Washington's penetration and war on Bitcoin: there is no absolute free currency

For a long time, Bitcoin even said that cryptocurrency is a feature of "free currency", that is, it will not lose its control due to any external influence, and can even be considered as a kind of "sovereign currency." "Parallel "non-sovereign value storage." However, the currency of the Venezuelan oil, the bitcoin address of two Iranian citizens in the cyberattack in Atlanta, and the fact that I was sanctioned and banned by the United States, and that Bitfinex&Tether suffered from the death of NYAG, can not help but re-examine Bitcoin and politics. relationship.

“On Tuesday, more than 8,000 Atlanta civil servants finally received a long-lost notice: they can turn on their computers.”

In a report on the cyberattack in Atlanta in the New York Times in March 2018, it was written in this way. In nearly a week, Atlanta's major public facilities and institutions were not working properly, including national laboratories, universities, government transportation departments, hospitals, etc., all of which were attacked by ransomware, which instructed attackers to pay A certain bitcoin to unlock the computer.

- 10 blockchain concept listed companies announced semi-annual report: blockchain technology has become a problem

- V God tells Serenity design principles to show you the uniqueness behind this magnificent project!

- Forbes: What challenges will cryptocurrency regulators face?

In fact, in addition to the main "affected area" of Atlanta, Los Angeles, San Diego, Kansas and other regions have also affected, which is said to be one of the most serious cyber attacks in the United States this century. The hacker succeeded in getting the $51,000 bitcoin at the time, and the victim spent more than $30 million to repair the computer system and recover the data.

The huge losses and the grim situation made the US government furious. After a half-year investigation, the spearhead was directed at Iran's Sam Sam Group, which was accused of having a relationship with the Iranian government to help the former escape US sanctions.

As the US Treasury Department identified two Iranian citizens, Ali Khorashadizadeh and Mohammad Ghorbaniyan, to participate in assisting the hackers affiliated with the Sam Sam Group to realize the bitcoin, so that the two and their bitcoin addresses were included in the Office of Foreign Assets Control (OFAC) of the Ministry of Finance. The "special staff list" and the "list of blocked persons" mean:

All property and property interests of designated persons within or transiting the United States, owned or controlled by Americans, or transited within the United States, are prohibited and Americans are generally prohibited from trading with such persons.

For a long time, Bitcoin even said that cryptocurrency is a feature of "free currency", that is, it will not lose its control due to any external influence, and can even be considered as a kind of "sovereign currency." "Parallel "non-sovereign value storage." However, the currency of the Venezuelan oil, the bitcoin address of two Iranian citizens in the cyberattack in Atlanta, and the fact that I was sanctioned and banned by the United States, and that Bitfinex&Tether suffered from the death of NYAG, can not help but re-examine Bitcoin and politics. relationship.

What is the relationship between Bitcoin and the government? We may wish to start with the possibility of the US government's ban on Bitcoin.

Possible incentives for the 01 Bitcoin ban

Although Bitcoin has gone through more than a decade of history, it has become a force that cannot be underestimated, but it may still face the ban of the US government. Other unlicensed cryptocurrencies similar to Bitcoin will have the same fate.

1. Characterize all cryptocurrency/dollar transactions as criminal in the name of national security – making it impossible for all centralized exchanges to conduct business – including Coinbase, Gemini and other exchanges.

2. Apply strict KYC/AML requirements to individuals. Specifically, if a bitcoin UTXO is related to a sanctioned person, it is illegal for an American to own the bitcoin UTXO or transfer money to the UTXO, just as for two Iranians. Sanctions for citizens and their bitcoin addresses.

3. With higher import taxes on ASICs and other mining-related hardware classes, the US government may use anti-China sentiment to include import taxation on Bitcoin mining-related equipment as part of the trade war.

4. By gathering enough hashing power to initiate a 51% attack, and deep reorganizing the PoW blockchains that have not implemented a checkpointing system to shake the relevant investor confidence, let the price fall, reduce the attack the cost of.

