Six Positioning Strategies in Current Financial Environment

Six Positioning Strategies in Finance # Introduction In finance, there are six common strategies investors can use. ## 1. Risk Aversion Reducing high-risk assets in a portfolio and increasing low-risk assets to minimize the impact of market fluctuations. ## 2. Value Investing Identifying undervalued stocks and investing in them for the long-term, based on the belief that their true value will eventually be recognized by the market. ## 3. Growth Investing Identifying companies with high growth potential and investing in them for the long-term, based on the belief that their earnings will continue to grow at a higher rate than the market average. ## 4. Passive Investing Investing in a diversified portfolio of low-cost index funds or ETFs, with the aim of achieving market returns over the long-term. ## 5. Tactical Asset Allocation Actively shifting assets in a portfolio between different asset classes based on market conditions, with the aim of maximizing returns and minimizing risk. ## 6. Active Trading Frequently buying and selling securities with the aim of generating short-term profits, based on market trends and analysis.In the current global financial environment, both the emerging blockchain Web3 industry and the traditional financial industry are experiencing a century-old misty situation with opportunities and dark currents. With the rise of digital currencies and the widespread application of blockchain technology, the investment landscape is quietly changing, and the holding styles of traditional institutional investors are gradually diversifying, making the choice of asset allocation strategies increasingly important.

To meet this challenge, investors need to understand the characteristics and risks of various possible investment strategies, analyze the advantages and disadvantages of various allocation styles in the current financial environment, and help us make decisions that are relatively most suitable for our own style in the current financial environment. This article briefly introduces six different asset allocation models, explores the advantages and disadvantages of various allocation styles in the current financial environment, and the corresponding risk-return characteristics.

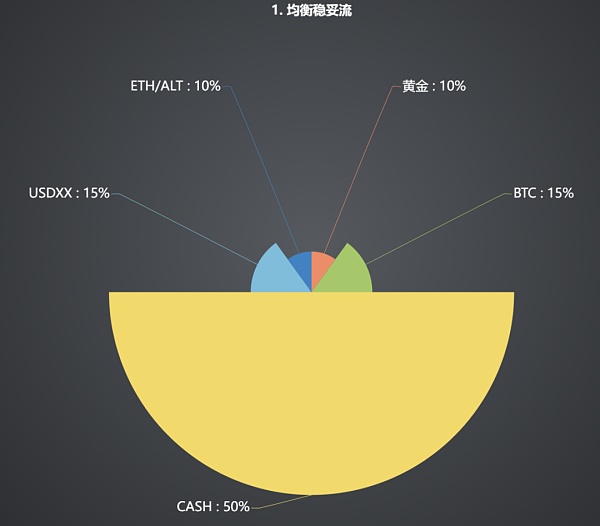

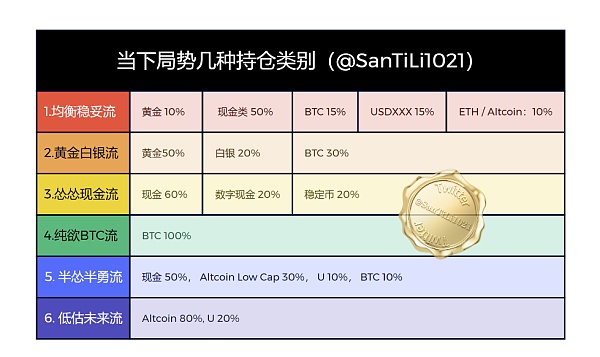

1. Balanced flow allocation: Gold 10%, Cash 50%, BTC 15%, USDXXX 15%, ETH / Altcoin: 10%

This combination strategy is suitable for risk-sensitive investors seeking relatively stable returns, investing relatively balanced in risk diversification and value preservation. The addition of gold provides traditional and relatively safe hedging means, while cash assets ensure the liquidity of funds. The proportion of BTC is the relatively stable target in the blockchain field (the volatility is also very large), and USDT/C stable coins increase the relative flexibility of entry and exit, and their volatility is relatively low, but the risk is linked to government bonds. The 10% ETH/Altcoin altcoins are configured to increase the potential appreciation space of the investment portfolio (the risk of fluctuations is relatively higher).

- Market Trend Prediction and Potential Alpha: Inverse Finance and Symm

- Bitcoin engraved wallet UniSat Wallet will launch an NFT marketplace next week.

- Interpreting the data on the growth of the NFT market in 2023: Is it due to new funds entering or old funds circulating?

