Comprehensive interpretation of DeFi options: market overview, product model and potential protocols

DeFi Options: Overview, Models, and ProtocolsOriginal author: 0x Keyu, Original translation: Deep Tide TechFlow

Main Points

Given that the monthly trading volume of the overall cryptocurrency options is only 40 billion US dollars (the monthly trading volume of perpetual contracts is about 1.6 trillion US dollars), we may need another market cycle to make on-chain options significantly develop.

Currently, the futures trading volume of decentralized exchanges (DEX) and centralized exchanges (CEX) is about 2%. If we assume that the market share of on-chain options will reach a similar level to on-chain perpetual contracts, the expected trading volume of on-chain options should be about 800 million US dollars, which may not be enough to motivate market makers to make markets on-chain.

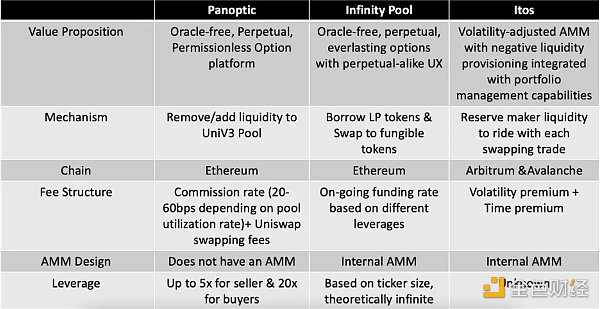

Derivatives that utilize centralized liquidity LP positions may be a solution to the liquidity problem, as there is already a large amount of liquidity present in centralized liquidity pools. These products (Infinity Pool, Blockingnoptic, Itos, Smilee, etc.) also provide significant product differentiation for CEXs, such as the ability to speculate on long-tail assets. The main challenge for them is to persuade centralized liquidity LPs to re-deposit their liquidity into their pools.

- Hong Kong Financial Secretary Paul Chan: There is no problem with the underlying blockchain technology of virtual assets.

- OKX will launch a signal strategy and has now opened a signal provider recruitment.

- Messari: Interpreting the Success of the Blur Airdrop Model from a User Retention Perspective

In the long run, I am bullish on on-chain option protocols based on CLOB (Central Limit Order Book), which first use off-chain order book matching and on-chain settlement similar to dYdX, and then gradually move the order book on-chain as the underlying blockchain infrastructure improves.

Overview of Options Market

In traditional finance, options are the most commonly used financial instrument. According to FIA data, the global exchange-traded derivatives (ETD) derivative trading volume (measured by the number of futures and options contracts traded and/or settled) increased by 34% from last year to a staggering $83.8 trillion. Options ($54.5 trillion) and futures ($29.3 trillion) trading volume accounted for 65% and 35% of the total trading volume, respectively, up 63.7% and 0.1% from last year.

Contrary to the situation in TradFi, where options trading volume is greater than futures trading volume, the current cryptocurrency derivatives trading volume is mainly dominated by futures: as of June 2023, the trading volume of ETH and BTC options (about 30 billion US dollars) is only equivalent to 2% of the futures trading volume (about 1 trillion US dollars). This may be due to the introduction of perpetual futures by Bitmex, which aggregates liquidity at the expiration date and achieves higher capital efficiency than traditional financial futures. Higher capital efficiency translates into better futures pricing, lower slippage, and higher leverage opportunities, catering to the risk preferences of cryptocurrency traders. For emerging asset classes like cryptocurrencies, capital efficiency is crucial because its liquidity starting point is not high compared to traditional stock markets. In the case of cryptocurrency options, the dispersed liquidity between expiration dates and strike prices leads to much lower trading volumes than cryptocurrency futures.