02 Data Analysis Company's Phantom

The United States behind the suspected violation of the cryptocurrency address and personnel and the company's repeated sanctions, bans and confrontation may be the phantom of the blockchain analysis company, supporting the government gradually infiltrated into this decentralized world. .

Blockchain data analysis is a field that is sometimes in the industry. Relevant companies are often responsible for providing legal and policy compliance issues, tracking and analyzing illegal activities such as extortion software and dark networks, and some tracking industry investment companies. With the dynamics of financial companies and the exploitation of potential assets, it can provide more perspectives and information for people inside and outside the industry.

From the blockchain analysis company's business scope, it is not difficult to see that they have a natural closeness with the government – the latter has a large number of monitoring, investigation, prosecution of illegal criminal activities through cryptocurrencies (money laundering, fraud, extortion, etc.) ), as well as insight into the needs of ordinary citizens and businesses in the same blockchain, especially cryptocurrency-related activities.

A report published by Diar on September 24, 2018 strongly argues the relationship between the two. The report pointed out that the blockchain company's analysis results can be used by financial institutions or banks to track the implementation of AML and KYC, and can also be used by law enforcement agencies to improve the information in their hands, which can be quietly attacked hidden in anonymous cryptocurrencies. Illegal activity under the wallet address.

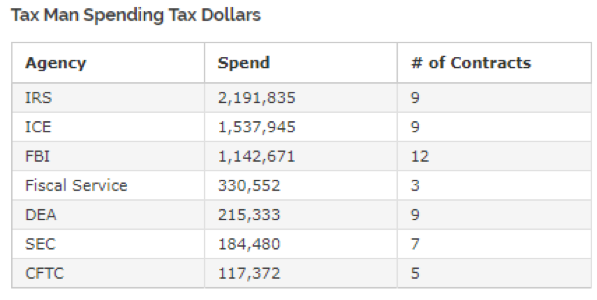

Diar also listed detailed data. As of the time of the report, US government agencies have purchased $5.7 million in service purchases from blockchain analysis companies. The main sources of these funds are IRS (US Taxation), ICE ( US Immigration and Customs Enforcement) and the FBI.

Number of service purchases and contracted contracts for blockchain analysis companies by various federal agencies | Source: Diar

To a certain extent, this may reflect that the crackdown on cryptocurrence and criminal activities is a higher priority within the US government. The Office of Foreign Assets Control (OFAC) of the US Treasury Department recently hinted that the regulation of the cryptocurrency industry will be at the forefront, or take active measures to purify the industry.

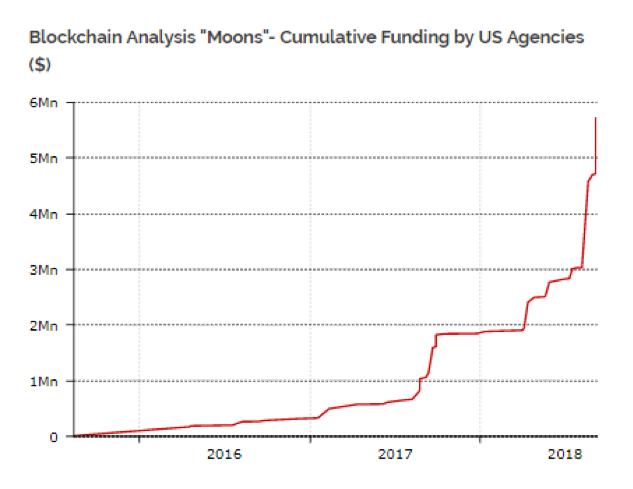

US government agencies' annual purchases of blockchain analysis companies have increased year by year, which confirms the positive correlation between industry development and government law enforcement needs. Source: Diar, carbon chain value