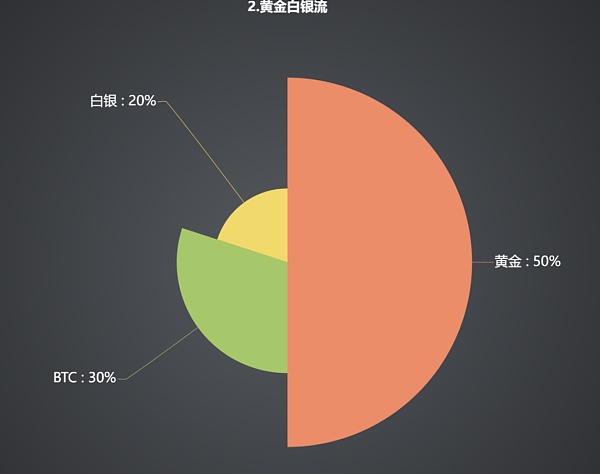

2. Hard currency allocation: Gold 50%, BTC 30%, Silver 20%

This strategy tends to guard against possible inflation risks. Among them, gold and silver, as hard currency assets in the traditional industry, can provide relatively stable value preservation effects during economic instability. BTC has gradually been regarded as “digital gold” with relatively long-term appreciation potential, while also carrying higher short-term volatility risks. This strategy can provide relative stability in times of market turmoil while retaining some Bitcoin as potential growth space.

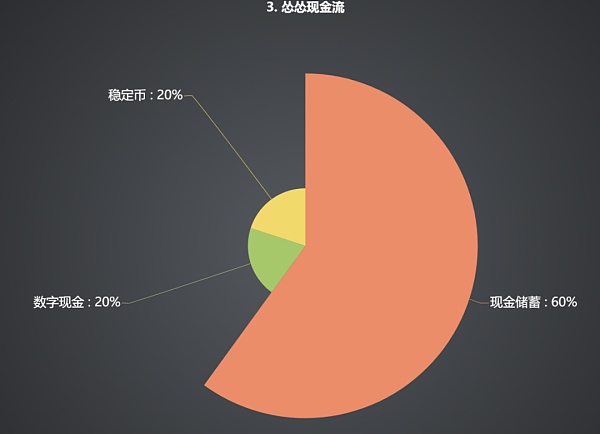

3. Cash Flow:

100% (Cash+ 60% Cash Reserves, 20% Digital Cash, 20% Stablecoins)

This configuration style is a cautious and defensive strategy in anticipation of market instability or significant decline. It emphasizes liquidity and risk control and is suitable for investors who are pessimistic about the market or want to control risk. Unlike gold, cash is more liquid and flexible. At the same time, electronic cash (such as digital RMB) and stablecoins can bring the universality and convenience of the digital world.

A configuration that relies entirely on cash assets is usually used by investors who are pessimistic about the market or expect to control risk. It can avoid significant losses when the market falls, but this type of configuration also needs to bear the risk of financial environment, bankruptcy of storage banks in different countries, and risk black swan events for investors. For example, Signature Bank, which is very popular among blockchain industry projects, went bankrupt this year.

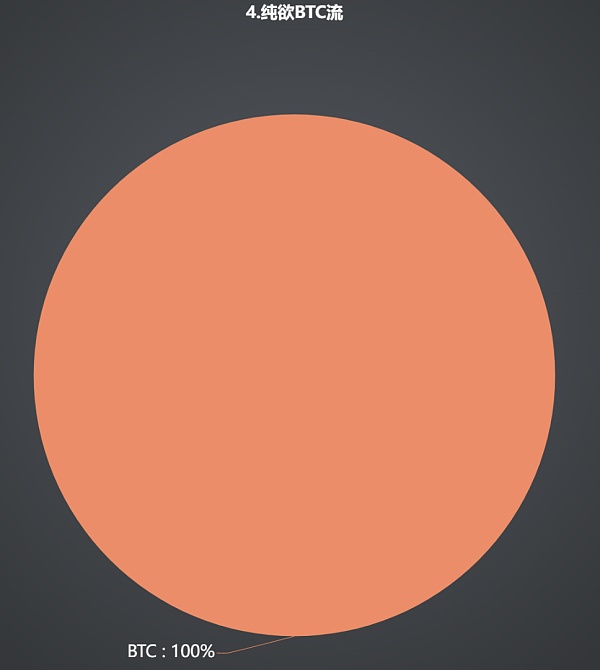

4. Pure Hold BTC 100%

This configuration strategy is suitable for investors who have high confidence in Bitcoin. Although it may obtain higher long-term returns in the future, it also bears the extremely high market volatility risk in the current world. This strategy requires investors to have a profound understanding of the history, development, and development of Bitcoin, and understand and accept the possibility of significant value fluctuations of BTC in the short term.

This is an investment strategy that is extremely optimistic about the future value of Bitcoin, suitable for lying flat flow, betting on the appreciation potential of future BTC, and not caring about how much short-term decline it will suffer, and willing to bear great volatility risks. Investors, even if it returns to zero.

