How to determine the quality of an X to Earn project’s economic model?

How to assess an X to Earn project's economic model?Is the economic model important for a Web3 project? Perhaps 8 out of 10 people would answer yes. But to some extent, the economic model is not that important. Either most project’s economic model paradigm has a high degree of convergence, or the allocation of tokens is often not as professional as it seems. In fact, most of the numbers for token distribution are more of a snap decision by the founding team, based on the premise of referring to mature solutions on the market.

Now, let’s go back to the question above, is the economic model important for a Web3 project? It is important, but it needs to be combined with the project’s own vision, product quality, and many other factors, rather than simply stacking complex formulas in the economic model to play with numbers.

In fact, a good project target may not use the latest economic model, and even this model may not be very complex, but it must be the most scientific economic model, which needs to be combined with the product characteristics.

This article from veDAO aims to popularize the elements of the economic model for readers, so that everyone can be more handy in the project selection process.

- Introduction to BRC20: Comparing Three Bitcoin Mnemonic Wallets

- Hong Kong Legislative Council releases “Development of Selected Places with Web3.0 Technology” (Full Text)

- Full Text of Avalanche Founder’s Testimony: Blockchain Technology Flourishes, US Needs Legislation to Protect Innovation

What is the economic model?

First, we need to understand what the economic model is.

Economic model: the English term is Tokenomics, which is composed of the two words Token and Economics. As the name suggests, it refers to the economic operation mode of different projects’ issued cryptocurrencies in the blockchain ecosystem. Its main function is to lead the supply, use, distribution, incentives, utility, governance, monetary policy, and other aspects of the project’s tokens.

With the rise of the DeFi concept and the increase of on-chain participation channels such as interaction, airdrop, Stake, and IDO, users have more opportunities to participate in project growth and early stages. Therefore, the importance of the project’s economic model has also increased. At its core, it is the mechanism behind all on-chain behavior operations. As a project party, you must use tokens to incentivize all participants to jointly maintain the self-operating complex economic incentive system; as a participant in the decentralized revolution, you must study and observe the advantages and disadvantages of different Tokenomics to choose investment targets, because Tokens are the mainstream financing method for Web3 projects, so Tokenomics is an important factor affecting investment returns.

The Importance of Economic Models:

As the saying goes, from 0 to 1, it’s all about the product, but from 1 to 100, it’s all about the economic model. A high-quality product requires good quality to push the first step, and then an economic model to keep the flywheel running.

Therefore, the economic model is important for a product for the following reasons:

1. Replacing traditional buyouts

For Internet products, the economic model provides a new business model. If the survival of traditional products depends on the pressure of even carrying the burden of loss in the early stages of the project, lowering user prices and investing huge amounts of capital to buy users, achieving market dominance in the number of users, and then aggregating user relationships and recovering costs.

With tokens, the task of capturing the market can be entrusted to tokens. On the one hand, by managing the market value, creating a value window for the token, and attracting more people to hold it, the user’s mental occupancy can be completed. In this process, the appearance of the token value window will often spontaneously attract more users and market attention, indirectly completing the traditional buyout task.

During the DeFi Summer period, the struggle between Uniswap and Sushiswap is a classic case: as the pioneer of DEX, Uniswap initially did not want to issue tokens, but Sushi pre-emptively attracted a large number of users from Uniswap through token airdrops. At its peak, Sushi users accounted for 70% of Uni, causing Uni to feel a sense of crisis.

Sushiswap’s cold start-up and rise are built on the “vampire attack” process against Uniswap. When Sushiswap was launched, it quickly attracted liquidity by allocating SUSHI to early LPs. Every time the block is updated, a certain amount of SUSHI will be released and allocated to LPs. Initially, Sushi required that the liquidity provided must be LP Token from a specific pool in Uniswap, which caused the locking amount of Uniswap to increase rapidly after Sushi went online.

Two weeks after its launch, Sushiswap started liquidity migration, migrating all LP Token liquidity participating in SUSHI mining in a specific pool of Uniswap back to Sushiswap, thus completing the rapid looting of liquidity.