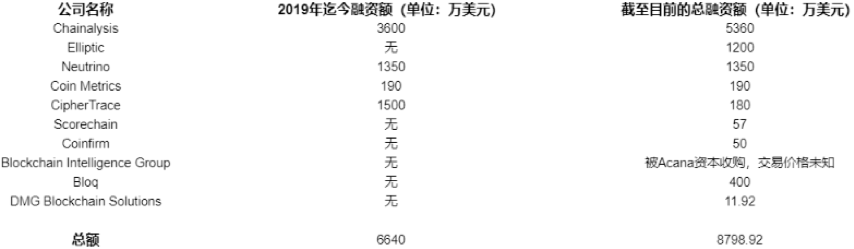

Judging from the financing of blockchain analysis companies, with the deep development of the industry and the accompanying increase in potential criminal activities, the financing of major blockchain analysis companies has increased year by year. According to incomplete statistics, only 2019, the main blockchain analysis company has reached 66.4 million US dollars, of which well-known blockchain analysis company Chainalysis has completed two rounds of financing this year, a total of 36 million US dollars, accounting for financing so far this year. Half of the amount of land. It should be noted that one of the financings was completed in the form of an acquisition, that is, Coinbase's acquisition of Neutrino completed in February this year at a price of $13.5 million.

2019 blockchain data analysis company financing list (Note: In the Diar report, there is also a company called Bitfury also has blockchain analysis business, but not the main business, it is not included in the list; in addition, Blockchain Intelligence Group The purchase price is unknown, so the amount of financing is not indicated, so the total amount of financing in this area so far is at least 879.928 US dollars) | Source: Crunchbase, Diar, carbon chain value

It is worth noting that among the major blockchain analysis companies, Chainalysis is one of the most conspicuous companies, not only with a total financing of more than 50 million US dollars (the data disclosed so far), but also the closest to the US government. Cooperation (The Diar report cited above stated that US government agencies invested $5.3 million in the $5.7 million investment in the company to Chainalysis, which included a $1.6 million completed by the IRS. Order).

According to a Reuters report on April 24, Chainalysis's real-time transaction monitoring tools have included ten currencies of BTC, ETH, BCH, LTC, TUSD, GUSD, USDT, USDC, PAX and BNB, which means the company and the government. And law enforcement agencies can track the flow of these 10 cryptocurrencies and track suspected illegal transactions through related tools.

03 How to reduce the risk of ban

1. The government is likely to issue a ban on the operator of the exchange, which is what the Chinese government has done while prohibiting the ICO. However, the US system and mechanism make the government face more legal challenges in directly implementing similar behaviors, which requires that the implementation of the relevant ban in the United States must be a logical process.

We have seen Bitfinex's parent company, Tether's stable currency party iFinex, and the New York Attorney General's Office (NYAG) resort to the law, which means other US-based exchanges, due to huge revenues and affluence VC has received a lot of money (such as Coinbase's $300 million in the E round in the fourth quarter of 2018), in the face of the government's decision to close their business, or more confident and capable of taking legal weapons to protect themselves .

Further, if the government really takes the exchange, the users and funds in the encrypted world will quickly flood into the DEX. The founder Zhao Changpeng has clearly expressed the same point of view when interviewed by the media recently.

