Dry Goods | Staking Economy Operational Expert Complete Manual (Revised Edition)

With the launch of the blockchain project with PoS consensus and the rise of Staking Economy , there are more and more service providers in the market that can provide professional staking services. At the same time, some investment institutions with large amounts of PoS tokens are also in the market. Consider how to cut into the runway of the staking service.

After systematically introducing the development prospects and possible impacts of Staking Economy, we hope to provide a “Guide” article on the basic elements of the staking economic mechanism and how to use the basic elements to design related operational activities or products, and how to Find useful information efficiently.

I hope this article will give readers who have just learned about staking a systematic understanding of the staking operational framework and how to continue to follow new knowledge. For those who already know, it can be used as a reference to open more interesting operational activities based on staking. And products.

Understand the five basic elements of staking business

- Centralized stable currency and breakout of decentralized stable currency

- Opinion | Data autonomy: my data I am the master

- The exchange is robbing the tokens, all of which are behind the interests.

By understanding these five basic elements, you can read the economics of most PoS blockchains.

1. Inflation rate of PoS consensus project

Often the "inflation" that everyone says is worthwhile and is the fundamental source of staking revenue. Just as the central bank will print money every year, the multi-printed banknotes are inflation-issued. An economy continues to grow positively, requiring more money as a lubricant, and the additional tokens are used as a medium in each blockchain, as well as a function that is similar to lubrication and promotes ecological development.

In general, the new PoS consensus project has chosen inflation as a model for the token economy, because the market generally believes that inflation is more in line with the real economic situation. On the other hand, the tokens for inflation issuance can be intuitively rewarded for participation. (whether it is a node or a currency holder).

Case

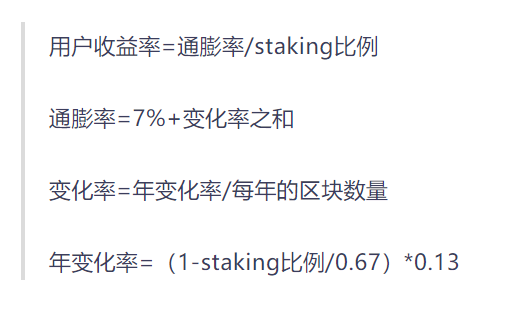

The inflation or issuance model for each project is different. There are fixed annual growth models like EOS and Tezos . The current increase rate of these projects is about 5%, which can be adjusted through community governance. It is also like Cosmos and Livepeer adjusted with staking ratio. The issuance model, one of the parameters affecting inflation in these projects is the ratio of the holder's participation in staking.

The inflation model for fixed issuance is relatively simple. The white paper usually writes specific information about the economic model of inflation, such as the inflation rate per year. The latter model, which is adjusted with the staking participation ratio, needs to be calculated manually. Usually, in each project's code, there are calculation formulas and models for staking, and engineers can be asked to assist in the calculation.

2. Staking ratio of all tokens

Please remember: although the income of the holders comes from these additional tokens, the inflation rate is not equal to the holder's rate of return.

why? Staking is an action to participate in the user and operate by itself. If you do not perform staking, you will not be entitled to the corresponding rights. Therefore, the tokens after each blockchain inflation is issued will only be distributed to the holders who have staking.

The formula for calculating the correct rate of return of a currency holder should be:

Yield = inflation rate / staking ratio of all token participation

Case

Tezos' current inflation rate is around 5.5%, but the bearer's rate of return is around 7%, because only 80% of the money-bearing users participating in Staking, that is, all issued Cosmos tokens will only be awarded to this 80%. People, the rate of return of these people is 5.5% / 80% = 7%, not just 5.5%.

3. Commission rate

The handling fee is the price at which the currency holder uses the entrusted service. If the holder has no time and energy to operate the node to obtain the staking income, the token can be entrusted to the node by the node, and the node will run for the user and obtain the inflation reward on the chain. At the same time, these nodes will charge a part of the processing fee to make up the server and labor. cost.

