Research Report | Blockchain Economics Panorama and Future: Exchange Compliance

Author: BlockVC industry research team

Source: BlockVC

Editor's Note: The original title is "Postal Chain Economic Panorama and Future: Exchange Compliance | BlockVC Research"

business background

In the production (or distribution) and circulation of the entire crypto-asset sector, mining machine manufacturers and exchanges are well-deserved core service enhancers. The former, by providing “production” tools for miners and even personally participating in mining activities, The circulation of coins has taken great benefits in the early days. The typical representative is Bitcoin. The latter has become the main trading and circulation place for mineral coins and non-minerals. Through the monopoly of the trading market, it obtains excess returns. The typical representative is the large encryption assets. Exchange. In comparison, mining machinery has high technical barriers, high participation thresholds, and does not cover all types of cryptographic assets. Therefore, its importance, popularity and visibility in the field of cryptographic assets are far less than those of exchanges.

- Babbitt Column | Digital Sterling: The Vision and Heart of the Financial Technology Story

- User Experience Survey: What is the next wave of DeFi users?

- People's Network Review "Analysis of Blockchain" 2: How to occupy the commanding heights of innovation

The popularity of the number of exchanges in the field of encrypted assets can be seen from the following data. Up to now, according to the incomplete statistics of the famous encrypted stock data website Coinmarketcap, the total market value of the encrypted asset market is about 220 billion US dollars. A total of 296 global digital asset exchanges have been included, providing 20791 trading markets for 3021 encryption assets worldwide. The type of encrypted asset is close to 1:10.

Compared with the traditional stock market, China's A stock market value exceeds 55 trillion yuan, there are three stock exchanges in the mainland, Shanghai Stock Exchange, Shenzhen Stock Exchange and the national stock transfer system ("New Third Board"), of which Shanghai Stock Exchange There are 1570 listed stocks, 2221 stocks in Shenzhen Stock Exchange, 9201 listed companies in “New Third Board”, and the average exchange and stock ratio is 1:4330. After eliminating the New Third Board, the ratio of exchanges and stocks is about 1:1895; According to the US stock data of Tiger Securities, US stocks are the world's number one stock market, with a total market capitalization of about 30 trillion US dollars, a total of 5,744 stocks, the trading volume is mainly concentrated in the three major exchanges of NYSE, Nasdaq and AMEX, a rough estimate of the exchange The ratio of shares to stocks averages 1:1914.

Obviously, the density of exchanges in the field of crypto assets is much larger than that of traditional financial markets. The crypto-asset field has such a dense distribution of exchanges. On the one hand, it shows that the exchange's business profit is considerable or the profit expectation is high enough. On the other hand, it also shows that the crypto-asset industry has lower trading thresholds. One of the important reasons is the degree of compliance. Generally not high. According to an inaccurate statistical report in the industry, the proportion of compliance transactions in the entire crypto-asset industry is extremely low, and the proportion of compliance transactions is only 14% (216 surveys). This article will conduct an in-depth study of the compliance laws and regulations and related ecosystems of crypto-equity exchanges around the world, with a view to providing an important guiding role for the exchange compliance process.

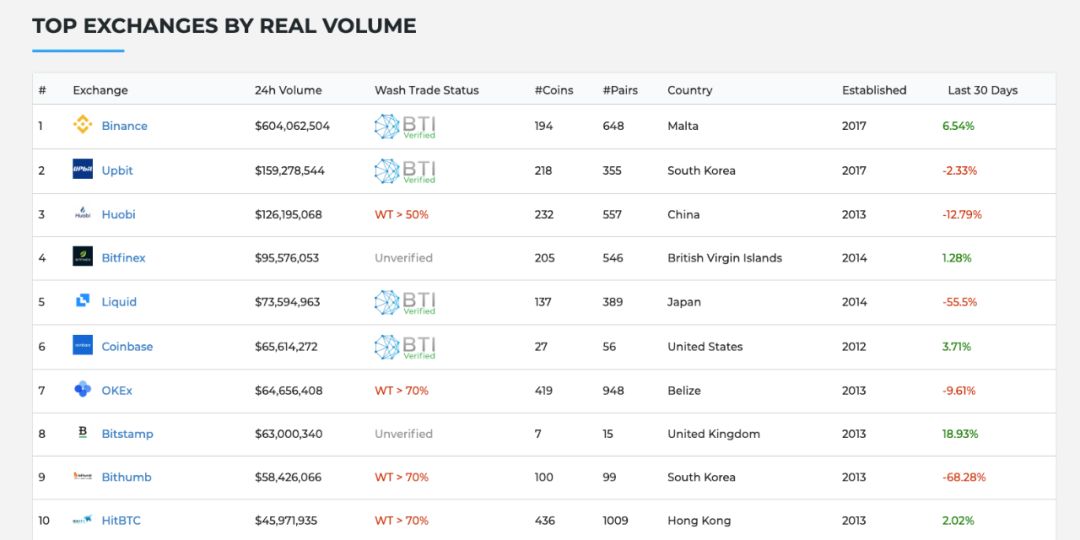

Global exchange real trading volume TOP10 and country distribution

(Data source: Blockchain Transparency Institute, where OKEx has moved to Malta)

