Defi reports: The total amount of encrypted loans is approaching $5 billion, and interest earns only 1.83%.

Microfinance is increasing.

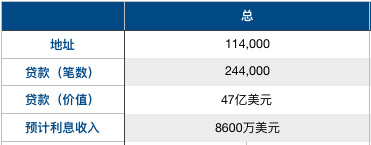

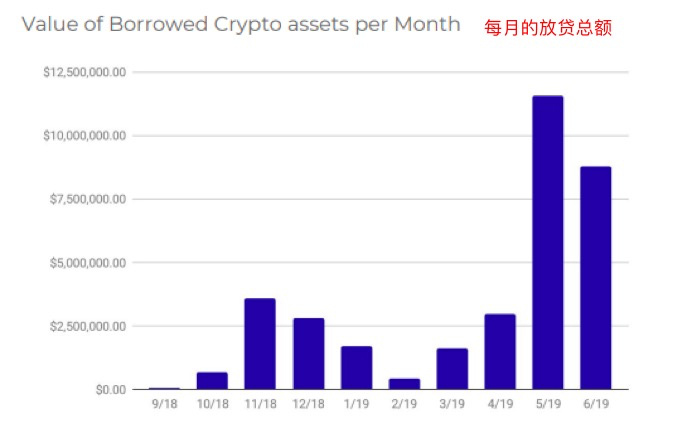

On August 15th, the credit credit evaluation startup Graychain released a 26-page Defi loan product report showing that crypto loans are currently worth more than $4.7 billion, but lenders only earn $86 million (or 1.83%). Interest income.

At present, credit is considered to be one of the important mechanisms to increase the liquidity of the economic system. The higher the liquidity of the market, the higher the operational efficiency. In order to promote the cryptocurrency as a powerful value exchange medium, we need to promote lending. . Therefore, this report focuses on the current credit industry in defi (decentralized finance). Currently, cryptocurrency lending products are mortgage loans. In other words, 100% of encrypted lending must be guaranteed.

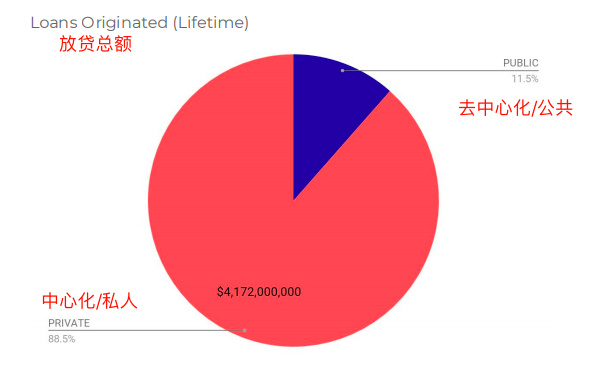

The report includes public data and resources on borrowed products including BlockFi, Celsius, Compound, Cred, Dharma, dYdX, EthLend, Genesis, Maker, Nexo, nüo, SALT, and Unchained Capital over the past 24 months. It also includes certain estimates. The report shows that public lenders are only a small part of this market.

- Does economic uncertainty increase demand for gold and bitcoin?

- Comprehensive upgrade: Ethereum development 2019 status and future prospects

- Libra's new currency war has threatened central banks around the world | Zhu Jiaming's new book is released

