Cryptographic currency and Stockholm syndrome

Foreword: The encryption world is full of contradictions. It is brought to the world by a group of idealistic ciphers. It hopes to bring more beauty and more possibilities to the world through technological innovation. However, it is also full of speculation, stimulating greed and causing many people to suffer losses. Everyone has their own initial heart, and different opportunities bring different results. The author of this article is $trong, translated by the "Blue Fox Notes" community.

Stockholm Syndrome is a rather sinister subject that describes “the trust or emotional sentiment of the victim to the defender when kidnapping or hostage taking.” Fortunately, the subject of this article is easier, it is designed to study similar behaviors, only the features shown by addiction or compulsive behavior.

This article aims to investigate this attraction and explore its path to confirm whether people's chosen cryptocurrency motives are healthy and draw conclusions.

Two different motives

- US Secretary of State Pompeo said that the cryptocurrency "anonymous transaction" constitutes a major national security risk, and the encryption community directly slammed back

- Destroy the bitcoin of Nakamoto! In order not to let the "fake books" be awkward, some people suggested

- The future of the central bank's digital currency

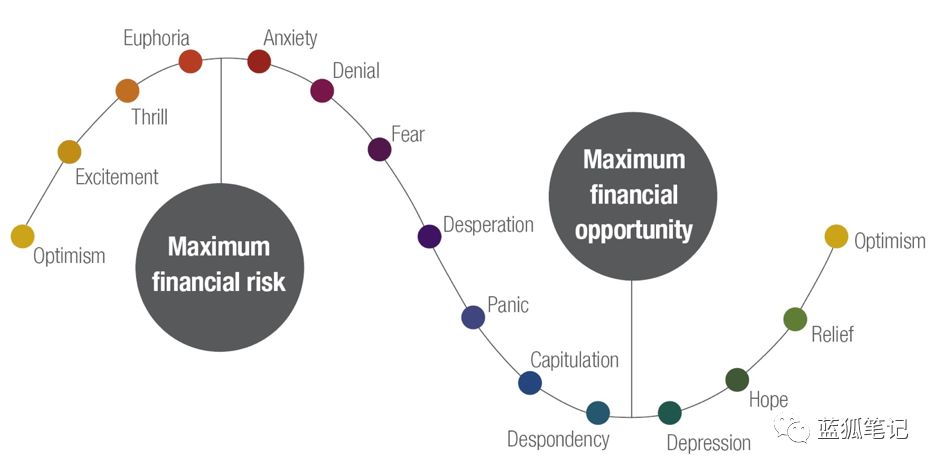

The nature of cryptocurrency is speculative, and prices are driven primarily by supply and demand. This creates a dilemma: some people make big money and some lose money. The 2017 bull market peak attracted a large number of aspiring cryptocurrency investors, and at the biggest financial risk point, most people held bad assets or lost money. With this in mind, many people are still in the field of cryptocurrency. Some people use this opportunity to learn and generate positive portfolio returns, creating valuable connections, while others still haven't learned anything.

With this in mind, if the possibilities offered by cryptocurrencies are so variable, why are people involved?

