Market Analysis: BTC low adjustment to retain rebound ability, mainstream currency countercurrent and upside differentiation to repair long-term sentiment

Recently, the mainstream currency has shown different degrees of decline with the fall of the BTC. After the morning BTC stopped the decline, the mainstream currency began to enter the repair stage, and some currencies rebounded better, but there are still relatively weaker currencies. Once there was a divergence, the adjustment will continue.

BTC

The daily trend has been adjusted around the 10-day moving average. The 5-day moving average is down. The short-selling market is constantly giving downward pressure. The long-term support is constantly being weakened. The previous upswing failed to achieve an effective breakthrough, thus making the long-term sentiment The signs of falling into wilting are reduced, the MACD indicator has been flattened, the upward momentum is no longer supplied, and the rhythm has been transformed into the empty market. The downside posture will continue to be maintained. Once the current low point is broken, there is no key support below, and it may be further Breaking 11,000 fell to 11,000 area.

The STOCH indicator continues the downward fork posture and continues to go down the 80 horizontal line. The RSI also runs downwards. The follow-up will continue to maintain the downward trend. The trend will also form a process of continuous exploration. The Bollinger Band is in an open position. The upside space is still open. If it can stand at the current low point, it will still give some chances of rebounding; Chen Chuchu suggests that the short position is the main one, and the multiple orders are supplemented. The current trend is in a low position and can be moderated in the low point area. Followed by 11200-11300, if you fail to rebound beyond the 11500 position, you can choose to leave directly. The empty order is recommended to follow up around 11400-11600. You can see the low point near 11220, and break this easy low point to continue to hold. When you see the 11,000 position, you will choose to leave the market in time after the profit in the operation, and make a safe operation plan to ensure that the income can be carried out smoothly and effectively.

- Shao Fujun, Chairman of UnionPay: Most worried about the spread of digital currency, the payment clearing institution may no longer exist

- Analyst: Bitcoin is a hedging tool under the quantitative easing and negative interest rate policy, which can solve the "Triffin problem" in the United States.

- Babbitt exclusive | central bank digital currency is on the horizon, design concept and technical architecture first exposure

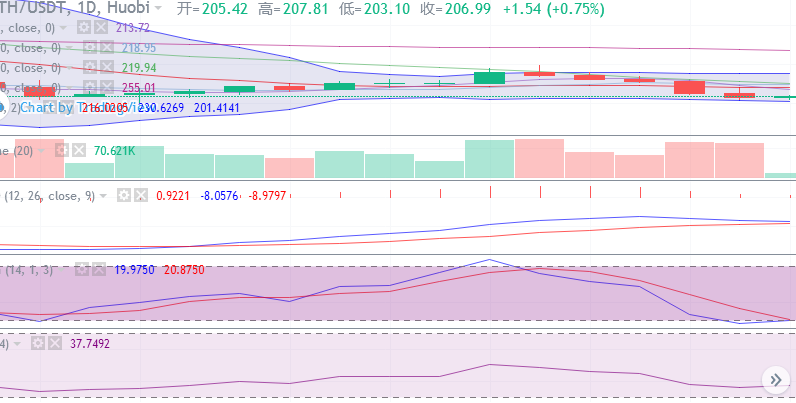

ETH

The trend further explored to the lower part of Bollinger Band, and the current small stock rebounded. The recent continuous decline did not break the key support of 200. If you can take the opportunity to gather long-term energy in the region, then the rebound will rise. It will also come, the STOCH indicator double-line intersects and bonds, the RSI keeps running upwards but has a flattened posture, so it is still a trend of oscillating adjustment, which can be operated in the 200-210 area, if it can be separated from the area Forming an effective offensive, the trend will enter the rising phase. Chen Chuchu suggested to look at the high altitude and support 200, with a resistance of 220.

XRP

At present, the Bollinger Band has been broken. Although the trend has returned to the Bollinger Band, it has been subjected to the 5-day moving average, which has caused the rebound to fail to form an effective breakthrough. The STOCH indicator is upward, and the rebound will be given. However, the MACD indicators remain parallel, and the fast and slow lines are about to intersect, the bullish sentiment is sluggish, and the amount of energy is also in a sluggish state. It is difficult to form a strong rising posture in the short term. The short-term proposal is mostly single-based, and the bargain-hunting is effective, returning to 0.30 effectively. After standing firm, enter the shock market.

LTC

The five-day downtrend also allowed the empty side to be emptied, and the bullish rebound was also established at the bottom, but the current trend is still suppressed by the 5-day moving average, and has not yet given room for rebound, then it can regain its stability 80- In the 85 area, the rebound trend will continue to continue, keeping the bottom and more ideas.

BCH

The trend went down to the middle and lower rail zone of the Bollinger Band. Currently, with the help of the 300 support line, it has formed a rebound. Once it was tested on the middle of the Bollinger Band, the strong posture has once again been reflected. Currently, it is temporarily blocked at 320, but the STOCH Golden Fork has already formed. The RSI will also maintain its upward posture. The uptrend trend will continue to be maintained. After breaking through the current resistance, it will continue to move toward the 10-day moving average, with more singles, dips can be laid, support 300, resistance 330.

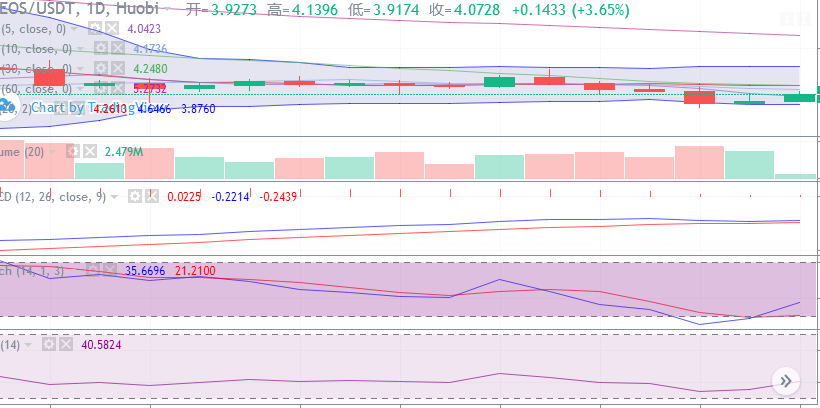

EOS

After the break, the trend formed a rebound. It once broke the 5-day moving average, but it was still blocked near the 10-day moving average. Then the trend will enter the stage of shock adjustment, and the trend will be adjusted around 4.0.

The recent repetitive BTC has been expected by the author. It has repeatedly given advice on the low point of the empty order, and also allows everyone to avoid the risk in time. The current pressure still exists. Whether the mainstream currency can stand still is also very good for the current situation. The big impact, then we should seize the opportunity to enter and exit in time, and receive the profits, only the real benefits are the real guarantee.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- How is Bitcoin more valuable? Master this method, you can profit in 98.66% of the time

- Huawei's distributed OS system – Hong Meng, is using blockchain technology?

- "We are not the same as Bitcoin!" The PoS Alliance wants to "educate" the US Congress.

- The competition currency continues to be sucked, and the market value of Bitcoin accounts for nearly 70%.

- Who will protect your privacy? Encrypt "weapons" to learn about | Geekhub offline activities

- BTC early morning support, XRP or usher in the big cycle market

- Ant blockchain: If the wind is not as good as the wind, the blockchain economy will usher in the next decade.