2. Reducing the difficulty of investment and financing and shortening the cost recovery cycle

As mentioned above, traditional Internet products often need to occupy the market before they can achieve profitability. This is also one of the reasons why JD and Bilibili have been losing money. But apart from policy risks, a Web3 product that issues tokens will often issue its own tokens before the project’s functions are about to go online, and through the economic model, the project side can pre-position income, making it easier for the funds that have been recovered to be reinvested in the development of the project, making the flywheel turn faster.

It must be admitted that in the current web3 context, the main way for projects to make money is still through selling coins. However, when a project has the conditions to issue coins but chooses not to, it means that the pressure to make a profit is completely transferred to the quality of the product, which brings it back to the competitive landscape of traditional internet products.

This phenomenon is not uncommon in the Web3 industry, especially for teams that have shifted from gaming chains to work content. Due to the uniqueness of games, these teams often attract many Web2 practitioners. Therefore, due to their natural fear of going global, regulation, or the limitations of traditional gaming operation ideas, even though they are doing blockchain games, they have been afraid to issue coins. This puts tremendous pressure on the team’s operations and reduces the success rate of entrepreneurship.

Not only that, but for pure Web3 projects, not issuing coins also means passivity in the Web3 market. Taking Opensea as an example, it once held more than 98% of the market share. With a 2.5% transaction fee, its highest monthly revenue exceeded 350 million US dollars.

However, because Opensea has been iterating slowly and wants to go the equity financing route, it has not issued coins. This has been seized on by projects such as looksrare, x2y2, and blur to grab the giant users on Opensea through token airdrops and incentives.

According to Dappradar data, as of June this year, Blur’s total lock-up amount, which has innovated its economic model, has reached 167.7 million US dollars, accounting for 65% of the NFT market share, while the former king Opensea has fallen to 27%.

Economic model classification:

