Early comment on April 30: BCH replays the power collapse

A talk currency:

The price of USDT has risen sharply in the short-term. A miner holds 37% of BCH's calculation power. There is a bad expectation of the crit of the computing power. Yesterday, the BCH is regaining power.

4.26 Akong in the USDT article, detailed talk about the trend after the USDT thunder, after the USDT thunderbolt fell, the currency price rose first and then fell.

After the price of USDT rises, the market will make up and stabilize and there will be a volatility trend, and then there will be a waterfall market with a unilateral plunging.

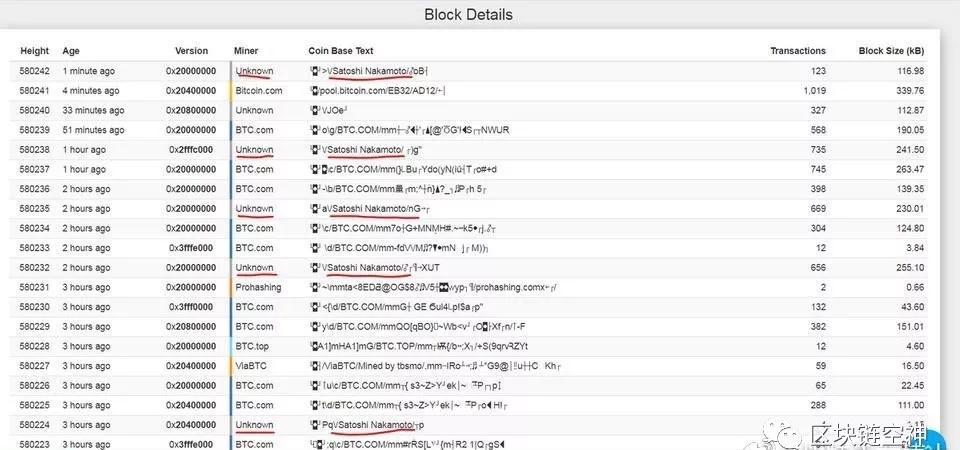

- Yuan Dao Dao | Rereading Nakamoto's Mail Series – Anonymous

- Getting started with blockchain | Let EOS lie down and “mining” REX deployment

- Opinion: Stabilizing the coin, this pig is ready to fly, but the wind has not come yet.

After the USDT explosion on 10.15 last year, the market showed three stages of trend. In the first stage, USDT appeared to be thundering expectations. The market was panicked. The USDT in the hand was replaced by BTC, and the short-term price of the currency was quickly pulled up.

In the second phase, the price of USDT rebounded rapidly, and then the market bottomed out and walked out of the short-term market.

In the third stage, the USDT shock consolidation, the price of the currency fell sharply.

It is worth noting that before the waterfall market on 11.15, BCH had a forklift crisis, and the market blamed the BCH for its hegemony.

In the past two days, a BCH miner named Zhong Bencong appeared to gradually occupy the BCH calculation power. At present, it is close to 40%, causing market bearish expectations and BCH short-term plunging.

Akong believes that the fundamentals of the market are re-enacting the October market. After the short-term rebound, the short-selling rallies will wait for the second round of short-selling profit.

In the past two days, I have been running around, and I don’t leave a message. The release time of the article is not very stable. I will send you an early comment, thank you for your understanding.

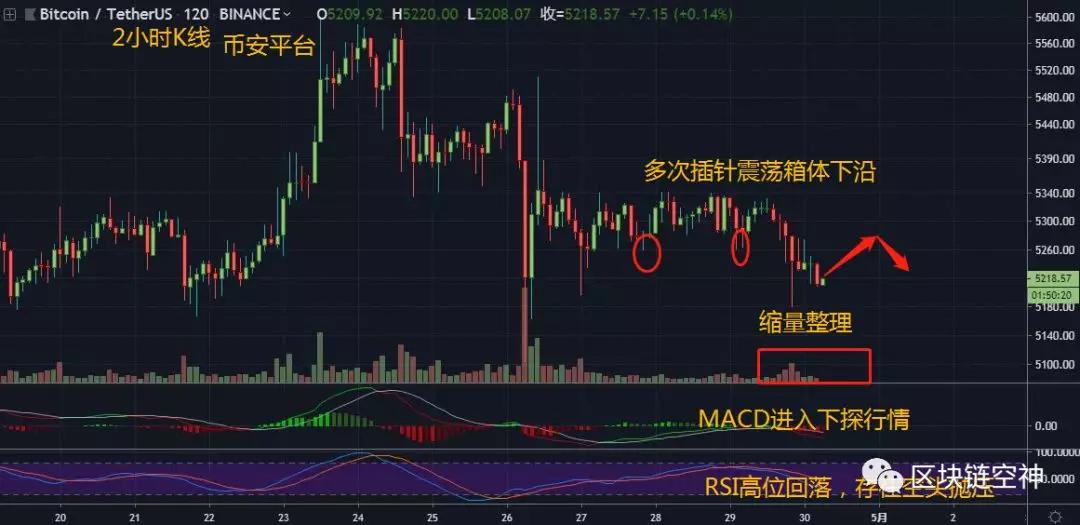

BTC:

Overall, the BTC made a shock, and there was a short selling pressure on the top of $5,267. The price of the currency was pumped back to the upper box, and the volume continued to weaken, continuing the shock.