Exchange Future Trends: Compliance

Since the birth of Bitcoin in 2008, the types and scope of cryptographic assets have been greatly improved. Up to now, according to Coinmarketcap data, there are at least 3,000 digital assets in the world, and the entire crypto-asset industry has spread to all Internet coverage in the world. Country and region. At the same time, the global regulatory system of the crypto-asset industry is becoming more and more clear. In order not to stifle financial innovation, although the current regulatory policies vary from country to country, it has basically formed a traditional licensing system, sandbox supervision and industry self-discipline. Dynamic integrated regulatory system.

In all aspects of cryptographic assets, because most of the information on the chain has serious identity information missing, but the transaction, circulation and custody of these assets occur in the centralized exchange, so by directly on the centralized exchange Key compliance regulation is undoubtedly the most effective and reasonable regulatory approach. Obviously, with the development of the crypto-asset industry and the continuous expansion of its influence, the compliance supervision of the exchange will become the core link of the entire industry supervision.

Compliance has become an inevitable trend in crypto-equity exchanges. Currently, crypto-equity exchanges around the world are actively deploying compliance, including the following:

- A traditional financial background exchange. The background of such exchanges originates from traditional financial institutions and often has unique advantages and resources in terms of compliance. Typical representatives such as the Bakkt Futures Exchange (approved by the US CFTC) initiated by the ICE Group, the parent company of the New York Stock Exchange, Nasdaq E-investment of the futures exchange ErisX and so on. In addition, SIX on the European Swiss Stock Exchange and Stuttgart, the second largest stock exchange in Germany, announced plans to launch a digital asset trading platform under the supervision of the authorities.

Exchange compliance basis: KYC and AML

In the exchange compliance process, KYC (Know Your Customer) and AML (Anti-Money Laundering) will become one of the most fundamental and important requirements in various compliance and risk control policies. Both AML and KYC are common means of risk control measures. Among them, AML is a series of means to ensure that the funds of the exchange are legal and to ensure the isolation of illegal funds in black or gray; and KYC means to fully understand the customer. Strengthen the information review and identity authentication of the account holder to achieve the purpose of risk control. KYC is usually one of the effective support methods for AML and anti-corruption, but KYC can also partially prevent risks from outside the exchange, such as identification of hackers.

KYC and AML are available in a variety of ways. Only KYC includes advanced technology such as real-name authentication, video authentication and live detection, while AML often needs support from the public security and anti-money laundering teams. Because in the actual exchange operation process, KYC and AML tend to raise the operating cost of the exchange and reduce the user experience. Therefore, how to establish a reasonable risk management policy, ensure the compliance and legality of the exchange users and funds. On the basis of this, as much as possible to improve the user experience has become one of the top considerations of the exchange. From this perspective, if it can ensure that the funds entering the exchange itself have a certain KYC and anti-money laundering pre-processing, then the operating costs of the two aspects of the transaction will be greatly reduced, and can also improve the user experience.

