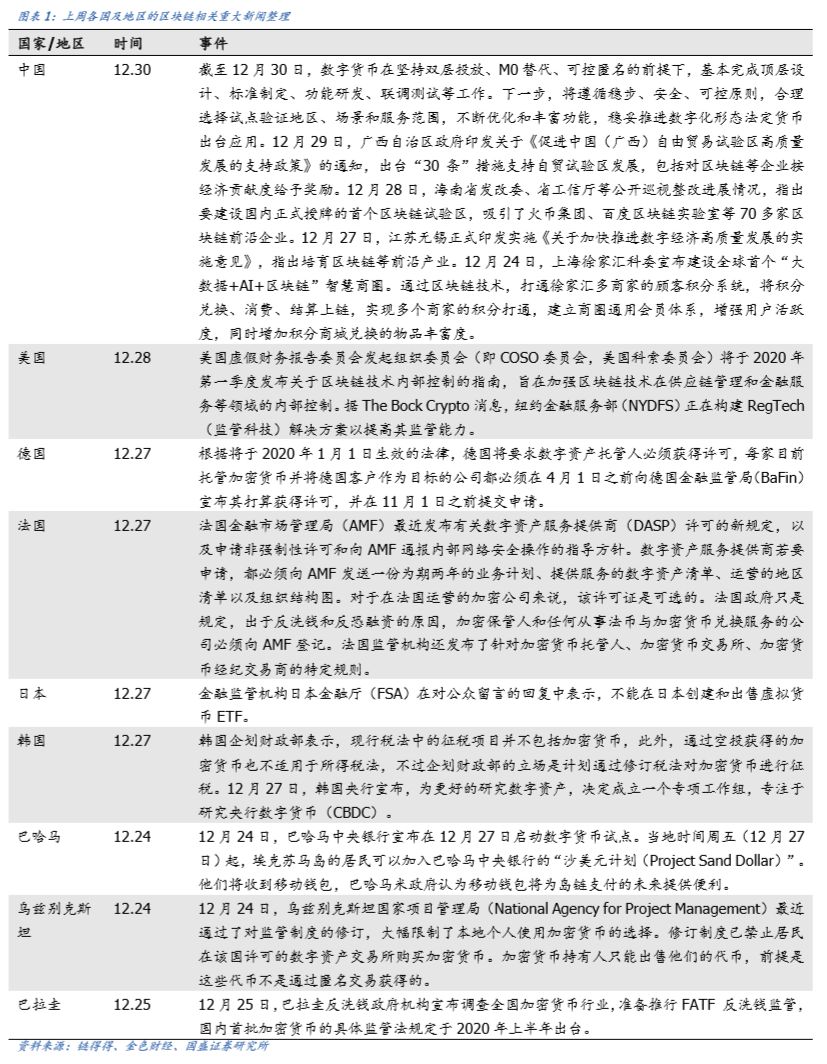

Last week, BTC added 2.04 million transactions, a drop of 6.8% from the previous month; ETH added 4.01 million transactions, a 5.6% decrease from the previous month.

