Institutions promote bitcoin value in June "landing" development 10 years end with ruler

On the evening of August 13, the United States suddenly announced that it would postpone tariffs on some Chinese products. The global financial market was affected by this. The offshore RMB exchange rate against the US dollar rose by more than 1,000 points. It rose above the 7 mark. US stocks rose sharply and gold fell short-term. The currency also fell by more than 7% in 24 hours.

More and more investors have found that Bitcoin has a strong correlation with the global macro economy and is increasingly positively correlated with the trend of gold, so that more and more is given the position of “digital gold”.

Mutual chain pulse found that this feature of Bitcoin was formed in June this year. Since the birth of Bitcoin in January 2009, it has become a "point-to-point cash system." After 10 years of development, Bitcoin has moved toward the "digital gold" road.

June "turned to positive"

Just in May of this year, at the shareholders meeting of Berkshire Hathaway, Buffett reiterated his view on Bitcoin: "Bitcoin is a kind of gambling equipment… Bitcoin can't do anything. It can only be placed there. It's like a shell, it's not an investment for me."

- 265 million US dollars! Ripple Announces 1 Billion Ripple Coin (XRP) to Coil

- A new breakthrough in food and beverage certification, how does this Shenzhen company make blockchain empowerment entities no longer talk?

- Babbitt column | The website office issued a security assessment announcement, what should the blockchain information service provider need to pay attention to?

At the time, it was also true. No fact can prove that Bitcoin has the ability to produce specific values. But June is a key node. Mutual chain pulse observations, starting from June, especially after June 17, bitcoin fluctuations and gold have a high correlation. As shown in the following figure, Bitcoin's peaks and troughs coincide with gold on June 17th. The difference is that Bitcoin fluctuates much more than gold.

Trend of bitcoin (blue lines) and gold (orange lines)

From June to the present, but within two months, it is not rigorous to determine that Bitcoin has become a digital gold. After all, gold has achieved today's status in 10,000 years in human history.

But bitcoin is increasingly becoming a safe-haven asset. In an interview with the inter-chain pulse, Tsinghua University’s Ph.D., Dr. Long Baiyu said: “Gold and sovereign debt have become a safe-haven asset. The market capacity of these assets is relatively large, liquidity is relatively good, concentration is not high, and concentration is not High means that it is difficult for groups to form a force to manipulate them."

Bitcoin's current market capitalization is about $188 billion, with a certain market capacity, and liquidity is better than gold.

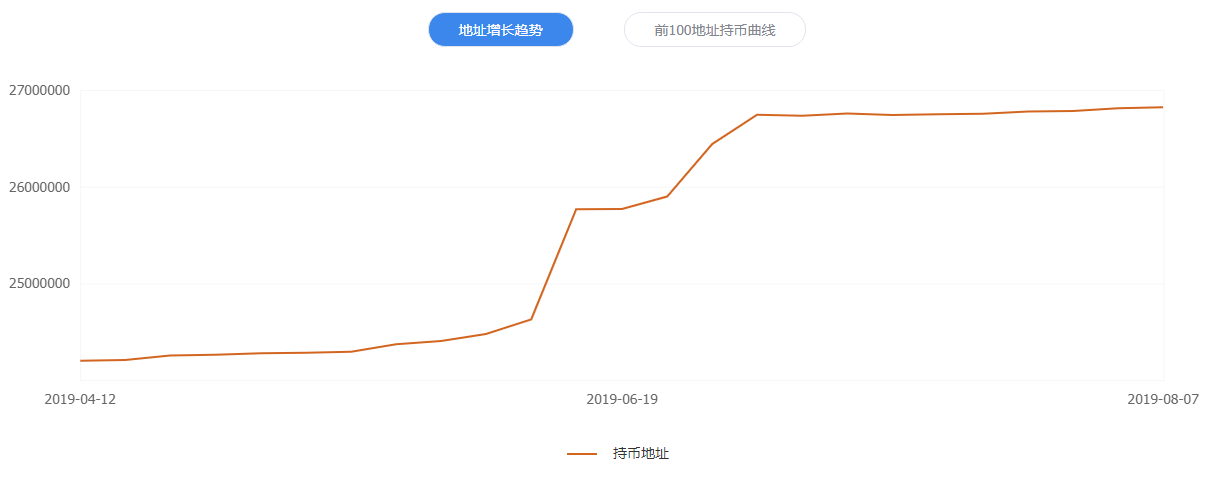

It is true that Long Baizhen believes that the current concentration of Bitcoin is still problematic. But the number of addresses holding Bitcoin is accelerating. Data show that at the beginning of 2019, the number of Bitcoin addresses was 22 million, and it has increased to 27 million as of August 14. Concentration is spreading.