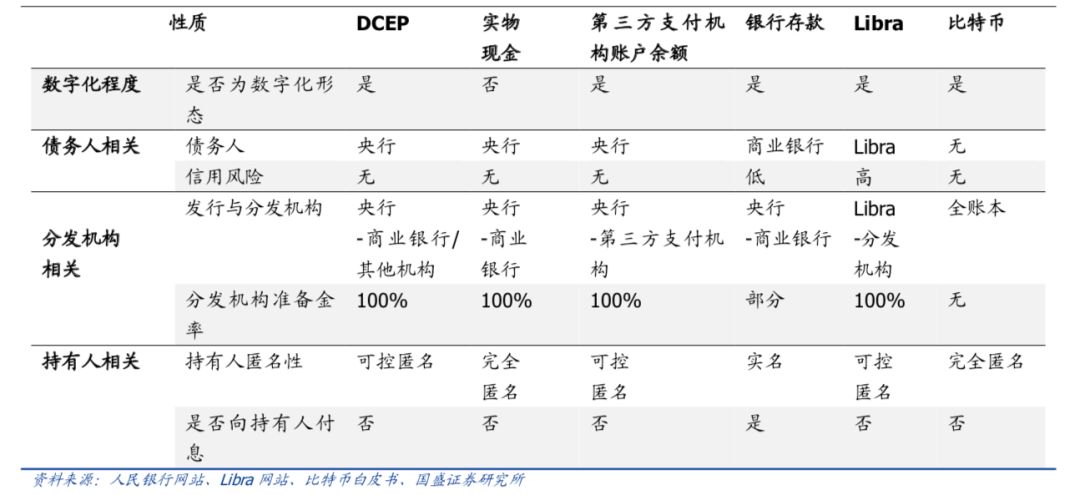

The central bank's digital currency may be one of the effective ways to resolve the above contradictions. Take the DCEP that the People's Bank of China has been studying as an example. Because DCEP is an encrypted electronic money system based on blockchain technology, it has the characteristics of 100% reserve, legal and controllable anonymity of the central bank, and information transparency is higher than cash. It can realize the real-time collection of data such as currency creation, accounting, and flow, which will make the fund itself have certain verifiability, low reconciliation cost and self-verification. Through the DCEP's targeted delivery function (such as freezing or restricting the transfer of illegal funds), the ability to “self-certify innocence” or even encrypted digital currency with certain authentication/restriction information will undoubtedly greatly reduce the accounting, KYC and AML of the transaction. The cost pressure on the aspect has further played a major role in counter-terrorism and anti-corruption.

Differences between DCEP and other monetary forms (Source: Cathay Securities Research Institute, Libra White Paper)

Global Exchange Compliance Regulation Overview

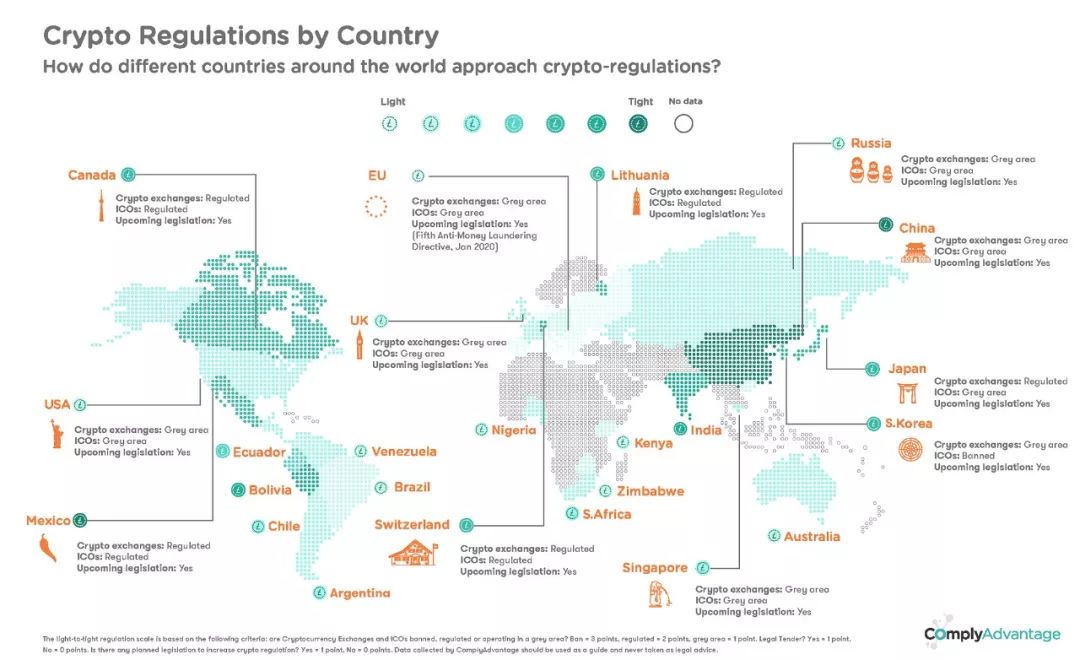

Up to now, although the world has not yet formed a unified international standard and consensus on the regulation of crypto assets, all countries in the world attach great importance to the emphasis on the new financial form of crypto assets. Up to now, countries such as China, the United States, Japan, South Korea, and Singapore all have their own management specifications for encrypted assets.

The compliance regulation of crypto-equity exchanges in some countries is as follows:

Global Encrypted Assets Regulatory Map (Data Source: ComplyAdvatage)

United States

In the United States, the authorities have a clear “multi-regulatory” pattern for the regulation of encrypted digital assets and exchanges, and the regulation is divided into two levels, the federal government and the state governments. The involved regulators include the Financial Crimes Enforcement Network (FinCEN) and securities transactions. Committee (SEC), Commodity Futures Trading Commission (CFTC), Currency Supervisory Authority (OCC) and State Treasury Authority (DFS). The relevant regulators have different definitions of cryptographic assets and have been included in different regulatory systems. Some examples are as follows:

Federal level compliance regulatory requirements

- Taking FinCEN as an example, although crypto assets are not considered legal tender, since 2013, FinCEN has included crypto-equity exchanges under the management system of money transfer service providers: exchanges and service providers of any cryptographic assets are required. Register as an MSB and establish an anti-money laundering mechanism to comply with AML and CFT regulations. In addition, the exchange also needs to obtain the corresponding state currency transfer license MTL (Money Transmitting License).