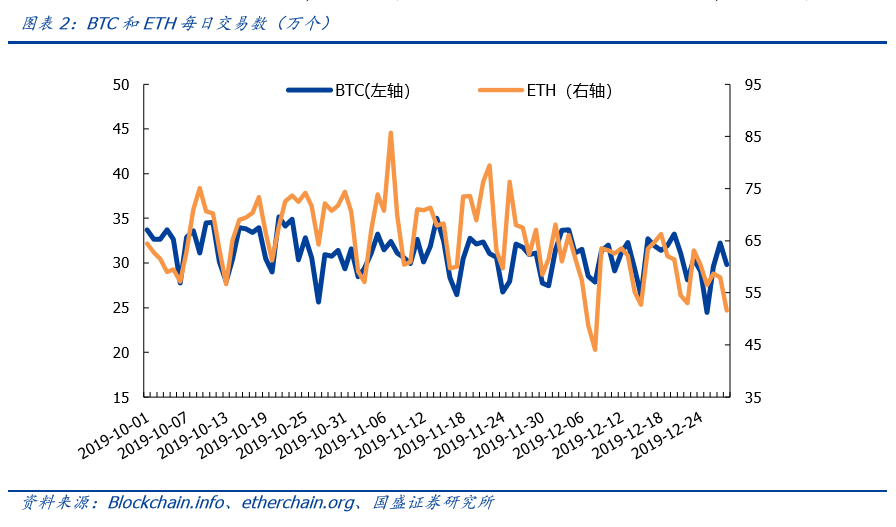

Last week, the average daily computing power of BTC reached 94.3EH / s, a drop of 1.5% from the previous month; the daily average computing power of ETH across the network reached 152.8TH / s, a decrease of 5.9% from the previous month.

Last week's BTC network-wide mining difficulty was 12.95T, an increase of 0.4% from the previous month; last week, the average ETH mining difficulty of the entire network was 2.52T, a 4.9% decrease from the previous month.

