Data | Traditional investment institutions compete in the blockchain field, nearly half flow to tool application projects

2017 is a year of blockchain boom, and it is this year's bull market that has led many traditional institutions to focus on a new area: blockchain. At the beginning of 2018, Shengjing also pushed the digital asset market to a climax. Although it experienced the cold winter of 2018, some of the big men left the scene, but they also precipitated and screened various projects in the impetuous market. With the recovery of the blockchain industry this year, traditional institutions have begun to re-examine the core values of blockchain technology, seeking to find truly valuable projects and promote technological and financial development.

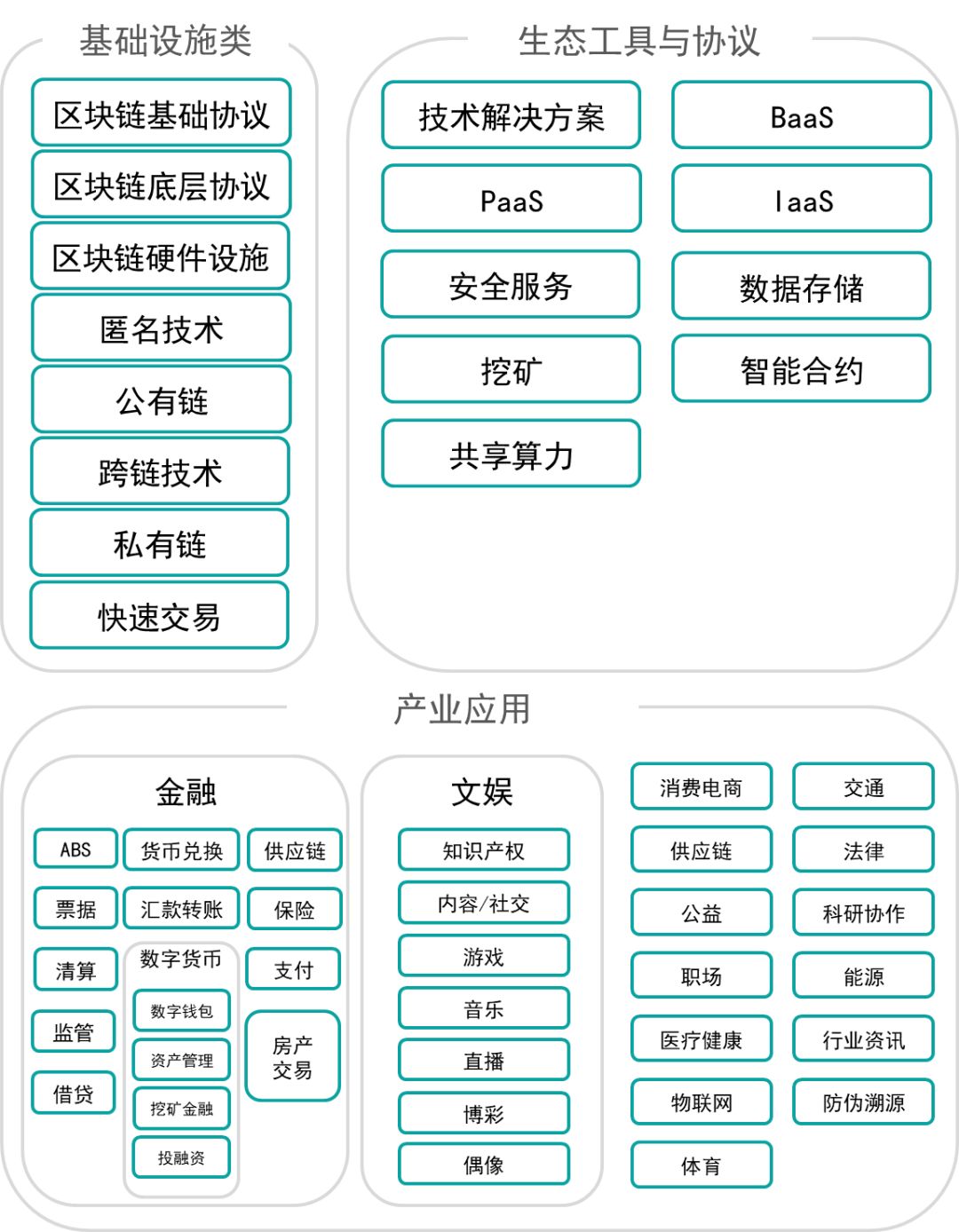

I. Overview of the blockchain industry chain

Blockchain technology is an integrated application of distributed data storage, point-to-point transmission, consensus mechanism, encryption algorithm and other technologies. In recent years, it has become a hotspot of research and discussion by many international organizations and national governments, and the industry has also increased investment. At present, the application of blockchain has extended to many fields, triggering a new round of technological innovation and industrial transformation.

Figure 1 Blockchain industry chain map source: 36氪 and network data

- Who is the most dangerous in the encryption market? Tether!

- July 29th market analysis: the needle market reappears, the market will stop falling?

- Bakkt was confirmed in the third quarter, and the super bitcoin bull market is really coming?