In addition, some crypto-equity trading platforms are required to be registered as an Alternative Trading System (ATS) under the SEC, and comply with the Rules 300-303 of Regulation ATS. Registered with the SEC as a broker (broker-dealer) and a member of the self-regulatory organization (SRO). The broker qualification here means that individuals and institutions can register as brokers in the SEC and enter the Financial Industry Regulatory Authority (FINRA) system. Up to now, there are 91 approved ATSs.

- The Commodity Futures Trading Commission (CFTC) is a regulator of the US futures and options market, which has introduced the Commodity Exchange Act (CEA) to include cryptographic assets in the “Commodity” category. For market participants of cryptographic assets, participants who sell or provide related services are required to register with the CFTC and to meet different registration requirements under the CEA Act for different participants' activities.

In addition, the Financial Industry Regulatory Authority (FINRA), the Consumer Financial Protection Agency, and the Office of Foreign Assets Management have issued statements and guidance documents on cryptographic assets, emphasizing the risk of cryptographic assets and calling for related activities on cryptographic assets. Comply with relevant laws and regulations. Currently, the US Department of Justice is cooperating with the SEC and CFTC to ensure that future cryptographic asset regulations can effectively protect consumers and achieve more simplified regulation. At the same time, the US Treasury is also in urgent need of developing regulations to combat criminal activities around the world and the United States. In January 2018, the US Treasury Secretary announced the establishment of a new FSOC working group to explore the growing market for cryptographic assets.

State level compliance regulatory requirements

Map of regulatory attitudes of crypto assets in US states (Source: Finance Magnates)

The New York State Financial Services Authority (NYDFS) officially implemented a series of regulations covering cryptographic assets activities in New York State on June 24, 2015. Regulations require that any institution that engages in the activities of cryptographic assets (transport, custody, storage, control, management, distribution, trading, and redemption) in New York State must hold a license, including BitLicense, which is located outside of New York State but is resident in New York State. The institution that provides the service. Applying for a license requires submitting a detailed activity briefing, background information for the operator and agency to the State.

As of July 1, 2018, the State of New York issued licenses to seven companies: Coinbase, Circle, Ripple, Bitflyer USA, Square, Xapo, Genesis; and two franchises, Gemini Trust and Paxos Trust.

In addition, depending on the company's specific situation, some companies engaged in cryptographic asset-related activities in New York must hold both BitLicense and MTL (Money Transmitter License/Charters).

In addition to the State of New York, states such as Washington State and North Carolina have clearly stated that the transfer of encrypted assets is a currency transfer and is subject to the corresponding currency transfer regulations. If you need to engage in cryptographic assets related businesses in the United States, you must apply to the states for various business qualifications and licenses under the laws of each state.

2. Japan

In 2014, Mt.Gox, the world's largest cryptocurrency exchange, was stolen with 850,000 bitcoins (in Japan). Since then, the Japanese government has begun to regulate encryption assets. The Financial Services Department set up a research team and issued a report recommending the establishment of an exchange registration system to prevent money laundering and protect users. In June 2016, the Japanese National Assembly passed the “Fixed Funding Algorithm Correction” (effective on April 1, 2017), which proposed a series of regulatory requirements for the operation and management of the crypto-equity exchange, and also managed the cryptographic assets instead of The exchanged services, such as the encrypted asset wallet, are also included in the business scope of the encrypted asset exchange business, and are subject to the “Fixed Funding Algorithm Correction Case”. Part of the bill includes:

- Strict exchange registration system

Based on international requests for anti-terrorist funds and anti-money laundering, Japan introduced the exchange operator registration system to protect users from user privacy protection, asset security management and anti-money laundering. The system was implemented in April 2017. .

Under the “Fixed Funding Algorithm Correction Case”, only the operators registered with the local financial authorities are allowed to operate the business related to the digital asset exchange. The operator must be a joint stock company or a “foreign encryption asset exchange business” that resides in Japan and has an office in Japan. The examination and approval will be carried out by the Financial Services Department, and the approval will be passed.

As of December 2017, the Financial Services Department issued a total of licenses to 16 exchanges. Coincheck lost $400 million worth of NEM on January 26, 2018. The Financial Services Agency launched a survey of Coincheck and issued a rectification order for seven exchanges. Since then, Zaif has had a serious incident of stealing money, a new license. The issuance was suspended.

In 2018, the Financial Services Department also established a new research group to study the exchange business / ICO, and laid the foundation for the new regulatory policy of 2019. In March 2019, a total of three new new licenses were approved, giving Coincheck, Rakuten Wallet and IIJ. 2019 is widely seen as a year of warmer regulation in Japan, and more exchange licenses are expected to be issued.

- New regulations for exchange operations

The “Financial Statement Algorithm Correction Case” requires the Exchange to establish strict security system protection information. If it is necessary to outsource the business, measures must be taken to ensure that the business is properly implemented. The Act also requires the Encrypted Asset Exchange business to provide its customers with information about fees and other contractual terms. In addition, crypto-equity exchanges must separately manage user funds or cryptographic assets and must be reviewed by a certified public accountant or accounting firm.

