What are the chances of decentralized exchanges completely replacing Binance and Coinbase?

Can decentralized exchanges replace Binance and Coinbase?Written by: Lincoln Murr, Mary Liu

Centralized exchanges are facing challenges, with regulatory scrutiny on Binance and Coinbase, and decentralized competitors gaining ground. These competitors are focused on various niche verticals, such as efficient stablecoin swaps, perpetual contract trading, and general token swaps. This article will compare these three common centralized exchange features to their decentralized counterparts.

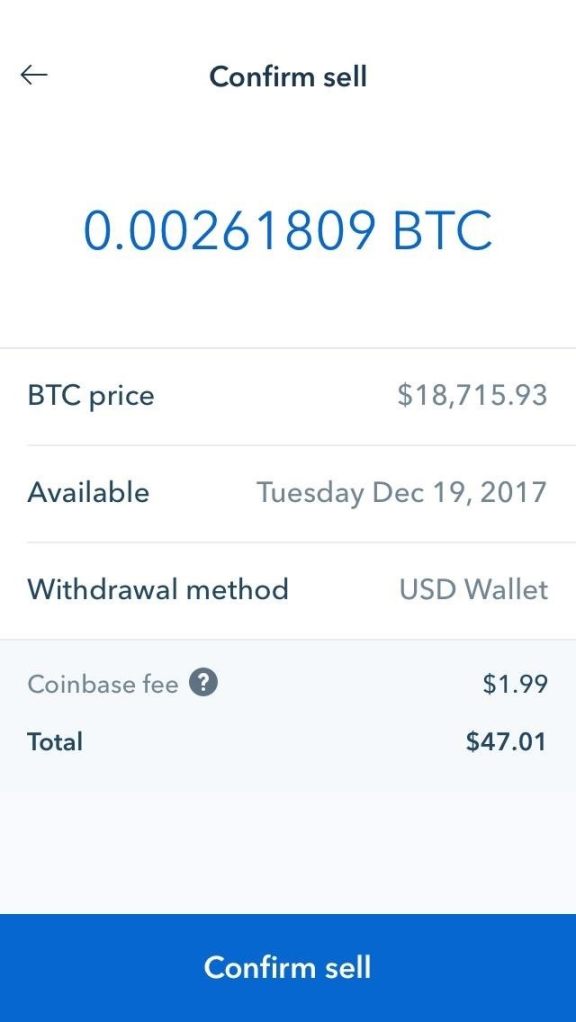

The most common exchange feature is trading one cryptocurrency for another. Coinbase charges high fees, ranging from 1.5% to 3% depending on order size. Binance charges lower fees, ranging from about 0.4% to 0.1%. Binance used to allow users to pay trading fees at a 25% discount using BNB (Binance’s native token), but that service has been discontinued due to concerns that it would make BNB more like a security. One of the biggest advantages of centralized exchanges is their high liquidity, with a spread of about 1% when buying $10,000 of Bitcoin.

- Join if you can’t beat them? Why did Binance hastily get involved in the L2 battle?

- BNB Chain has launched the opBNB testnet, a Layer 2 network based on the OP Stack.

- South Korean professor tracking Do Kwon’s funds: Signs of Terra’s collapse were present in early 2019