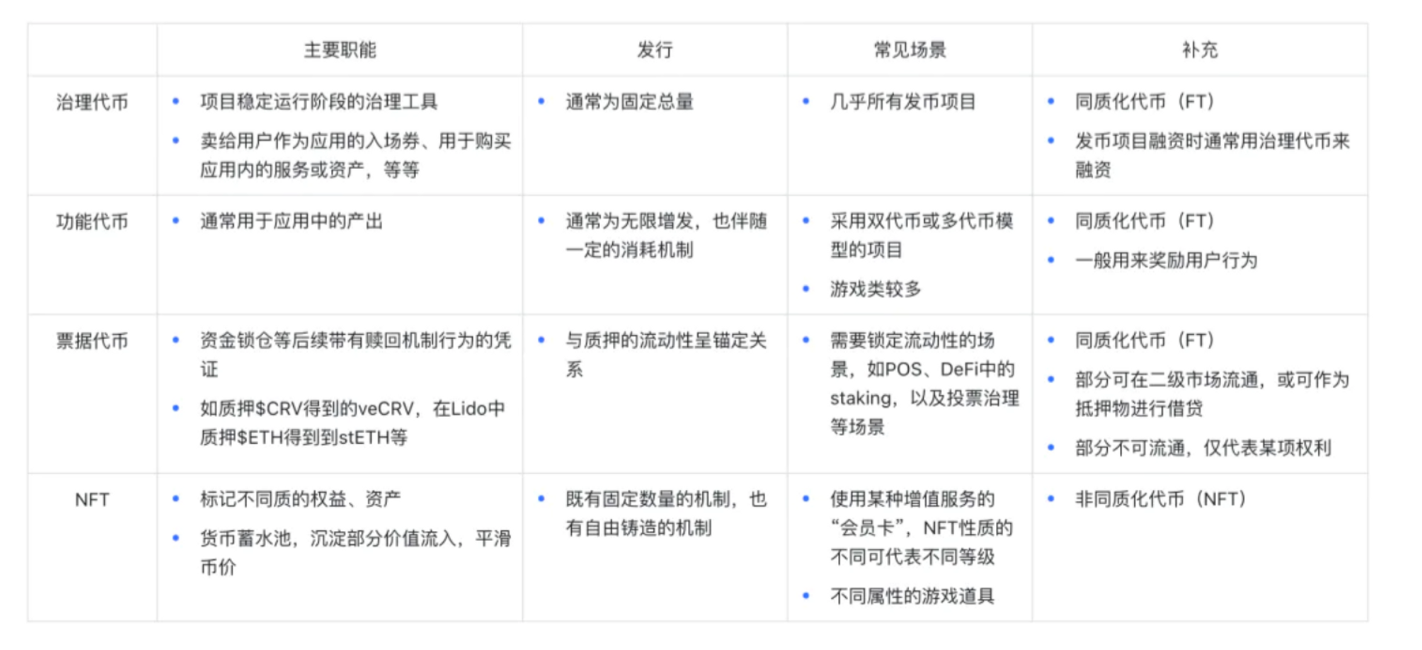

Currently, in the industry, X to Earn project economic models can be divided into four categories: governance tokens, utility tokens, special tokens, and NFTs.

Here we quote Buidler DAO’s “Tokenomic, the Economic Order of the Cryptographic World” article, which defines the four types of tokens:

It is worth noting that Buidler DAO directly regards bill tokens as a special third type of token here, but in fact, this category can be expanded. Some chain games and social products in the current industry generally implant a kind of off-chain token similar to points under the conventional dual-currency model, which can only be converted into on-chain currency under specific conditions. This type of points-based token should also be considered as a special third type of currency.

Based on these four tokens, the mainstream solutions can currently be divided into single coin, dual coin, and triple coin models.

Single coin model: Refers to a single token issued based on the ecology content itself. These types of tokens often only carry a single governance function (such as UNI), or a combination of governance and utility functions.

However, because most of these models use a fixed supply, if they only carry on-chain governance functions, it means that the value of the token is difficult to reflect, and the willingness of holders to hold the token will decrease as the project iteration speed decreases.

If it carries both governance and utility functions, it means that users will obtain more tokens through various means, eventually leading to an explosion in inflation rates, which will affect the market’s evaluation of the token’s value during its IDO.

Therefore, many project parties have optimized on this basis, either by splitting governance and utility functions, which is the so-called dual coin model, or by expressing utility functions in the form of points.

Dual token model: The so-called dual token generally refers to the combination of governance tokens and utility tokens, with the addition of NFT elements. The earliest proposal was Near, whose issued stablecoin USN can be integrated into the protocol layer as NEAR’s native asset, used to pay for gas and storage fees. This can be seen as the earliest prototype of a utility token. Since then, the dual token model has been greatly developed, with Axie being the most well-known example.

The emergence of the dual token model has greatly delayed the death spiral cycle of the original single token model, transferring and consuming governance token selling pressure through the association of utility tokens and governance tokens, and reducing the risk of project failure. On the other hand, managing a dual-token system is not just twice as difficult considering the possible correlation between tokens. When there is more than one token in the system, it is also necessary to consider how to allocate value reasonably. In addition, since utility tokens are often infinitely increasing, they are prone to inflation. If excessive inflation or other related reasons cause prices to fall, more tokens need to be issued to maintain a sufficient level of incentives for users, which will further strengthen inflation.

Triple token model: This solution is not a popular choice in the Web3 market, as the triple token model was generally seen as a patch on the dual token model at that time, but it has also had some innovation since then. The most well-known triple token model is the VCT model that appeared last year: on the basis of traditional governance tokens and utility tokens, a token for capturing asset value is added.

VCT Token has a strong association with Utility Tokens: in terms of quantity, regardless of whether inflation or deflation occurs, the ratio between the two always remains 1:1; in terms of price, since each Utility Token can be “exercised” at any time (exchanged for one VCT Token from the project party, and then exchanged for a stablecoin equivalent to the current VCT Token price). Therefore, the price of the Utility Token is always greater than or equal to the price of the VCT Token.