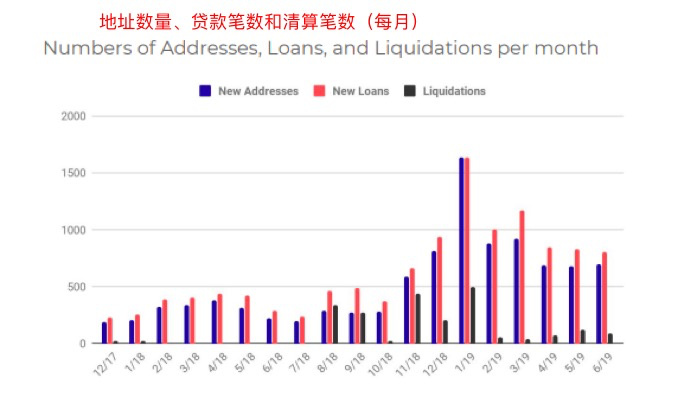

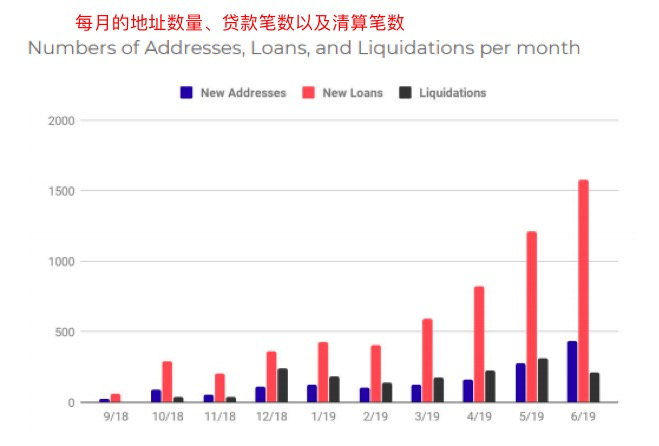

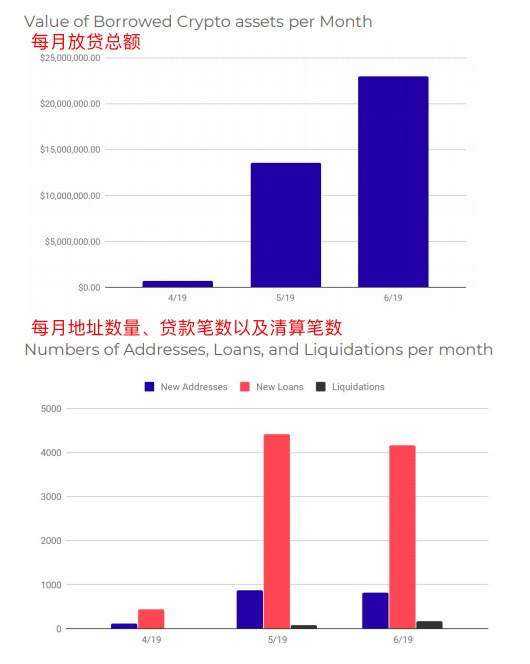

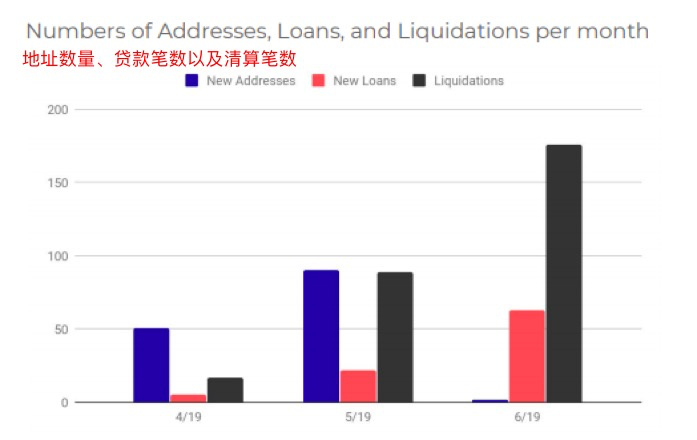

In the past 18 months, about 244,000 loans have been issued; it is worth noting that many are short-term, including weeks or even days. Personal loans are short and frequently issued, which means lending. The time value generated by people is small; the total value of lending is about $4.7 billion; the most traded platforms are Celsius and Genesis, which account for 65% of the loan disbursement; the total number of individual addresses is currently estimated at 114,000. We expect this number to grow rapidly.