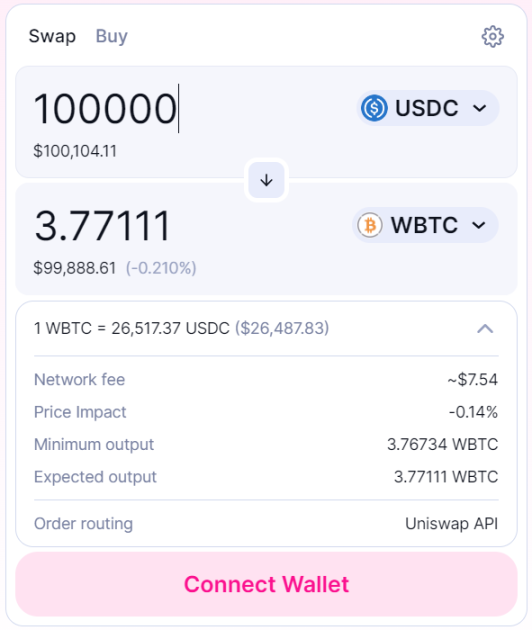

The largest general DeFi exchange is Uniswap. Surprisingly, its decentralized automated market maker model offers very similar or even better rates compared to its centralized competitors. It has three trading fees, 0.05%, 0.30%, and 1%, depending on the type of traded asset and its volatility. Liquidity for top assets is very high, with a conversion of $100,000 of USDC to BTC being ten times cheaper on Uniswap than on Coinbase, with a slippage of only 0.14%. Additionally, Uniswap allows liquidity providers to earn trading fees from each transaction.

Curve Finance is the largest exchange by total locked value (TVL) and focuses specifically on trading stablecoins and similar assets, charging a 0.04% fee. Some DeFi platforms, such as 1inch Network and Matcha, exist solely to aggregate the best prices from top DeFi exchanges, offering users the best prices. Overall, these platforms offer the same experience to regular users at similar or lower costs, while providing more asset choices and liquidity-providing options.

Perpetual contracts are a type of futures contract that is an agreement to buy or sell an asset at a specific price in the future. Unlike conventional futures contracts, which have a fixed expiration date, perpetual contracts have no expiration date and can be held indefinitely. Traders often use margin and leverage to take on higher risk positions, with the potential for high gains and losses, and bet on asset prices going down. As a US-based exchange, Coinbase does not offer futures trading, but Binance’s global platform charges 0.015% fees and offers leverage of up to 125x.

There are currently two mainstream DeFi perpetual exchanges: dYdX and GMX. dYdX is the older of the two and was initially built on Starkware, but it is now moving to its own Cosmos-based chain for greater customizability, decentralization, and scalability. GMX is a newer, Arbitrum-based DEX that is known for promoting “real yield” and no longer incentivizes liquidity mining purely with its own token, but instead gives users stablecoins or mainstream tokens like ETH and USDT. dYdX allows leverage of up to 20x and charges no fees on the first $100,000 in monthly trading volume, then reduces fees from 0.02% to zero as trading volume increases from $100,000 to $50 million. GMX charges a fixed fee of 0.1%, significantly higher than other options, but offers leverage of up to 50x.

Overall, in spot trading, decentralized exchanges seem to be equal to or better than centralized exchanges, while in perpetual trading, centralized exchanges are greater than or equal to DeFi. Another aspect not considered is the benefits of decentralized and trustless platforms. On centralized platforms, you must trust that the company will fulfill its promises to secure funds and allow withdrawals. As we have seen in numerous cases such as FTX, Mt.Gox, and BlockFi, this is far from 100% guaranteed, and the only way to truly own your cryptocurrency is to store it in a wallet. Decentralized exchanges never custody funds, and cryptocurrency is never lost unless a trade is successfully executed.

However, centralized exchanges do have their benefits. One key service they provide is the ability to convert fiat currency to cryptocurrency, which is necessary before using any DeFi exchange. Additionally, they are easier to use and may be a better choice for those who are not technically savvy.

Despite the difficulty with fiat deposits and withdrawals, the innovation and competitive advantages of decentralized exchanges are overwhelming. The regulatory difficulties faced by Coinbase and Binance provide a “shortcut” opportunity for decentralized exchanges and they are likely to capture a large portion of the market share.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Who are the winners in the EVM innovation wave?

- Attention drawn to Ethscriptions, an Ethereum NFT protocol that competes with Ordinals, with over 30,000 minted in just a few days since launch.

- Comprehensive Review of the Polygon zkEVM Ecosystem: Slow but Steady

- Exploring the Effectiveness of Layer2 Airdrops: A Case Study of Optimism and Arbitrum

- Cracking the interoperability trust problem: how will Web3 and cross-chain bridges ultimately evolve?

- Analyze the three main characteristics of the Cosmos LSM module: what are the positive implications?

- Blockchain detective ZachXBT sued by “Big Brother Ma Ji”: Received donations of over one million US dollars, supported by CZ and Justin Sun