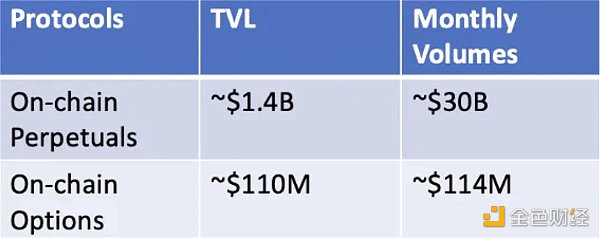

On-chain options account for only a small portion of decentralized finance (DeFi) derivatives trading volume and total locked value (TVL). Currently, the total TVL of on-chain derivatives protocols is about $1.5 billion, while the TVL of on-chain options protocols is only about $110 million, indicating a huge untapped market. In terms of trading volume, DEX options trading accounts for only $114 million in nominal trading volume (premium of $3.7 million) in a monthly derivatives trading volume of about $30 billion. This means that the on-chain options market is still in its infancy, with huge market potential.

Difference between Futures and Options

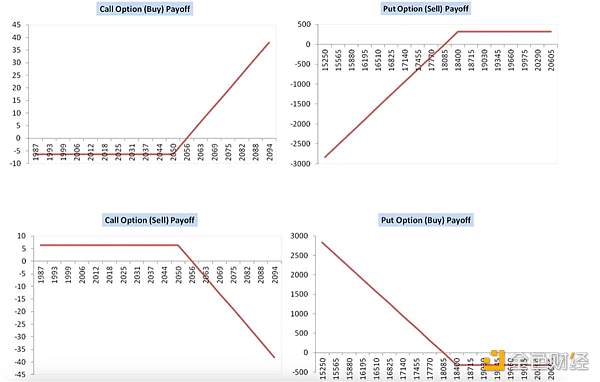

As options give the buyer the right but not the obligation to execute their position at the strike price, the buyer needs to pay a premium upfront to pay for this flexibility when executing their position on the strike price. This mechanism makes option buyers have a convex return function (fixed downside risk and unlimited upside potential), while option sellers have a concave return function (fixed upside potential and unlimited downside risk). In contrast to the asymmetric return functions of option buyers and sellers, futures buyers and sellers have symmetric return functions. Different return functions lead to different user investment lists and use cases:

User Personal Investment:

-

Options: Higher entry barrier; Buyers: Long Gamma, Short Theta; Sellers: Short Gamma, Long Theta.

-

Futures: Lower entry barrier (especially in perpetual futures, which abandon physical delivery and expiration date), suitable for typical crypto users with high leverage requirements.

Use Cases:

-

Options: Income generation (sellers), hedging, speculation, volatility risk exposure;

-

Futures: Hedging, speculation, high leverage (for perpetual futures).

Competitive Landscape

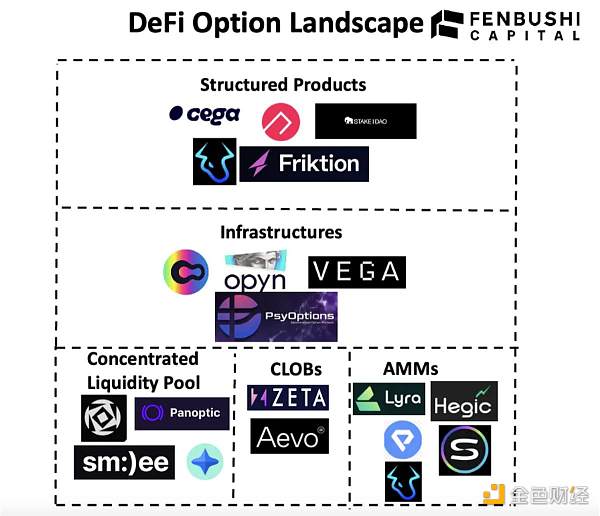

According to their mechanisms, option protocols can be roughly divided into five categories: structured products, option infrastructure, automated market makers (AMMs), central limit order books (CLOBs), and protocols that utilize centralized liquidity pools.