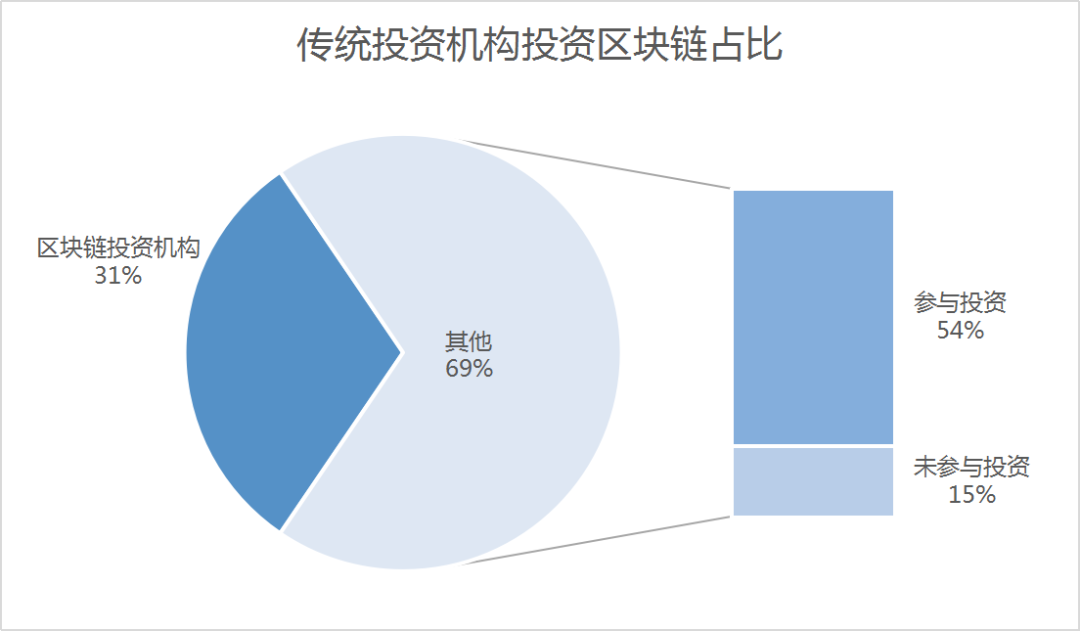

Second, the admission of traditional investment institutions

According to incomplete statistics, there are currently more than 630 traditional institutions involved in blockchain project investment in China (this does not include traditional institutions that have investment intentions for blockchain projects but have not yet invested), if only concerned about blockchain The field, or whether it is signed with the blockchain project, will make this data even more impressive. Here, we select 213 of the domestic investment institutions (including blockchain investment institutions and traditional investment institutions) in the blockchain field as samples (in terms of investment quantity >=2), among which there are probably blockchain industries. There are more than 147 traditional institutions with investment intentions, and 115 traditional institutions have participated in blockchain investment, accounting for 54%.

Figure 2 Traditional Investment Institutions Investment Blockchain Occupation Source: Network Data Sorting

Among them, there are many famous traditional investment institutions, such as China Merchants Venture Capital, Danhua Capital, Zhenge Fund, IDG Capital, Jingwei China, Sequoia Capital, etc. Most of these famous traditional investment institutions are late to enter the block. The investment in the chain project is more cautious. Although the investment amount of the blockchain project accounted for a relatively high proportion in the previous two years, the investment quota and the total investment amount were not high.