Bitcoin's address growth in recent months

Today, many articles that analyze the rise and fall of Bitcoin have already called the macro economy. The speculator "chunfengchuiyouyu" felt that "bitcoin is highly sensitive to macroscopic stimuli, and the side also reflects the large-scale entry of large institutions. They bring the thinking of traditional assets into the bitcoin market."

A number of cryptocurrency projects have felt the pressure of institutional entry. A technical team in Beijing's public chain said: "In June, the agency entered, but only pinpointed bitcoin, etc., other cryptocurrencies were left out." A technical team in Shanghai's public chain also said: "The agency is tentatively entering The cryptocurrency is mainly bitcoin because of its good liquidity."

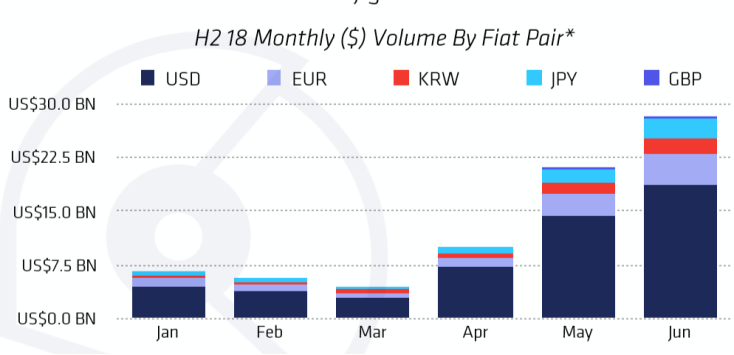

Digital asset management company Coinshares released a research report on digital assets in the past six months in July. It has been observed in the report that since May and June, off-exchange funds have flowed into Bitcoin on a large scale. The dollar and the euro are the main forces.

Figure: The purchase of bitcoin in different currencies in the first half of the year

This verifies what the US investment institutions have said.

In October last year, Fidelity Investments, the world's largest asset management company, divested an independent company called Fidelity Digital Assets, providing enterprise-class hosting solutions, cryptocurrency trading execution platforms and institutional consultations 24 hours a day, 7 days a week. service.

On May 6 this year, Bloomberg reported that Fidelity Digital Assets will launch bitcoin trading services in recent weeks, which will face institutional investors rather than retail investors. The co-founder of Morgan Creek Digital said at the time that Fidelity would help institutional clients trade Bitcoin in the coming weeks. In the end, every financial services company will do this.

Goldman Sachs, which has always had a good impression of cryptocurrencies, can’t help it. Goldman Sachs announced last year that it would provide Bitcoin futures contracts to its customers. Recently, Goldman Sachs analysts are clearly already consulting Bitcoin futures investments for their clients. In a group of slides that Goldman Sachs submitted to the client on August 12, Goldman Sachs technical analyst Sheba Jafari predicted that Bitcoin would rise 23% in the short term, and there is still a good chance to continue. rise.

Fidelity, the world's largest asset management company, and Goldman Sachs, the world's largest investment bank, are highly indicative – the traditional financial institutions on Wall Street accept bitcoin. In the name of Bitcoin, “turning positive” – becoming the “pool thing” of the mainstream institutions in the world.

On the other hand, these institutions push bitcoin from imaginary idling and establish a connection with the real economy, especially defining it as digital gold, which means that Bitcoin's actual “turning positive” – with the value of determining bitcoin "anchor".

Bitcoin landing reasons

In the past, Bitcoin lacked a convincing valuation system. So the investors summed up a lot of valuation methods that are complicated to explain. For example, the ratio of network value to transaction (NVT), the ratio of network value to Metcalf rate (NVM), the proportion of bitcoin in the cryptocurrency market, market consensus sentiment, traditional technical analysis, mining cost method, etc.

But no valuation system can be convinced. Because all of the above valuation systems have been hit by the trend of Bitcoin.

After gradually squeezing out the speculative bubble, Bitcoin can become more and more sensitive to macroeconomics in 2019. It is a combination of internal and external factors.