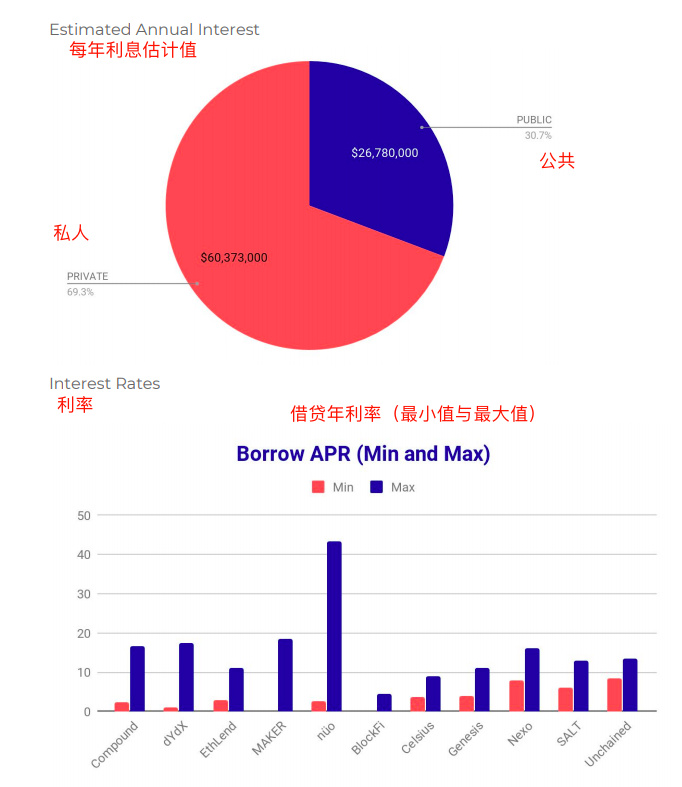

One indicator of the health of the industry is the total amount of interest charged. The report calculates a number of interest rates that are liquidated or matured for these loans and applies the average interest rate for each platform. Mastering the data shows that about 35% of loans are still active. This means that the industry's capital utilization is about 5.1% of its active value, or 1.8% of its lending value. Both numbers will grow.

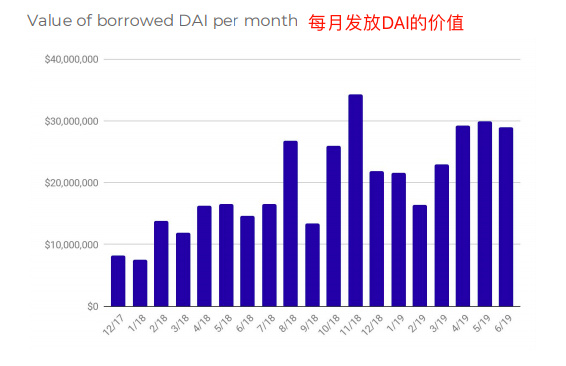

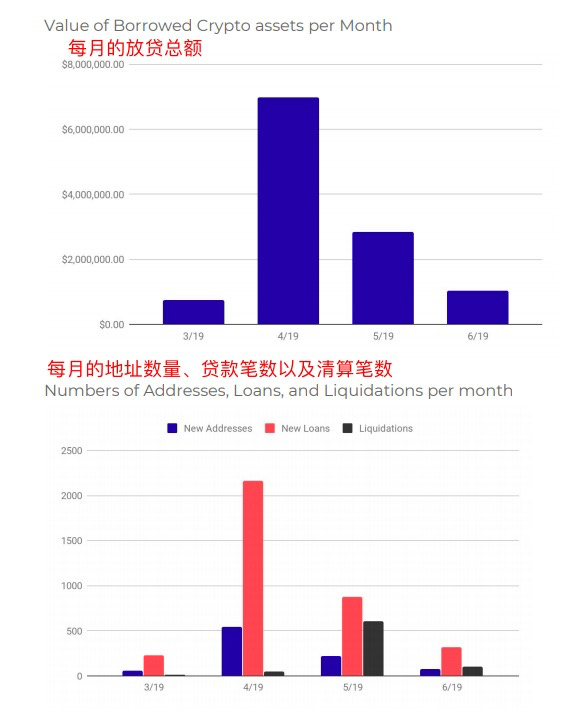

From our quarterly analysis, you can see that the number of loans has grown faster than the new address and total loans, which means that people are paying more microfinance instead of borrowing millions at a time.

- Mortgage loan

In mortgage lending, the borrower uses the asset as a mortgage to secure the loan.

In traditional finance, this type of loan is very common. For example, real estate can be used as a collateral for a mortgage loan, and a guitar can be used as a collateral for a short-term cash loan. If the owner fails to pay the agreed mortgage payment in a timely manner, the lender can obtain a mortgaged home to offset the bad debt. If the guitar owner fails to repay the cash loan, the lender can sell the guitar to recover the arrears.

- Encrypted lending

In the encrypted world, cryptocurrencies can be used as collateral. The three main reasons for doing this are: 1. Leverage (see more); 2. Arbitrage; 3. Deferred tax payment (the cryptocurrency cash may be taxed, while the sale of borrowed products may be able to evade taxes), the excess mortgage rate is generally In the 110%-200% range, the over-collateralization is required because when the mortgage assets suddenly plummet, the borrower needs time to liquidate (sell) the collateral. The 50% excess rate looks high, but for volatility cryptocurrencies, this is not an exaggeration.