BTC only has a volume that has fallen below $5,150 to form a new round of downswings. There have been multiple rebounds underneath and there is some long-term support.

Short-term oversold rebound, after waiting for a short-term rebound in operation, rallies to lighten up.

Next, the BTC peaked at $5,267.

Resistance level: 5267, 5300, 5332

Support level: 5187, 5150, 5082

EOS:

Short-term quick bottoming, enter a new down market, test the bottom support.

Below the 4.42 US dollars is the long-term key point formed in early April, the role of long-term support for the price of the currency, once the volume fell below the short-term $4.42 will quickly weaken.

Above the $4.58, it is the position of the lower edge of the shock box, and the currency price is tested to the upper resistance level.

Next, EOS peaked at $4.58 and doubled.

Resistance levels: 4.58, 4.62, 4.66

Support level: 4.46, 4.42, 4.37

ETH:

The amount of ETH can continue to weaken, indicating continued volatility.

At the $151.8 rally rebound, there is a certain long-term support. Below the current bullish key point of $151.8, the price of the currency has fallen below $151.8, which will result in a new downtrend.

Akong believes that ETH will continue to fluctuate and test the bottom support.

The short-term is close to the zero-axis, and then ETH oscillated at $155.8.

Resistance level: 155.8, 157.8, 158.6

Support level: 153.2, 152.6, 151.8

BCH:

BCH will be upgraded on 5.15 days. Like ETH, once the fork is upgraded, the price of the currency will often appear weak. Under the expectation of bad, BCH will fall rapidly and lead the mainstream currency market.

Below the 224.5 US dollars, is the position of the long neckline in early April, once the volume fell below 224.5 US dollars, it will form a new round of decline.

You can focus on the leading trend of BCH, which will lead the mainstream currency market into the second round of the big downtrend.

Short-term bottoming weakened, and then BCH weakened at $242.3.

Resistance level: 242.3, 246.8, 251.3

Support level: 230.2, 227.3, 224.5

BNB:

The price of the currency continued to weaken, and the platform currency fell sharply, driving the market of the small coin to bottom out. The short-term IE0 hot spot fell rapidly.

The rebound of $21.2 below is the key point for BNB. Once the volume falls below $21.2, it will form a new round of decline.

Akong believes that the amount of BNB can continue to weaken, and the bottom of the shock is tested.

Next BNB oscillated at $21.2.

XRP:

The XRP shocked to the bottom, and there was a long support at $0.288 below, which was the lower edge of the XRP shock box.

The quantity can continue to weaken, indicating that the currency price will continue to fluctuate and return to test the top resistance level.

Once the volume drops below $0.288, the price will enter a new round of decline.

Akong believes that XRP will continue to fluctuate and make shocks.

The short-term oversold rebound, and then the XRP was shocked at $0.295.

Resistance level: 0.295, 0.297, 0.298

Support level: 0.289, 0.285, 0.283

Altcoin:

Recently, the small currency has emerged as an activist market. Most of the new coins have fallen sharply, showing a very large decline. The previously rising model coins have also fallen back to the starting point.

The leading platform currency is also weakly organized. Only the platform currency will strengthen its bottom line, and the small currency will be able to rebound. The market is dominated by BTC support. Akong believes that it can wait for the rebound of the mainstream currency in these two days. The short market of Gao Jiancang mainstream currency.

The latter market will also be dominated by short-selling market. In the trend operation, the positions that have been short-selled from mid-April can continue to wait patiently. This round of short-selling market is a weekly downtrend, and the spot is mainly on the sidelines.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- April 29th market analysis: Bitcoin long and short shocks are difficult to divide

- Video|"8" He Bin: I want to copy myself in the digital world

- Half a year of gold 5.2 billion, the "black" of the Bell chain

- Dry goods | Current main limitations of Lightning Network (Part-1)

- Korea Exchange Bithumb enters STO field

- Is the pledge token cut off? BitGo co-founder talks about the vicious circle of Staking drive

- LTC's total network computing power has dropped significantly for the first time after reaching a four-month high this month.