Source: SFG

Source: SFG

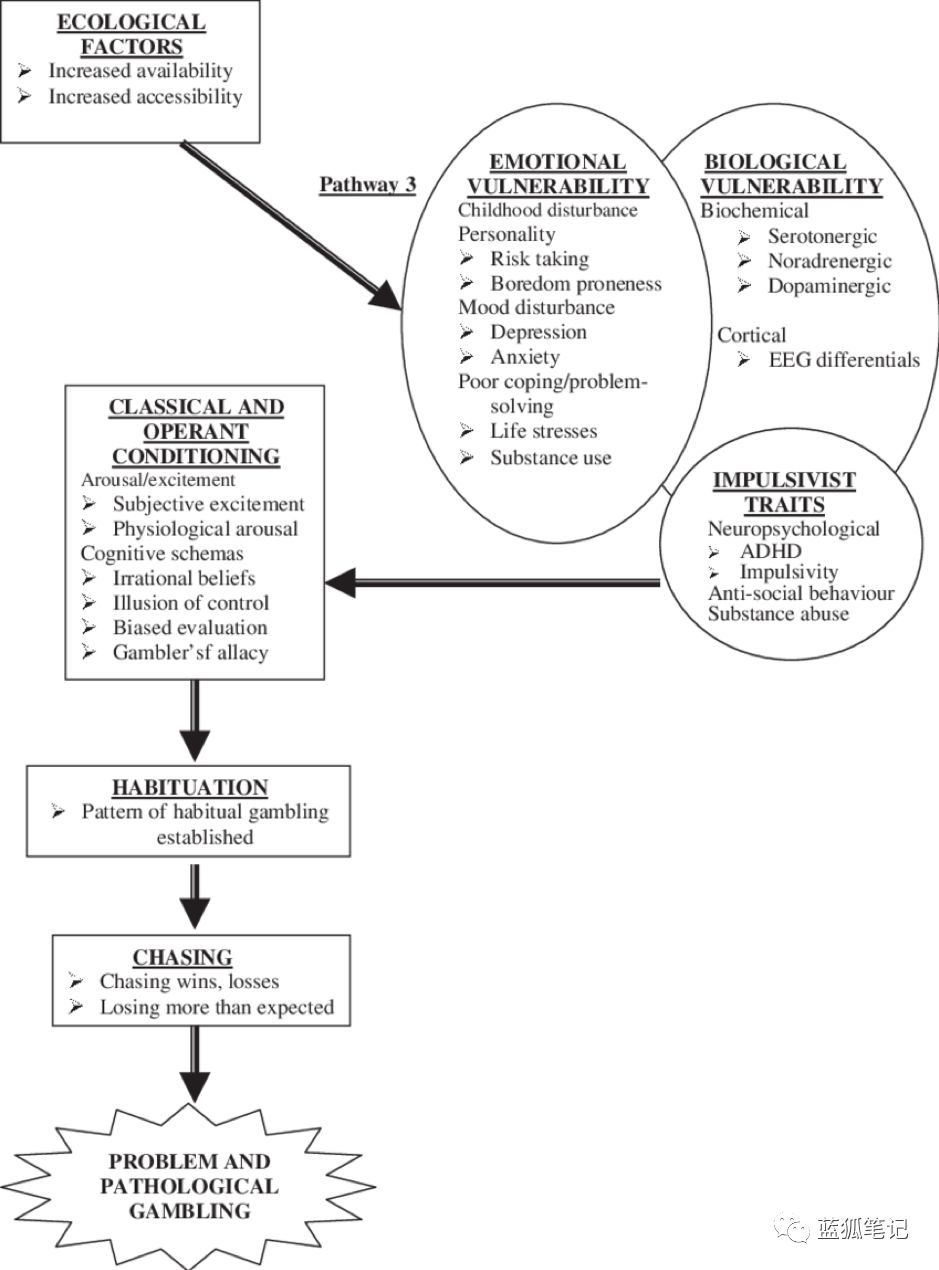

A suitable starting point is to look at yourself before entering the cryptocurrency. Are these people good, bad or indifferent in their daily lives? What inspired people's interest in cryptocurrencies? Is this an opportunity they can see, or are they chasing daydreams to replace others?

The motivation to actively participate in cryptocurrency is only one of them. However, how to implement decisions is also important. The combination of the Internet and smartphones greatly facilitates access to the global market. Being free to enter financial activities has a major impact on the participants' thinking process.

In general, cryptocurrency is a high-risk, volatile market that attracts people who are vulnerable to gambling weaknesses. If there were personal or external issues that affected the participants before, these issues would have a strong impact on the participants entering the cryptocurrency, giving them the opportunity to escape reality.

The consequences of this may result in huge economic losses for the participants. If one can't recognize these failures, then they will continue to slide down and start a "retaliatory" transaction, which is a regrettable cycle, like a gambler chasing losses. This may be addictive.

Of course, there are many positive aspects to participating in cryptocurrencies. From a trading or investment perspective, there are well-thought-out plans and processes that follow a strict set of rules that allow you to control the risk range. These give a lot of "trained" individuals a good income. In addition, from a technical point of view, the field of encryption provides opportunities for creative people to change the world.