The exchange must strictly implement KYC, maintain good transaction records, report suspicious transactions, and submit annual reports to the Financial Services Department.

If the exchange no longer meets the requirements or there is a violation of the "Finance Algorithm Correction", it will accept a strict review from the Financial Services Department. Those who do not pass will be suspended from business operations or even revoked.

- Currency review system

In March 2018, the Financial Services Agency approved the establishment of the Japan Encrypted Asset Exchange Association, referred to as JVCEA (Japan Virtual Currency Exchange Association), as a private entity for encryption assets. All licensed exchanges are added to the local government. The association aims to ensure that the exchange conducts business under the scope of the “Funding Algorithm Correction Case” to protect user rights and promote the healthy development of the encrypted asset exchange industry. At present, the Japan Financial Services Agency has instructed JVCEA to be responsible for the examination of the currency, while the major exchanges are sponsors and have the qualifications for recommendation. The JVCEA review can be conducted on the Japanese exchange.

In addition, the income from trading crypto assets in Japan is considered to be “multiple incomes” rather than “capital income” and is included in the taxation scope.

3. South Korea

The Korean people are enthusiastic about crypto-equity transactions, trading volume is second only to the United States and Japan, and even because of the hype of the Korean people, the phenomenon of “Kimchi premium” has been generated, and its price is higher than the international average. According to relevant reports, the total population of South Korea is about 50 million, and the number of investors in encrypted assets is 3.5-400 million, accounting for 8% of the national population. It is the third largest market after the United States and Japan. Based on the crazy investment and trading phenomenon of Korean crypto assets, the Korean government has adopted strict regulatory measures to combat money laundering and anti-fraud.

In January 2018, the Korean government announced that all transactions of encrypted assets must be conducted under the real-name bank account system, and the exchange must be strictly enforced. The real-name bank account system means that the crypto-asset retailer needs to sign a contract with the bank. The bank needs to check the retailer's management and network system before signing the contract, and the user must have the same bank's real-name bank account as the crypto-asset retailer. Top up trading funds. Banks and retailers need to check the user's bank account number and personal information. Anonymous users can extract encrypted assets but cannot refill the transaction funds.

In response to anti-money laundering, the Korea Financial Intelligence Unit (KFIU) has provided guidance on monitoring money laundering through encrypted assets, requiring further anti-money laundering review when the following conditions are met:

(1) When a trader deposits or withdraws 10 million won (about 9,400 US dollars) or more per day, or 20 million won or more per week;

(2) When a trader conducts five or more times a day, or seven (or more) financial (banking) transactions per week;

(3) When the trader is a company or organization;

(4) When a trader who does not have an encrypted asset exchange account deposit record withdraws most of the funds from the encrypted asset trading account in cash;

(5) When there are reasonable grounds to suspect that the trader will spread the transaction amount or the number of transactions to avoid being reported by financial institutions.

South Korea aims to ensure the normal development of normal transactions and the development of encrypted asset transactions through anti-money laundering, and will plan a tax system for encrypted assets.

4. Singapore

Singapore has adopted a positive regulatory attitude towards crypto assets. In 2017, MAS, the Monetary Authority of Singapore, issued the A Guide to Digital Token Offerings, which was updated the following year to increase the number. Regulatory norms for asset exchanges and securities financing. In 2019, MAS submitted the Payment Services Bill (PSB) to Parliament, requiring anyone to support crypto-equity transactions or exchange services to obtain a license, and to develop anti-money laundering/anti-terrorism risk aversion Measures have thus established a comprehensive "license system supervision" system.

5. Malta

Malta has adopted a positive embrace of crypto assets and blockchains. It passed three bills at the Malta meeting in 2018, becoming the world's first national law in the field of blockchain, crypto assets and distributed ledger technology. Yes: the Malta Digital Innovation Authority Bill (MDIA Act), the Innovative Technology Arrangement and Services Act (ITAS Act) and the Virtual Financial Assets Act ( Virtual Financial Assets Bill, referred to as the VFA Act). Among them, the crypto-equity exchange and the decentralized English platform are subject to the supervision of the ITAS Act.

ST and STO Exchange Compliance

ST, full name Security Token, securitization token. As the name suggests, ST is a token of value supported by traditional assets and equity. Its broad meaning means: any value system that is represented by blockchain technology and subject to securities law supervision. The so-called STO refers to the issue of securities issuance and fundraising by ST. It has both the ICO's token carrier and the IPO's securities issuance attribute, which is a transition between ICO and IPO. The platform for trading and distribution of ST (Security Token) is the STO exchange. But looking at global regulation, there is no specific regulation for ST issuance and STO exchanges. In regulation, general tokens are divided into functional tokens and securitization tokens, once they are attributed to securitization tokens. It is included in the scope of supervision of the securities law.