Additionally, the VCT Token is “insensitive” to ordinary players, does not increase the burden on players, and does not circulate on the secondary market, only being used when “exercised”. And the process of “exercising” is unidirectional and irreversible, and each Utility Token and VCT can only be “exercised” once, after which the Utility Token and VCT Token will be destroyed.

For example:

-

The number of Utility Tokens in a certain game = VCT = 10,000

-

The total value of VCP that accesses advertising revenue and fiat revenue = 10,000 USDT

-

So at this time 1 VCT = 1 USDT

-

When the Utility Token of the game is sold on a large scale, it begins to fall continuously from 3 USDT

-

Through the “exercising” mechanism, players will feel that they can lock in a return rate of at least 1 USDT, so it will not cause panic. On the contrary, due to the deflationary expectation of “exercising”, it will effectively suppress the downward trend of the Utility Token.

This model caused a lot of heated discussions when it was proposed. Before this, many game teams had already used the governance token to divide a certain proportion of tokens to specifically perform the function of VCT. In other words, under the premise of future relevant functions, is it necessary to introduce new currencies? In addition, the “three currency” model represented by VCT is also based on being able to capture enough value at the beginning of the game, that is, adding icing on the cake. But it cannot solve the problem of where the initial liquidity comes from and cannot provide help when it is most needed.

Several elements of the economic model

After discussing the classification of the X to Earn mode economic model, we also need to focus on several dimensions:

First are the three major elements of the economic model:

Supply: the source of the target token, usually divided into two ways:

- Public offering behavior: ICO, IEO, IDO, LaunchBlockingd, Fair Launch (Benddao mode, everyone has the same cost), ILO (X2Y2 mode, the first liquidity issuance, now most small projects do this).

- Incentive behavior: Airdrop, TVL investment incentive, Stake incentive, Volume incentive (projects mainly based on exchanges), Liquidity (DEX main battlefield), P2E (X to Earn mode).

Three terms to pay attention to:

TGE: how much circulation is there when tokens are issued

Cliff: how long to freeze before unlocking

Vesting: how long it takes for tokens to unlock

Requirements: the expected use of tokens, typically including: value storage, spending, mining, governance, protocol revenue, collateral,

Memes, speculative demand (sector rotation).

Value capture: the ultimate goal is to solve the token value capture path: service fee payment (MV=PY), buyback & destruction (rarely used now that there is staking), staking protocol revenue, buyback rewards.

Summary:

In general, a good economic model should have the following characteristics: low inflation rate, high incentives, low selling pressure, rich usage scenarios, sufficient liquidity, and governance primarily from B-end.

In addition, when investing in decentralized autonomous projects such as public chains, it is necessary to analyze whether the economic model has incentives for maintainers and token value capture to ensure that the project can provide users with continuous and stable services while allowing network maintainers to capture value and reduce selling pressure from maintainers;

When investing in DeFi and other projects involving large-scale capital transactions, the focus of analysis should be on how the economic model coordinates the distribution of interests between LP and governance token holders, including whether revenue can incentivize LP to continue to provide liquidity, and whether governance token holders can allocate reasonable income, etc.

However, as mentioned earlier, a good product is the key to user retention. Just like the previous section, the economic model can only complete 1-100 conversions, while the most difficult 0-1 depends on the quality of the product itself and the operational means.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Shanghai releases the “Key Technology Research Plan for the Metaverse in Shanghai (2023-2025)”

- Bit Block Summit NYC 2023 successfully concluded: Global blockchain and AI elites gathered in New York to explore the innovation of Web3 technology and new investment opportunities.

- Vitalik: Ethereum needs to go through three technical transitions – L2, wallet security, and privacy.

- Why has blockchain become a key technology? In which industries is it applied?

- Modular Data Availability in OP Stack

- BTC Tech Stack and Trends: Exploring Directions Amidst Confusion and Debate

- Challenges and Opportunities of User Retention in Web3 Games: Starting from Economic Models and Game Design