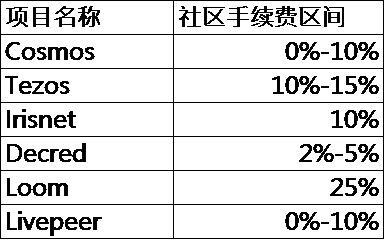

market information

According to our understanding, the current staking fee on the market is between 5% and 20% on average:

4. Locking period

Most projects that use the PoS consensus will have a lock-up period. The lock-up period means that when the token holder's token is involved in staking, if it is decided not to participate in staking, for example, when the secondary market is sold, it takes a while to unlock the free flow.

The simple understanding of setting the lockout period is a safeguard to prevent the block node from doing evil. The length of each project's lock-up period varies, generally around 20 days.

Why do I need a lockout period?

There are three considerations for setting the lockout period:

- Security: The lock time can be used to prevent the "long-range attack" problem proposed by PoS theory research. At the same time, the locked token can be used as a penalty for malicious attacks by nodes. The lock-up period gives the system discovery or the time when the community reports malicious behavior.

- The project side hopes to lock the tokens, because the lock can increase the system security roots, reduce the circulation of tokens, and reduce the price fluctuations in the secondary market.

5. What are the factors that affect the risk of the holder?

The most common risks encountered in Staking are the following:

- The node does not participate in the generation of random numbers in the consensus

- The node did not participate in each election cycle, the election of the blocker

- The selected node, Miss is out of the block: the node has one less block corresponding to the reduction of reward

The above three connections will lead to a decrease in the rate of return of the node, so the yield of the holder will also decrease.

- Slash Penalty: The most common Slash is a node, not acting, improperly running or doing evil. When doing Double Sign, the system will impose some punishment on the node.

Further explanation: Some PoS mechanisms are directly penalized by means of confiscation of mortgages, also known as reverse incentives; some PoS mechanisms are penalized by not giving rewards to the verifier, which can be regarded as positive incentives.

Some exceptions

Loom and WanChain currently do not have a token model for inflation. Instead, they reserve a portion of the token in the total amount as a staking reward. Chain X uses the form of “recharge and mine” and “voting mine” to start PoS. The initial distribution, subsequent distribution is also based on the total weight of "Daily Recharge + Voting", which divides the token generated by the system every day.

For these projects, except for the inflation factor is not applicable, other elements can be referenced, and the core of all PoS projects is that the staking equity is positively related to the staking amount of the holder.

Seven product design tips that need to be considered the most

After understanding the above five basic elements, you can consider the possible design of possible operational solutions. We have a few ideas for the introduction of jade.

Fee pricing strategy

The Staking fee is very similar to the transaction fee of the exchange. Operators can use this to plan. The strategies that can be considered include:

- The first few cycles are free, first attract users to increase and then increase;

- In the middle of several cycles to match the holiday promotion;

- Draw a lot of cycles to stimulate a single cycle of staking;

- Paired with the exchange platform currency, for example, you can enjoy the staking fee discount when you hold the platform currency;

- Reducing and exempting according to the amount of user entrustment, and calculating according to the function of entrustment amount and handling fee;

- There are different fees depending on the length of the user's entrustment. This is a disguised membership system that attracts long-term staking delegates.

2. Locking period strategy

This strategy is mainly aimed at the centralization mechanism, because the tokens in the exchange and the wallet need a certain degree of liquidity. In other words, the exchange cannot put all the coins into the staking, there will be a lock time limit, once the staking is put in, when the user Temporary need for tokens creates a liquidity risk.

design example

In the case of wanting to use the user's currency for staking and want to maintain the liquidity of the exchange, the exchange must measure how many users' coins will be idle and idle for how long? Exchanges or wallets can staking idle tokens while maintaining a certain level of liquidity.

