Dry goods: how to profit by “moving bricks” in the cryptocurrency market?

Source: cryptoglobe

Translation: First Class (First.VIP)

You may hear arbitrage trading mentioned from time to time, but do you really understand how it works? In the following, I will delve into the different arbitrage methods and arbitrage methods in cryptocurrencies.

What is arbitrage?

- Bitmain's three-line axe bets halving the market, and the mining industry behind the gamble needs to turn around?

- Subway Line 1 "Code" is about to open! Lanzhou applies blockchain technology to access two-dimensional code of rail transit

- R3, IBM, JP Morgan Chase grab Singapore, seize new fortress of blockchain trade finance

Arbitrage is defined as: "Using different prices of the same asset, buying or selling securities, currencies, or commodities simultaneously in different markets or in the form of derivatives." In short, this means that a trader has bought an asset (such as Bitcoin ) And then sell the asset at a higher price on another exchange or through another trading pair. There are several different ways to do this, and each has its advantages and disadvantages.

Why is there a spread?

In order to profit from arbitrage, there needs to be a price difference between exchanges or markets. For example, one bitcoin costs $ 8,000 on one exchange and $ 8,100 on another. Why is there a spread? This is because there is no fixed price for any asset on the exchange, and the order book maintained by the exchange is a list containing all the prices others are willing to buy or sell the asset (because the user created a buy or sell that was not executed Order). When you want to buy bitcoin on an exchange, you will buy it at the lowest price others are willing to sell (e.g. $ 8,000). If no one wants to sell Bitcoin for $ 8,000, the next lowest bid will be used. This will depend on other people's bids, either $ 8000.10 or $ 8005. Due to this mechanism, prices are always changing.

How to find spreads?

Finding the huge price differences you can take advantage of to make a profit can be difficult. You need to constantly observe real-time quote (price) data from multiple exchanges and calculate how big the bid difference is. Due to the transaction costs of the exchange, a spread of 0.10% may not be profitable, but a spread of about 3% can easily be profitable.

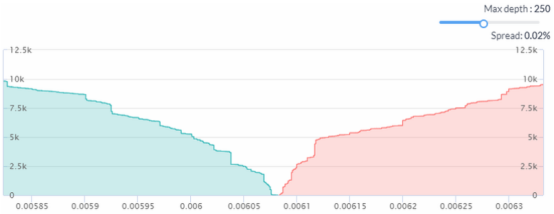

In fact, you may need to use some tool or custom spreadsheet to find spreads in real time. These are often called "cryptocurrency arbitrage scanners" or something similar. Sometimes profit opportunities exist for a short period of time, so it is important to find tools for these spreads. There are many tools that can help solve this problem. The figure below is an example of an arbitrage scanner.

How to profit from cryptocurrency trading through arbitrage?

With the above tools, you can find a considerable spread, and now it's time to trade and (hopefully) make a profit. There are several ways to perform arbitrage, and I will introduce two different options.

Inter-exchange arbitrage that requires token transfer

This is probably the method most often discussed. You buy assets on one exchange at a lower price, then transfer them to another exchange with a higher selling price, and then sell on a second exchange.

The risks involved are unpredictable, as transferring tokens may take time (for example, Bitcoin transactions are completed in an average of 10 minutes), and transfer fees must also be considered. When you transfer tokens to a second exchange, the spread may no longer be large enough to be profitable, or your transfer fees may offset any potential profits.

Inter-exchange arbitrage without token transfer

A faster and more reliable option is to not involve token transfers between exchanges. But it is important to note that you must already hold the asset you want to sell on the first exchange you want to buy and you already have the asset you want to sell on the second exchange you want to sell Purchased assets.

Suppose you find the spread on the Dash-ETH market of the two exchanges. You will use ETH to buy DASH on exchange A, and sell DASH purchased on ETH on exchange B. Therefore, you must already hold ETH on exchange A and DASH on exchange B. When there is a profitable spread between the two exchanges, you can buy on exchange A and accompany selling on exchange B. This way you increase the overall value of your portfolio, except that it is spread across two exchanges.

Exchange arbitrage (all on the same exchange)

This involves arbitrage on the same exchange, in which case you will find the difference between three different assets. Let's take a theoretical example: the price of BTC-USD is $ 8,000, and the price of BTC-LTC is 50 LTC. You would think that LTC was trading at 160 USD (8000/50), while the actual LTC-USD trading price was 175 USD. You can use this spread for arbitrage.

You can buy 1 Bitcoin on the BTC-USD market for $ 8,000. Then in the BTC-LTC market, exchange 1 BTC for 50 LTCs. You can then sell LTC on the LTC-USD market for $ 8,750 (50 LTC x $ 175). You started with only $ 8,000, and after three trades you made $ 8,750, a profit of 9.4%.

Liquidity matters

When you want to take advantage of cryptocurrency arbitrage, you should keep the following points in mind. First, the spread may seem profitable (some instruments claim to find a 30% spread), but without liquidity you would not actually get that much profit. If the depth of an order book is very poor, the last bitcoin pending order you may see is $ 10, and the difference calculated using this price will be very profitable. But if you eat the entire order book, you will find that the final price paid is not beautiful, because the average transaction price is not 10 dollars, but much higher (when buying) or much lower (selling). In general, you should choose markets that are liquid. A quick glance at the depth map will give you a good understanding of market liquidity.

Use the right tools

Another thing to note is that many people and robots are trying to use spreads to arbitrage, so the spread will not last long.

Therefore, you may need tools to help you trade. When speed determines whether you can make a profit, you don't want to trade back and forth between a bunch of different windows. There are many different tools that can help you trade on multiple exchanges at the same time.

I hope you understand how arbitrage works and how it can be used to monetize. If you have mastered the skills, cryptocurrency trading can be a profitable game and I wish you a smooth transaction!

This article represents the original opinion of the original author. First.VIP is always objective and neutral, presenting readers with diverse information for learning and communication, and does not constitute investment advice.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Babbitt Live | Guo Yu: 3 minutes to understand zero-knowledge proof, why is it a double-edged sword?

- US SEC postpones ruling on another Bitcoin ETF proposal, how is this proposal different than in the past?

- Babbitt original 丨 First time! Shenzhen Stock Exchange released the Blockchain 50 Index, the total market value of constituent stocks is 1.3 trillion

- Analyze the consensus mechanism from an economic perspective: PoW is a diesel car and PoS is an electric car

- Bitcoin Core developers share Bitcoin roadmap for 2020, these four major improvements are worth looking forward to

- The official blockchain stock selection list is here! Shenzhen Stock Exchange released the first blockchain index in the two cities, the most beef stocks rose 310% during the year

- Digital currency silent smoke: Alipay RMB and Libra USD