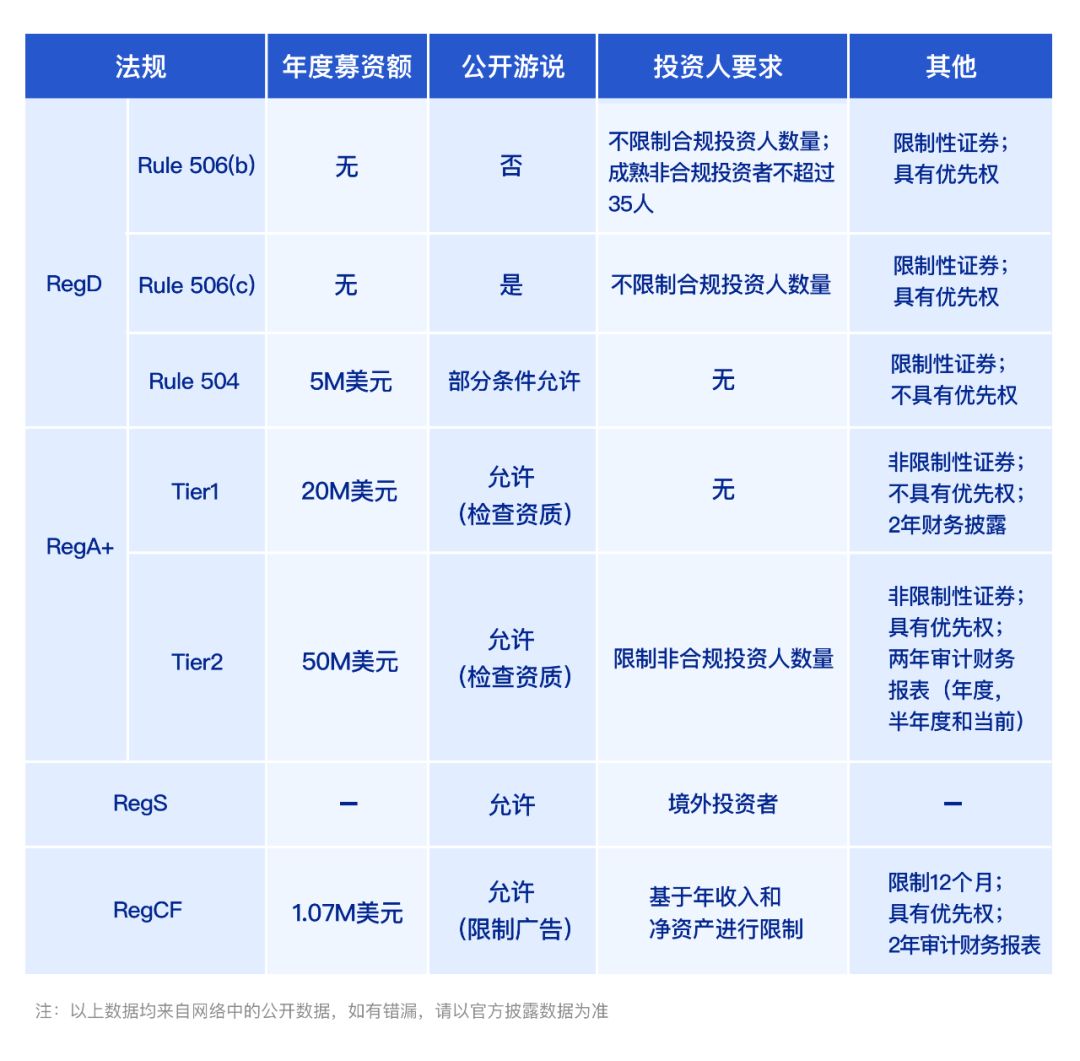

Take US regulation as an example. In the US securities laws, there are no clear rules or opinions on STO issuance regarding “registered securities issuance” and “exempted securities issuance”. The recognition of ST and STO relies on mature test methods like Howey Test. At present, the main compliance direction of STO issuance in the market is the exemption of securities issuance, that is, the RegA+, RegD, RegCF and RegS are satisfied to carry out fundraising and fundraising. Among them, RegA+, RegD, RegCF are issued and traded for exempt securities in the United States, RegA+ is for small IPO compliance, RegD is for private equity financing, and RegS is for securities issuance and sales outside the United States. The characteristics of the above exemption regulations are shown in the following table:

At present, most of the STOs on the market adopt RegD (506c). They have no financing limit and can publicly promote lobbying fundraising, but they can only be sold to qualified investors, and the issued securities cannot be traded in the market within 12 months. . For STO exchanges that serve securitized tokens ST (such as OpenFinance, tZERO, Sharespost, and Coinbase), most of them need to be registered with the SEC as an Alternative Trading System (ATS) and comply with alternative trading system regulations.