The exchange's strategy is to design a staking product and sign an agreement with the user. For example, if the user is willing to lock for 30 days, the fee can be reduced. Trading all of this agreement, it is clear that these ratios of tokens can be used without risk of liquidity and can be used directly for staking to generate revenue.

Going back to Loom's example, Loom itself has a lock time bonus setting, so if the exchange wants to provide users with Staking rewards for Loom tokens, they must provide users with products and protocols that choose to lock time.

The above mentioned is about the strategies that can be utilized by centralized exchanges, but in the decentralized world, we have to explain to users more clearly. From a technical point of view, some projects such as Cosmos and Wanchain can directly issue Staking rewards to each one. On the address of the holder of the coin; rather than by issuing a reward to a third-party service provider, and then by the service provider to each holder of the Staking (currently Tezos practice), the former approach is On- Chain Governance, all rewards are clearly identifiable and there is no room for evil. The latter approach, after a middleman and then to the user (such as through the exchange), has the potential to do evil.

3. Risk assurance strategy

Simply put, this is a revenue promise. For the user, the staking reward for getting the hand depends on the performance and commission of the team's running nodes. When the team's operating node is in poor condition and the revenue drops, some insurance measures will play a role.

Case

At present, the service provided by the team is to ensure that the technology is excellent to the holder, and there will be no loss of the block or the double signature (Slash). If a similar situation occurs, the team will bear the loss and hold the currency. People can get the theoretical benefits of the team's normal performance. This is actually a kind of income guarantee.

By choosing a team that can provide staking revenue guarantees, the currency holder only needs to consider the fee. The fine-running staking service provider can also allow the holder to choose the insurance coverage (this can be compared to the innovation of the PoW pool from PPLNS mode to PPS mode, which is to balance the risk of lucky value through insurance. ).

From another dimension, insurance can also be used to balance the portion of the currency risk hedging. Many users don't know how to properly use futures and options to hedge their risk. By means of a professional team, and with such an insurance agreement, users only need to pay part of the service fee to balance the risk of currency fluctuation during the staking period. Of course, it is possible that such an operation cannot fully hedge the risk, but by purchasing BTC and mainstream token financial derivatives, at least the currency risk in the general direction can be hedged. For the organization, how to use existing derivatives, this is also the most worthy product direction.

4. Liquidity strategy

The Staking reward requires a certain lock-up time from issue to removal, which naturally creates a space for liquidity. In the previous section, we mentioned the liquidity needs of the exchange. Here, we can also pay attention to the liquidity needs of users: the exchange can play the role of pawnshop.

Case

When the user's funds are tight and need to be borrowed, the exchange can first use the balance, that is, the token or the stable currency with liquidity, to the user. If the loan interest rate is equivalent to the annualized interest rate of the user token staking, the risk is relatively low, because the user always has assets and future rewards in the hands of the exchange.

This loan is actually a staking reward that the user will get in the future. This service can be designed with the discounted value. The longer the advance payment time, the less the present value reward will be obtained in the future.

Supplementary explanation: It can introduce an insurance mechanism. The intrinsic locking period is to prevent malicious certifiers from attacking. Therefore, if it is not locked, it is technically risky, but at the same time there must be digital currency insurance institutions in the market to value this opportunity. In the insurance business, users can lend a certain amount of tokens as liquidity when they lock the token for Staking. For the project side, most of the tokens are Staking to reduce the risk. For the client, the deposit is settled in Staking. The rate of use of funds.

5. Special equity strategy

Special interest refers to the equity other than staking income. For example, EOS can lease resources, and the token has the use value. For example, NuCypher 's Wordlock solution can be used to recharge ETH into the smart contract, and the user can obtain the newly assigned NU.

Case

The centralized team can use the user's idle tokens by signing an agreement with the user to obtain these special benefits through active operation. For example, after signing an agreement, EOS can receive interest income on a regular basis; after signing the agreement, the centralized team can also use ETH to participate in the acquisition of special interests in valuable projects.