Structured products are designed to generate returns for LPs through various strategies, typically relying on options infrastructure to mint/settle on-chain options. Currently, structured products include option vaults (e.g., Ribbon, Psyoption) that offer covered call/put positions, and more complex yield products (Cega) that feature exotic options as well as opportunities for collateralization, borrowing, and providing liquidity. Options infrastructure is essentially a smart contract protocol that allows users to create, mint, and settle various financial derivatives. Option AMMs take the opposite side of traders by utilizing liquidity pools. They use algorithms to automatically price options based on a modified Black-Scholes formula and the supply and demand of option contracts. Option CLOBs are markets that actively match buy and sell orders of options. Protocols that utilize centralized liquidity pools are those that create the primitive for derivative products by taking the opposite side of the trade with centralized liquidity pool providers.

Currently, AMM-driven options exchanges occupy the majority of the options trading market share, similar to early on-chain perpetual models. This is because AMM-driven options exchanges are typically easier to establish and launch their liquidity compared with CLOB-based models. A fully on-chain CLOB options exchange requires a matching engine that can quickly scan the order book and match orders, which is difficult to achieve on a blockchain and requires significant business development resources to find centralized market makers to launch initial liquidity.

Therefore, most order books only support option minting and settling, rather than trading, which is typically done through OTC auctions with market makers. Zeta solves this problem by combining with Serum’s order book infrastructure to check its order book up to two times per second. However, due to the FTX incident that caused Serum’s liquidity to drain, all users and trading volume migrated to Openbook, a community fork, causing Zeta’s option trading to temporarily halt. Another solution may be a hybrid model of off-chain order books and on-chain settlement, which is exactly what Aevo is currently building. However, due to the market being in its infancy, current market share is not indicative. With the emergence of more CLOB-based models and more innovations in AMM-pool models in Delta neutrality and capital efficiency, the market landscape will undergo significant changes. Next, I will outline the history of options protocols, identify some key challenges they face, and the improvements that have been made.

Challenges Faced by AMM in the First Wave

Option pricing error: The problem with AMM point-to-point pool models is that they require accurately priced options. In traditional markets, the price of options is determined by the supply and demand of the options. However, in the point-to-point pool model, there is no supply and demand for options because the supply is fixed (it automatically acts as the counterparty to the option buyer). Therefore, the main problem facing the AMM liquidity pool model is how to come up with an effective pricing model to price options.

The most common pricing method is to use the Black-Scholes formula, which takes into account asset prices, exercise prices, risk-free rates, expiration times, and implied volatility. Of these five factors, the only unobservable factor is implied volatility (IV), which is an indicator of the market’s expectations of future volatility for a particular security. Traditionally, IV can be calculated based on the supply and demand of option contracts: high demand and low supply lead to high IV, and vice versa. However, IV is difficult for on-chain option protocols due to the flow of demand and supply being inconsistent. For example, in Hegic, its IV is calculated off-chain and manually updated to on-chain every week. This means that regardless of whether you open a $100 or $10,000 at-the-money option, its pricing will be the same. This is important because unlike market makers in CLOB-based systems who can dynamically reprice quotes based on new information about the true price, AMM LPs rely only on a pricing function embedded in the smart contract. Therefore, LPs may face significant impermanent losses during market volatility, where IV may be significantly lower than realized volatility. As shown in the figure below, most first-generation option AMMs have static volatility inputs that do not adjust dynamically based on real-time trading volumes.

Unhedged LP positions: In the first wave of AMMs, protocols like Hegic, Dopex, and Premia provided unfriendly experiences for LPs because their collateral was not hedged. This mechanism is based on concerns about capital efficiency, as delta hedging typically requires taking some liquidity out of the liquidity pool to trade long/short based on the net delta of its short position. However, this results in LPs accumulating high exposure to the underlying asset. As a result, this increases LPs’ liquidity costs and hinders the growth of the liquidity pool.

From the perspective of traders, their choices in asset selection, exercise price, and expiration date are limited compared to CEX, and pricing efficiency is low. Limited choices in asset selection, exercise price, and expiration date are attributed to limited liquidity, as wider choices would further dilute liquidity that is already scarce in the pool.

