How much selling pressure remains after the hacker account has liquidated 300,000 BNB?

What is the remaining selling pressure after the hacker account sells 300,000 BNB?Original | Odaily Star Daily

Author | Qin Xiaofeng

In the past few days, as the cross-chain bridge hack of BNB, Venus account positions have started to be liquidated, foreign encrypted KOLs have begun to focus on discussing the future trend of BNB. Pessimists believe that BNB may follow in the footsteps of FTT and collapse, and even compare the historical trends of the two, causing community panic. The following is shown:

- a16z Partner 4 Theories Driving the Creator Economy

- Taking speculation to the extreme? While everyone is obsessed with ‘personal stocks,’ friend.tech options contracts quietly go live.

- Enhancing user experience, reducing interaction steps, how can ‘intent-based transactions’ support the next wave of Web3 narrative?

The question is, how much selling pressure will BNB’s recent liquidation have on the market? To conclude, there is no significant impact. The liquidation of BNB positions on Venus is completely taken over by the BNB Chain team, and it will not be sold on the market, let alone a large-scale cascading liquidation.

The incident started in October last year when a hacker used a loophole in the BNB cross-chain bridge “BSC Token Hub” to steal about 2 million BNB coins. At that time, the price of BNB was $280, with a total value of about $560 million. Afterwards, the hacker deposited 924,821 BNB into the lending protocol Venus, borrowed about $152 million stablecoins (including $116 million USDT and $36 million USDC), and transferred them to other chains.

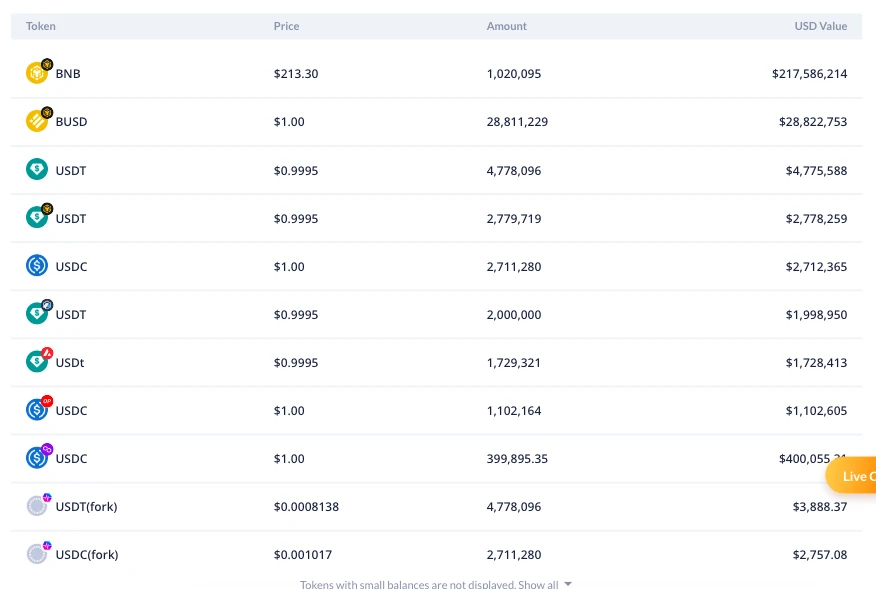

After the incident, BNB Chain immediately released a new version, BSC v1.1.15. This version can prevent hacker-related activities, and BNB Chain node programs can block stolen funds and potential attacks through blacklists and suspension functions. In simple terms, the assets in the hacker’s wallet address (the remaining 1.02 million BNB and other stablecoin assets) are restricted from being transferred. To some extent, the wallet assets are permanently frozen, and the hacker only actually stole a little over 900,000 BNB.

At this time, the only headache for all parties involved is how to handle the BNB assets that have already been used as collateral in Venus. Directly reclaiming and destroying them at zero cost means that Venus will have a huge deficit of $150 million, which the depositors of Venus obviously do not agree with. If the Venus protocol is allowed to operate independently and automatically sell at the liquidation price, a large amount of BNB will trigger cascading liquidation, further suppressing the price of BNB, which is also not in the best interest of Binance.