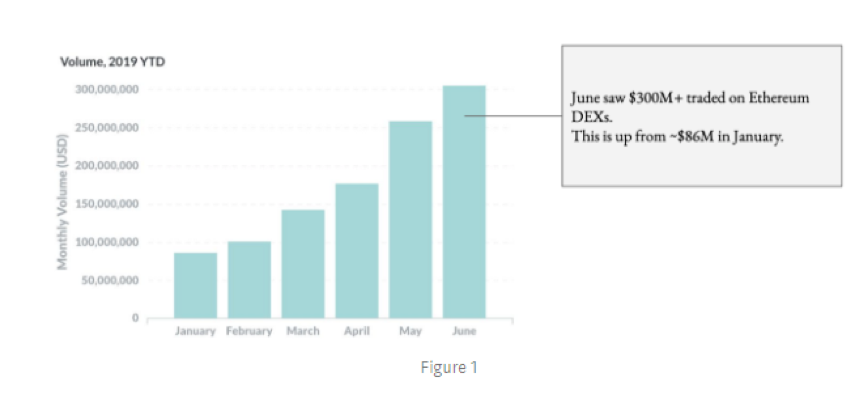

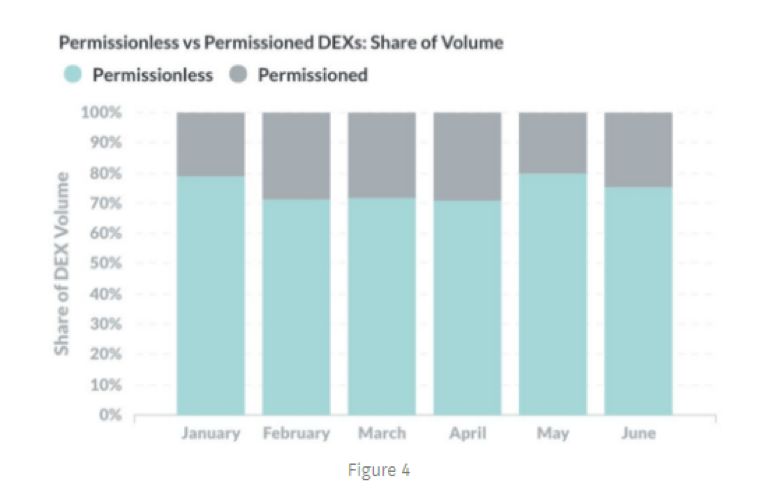

Since January this year, the trading volume of DEX on Ethereum has increased by about 3 times, and among these DEXs, unlicensed DEX has a market share of about 80%. This trend will further reduce the impact of heavy regulation on cryptocurrency transactions.

The DEX transaction volume in Ethereum was US$86 million in January and suddenly increased to US$300 million in June+ | Source: D5—The Science DAO

Market share of unlicensed vs licensed DEXs | Source: D5—The Science DAO

2. As mentioned above, earlier this year, the US Treasury's Office of Overseas Asset Control (OFAC) banned two bitcoin addresses (149w62rY42aZBox8fGcmqNsXUzSStKeq8C and 1AjZPMsnmpdK2Rv9KQNfMurTXinscVro9V, the last transactions of both addresses were in 2019 3 On the 13th of the month, the balances were 0.00024812 BTC and 0.00098789 BTC, respectively, that is, US citizens may not transfer money to these two addresses. To some extent this means that Bitcoin is illegally out of the way, and the US government can sanction bitcoin holders by blacklisting.

Such sanctions are certainly worthy of an encrypted community alert – Bitcoin may not always be a “free currency”, but in terms of its actual effect, it may be very limited.

"Basically, the US Treasury searched my bitcoin address with me through Google, and I won't make such a mistake again."

Ghorbaniyan, one of the sanctioned people, told the New York Times. In other words, it is still possible for all sanctioned people to escape the US government's sanctions by replacing a new bitcoin address. In fact, the New York Times also reported that the two sanctioned people returned to the mall again with a new website and cryptocurrency address shortly after the ban.

To take a step back, even the US government is going to prosecute offenders or foreigners living in the United States. The possibility of conviction geometry remains to be seen, as there are no precedents for this in the future – just as Americans are not obliged to verify the identity of users before and after the federal reserve note.