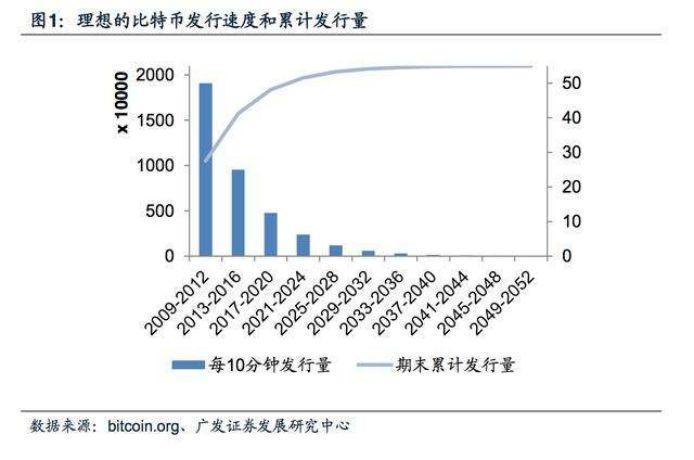

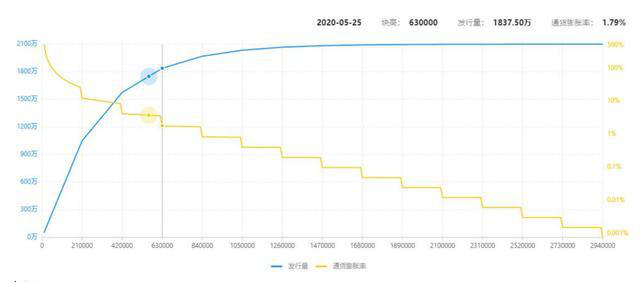

In terms of internal factors, Bitcoin has circulated and released most of the currency, accounting for more than 84%. Miners no longer become mainstream currency holders. Imagine if gold is the owner of gold, and gold is probably a common commodity.

In addition, the bitcoin inflation rate was in 2019, the bitcoin block height was between 560,000 and 610,000, and its annual inflation rate remained basically between 3.6% and 3.7%. The last block of Bitcoin's block halving (25 block rewards reduced to 12.5) was in July 2016, and the inflation rate in the same year fell from 8.5% to 4.2% in a relatively short period of time. The next block reward will be halved (12.5 block rewards reduced to 6.25). In June 2020, the annual inflation rate will be reduced from 3.6% to 1.8% in a short period of time. The actual situation of the economy.

Diagram of Bitcoin circulation and Bitcoin inflation

In terms of external factors, Facebook published a Libra white paper on June 18th, which turned out to make cryptocurrency a prominent school. Up to the US president, the financial institutions, and the people began to pay attention to the cryptocurrency. This allows the cryptocurrency consensus to go to the third level – institutional consensus.

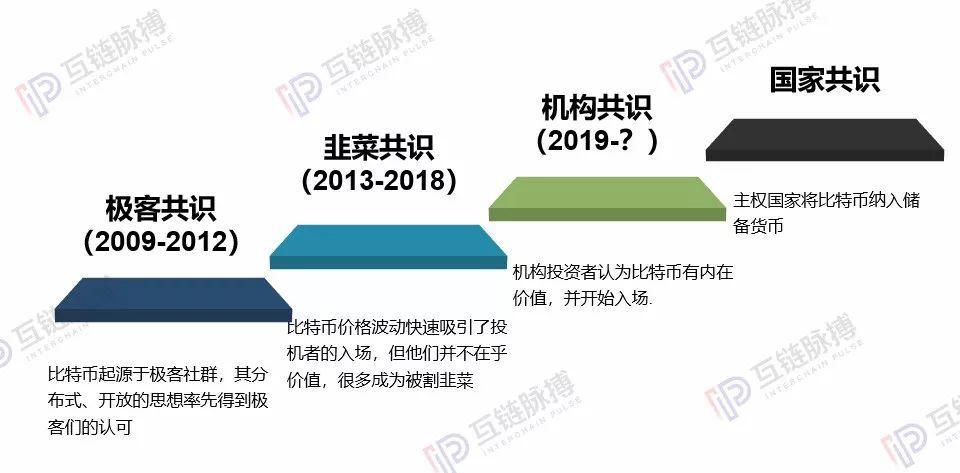

Inter-Chain Pulses are divided into four phases based on the nature of the participants in Bitcoin: geek consensus, amaranth consensus, institutional consensus, and national consensus.

The consensus of the organization on Bitcoin has just been formed, and there is still a lot of change in whether it can reach the national consensus. But you can see that the world is changing.

This article is [inter-chain pulse] original, the original link: https://www.blockob.com/posts/info/20622 , please indicate the source!

Wen Hao Mutual Chain Pulse Yuan Shang

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Washington's penetration and war on Bitcoin: there is no absolute free currency

- Blockchain + pets = high yield? Pudong network police: Bit pig was investigated

- 10 blockchain concept listed companies announced semi-annual report: blockchain technology has become a problem

- V God tells Serenity design principles to show you the uniqueness behind this magnificent project!

- Forbes: What challenges will cryptocurrency regulators face?

- Bitcoin Quotes | Short-term fears are released, not optimistic in the medium term

- Heavy: Coinbase spent $55 million to acquire Xapo hosting business, managing assets over $7 billion