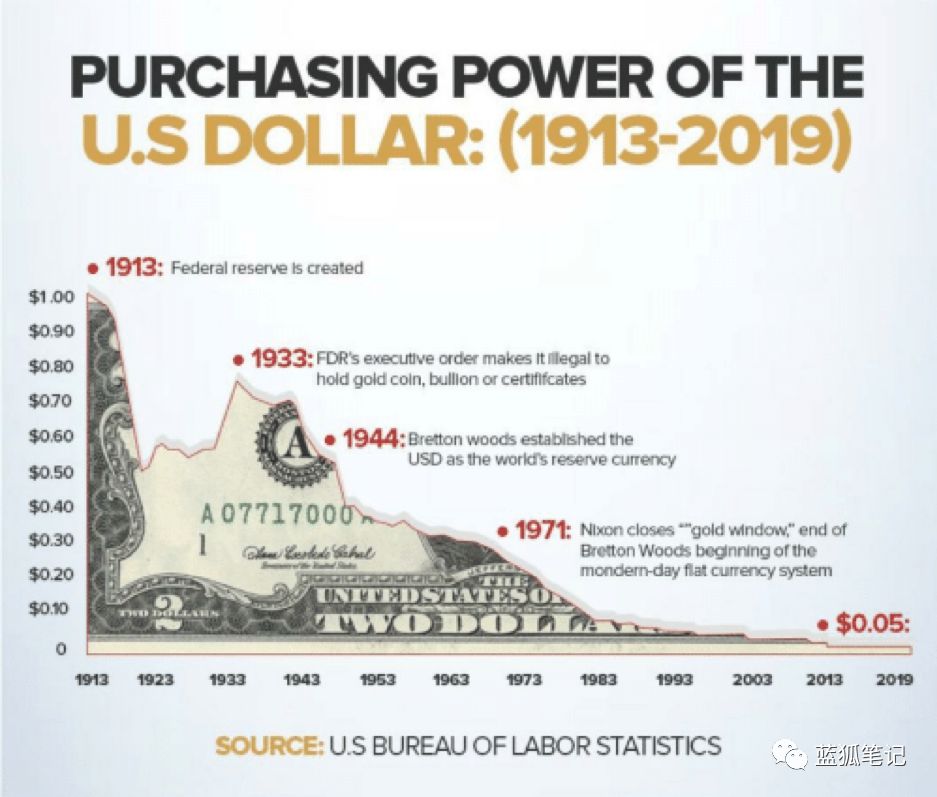

The idea from Naval combined with Robert Kiyosaki's thinking prompted people to believe that cryptocurrency is not only a technological advancement, but also a financial hedge against the depreciation of the French currency.

Although Robert is primarily concerned with real estate, not cryptocurrencies, his thinking about the depreciation of the French currency is still related to why some people consider investing in cryptocurrencies.

"So the third new rule of money, I think the biggest mistake is: I heard a lot of people saying that saving is important. It's ridiculous! Because what happened in 1971 is crucial. Since 1971 the dollar is no longer It's money, but currency. In 1971, President Nixon decoupled the dollar from gold… It's a bit like an unrestricted credit card for someone who can't control the cost…so The status quo is that all savers are losers. You know, the problem in 1971 was that the federal government kept printing money, causing your money to drop in value… So now I don’t save money, I am in the hedge In 1997, I started investing in oil, gold, and silver. So, as the dollar fell, oil, gold, and silver rose. So, I am not betting on oil, gold, and silver. I am hedging the dollar. That's why you want Tell others the idea: "You want to save money." This is an outdated idea." (Robert Kiyosaki)

Source: Bullion Star

Source: Bullion Star

With these ideas in mind, some people's goal is to have the opportunity to innovate because they believe that the existence of money in the bank will depreciate, while innovation is profitable, although this requires careful research and risk management.