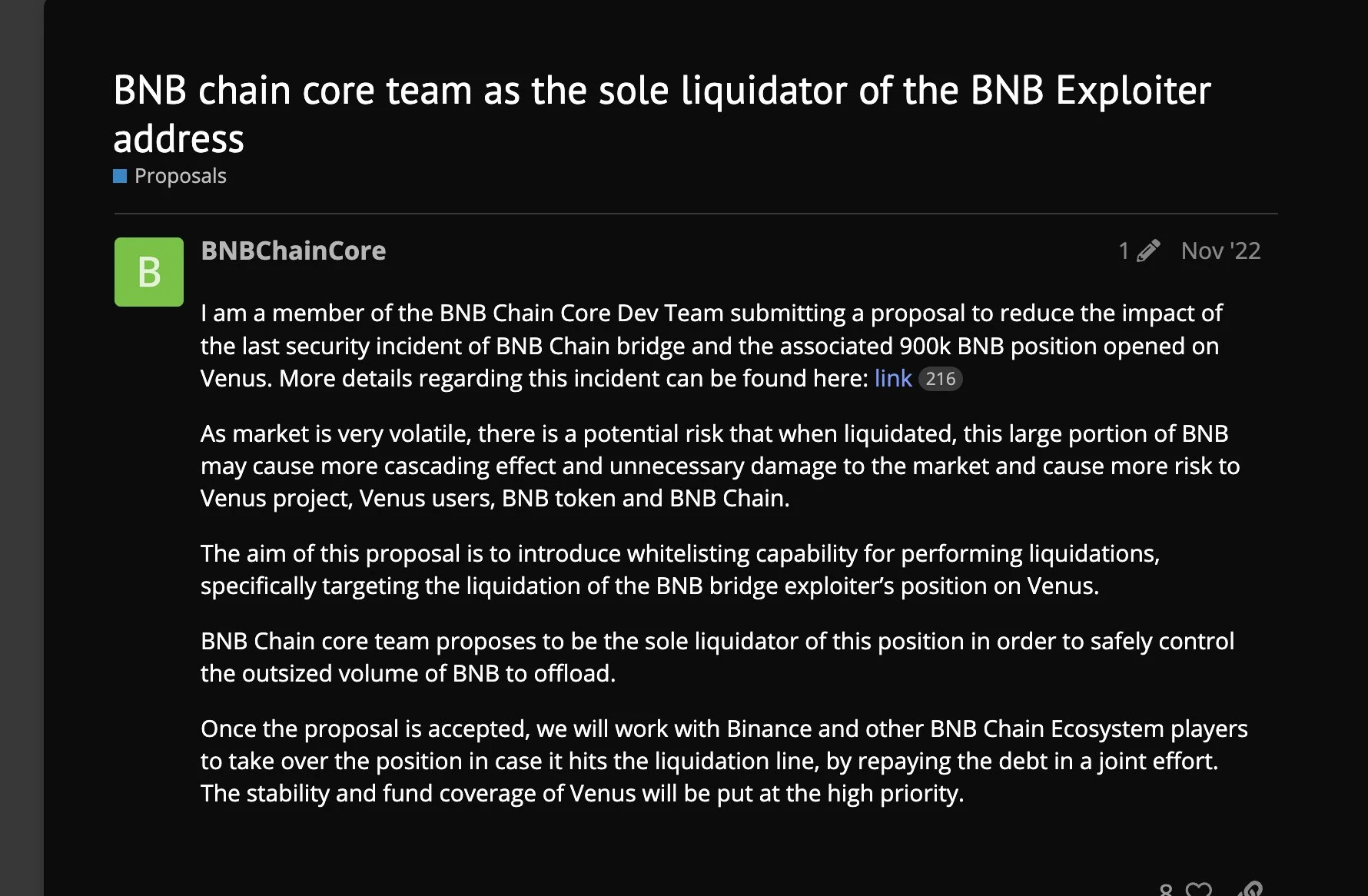

Finally, Binance decided to bear the loss and proposed a proposal called VIP-79 in the Venus community, which was approved. The specific content is: the whitelist addresses controlled by the BNB Chain core team will be the only liquidators of the positions, ensuring the safe control of this large supply of BNB to avoid cascading liquidation. And Binance also promised that the liquidated BNB will not be sold on the market, but will be destroyed after being reclaimed.

At that time, the liquidation price of the Venus hacker address’s BNB position was about 220 USDT, and the spot price of BNB approached this level. BNB Chain then transferred 30 million USDT to the whitelist address as backup liquidation funds to prevent short-term price crashes. Interestingly, in the following weeks, the price of BNB started to rise and even reached 400 USDT, moving further away from the liquidation threshold, and discussions about BNB liquidation pressure gradually decreased.

Until June 12th of this year, as BNB price continued to decline and approached the 220 US dollar liquidation line again, it attracted the attention of the cryptocurrency community. BNB Chain once again replenished 30 million US dollars in stablecoins to face the challenge. This time, the BNB price remained resilient around 220 US dollars and began to rebound, avoiding liquidation once again.