Compliance: The “Make the Way” for the Digital Asset Industry

With the rapid development of the industry and the maturity of the market, it is not just the giants of the trading platform that seeks compliance. Regardless of whether it is a regulatory agency or an innovative enterprise, there have been more and more compliance attempts and explorations in the direction of stable currency, asset custody, clearing settlement, and compliance securities issuing. From a market perspective, digital asset price performance experienced a roller coaster-like price volatility in just three years from 2017 to 2019, but bitcoin-led crypto assets are still far from the recognition of the mainstream society. In the case of the Bitcoin ETF, which is generally considered to be the next round of bull market tipping points, US regulators again rejected several Bitcoin ETF applications in October, citing the apparent and violent price manipulation in the bitcoin market. behavior. It is undeniable that on September 25, Bitcoin quickly smashed in a few minutes, and the performance of the highest 20% decline was the best footnote for price manipulation. Today, when ETFs are rugged with roads, and personalized derivatives such as Bakkt continue to emerge, we can't help but wonder what compliance means for the digital asset industry, especially the exchanges. Is it just the so-called "institutional admission" and "Going to the country"? Compared with the history of the development of the traditional securities market, what is the historical stage of the current digital asset trading ecology?

Since the birth of mature securities markets in various countries, they have experienced the process of unregulated and unregulated wilderness to the gradual establishment of regulatory compliance standards, and finally formed a standardized and complete regulatory compliance system. Take the US stock market as an example. The US securities market sprouted at the end of the 18th century, when the market share of many exchanges including the New York Stock Exchange was almost the same. But unlike other exchanges, the New York Stock Exchange has banned Ponze scam financing, which helped the New York Stock Exchange win in competition with other exchanges. The invention of the telegraph around 1850 strengthened the impact of the New York Stock Exchange on other regional stock exchanges. Other exchanges were rapidly marginalized and Wall Street became the center of US stock and securities trading. This can be seen as a future prediction of the digital asset exchange. The current situation of the coexistence of multi-platform giants is likely to undergo structural changes in the future due to technological advances and other reasons. At the same time, stocks gradually surpassed the national debt and became the most active variety in the exchange. Similar to the current digital currency market, the US stock market was almost purely a speculative market, and the corruption of the US government also contributed to the stock market at that time. Manipulation and plunder.

One of the founders of the New York Stock Exchange, then Assistant Secretary of the Treasury, William Dürr, was keen to use the status of government officials to manipulate stocks and became the originator of the market financial market manipulators, which showed that government officials used their power to profit from the market. The situation is not uncommon. The financial history book reads: "In the past century of stock exchange history, stock prices have not been released on a regular basis. Articles on listed companies are flooding, and they are generally false reports. The stock marketer’s masterpiece is Making news… In order to avoid risks, some investors only invest in other safer areas.” Like the digital currency market, the “stocking” and “match sale” transactions of US stocks at the time were very common. “Early New York The market can only provide a gambling venue for traders who have sufficient capital and leisure time to speculate on stocks." At that time, Wall Street had a number of so-called "robber barons" dedicated to stock market manipulation, such as Daniel Delu, Vanderbilt, and Jay Gould. These people openly profit for themselves by monopolizing stocks of listed companies, manipulating stock trading prices, and even bribing judges to change rules.

Marked by the victory of the US-Western Sea War and the First World War in 1898, benefiting from the second industrial revolution, the international status and comprehensive national strength of the United States have developed rapidly in the past few decades. The US stock market is also in full swing, but market manipulation and insider trading are still in the same situation. very serious. The development of the stock market was accompanied by frequent stock market panic. The government began to think about starting to regulate the stock market. During this period, Congress passed legislation to approve the Fed. The Clayton Act of 1916 passed, and the misconduct of financial oligarchy had to be Converging day by day. The prosperity established under market manipulation and disorder finally ushered in a great collapse in 1929. In August 1929, the US Dow Jones Industrial Average exceeded 380 points, and in 1932 the index fell to 42 points, a drop of nearly 90%. At the same time that the US stock market fell, a large number of bonds were refused, and about 40% of the US banks closed down.

After the Great Depression, the US stock market entered an important norm and recovery period. Despite the resolute opposition from the Wall Street interests, President Roosevelt resolutely pursued the New Deal and reconstructed the regulatory framework for the US securities market. Richard Whitney, then president of the New York Stock Exchange, was a pioneer in opposing regulatory compliance. In the golden age of US stocks in the 1920s, Whitney drew a lot of wealth, but when the government's top-down regulatory pressure combined with Haotian's public opinion, he finally surrendered and launched industry self-discipline behavior, making the transaction The committee passed a decree prohibiting the joint operation of the village, while also prohibiting special agents from revealing inside information to friends and prohibiting special brokers from purchasing options for the stocks they make. Financial manipulation has been banned step by step, and information transparency and investor protection of listed companies have become the subject of Wall Street regulation. In 1933, Congress had run the first national securities industry regulation "The Securities Act of 1933" after more than 100 years of operation in the US stock market, mainly regulating the information disclosure of securities issuers. The Banking Act of 1933 separates commercial banks from investment banking, and the status of the Federal Reserve Board is further strengthened, and a deposit insurance system is established. The Securities Exchange Act of 1934 was enacted, which defined securities manipulation and fraud, and the defense of securities in securities litigation was established, which greatly regulated securities trading behavior and contributed to the establishment of the Securities and Exchange Commission (SEC).