On the other hand, a model like NuCypher that acquires tokens through active user participation, which assists the user with the centralized team, may help to improve the decentralization of the project, provided that the holder agrees in advance. Let the exchange or other service provider's own ETH take the initiative to participate in the acquisition of NU.

I believe there will be more examples of special interests.

6. A basket of staking yield products

A basket of commodities is a portfolio that allows users to save a lot of time and invest in a combination of relatively dispersed risks. At present, the Centralized Exchange has launched a product that packs the top cryptocurrencies into a certain proportion by a certain percentage.

Case

For PoS projects, the same index products can also be developed. Because of the staking reward characteristics, index products can be subdivided into only fixed income (ie staking rewards) or “token investment income + Staking rewards”. different kinds.

7. A basket of excellent node packages

As the name suggests, such products can set a certain percentage of tokens and delegate them to multiple nodes at once.

At present, one of the money-holding users is that the staking process can select multiple different nodes, but the user usually selects only one node for convenience, and this mode will lead to stronger ones. Especially if the exchange becomes a staking node, the exchange will inevitably become a central node that is large and easily criticized in the future. In fact, the controversy over the role of the fire coin in the EOS blockchain community can be used as a reference.

Case

We believe that there will be a tool in the future that allows the holder to conveniently delegate one-time tokens to a number of excellent nodes through a button or through a protocol, which will be pre-set according to the holder. proportion. Such a function not only enhances the reputation of the tool provider, but also promotes the decentralization of the blockchain, and the user can balance the risk of handing over the token to a single node. If you pay attention to the design of Polkadot, you can find the corresponding design in its NPoS.

Where can I find staking related information?

The above are some of the possible trends in product and operational solutions. However, in order to design a good product and set effective operational rules, it is necessary to proceed from the essential rules of each blockchain.

The rise of Staking Economy has the potential to allow a large amount of tokens to settle on a centralized exchange, and once it has settled, it means that it is not easy to have the opportunity to flow to other exchanges. For operators who provide staking services, they must consider how to differentiate the user's tokens to their own exchanges, wallets or staking service nodes.

In addition, the operators of the staking service also need to build a solid knowledge of staking and PoS. We also want to provide some channels for basic information about staking and PoS:

Project white paper

To get information about the specific project's economic settings, such as total tokens, initial allocation, and inflation rules, the best way is to consult the project white paper. You can look at the table of contents directly or use Ctrl+F to search for keywords without wasting time watching the entire white paper.

2. Block Browser

The English of the block browser is named after "XXXScan", and the corresponding block browser can usually be found on the official website of the project. The content displayed on each block browser is different. The basic information that can be seen is that there are several nodes in the entire network, the staking weight of the entire network, the name, address, and block of each node (uptime, Slash) and so on. In addition, some blockchains can clearly see the on-chain record of the block rewards for each block, which is very helpful for operators to verify the staking reward formula, lock time, and calculate the start time of the staking weight.

The browser can also see the community voting information, you can see which addresses are cast, what the proposal content is, the start and end time, and so on.

3. Medium

There are many authors on Medium's platform who share information on how to calculate stkaing benefits and how to perform staking. Generally speaking, if the white paper is too complicated or can not find relevant verification data, you can consider searching for "project name + Medium" to see if there is any relevant team in the foreign country to write similar information to enhance understanding.

4. Official forum

At present, Cosmos and Tezos have official forums, and the forums have a very clear classification of various discussion topics.

5. Reddit

You can also try searching for reddit after the keyword and you will find many interesting online discussions.