Second Wave, AMM Improvements

Emphasizing Delta hedging to attract liquidity: Lyra’s Valon update introduced the first AMM for Delta hedging. Lyra reduces risk by taking hedging positions through GMX or Synthetix. For example, when a trader holds a long position in ETH call options, Lyra’s Market Making Vault (MMV) takes an ETH long position equal to the net Delta when the position is established. By doing so, the MMV can protect itself from the potential unlimited profit that traders holding long call options may make when the ETH price rises.

Similarly, Siren Flow has also introduced a Delta hedging system, partnering with Prennial to hedge Delta exposure and provide liquidity. Other AMM liquidity pool protocols are also attempting to solve the problems of LP in different ways: Hegic, Premia, and Dopex divide liquidity pools into call and put vaults, giving LP more control over the options they underwrite. However, this approach is not as good as Lyra and Siren’s approach, as it still shifts the burden of hedging onto LP and disperses liquidity.

Improving inefficient pricing models and introducing partial collateral for a better user experience: Compared to Hegic’s static IV problem, protocols such as Lyra, Dopex, and Siren Flow have implemented new strategies to improve pricing efficiency. The core mechanism of Lyra AMM adjusts implied volatility (IV) and option cost based on market conditions. When option demand is high, AMM increases implied volatility; when there is oversupply, it lowers implied volatility. This approach enables AMM to converge with the market clearing value of IV for each execution price and expiration date.

When expiration dates are listed on Lyra, the baseline volatility value IV and the ratio of the listed strike price volatility to IV are initialized. These initial values are derived from IVs at 50 Delta (at-the-money) strike prices based on current market data. After initialization, IV and strike price volatility ratio (skew) are determined by the supply and demand of options for specific strike prices and their related expiration dates. On the other hand, Siren Flow implements a hybrid on-chain/off-chain request-for-quote (RFQ) system to provide competitively priced options trading. This innovation allows Siren Flow to offer pricing comparable to that of centralized exchange derivatives while retaining the advantages of self-custody and decentralized trading. However, Siren’s approach determines that it cannot serve as a price discovery platform, as it relies on data from centralized exchanges to infer its IV.

Additionally, Lyra has adopted an innovative approach by providing partial collateral for options sellers, thus increasing capital efficiency 4-5 times. Avalon allows traders to partially collateralize their short positions, enabling them to sell 4-5 times the amount of options with the same amount of capital. Partially collateralized short trades are important for two reasons: they provide option traders with a more complete experience comparable to that of CeFi platforms, and they enable AMMs to provide more efficient pricing. The main challenge in implementing partial collateralization is calculating the initial collateral amount based on various factors and establishing a sound risk management system to prevent bad debt issues.

CLOB: Limited Appeal So Far, But Promising Products on the Horizon

Due to the FTX incident resulting in the shutdown of Zeta’s options exchange, Aevo is a promising CLOB-based options exchange that is incubated by Ribbon and employs a hybrid model of off-chain matching and on-chain settlement. Aevo is built on a custom EVM-rollup that is said to provide access to hundreds of instruments tradable across various strike prices and expiration dates with deep liquidity. To bootstrap its liquidity, Aevo plans to integrate with Ribbon’s DOV as a venue for settlement of sold options contracts, in addition to partnering with professional market makers. Ribbon currently has a monthly trading volume of around $30 million, laying the liquidity foundation for Aevo. This also solves the current conflict of interest issue facing DOV, which may bring more trading volume to Ribbon. DOV depositors can also profit or reduce losses before expiration, greatly increasing the flexibility of Ribbon DOV. Lastly, Aevo will create liquidity for market makers who are currently buying DOV options off-chain and hedging their positions directly on the exchange. Aevo can also generate synergies for other DOV protocols as an infrastructure layer.

Comparison of CLOB-Based Model vs. AMM Liquidity Pool Model:

Overall, there are three most important metrics when evaluating on-chain options exchanges: liquidity, capital efficiency, and asset selection.