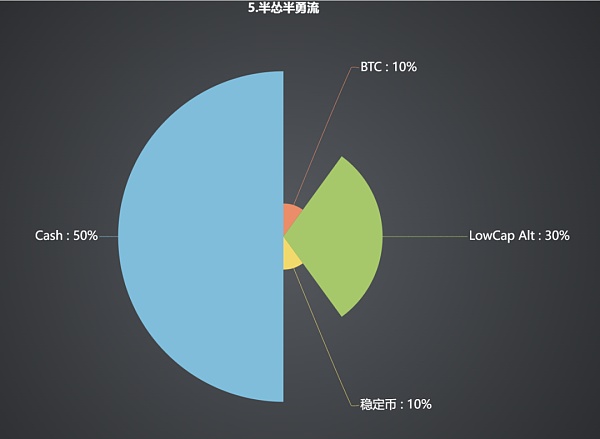

5. Semi-Flow:

Cash 50%, Altcoin Low Cap 30%, U 10%, BTC 10%

This investment configuration method differs from the first one in that it is more optimistic about low-market-value Altcoin categories, and is backed by a higher proportion of cash and mainstream digital currencies. Investors who choose this configuration tend to be willing to accept higher volatility risks to pursue higher returns. Investors in this configuration method are recommended to have a deep understanding and synchronization of the background, development progress, and economic model of Altcoin and be willing to bear the risk of returning to zero.

This investment strategy emphasizes investment in diverse digital currencies, especially bullish on Altcoins with lower market values.

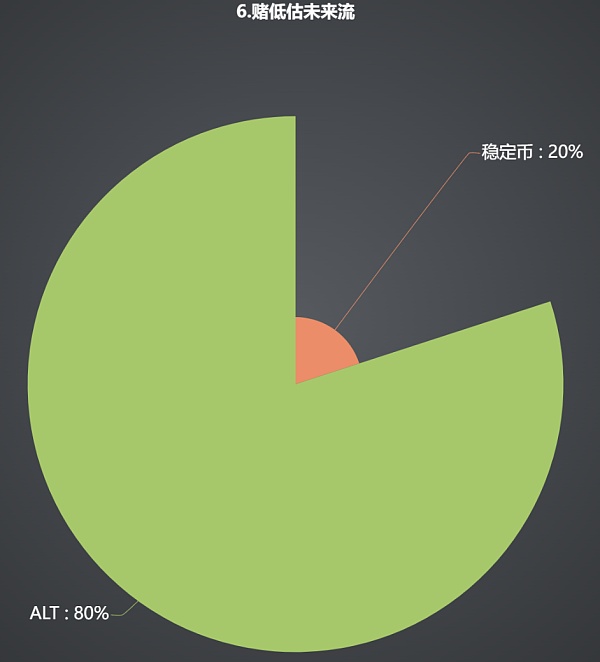

6. Bet on low undervalued future cash flows, 80% Altcoin, 20% U

This strategy shows extreme trust in the Altcoin that the investor chooses, and requires the investor to have a deep understanding of the market and high-risk tolerance. It has a strong ability to predict and respond to market changes, especially high requirements for buying points and trends. If chosen correctly, the returns may be extraordinary (such as GMT, CFX, which even had a 20-fold high volume increase during the bear market), but the risk of zeroing or large-scale losses is also possible (such as buying at short-term highs or experiencing a bottomless pit situation like LUNA in 2022).

This is a high-risk, high-return investment strategy. A large amount of investment in Altcoin means that the investor is willing to bear the possibility of huge losses.

Summary:

This article introduces six different holding models with proportions that are flexible rather than rigid. Although the digital currency market has enormous growth potential, its price volatility is also very high. Therefore, investors must remain rational, avoid over-investment, and be prepared to respond to possible market fluctuations. Any investment strategy is accompanied by risks. When choosing a suitable holding style, investors need to consider their own financial situation, market changes, risk tolerance and investment goals, and life status comprehensively. In particular, it is necessary to understand what kind of person you are, understand your weaknesses, high-risk investments may bring high returns, but the possibility of losses is also greater.

Investment needs to be carried out in a relatively calm state, and it is not advisable to invest in the idea of earning money through investment because of temporary financial difficulties or debt expectations, which often has a high probability of losing the funds you already have.

Special statement: This article only conducts popular science and sharing explanations of different types of holding styles, and does not have the nature of specific investment buying and selling advice. Investors should judge according to their own characteristics.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Breaking down the past three Bitcoin cycles: Who will drive the next cycle?

- Breaking down the past three Bitcoin cycles: what will drive the next cycle?

- Analysis: Why did the cryptocurrency market fall today?

- Arthur Hayes: Bitcoin Will Become the Currency of Artificial Intelligence

- Arthur Hayes: Why Bitcoin Will Become the Preferred Currency of Artificial Intelligence?

- Has Inverse Finance successfully transitioned from CDP lending products to fixed-rate lending markets?

- “Fortune” interview with Sister Wood: Will ARK win the first Bitcoin spot ETF?