So far, through the government's comprehensive and rigorous legislation, the establishment of regulatory agencies and the industry's own clearing and self-discipline, the US stock market has flourished during the economic recovery period after the end of World War II, and its good trading environment has also allowed institutional investors such as post-war pensions. Gradually becoming the main force of the market, the value investment concept led by Graham has gained widespread attention in the standardized market. The above two reasons have finally become a solid foundation for the US stock market for decades. Today, US stocks have formed a compliance ecosystem of exchanges, brokers, brokers, securities regulators, and federal and state-level laws and regulations. From barbaric growth to rational prosperity, US stocks have created the most prosperous financial secondary market in human history for 200 years. Regulatory, regulatory, and institutionalization are the firm mainstays in their development.

Although Bitcoin originated from the password-punk mailing group, Ethereum began with a talented programming teenager. Encrypted digital assets are inherently characterized by decentralization and anonymity, but with the positioning of the Bitcoin electronic payment system gradually being valued and emerging. The diversion and replacement of alternative asset allocation projects, the compliance of digital asset markets and the stepping of traditional financial institutions are difficult to reverse. The bridge between the native encryption world and the traditional financial world is of great significance. It will be a mechanism for injecting and relocating funds and resources from the traditional world. The four engines of the industry compliance process are the compliance exchange, the compliance custodian, the securities digital assets issued by the compliance, and the compliance stable currency. These four items also correspond to the transactions and custody in the ecology. The four aspects of the issuance and liquidation of the underlying assets.

The emerging digital asset market, from the perspective of the underlying assets of the investment target, also faces various risks in the areas of asset issuance, asset custody, liquidity problems and asset settlement. In terms of current market conditions, both assets The issuance of endorsements, or the subsequent custody, liquidity and clearing settlements, all have a certain degree of deficiencies, preventing the further expansion of the market size, which is also the "asset custody +" launched by new players such as Bakkt, ErisX and LedgerX. The main reason for the transaction + clear settlement solution. We have reason to believe that the current situation in the ecological exchange will play a role in custody, matching transactions, asset liquidation, and asset selection. In the future, it will inevitably evolve from the top-down to the digital asset industry from traditional financial institutions. The industry's head platform itself seeks compliance and business evolution, and it will be the “impassible way” for the industry. In the possible separation and reorganization of the business, a number of new tracks will also be born in the industry, bringing new value and growth points to the industry and users. The brokerage track represented by TroyTrade this year is emerging in the market. Investment hotspots, and in the far future, with the further maturity of technology, the emergence of a central clearing network across exchanges will also become inevitable.

From the history of Wall Street, we can see that when the tide of compliance comes, the industry will inevitably experience deep and intense pains. When new rules of order and industry standards are established, the original encryption world and the traditional financial world will be" The book is the same as the text, and the car is on the same track. The blockchain technology and the pass-through economy can truly bring about changes in the production relationship for the society. The encrypted digital currency such as Bitcoin can welcome a large number of new institutions, and the blockchain can Really become the mainstream.

1.RegulatingCrypto Exchanges: Mind the Gaps, Forbes

2.TheComplete Crypto Regulatory Landscape, The Startup

3.CryptocurrencyRegulations Around the World, Comply Advantage

4.TheGood, the Bad, and the Ugly: Crypto Regulation in the USA, Finance Magnates

5.Pierre Villenave, "Understanding the RegulatoryFramework of Security Tokens", 2018

6. Blockchain – Preliminary Study of China Central Bank Digital Currency (DCEP): Goals, Positioning, Mechanisms and Impacts, Guosheng Securities Research Institute

7. Global blockchain industry panorama and trend annual report (2018-2019), Fire Coin Research Institute

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Why is the distribution of bitcoin fair?

- QKL123 Quote Analysis | The end of Bitcoin, Bakkt's ambition (1030)

- Where are you, my blockchain is back?

- The Central Political Bureau collectively learns the blockchain technology to transmit the signal? Interpretation of the former chairman of the China Securities Regulatory Commission, Xiao Gang

- Jia Nan Zhi Zhi will be listed in the US, what is the composition of the “blockchain first stock”?

- Deloitte uses zero-knowledge proof technology to improve the privacy attributes of its blockchain platform

- Infinite War in the World of Cryptographic Currency, ASIC and Anti-ASIC