Liquidity: AMM liquidity pool models have a clear advantage in attracting initial liquidity as it can easily attract retail liquidity to auto make market. However, in the long term, CLOB-based models have a higher ceiling as it enables professional market makers to make markets on the platform. Moreover, protocols like Elixir also provide market-making functionality for retail users on CLOB-based systems. Therefore, CLOB-based models have an advantage in attracting liquidity over AMM liquidity pool models.

Future: The maturity of CLOB-based options exchanges can solve the problem of conflicting interests between market makers and structured products. With the emergence of CLOB-based options exchanges like Aevo, this can provide a price discovery venue for DOV to find their sellers and solve the power dynamics imbalance in OTC trading. Additionally, as mentioned above, combining DOV with a chain-based CLOB options exchange can allow depositors to profit or reduce losses before DOV expires, providing greater flexibility for depositors.

In summary, the current on-chain options protocols, whether based on CLOB or AMM models, have made little progress in trading volume and liquidity. This raises a typical chicken-and-egg problem. Without liquidity, there is no trading volume, and vice versa. From the perspective of liquidity, on-chain liquidity providers face the problem of inconsistency with option pricing, leading to realized volatility usually higher than the implied volatility calculated, making them reluctant to participate in liquidity pools. For traditional market makers, they have no incentive to make markets in these protocols due to negligible trading volume. In the long run, I am optimistic about the CLOB-based model gaining a market share in options trading volume, similar to DyDx. However, the current on-chain options protocols are not differentiated enough from CEX in terms of product differentiation, which leads to our next wave of protocols that leverage centralized liquidity pools to tap into the large liquidity in centralized liquidity pools.

Next Wave: Protocols Leveraging Centralized Liquidity Pools

The core idea behind these new wave protocols is that Uniswap v3 liquidity provider (LP) positions can be viewed as tokenized short put options. This is because the LP’s economic return function is mathematically equivalent to selling put options. For Uniswap V3 LPs, they are essentially short Gamma and long time value, as they incur losses when the underlying asset price fluctuates rapidly and earn exchange fees as time passes. Therefore, various protocols, including Blockingnoptic, Infinity Pool, Smilee, and Itos, attempt to use the large short option positions in centralized liquidity pools to construct their derivative primitives. Although similar in basic concept, these products have significant differences in design and offering.

Overview of Mechanisms

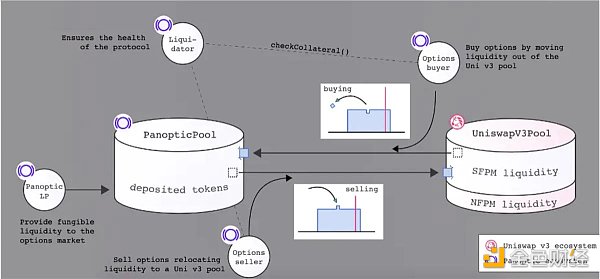

Blockingnoptic

Overall, Blockingnoptic consists of liquidity providers, traders (option buyers/sellers), and liquidators. Liquidity providers need to deposit interchangeable tokens 1/token 0 in any proportion into the Blockingnoptic pool. Option sellers can borrow this liquidity to create short options by depositing liquidity into the corresponding Uniswap v3 pool. Similarly, traders can create long options by withdrawing liquidity from the Uniswap v3 pool. For example, suppose a trader wants to buy a put option with a strike price of 1000 USDC and a width of 10%. When the trader buys the option, a portion of the liquidity in the Uniswap v3 pool within each ETH range from 909 to 1100 USDC is taken out and returned to the Blockingnoptic pool. The cost of the option is the amount of fees that would be incurred if the liquidity remained in the Uniswap pool. Now, let’s consider different scenarios:

- If the ETH price is above 1100 USDC at the time of purchasing the option, the option is out of the money (OTM) – it is yet to make a profit and will therefore not accumulate any premiums.

- If the ETH price remains between 909 and 1100 USDC during the option’s validity period, the option remains out of the money, and its cost remains at zero. Users can decide to close their option positions without paying any premiums.