In addition, since the end of last year, traditional institutions have slowed down investment, and most institutions have only participated in investments of no more than five projects. On the one hand, because the blockchain industry was too impetuous and fluctuating too much last year, the various projects are difficult to distinguish between good and bad; on the one hand, because the national policies and attitudes are not too clear, and they are afraid of affecting the reputation and future development of the organization itself. . On the other hand, investment institutions with less visibility or short set-up time may lead to a relatively high proportion of blockchain project investment due to the small total investment, but it can be seen that these institutions will block The chain industry is an opportunity to take this opportunity to make a difference.

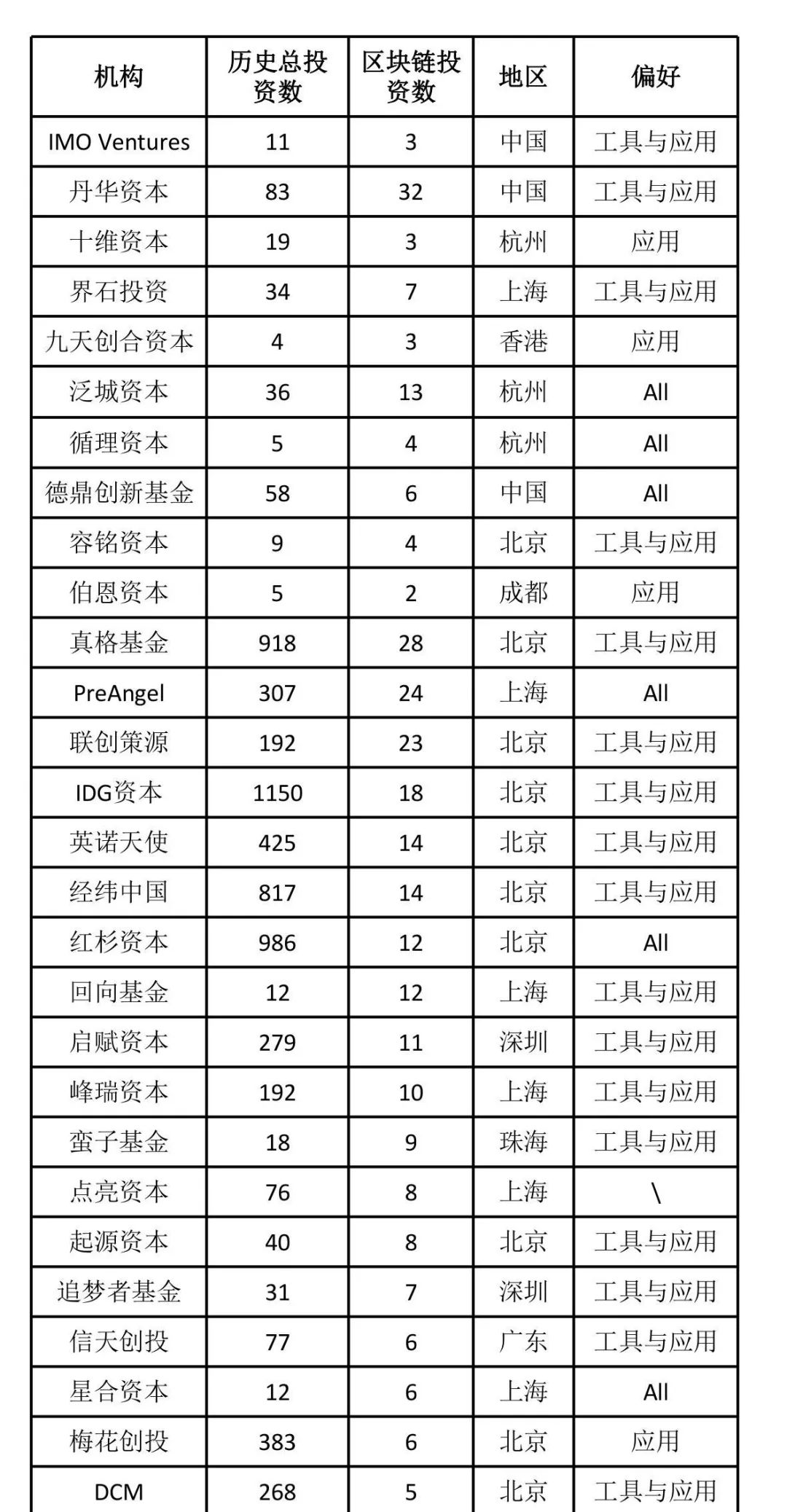

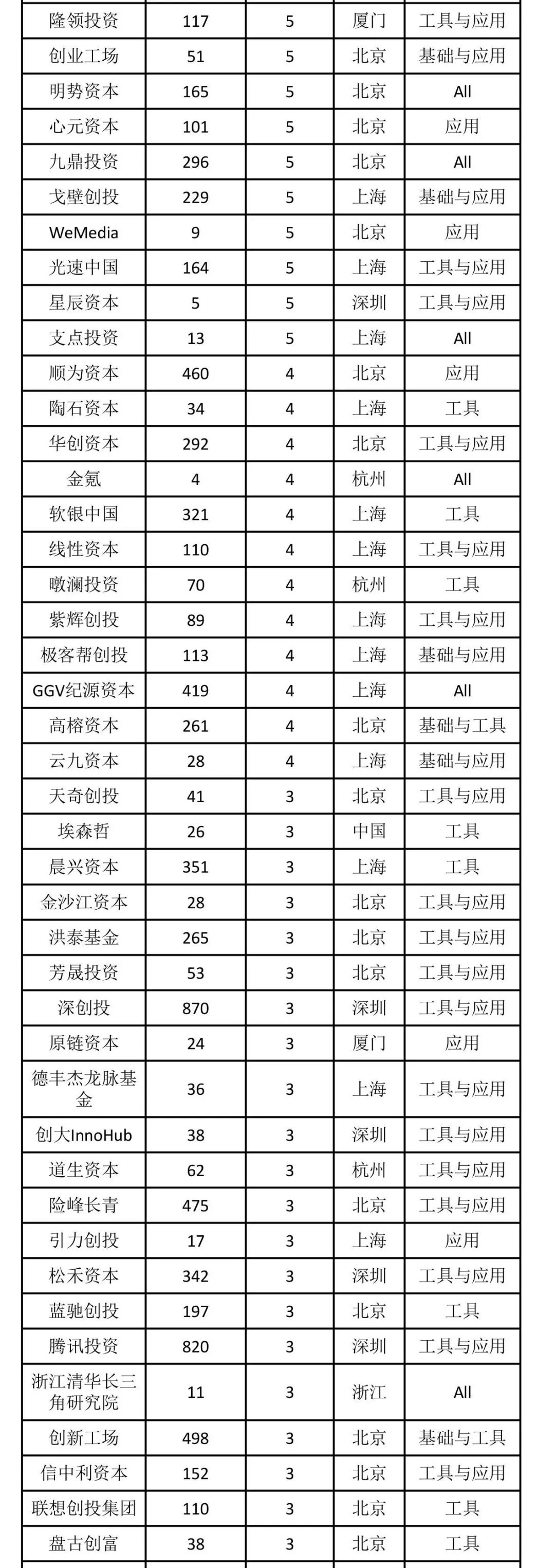

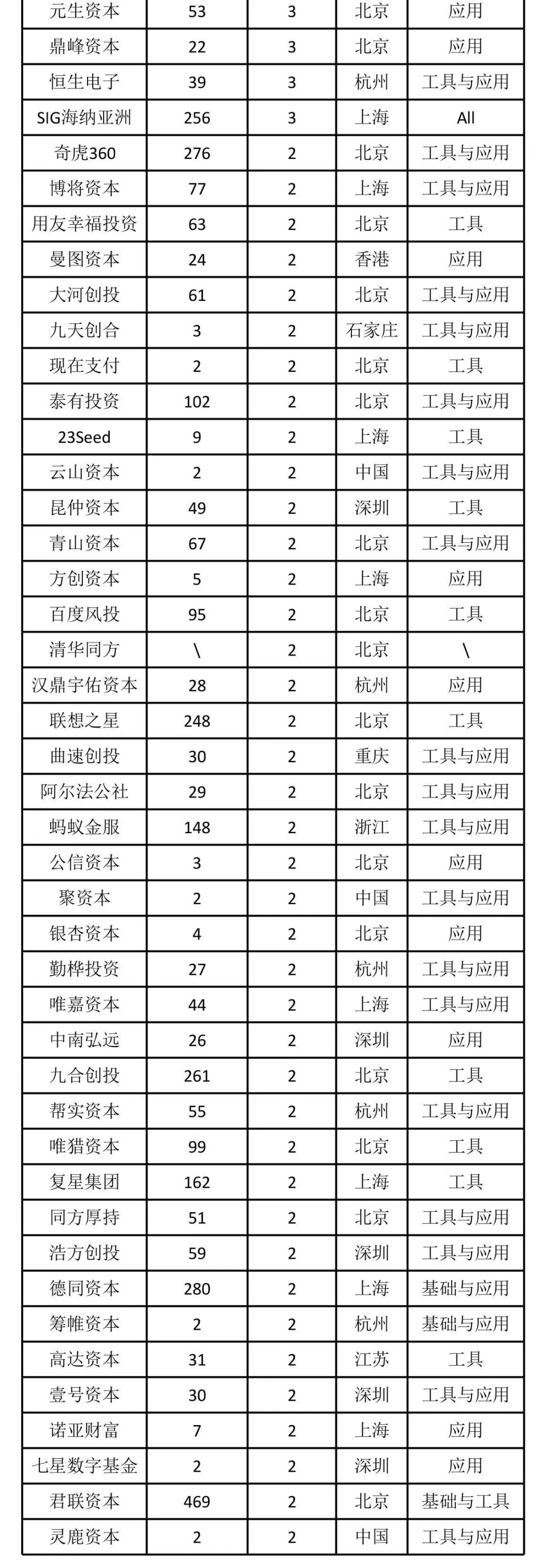

Table 1 Number of investment blockchain projects of traditional Chinese investment institutions

Source: IT oranges, unicorn data and network finishing

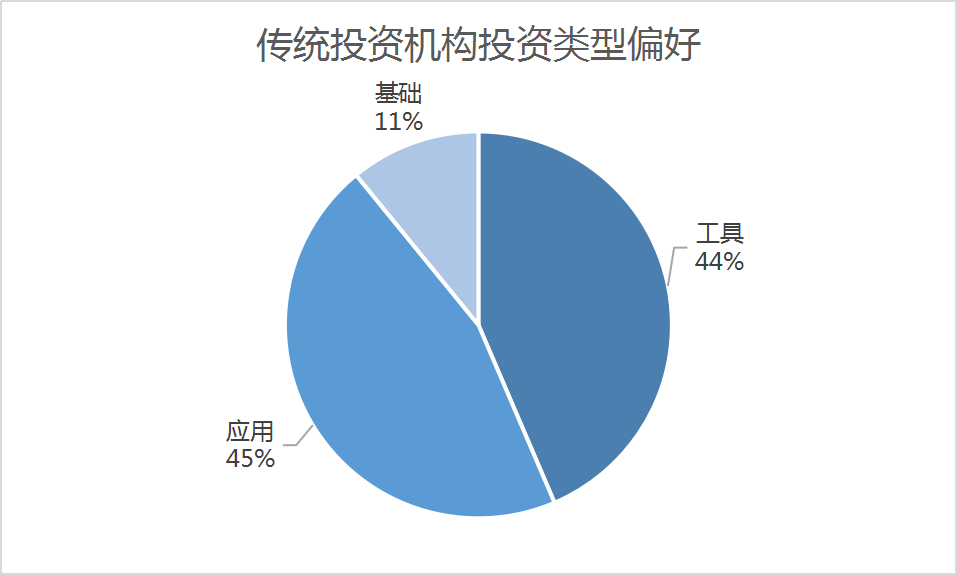

From the perspective of investment project type preferences, traditional investment institutions are generally biased towards investment tools and application projects. Judging from the 115 traditional institutions involved in the investment, according to incomplete statistics, about 551 blockchain projects were invested. Among them, the proportion of investment in applications and tools projects is close to half, while the projects in the basic category account for only 11%. It can be seen that the blockchain industry investment that has experienced the downturn generally favors tools and application projects, which is consistent with the results of previous China's overall investment institutions.