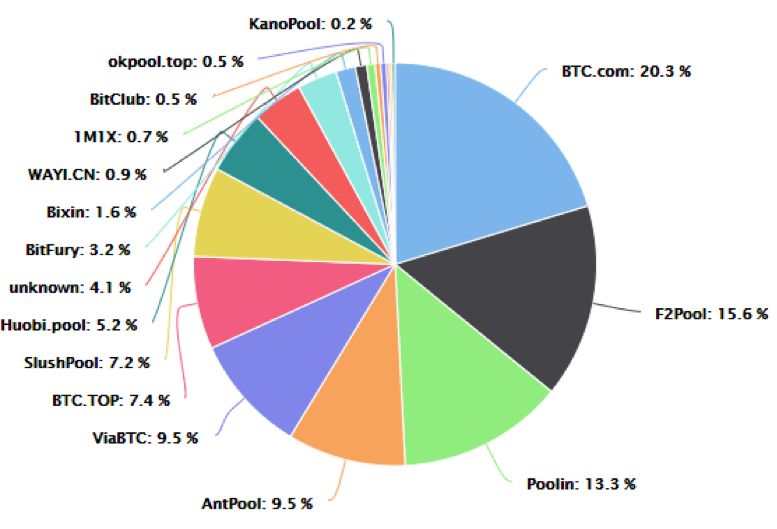

3. As far as the application of tariffs is concerned, it is feasible to impose heavy taxes on mining-related equipment due to the advancement of Sino-US trade and the tens of billions of dollars of commodities already being involved. But it also faces some problems: it can only reduce the increase in computing power, but it has no effect on the existing computing power stock – which further makes the fourth bad situation (that is, the United States gathers enough computing power to launch 51) % attack) is difficult to achieve, because in terms of ASICs manufacturing capabilities, chip production, and related equipment and supply chains, there are not enough cards in the United States. This industry is based in Taiwan, Hong Kong, Shenzhen, Japan, Korea, etc. The East Asian countries and regions represented are closely related.

In terms of encryption mining, Chinese businesses have an overwhelming advantage | Source: btc.com

4. The fourth attack scenario described above is the most serious (as far as it is concerned with Bitcoin and other public blockchains), but it is also the least likely. Many cryptocurrency communities in the early days of password punks still worried that the CIA/FBI would infiltrate the developer community, secretly collect hashing power, and eventually put bitcoin in one pot. Some people even think that Nakamoto has been arrested and is currently in the hands of the government. There are several problems with this type of thinking:

- The actual impact of the 51% attack is magnified in the narrative of the mainstream media – although some double flowers are likely to happen, usually one's money is safe, and the bitcoin or blockchain blockchain network Both can be rolled back and forked to restore network state before being attacked significantly.

- Some people's thoughts about the CIA and FBI infiltrating the developer community have erroneously overestimated the impact of an open, unlicensed network on national security—after all, the US government's chaos in the Middle East, its relationship with China and Russia. More important than cryptocurrency.

- If Nakamoto was arrested by the US government, then Trump’s comments on Libra’s series on Twitter and the view of US Treasury Secretary Nuchin on the cryptocurrency in the press conference would be quite different.

04 Improve acceptance: think tanks and lobbyists flocking to Washington

At the same time, more organizations and individuals who have encrypted the world's originals need to communicate with government departments to establish deep connections. The founder of Circle and the head of the Libra project have recently been seated in Congress to participate in a few hours of special hearings is a good way to communicate. For example, the Blockchain Association, Coin Center, and the Electronic Frontier Foundation, led by industry leaders such as Coinbase, Circle, DCG, and Protocol Labs, focus on blockchain and cryptocurrency-related research. Policy legislation and so on, are also the bridge between the encryption world and government departments.

This is the common task of all publicly licensed blockchains, blockchain projects endorsed by companies (such as Libra), and even central bank digital currencies. Only by making the world of digital assets more familiar, understandable, and integrated into the lives of as many Americans as possible, can we eliminate the blockchain technology and cryptocurrency that Washington’s politicians use for criminal activities. Worrying and releasing the technology will eventually bring positive power to the society.

Author: BIMONTHLY

Produced: Carbon chain value (cc-value)

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Bitcoin Quotes | Short-term fears are released, not optimistic in the medium term

- Heavy: Coinbase spent $55 million to acquire Xapo hosting business, managing assets over $7 billion

- One-day tour below Bitcoin $10,000, short-term market standing

- STO pioneer, the US "blockchain concept stock" Overstock brilliant and difficult to continue

- Can I withdraw the chain transaction only by paying 0.5 yuan? This brings endless trouble to DApp.

- Review of the plate rotation in the first half of 2019: IEO ignited the first fire, mode coin madness

- The plunging is very flustered, does the Bitcoin hedging property really disappear?