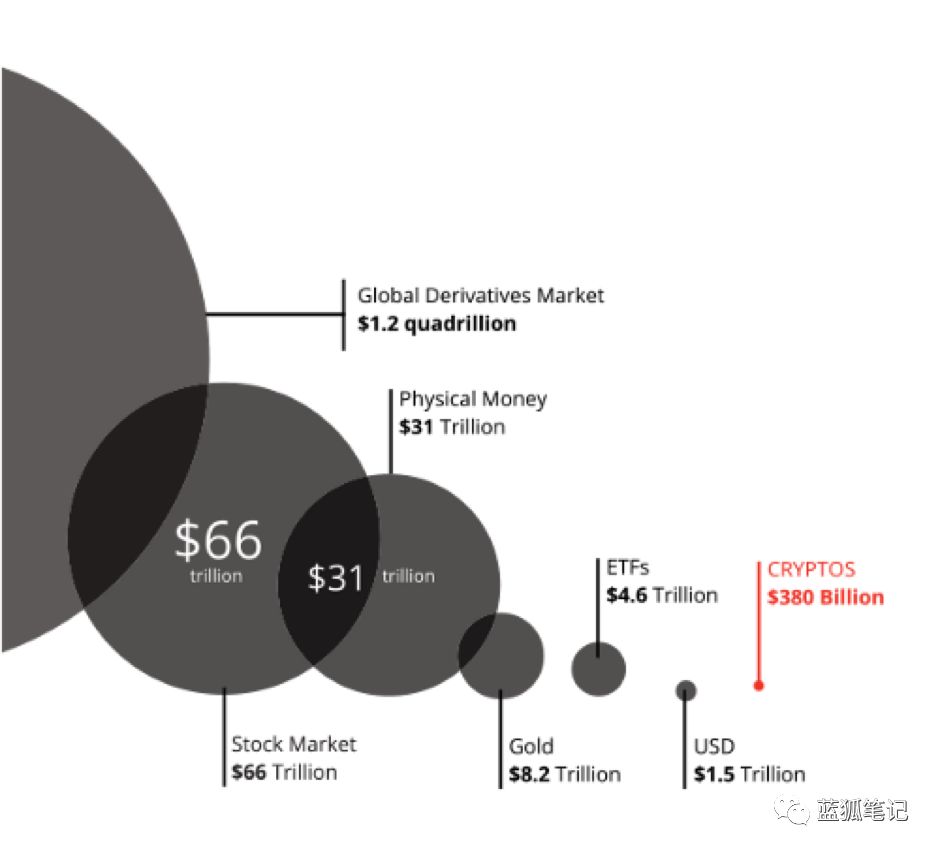

The potential of cryptocurrency and blockchain technology in multiple industries can be further expanded in the coming years. From a purely financial perspective, the total market value of cryptocurrencies (although in volatility) accounts for only about 0.2% of the total market capitalization of all assets. This shows that even a certain degree of development will achieve significant growth in this area. (Blue Fox Note: The author's meaning is that the scale is very small now, as long as a little effort, there is a lot of room for growth.)

Source: SwissOne Captial

For now, it’s quite speculative. But some people use a targeted approach to try to implement a risk-controlled balance plan instead of being a full-fledged gambler. (Blue Fox Note: This is also true for most ordinary crypto investors, and there is a need for a clear and feasible plan, rather than a coin-throwing. By luck rather than a long-term strategy, when you are lucky, you will come. Fast, but go too fast.)

in conclusion

In summary, it is important to identify the motivation of a person to participate in cryptocurrency. Is this because of the addictive upgrade? Or is it because you want to achieve measurable opportunities? Addictive upgrades often have an unrealistic goal or a lack of clear judgment. A measurable opportunity is an opportunity that has been evaluated and carefully planned, with available data support.

Both types of participants have valid cases that affect many people involved in cryptocurrencies, although participants are responsible for their own interests. If these interests are flawed, they are unlikely to gain extensive experience in this area. There is always a risk to counter the opportunity, but with a well-thought-out structured plan, it may have a chance to survive.

“Wise people seek not security, but opportunities. Once we try to find them, we will find them. You can measure the equal opportunity with a ruler that measures risk. They are together.” (Earl Nightingale)

Risk Warning : All articles in Blue Fox Notes can not be used as investment suggestions or recommendations . Investment is risky . Investment should consider individual risk tolerance . It is recommended to conduct in-depth inspections of the project and carefully make your own investment decisions.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Live capture, delete tweets, this mysterious Twitter account is onlookers

- Bitcoin computing power hit a new high, with an average daily trading volume of $2 billion. Analysts believe that price increases will follow.

- Facebook's WhatsApp plans to launch digital payment service in Indonesia

- Sharing algorithms is dangerous? Unless you have enough computing power

- Rethinking Zhu Jiaming's Speech: Two Levels of "Monetary Financial Hegemony"

- The market oscillated again, paying attention to ETH long-line layout opportunities

- Coinbase publicly acknowledges that 3,420 user information is threatened by registration vulnerability