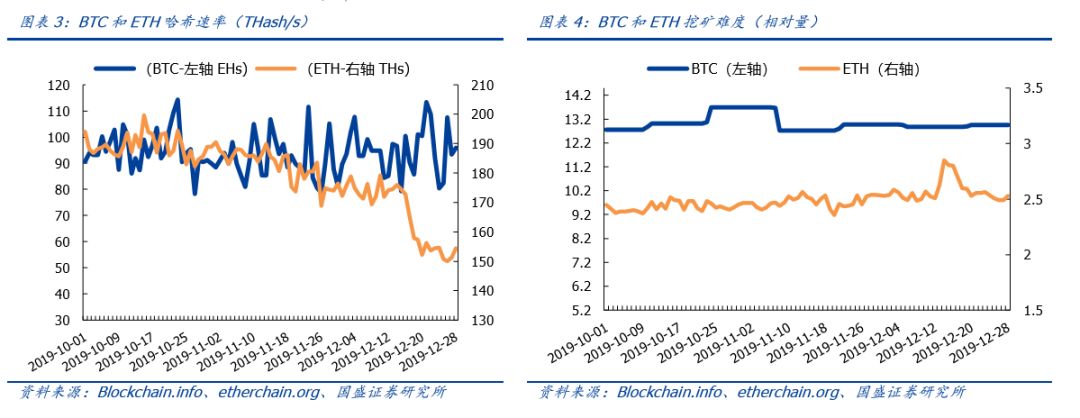

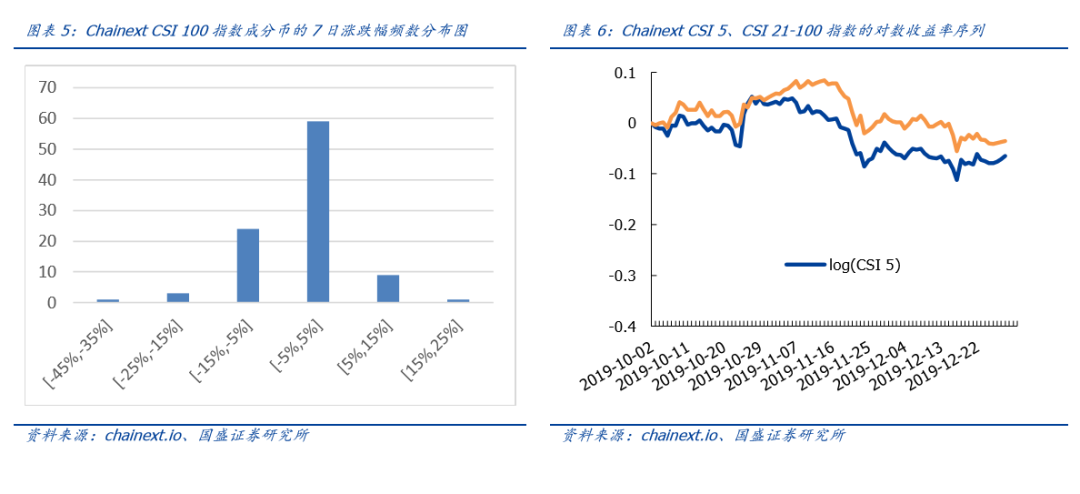

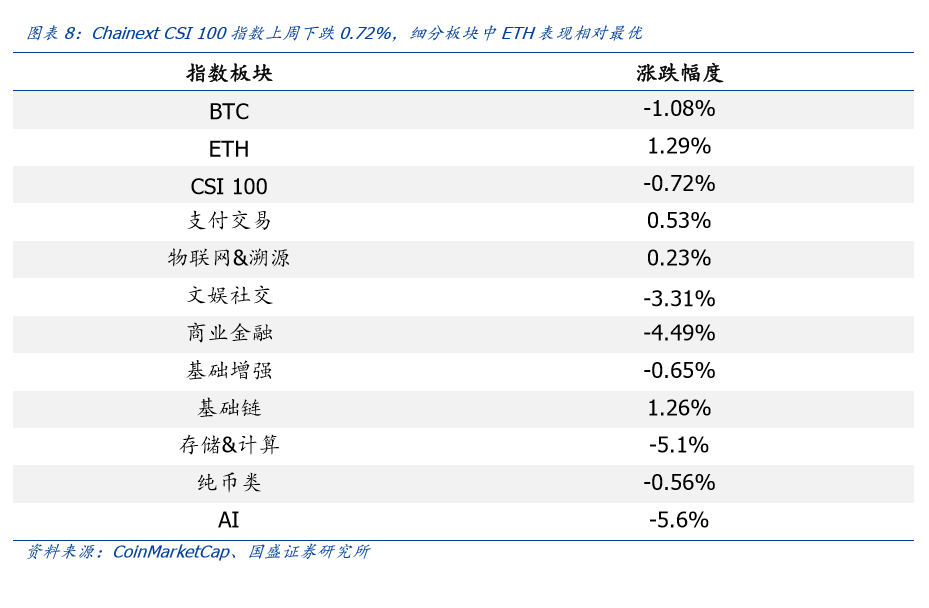

Fourth, the market review last week: Chainext CSI 100 fell 0.72%, the best performance of ETH in the segment

[2] The Chainext CSI 5 index is composed of the 5 largest and most liquid tokens in the token market (BTC, ETH, XRP, BCH, EOS), reflecting the price trend of the market's oversized currency;

[3] The Chainext CSI 21-100 index is composed of the CSI 100 index sample and the CSI 20 index sample, which reflects the price trend of the market's small cap currency.

The development of blockchain infrastructure failed to meet expectations. Blockchain is the core technology for solving supply chain finance and digital identity. At present, the blockchain infrastructure cannot support high-performance network deployment. The degree of decentralization and security will have a certain constraint on high performance. The blockchain infrastructure exists Risk of development not meeting expectations.

This article is an excerpt from the report "Guosheng Blockchain | Russian Central Bank Tests Stable Currency, Sichuan Regulates Bitcoin Mining", which has been published on December 30, 2019 by Guosheng Securities Research Institute. For details, please refer to the relevant report.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Introduction | ZK Sync: a key part of the popularity of Ethereum

- Read through the blockchain series: Key role in the blockchain world Token

- "Death sentence" on Telegram? Interpretation of the latest interview of the SEC "crypto old godmother"

- Perspective | How will Facebook Libra affect the banking industry?

- Electronic invoice blockchain application survey (below)

- Industry Blockchain Weekly 丨 The Supreme Law issued a document supporting the blockchain, adding 3 more group standards in China

- What happened to Bitcoin and Ethereum in 2019? What does it bring to 2020?