- If the ETH price drops below 1100 USDC, the option begins to appreciate – the premium begins to accumulate. If the ETH price drops further below 909 USDC, the option is now in the money (ITM), meaning that it is profitable. At this point, the option stops earning fees, and users can decide to exercise the option.

When exercising the option, users must return the borrowed liquidity, which now exists in the form of ETH. Therefore, they send ETH to the Blockingnoptic pool and keep the USDC they originally received when purchasing the put option. This means that they actually sold their ETH at a price of 1000 USDC, even if the market price may be lower than 909 USDC.

On any available tokens in the Blockingnoptic liquidity pool, option sellers can get 5x leverage, and option buyers can get 20x leverage.

Itos

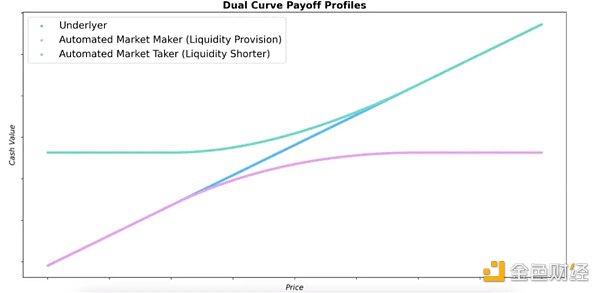

Unlike the Blockingnoptics that rely on Uniswap V3 AMM to create long/short options, Itos provides similar products by establishing its own centralized liquidity AMM (CLMM) on top of forward liquidity provisioning with negative liquidity position holders (called takers). The AMM structure has three market participants: maker, taker, and trader. In Uniswap V3, maker and trader are the same concept, with maker referring to liquidity providers who deposit interchangeable token pairs into the liquidity pool and trader referring to participants who swap one token for another in the liquidity pool. Unlike makers who provide liquidity, takers hold liquidity for trading. These takers always trade with the exchange, paying fees to ensure that the trade enters the more valuable token. This allows TakerPuts and TakerCalls, similar to bearish and bullish options, to be created. For example, when a trade occurs on a decentralized exchange (DEX), the taker profits from participating in the trade while paying funding rates to ensure there is enough liquidity to execute the trade. By always capitalizing on every trade, their position value increases with price fluctuations, while the value of market-making positions often decreases. This allows takers to experience a return function similar to that of long options (the green line in the figure below), effectively hedging any maker position.

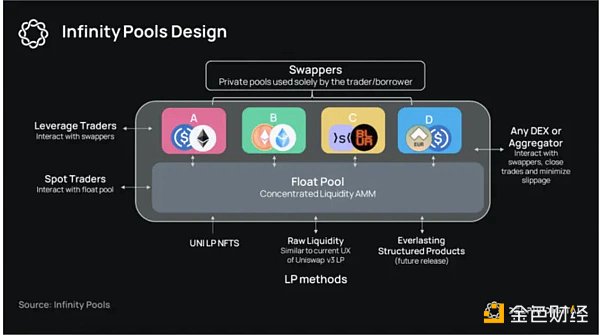

Infinity Pool

Infinity Pool is a decentralized exchange (DEX) for leveraged trading, built on its own CLMM (called float pool) similar to Itos. LPs can deposit directly into tradable token pairs or deposit their Uniswap V3 LP tokens into the float pool (the protocol will represent LPs by converting their LP tokens into tradable tokens). The float pool has two functions: 1) spot trading and 2) lending to leveraged traders. In the second case, the borrowed LP tokens will be extracted from the float pool to private pools (swappers), where traders can make an unlimited number of free swaps at a pre-determined execution price. As a return, traders pay funding fees to LPs through fixed-term loans (1-40x leverage) or perpetual loans (over 40x leverage). Furthermore, traders can repay their loans in any token combination in the float pool at the required price range by borrowing the necessary LP tokens, converting them into tradable tokens in their private pool at the required price range via an off-chain matching engine, and any subsequent external swaps if needed, thereby achieving a leveraged trading experience on any available asset in the float pool. For example, as outlined in their whitepaper, traders can go long on ETH with 10x leverage by borrowing ETH/USDC LP tokens worth 1,000 USDC at a tight liquidity range centered around 900 USDC. Assuming the market price of ETH is 1,000 USDC. Since the price of ETH is currently above the liquidity range, traders can exchange the LP tokens for 1 ETH at any spot DEX for 1,000 USDC (assuming no exchange fee or slippage). If ETH drops below 900 USDC, the LP position will contain 1.11 (1000/900) ETH and if they decide to close the position, LP will need to buy an additional 0.11 ETH. Therefore, the worst-case scenario for the trader is when ETH is at 900 USDC, where they need to buy 0.11 ETH for 99 USDC. This means that in this example, a trader can achieve 10x leverage by providing only 100 USDC as collateral.