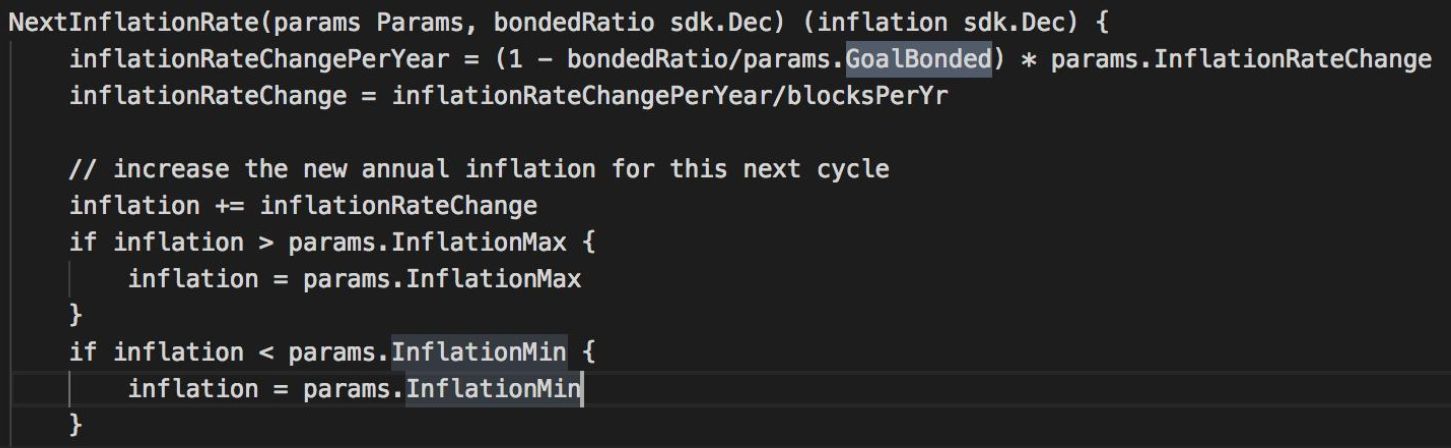

6. Browse the code

If you can't find the details of the economic mechanism of staking, you can ask an engineer friend. Don't worry about reading the code is very difficult. In fact, the staking yield or related parameters are as simple as a definition in the code. There will be a clear name. The equal sign is followed by a parameter or a formula.

Like this:

But in fact, the translation is as simple as this:

7. Recommended sources of information

– "Seeking Yield" by Staked.us

Https://staked.substack.com/

– "Staking Economy" series by Chorus One

Https://blog.chorus.one/tag/staking-economy/

– Cryptium's introduction to the vernacular PoS consensus project technology, staking tutorial, risk tips, etc.)

Https://medium.com/cryptium

– Report by staking about Diar.co

Https://diar.co

– "Staker Digest" weekly report by StakeWith.us

Https://stakewith.us/

Chinese

– Special topic about Staking Economy by Block123.com

Https://www.block123.com/zh-hans/feature/proof-of-stake

– Wetez public section " Wetez_Wallet " for the in-depth analysis of Staking Economy and the PoS part of the "Finding the Holy Grail" weekly

High energy warning

"Proof of Stake" Chinese Weekly Test

Interested friends can register for the weekly report and participate in product testing by visiting the following website:

Https://proofofstake.substack.com

In short, this is a guideline article. It can be met that the future staking mechanism will become more and more complicated. When the star project launches innovative design, other projects will be quickly imitated.

Of course, for the user, it is not necessary to understand too many complicated mechanisms. The intermediate cognitive cost should be filled by the blockchain practitioners. However, for practitioners and serious investors, having more information will definitely mean more opportunities.

Source: Wetez

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Blockchain: Casting a new financial civilization

- Is Bitfinex and Tether actually a victim? The culprit behind the scenes is it!

- Internet vs blockchain revolution: early challenges

- Three "printing machines" are open: this year, USDT has accumulated more than 1 billion yuan to renew the stable currency market.

- Samsung executives responded to the rumor of the currency: most likely the development of the electronics department, but ultimately depends on the use case

- Building a city of wisdom on the blockchain | 2050 Conference·New Life Forum

- The history of password punk is the history of growth after 90, is the spirit of password punk lost?