Until August 18th, with the significant pullback of BTC price, the BNB price finally broke through 220 US dollars, and the BNB position in the Venus hacker address began to be liquidated (health factor below 1). On-chain data shows that on August 18th, a total of 6.7431 million vBNB (Venus BNB) were liquidated, and BNB Chain addresses paid over 30 million US dollars to recover about 140,000 BNB. At this time, the liquidation price of BNB dropped to around 211 US dollars, and there were 784,615 BNB remaining in the hacker address. As shown below:

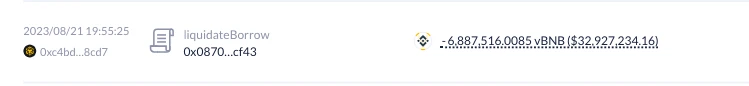

On the evening of August 21st, when the BNB price fell below 211 US dollars, it triggered another liquidation, and a total of about 6.88 million US dollars worth of vBNB were liquidated. BNB Chain addresses once again paid over 30 million US dollars to recover about 156,200 BNB. As shown below:

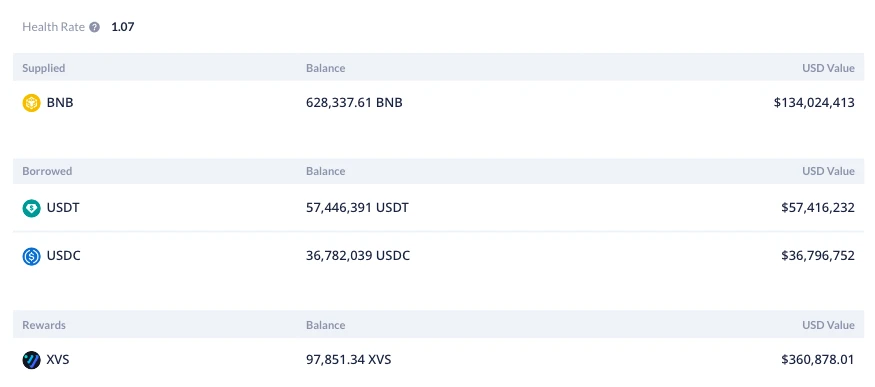

As of now, the remaining BNB balance in the hacker account is 628,337 BNB, and the health factor of the Venus account has returned to 1.07. According to estimates, the next round of liquidation price is about 199 US dollars, while the current BNB price is 213 US dollars, which needs to drop by 6.5%. The borrowing amount of this account is about 94.21 million US dollars, and the breakeven point between debt and collateral is about 150 US dollars. In other words, as long as BNB stays above this price, Venus will not incur financial losses.

Overall, in the past few days, BNB Chain has paid 60 million US dollars to recover 296,400 BNB, which has had a relatively small impact on the market. The BNB price has dropped from a low of 220 US dollars to 203 US dollars, with a maximum decrease of 7.7%. Currently, the BNB price has only dropped by 3.1% from the 220 US dollar level on the 18th, while the BTC price during the same period has decreased by 2.3%.

However, with the agitation of interested parties, BNB seems to have become a doomsday twilight, even the second FTT. In fact, the situation Binance is facing is not at the same level as FTX at all: FTX caused a shortfall of tens of billions of dollars through misappropriation of assets, while Binance only liquidated $150 million of hacker debt, and the process was transparent and open throughout.

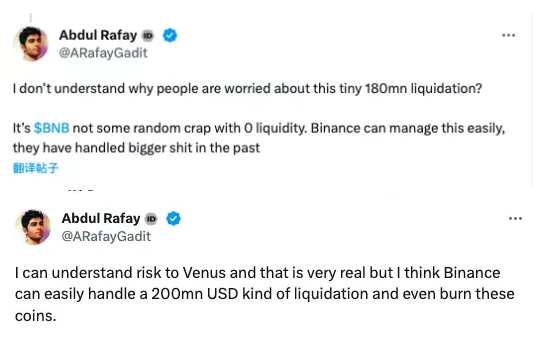

“I don’t understand why people are worried about this small $180 million liquidation. BNB is not some random garbage with zero liquidity, Binance can easily handle this issue, they have dealt with bigger things in the past. I can understand the risks Venus is facing, but I think Binance can easily handle the liquidation of nearly $200 million, or even destroy these tokens,” commented Abdul Rafay, co-founder of the cryptocurrency investment platform Zignaly.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Wreck League Research Report Bored Apes Teams Up with Animoca to Create a 3A-Level PVP Fighting Blockchain Game

- Analyzing Friend.Tech from First Principles

- Attracting 100,000 users in a month and ranking third in terms of protocol income, how much longer can the decentralized social application Friend.tech stay popular?

- OPNX Development History Tokens soar by a hundredfold, becoming a leading bankruptcy concept?

- Weekly Announcement | OKX platform upgrades KYC process and recommends users to complete advanced authentication; Avalanche (AVAX) will unlock tokens worth approximately $100 million.

- LianGuai Daily | The SEC files a motion for intermediate appeal regarding the Ripple case; friend.tech completes seed round investment, with LianGuairadigm participating.

- Content Marketing Methodology A Required Course for Web3 Startups