Infinity Pool offers perpetual options of theoretically infinite leverage for any listed token in Infinity Pool AMMs, and has similar user experience to perpetual contracts.

Summary

Fundamentally, the main challenge facing the above agreements is convincing the LP of the centralized liquidity pool to redeploy to their protocol.

Among these three protocols, compared with Infinity Pool and Itos, Blockingnoptic does not need to guide too much liquidity because their options products are created through interaction with the Uniswap V3 pool. However, Blockingnoptics still needs enough liquidity for option buyers and sellers to borrow for leveraged trading. Therefore, these three protocols implement different fee models to compensate LP. In Blockingnoptic, LP earns a commission rate of 20-60 basis points based on pool utilization. In Infinity Pool, LP earns exchange fees when not borrowed and pays interest on loans based on the trader’s leverage level. In Itos, LP (maker) earns a return on the cost of holding currency market borrowing rates based on liquidity utilization rates reserved by takers. In theory, all of the above agreements should offer fairly competitive rates compared to the fixed swap rates provided by Uniswap V3 AMM, taking into account the expected volatility of their quoted ranges.

The most exciting part of these derivatives is that they offer speculative experience for small-cap tokens, which is impossible in any other DEX or CEX. On the other hand, these agreements may be difficult to compete with CEX for major asset pairs due to relatively high fees. This is particularly evident for Blockingnoptic.

For any option created in Blockingnoptic, the user needs to pay at least 30 basis points (20 basis point commission rate and 10 basis point Uniswap V3 exchange fee), which is even higher than many other derivative DEX, let alone CEX.

For Infinity Pool, they still need to interact with external AMMs to successfully close positions, resulting in relatively high fees. On the other hand, Itos’ pricing may be more competitive than the other two protocols, as they do not need to interact with any external AMMs and adjust exchange fees based on volatility. That being said, the different offerings of these protocols mean that they can attract users with different risk configurations: Infinity Pool’s theoretically unlimited leverage may be more suitable for perpetual futures traders, while Blockingnoptics and Itos may be more suitable for more complex retail traders and DAOs that need to hedge directly on-chain.

Summary and Reflection

Overall, this new wave of derivatives has released liquidity from concentrated liquidity pools by identifying a similar payment function between Uni V3 LP positions and options sellers. In short, the aim of all these protocols is to take on the other side of the impermanent loss to solve the liquidity problem that hinders the growth of the options market. In addition, if they can obtain a certain scale of liquidity, I am also looking forward to seeing various structured products built on top of these protocols.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- White hat disclosure: Huobi leaked OTC trading information, big account information, customer information, internal technical architecture, etc. on a large scale in 2021.

- Deep analysis of the latest vulnerability “Hamster Wheel” in Sui blockchain

- Analysis of the technical details and in-depth of the latest Sui vulnerability “Hamster Wheel”

- How to determine the quality of an X to Earn project’s economic model?

- Introduction to BRC20: Comparing Three Bitcoin Mnemonic Wallets

- Hong Kong Legislative Council releases “Development of Selected Places with Web3.0 Technology” (Full Text)

- Full Text of Avalanche Founder’s Testimony: Blockchain Technology Flourishes, US Needs Legislation to Protect Innovation