The reason is that on the one hand, the infrastructure such as the public chain has higher requirements on technology and is difficult to implement; on the other hand, because the investment institution's expectation time for the capital return cycle is shortened, and the tools and applications are landing quickly, the user participates. The activity is relatively high.

Figure 3 Traditional investment institutions investment type preference source: network finishing

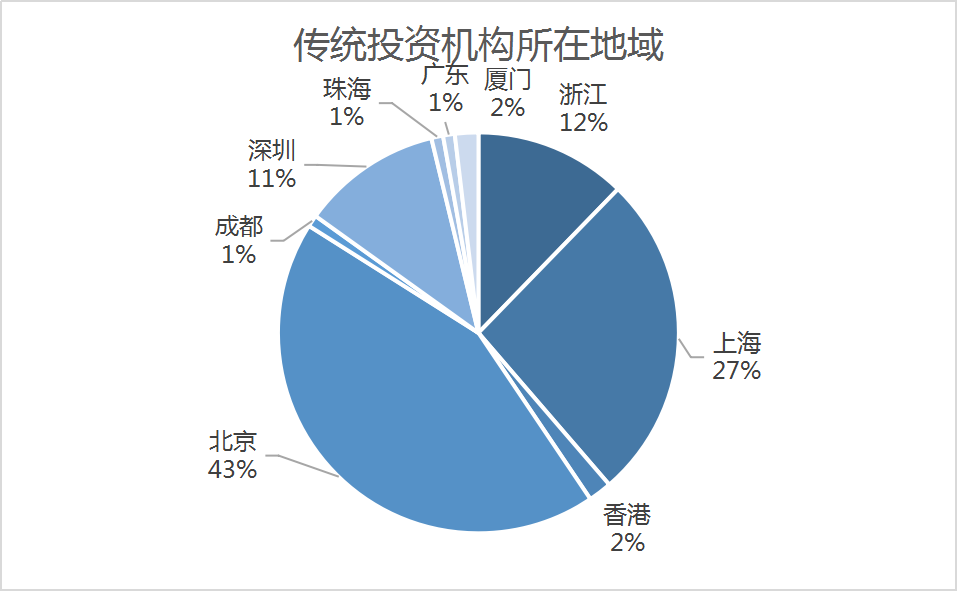

From the perspective of the location of investment institutions, traditional investment funds in Beijing and Shanghai are more active, and attitudes towards blockchain projects are more positive and optimistic. Among the 116 traditional institutions involved in blockchain investment, apart from the seven institutions registered in China, there are about 46 in Beijing, accounting for 43%, close to half of the total number of investment institutions; there are about 28 in Shanghai. The proportion is about 27%, which is the second most active area after Beijing; Zhejiang and Shenzhen are ranked 3 or 4, and the number is more than 10; in other areas, there are no more than 2, which is relatively dull.

Figure 3 Location of traditional institutions: Source

From the perspective of the investment target area, domestic traditional investment institutions, especially small and medium-sized institutions, are more inclined to invest in domestic blockchain projects, and are mostly in Beijing and Hangzhou. Although it will also invest in foreign projects, it may be because most of the large-scale traditional investment institutions and foreign investment institutions occupy a quota, so the remaining investment share is not much; on the other hand, because of the domestic district The blockchain is still in the stage of trial development. Small and medium-sized traditional investment institutions hope to improve the blockchain layout of the entire institution by investing in domestic projects.

From the perspective of investment rounds, most of the investment takes place in Angel Wheel, Round A and strategic investment. It can be seen that the industry is still at a very early stage. Most of the projects that have been invested have only one initial product framework or the products have been in operation for some time. Only the angel wheel project of Idea is more cautious. After a less optimistic 2018 downturn, investment institutions' investment pace has gradually slowed down, but they do not want to miss the blockchain industry, so most of them have adopted strategic investment layout.