In traditional finance, mortgages tend to be huge; but in the world of encryption, mortgages are largely automated on smart contracts, so the loan amount can be very small.

According to one of the loan service providers we interviewed, their customers are geographically distributed mainly from North America and Asia.

Encrypted lending can be divided into public (centralized) and private (centralized) according to the platform; according to asset types, it can be divided into encrypted assets and legal coins. In general, the decentralized loan platform has a higher annual interest rate, which we consider to be an “anonymity fee”, which gives the decentralized platform a huge interest return, even though they have a small market share. .

- Makerdao

In Makerdao, the user mortgages ETH to obtain the stable currency DAI. The loan interest rate is called the stability fee, which is used to maintain the stability of the DAI price. The maker is a smart contract system that manages the supply of DAI through a pledge debt warehouse (CDP). The system is to achieve a stable DAI price. The loan exists to maintain DAI stability.

- Compound

Compound is a decentralized liquidity pool that allows users to share their assets with other borrowers on the platform to create dynamic interest rates based on the supply and demand of the asset pool.

Dharma

Dharma is a peer-to-peer lending platform. On May 31, 2018, version v1 was released on the Ethereum. This platform allows anonymous lenders to apply for loans on their own terms, and any lender can lend.

- dYdX

dYdX is a decentralized encrypted digital currency derivatives exchange that was released on Ethernet on May 1, 2019. Like other decentralized lending agreements, dYdX allows users to borrow and lend encrypted assets. In addition, users are allowed to customize margin trading. dYdX's customers are still completely anonymous.

- NUO

NUO is very new, they support a wide range of assets, including Makerdao's platform currency MKR. It is currently Asia's largest loan agreement, and in addition, they are the first contract-to-contract (C2C) provider of margin trading and loans.

- EthLend

Launched in December 2017, EthLend supports mortgages of BTC, ETH and French currency, offering a variety of loan products and a 25% discount on its platform token (LEND) repayment/lending.

- Salt

Salt was founded in 2016 and is headquartered in Denver, Colorado. Salt has a wide range of licenses around the world, and loans from Salt can be deposited directly into the borrower's bank account. Salt platform currency (SALT) holders can enjoy membership, including more lending credits, more currency types, and higher credit limits.

- Nexo

Nexo is unique in the encryption lending industry by offering customers a credit card for everyday shopping. Nexo platform coins can also offer users a more favorable interest rate; in addition, Nexo offers legal currency loans supported by various encryption assets.

- Unchained Capital

Unchained Capital's multi-sig cold storage is one of the security practices in the field of cryptographic lending and provides transparency on the chain without the need for collateral guarantees.

- Genesis

Genesis is the largest decentralized financial institution based on total loans. It provides encryption-based financial services to high-net-worth individuals and institutions with a minimum loan of $75,000. It can be assumed that most of the loans come from a few large households.

- Celsius

Celsius is available for hedge fund, exchange and institutional trader loans at an annual interest rate of 9%. The loyalty level is determined based on the ratio of the CEL token to the token in the wallet, the higher the ratio, the more the benefit.

- Cred

Cred offers a variety of different token rates. In addition, platform currency LBA holders can enjoy a better loan interest rate. The credit line provided by Cred is based on the current credit usage to calculate the LTV (Total Lifetime Value), not the amount of the loan.

- BlockFi

BlockFi provides encrypted interest accounts, as well as encrypted loan products. They also offer security options for home mortgages and car loans.

Source: Odaily Planet Daily

Author: aloe

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Moved the city service to the blockchain, and Moscow’s government affairs work is promoted in this way.

- The Bitcoin panic index is low, and Coinbase data says that whales are buying.

- Bitcoin market share accounts for up to 70%, what happens next?

- Institutions promote bitcoin value in June "landing" development 10 years end with ruler

- 265 million US dollars! Ripple Announces 1 Billion Ripple Coin (XRP) to Coil

- A new breakthrough in food and beverage certification, how does this Shenzhen company make blockchain empowerment entities no longer talk?

- Babbitt column | The website office issued a security assessment announcement, what should the blockchain information service provider need to pay attention to?