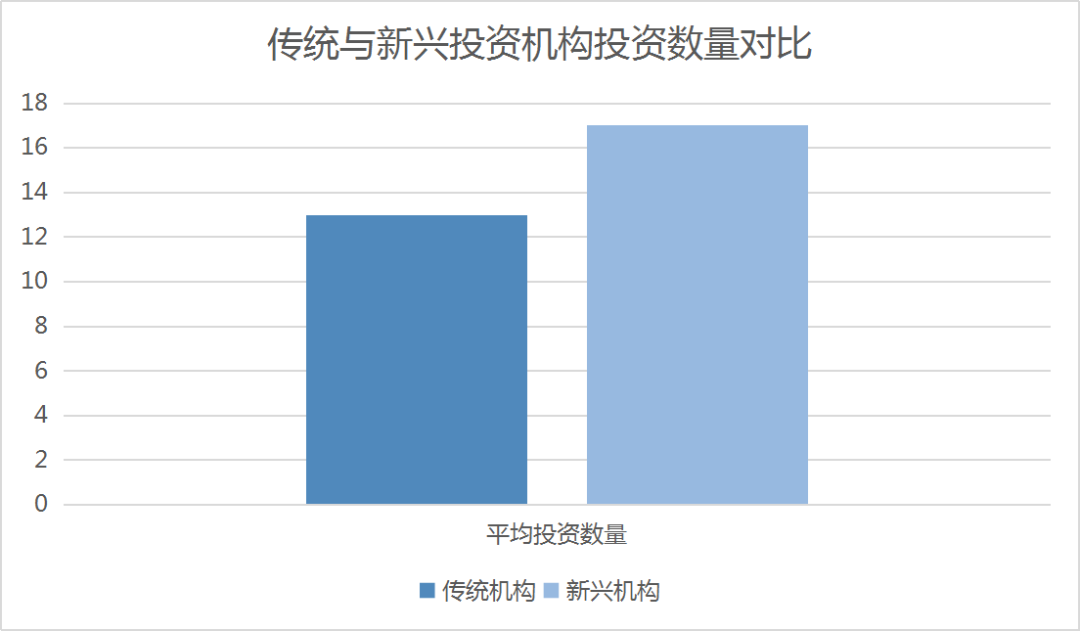

In terms of investment activity, although the emerging investment institutions focusing on the blockchain are more active and active than traditional investment institutions, there are more blockchain projects for investment, but on the one hand, the investment institutions that focus on the blockchain originally only pay attention to this one. On the track, multi-project investment may have the opportunity to win more investment returns for the organization. On the other hand, investment institutions that focus on the blockchain industry have great enthusiasm and high faith in the industry. It is recognized that the rapid development of blockchain technology can bring them considerable returns.

Figure 5 Comparison of investment in traditional and emerging investment institutions Source: Network data

These two points have little restriction on the existence of traditional institutions. There is not much restriction on the track invested by traditional institutions. There is no need to gamble all the return on investment in the blockchain industry. The funds can be dispersed in different tracks to reduce risks. On the other hand, traditional investment institutions The enthusiasm and belief of the blockchain industry are not very high. The investment in the blockchain project is mainly due to the fact that the blockchain concept has caused more and more large companies to enter the market. The investment institutions hope to have their own in the blockchain industry. The layout, occupying a place. In addition, the traditional track has been slightly depressed in recent years, which has led traditional institutions to hope to find a higher return on investment and new fundraising methods in the blockchain field. It also hopes to incubate unicorn companies in this new field. . But relatively speaking, traditional investment institutions appear to be relatively conservative in the overall economic downturn, and are in a tentative attitude.

Author: Ling think tank up

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Lightning Labs Releases Lightning Network Monitoring Tool for User Visualization

- [07.28] Waterfall and waterfall, where is the bottom?

- Bitcoin plunged 600 dollars in short-term, it was the main opportunity to flee

- The United States wants to make money in abandoned bitcoin, and the exchange may face litigation?

- Staking has a wealth of money: an average of about 7% per year. There are many new ways to play.

- Please ridicule our coins

- V God intends to let Ethereum marry BCH and is planning to enhance privacy. Will ETH sidechains and anonymous coins tremble?