Efficient Market Hypothesis and Bitcoin S2F Model: Prediction of Bitcoin Value

Foreword: Views on the future valuation of Bitcoin have never been consistent, and there are even large opinions to the left. Some people agree with the S2F model, some people believe in the efficient market hypothesis, some people worry that the miners will surrender after halving, some people think that Bitcoin is an efficient market, a lot of information has been included in the price, and some people think that the market overestimates the risk … Different views lead to different decisions. This will continue to accompany Bitcoin's growth history. The author of this article, PlanB, was translated by "JoTo" from the "Blue Fox Notes" community.

Introduction

The Bitcoin S2F model was released in March 2019. It is welcomed by Bitcoin supporters and investors. Many analysts have also verified the cointegration S2F model and confirmed its price prediction. (Blue Fox Note: Stock-to-Flow model is an indicator of scarcity. Assuming that the S2F of gold is 62, it takes 62 years to produce a stock of gold, which means that the higher the S2F, the new The slower the item becomes, the more scarce it is. Bitcoin will reach an approximate level of gold after the next halving)

The S2F model has also been criticized. The best argument against the S2F model comes from the Efficient Market Hypothesis (EMH). The argument claims that the S2F model is based on public information (S2F, the bitcoin supply trajectory is visible), so the analysis and conclusions have been factored into the price.

In this article, I will share my views on the S2F model and EMH. I analyze arbitrage opportunities, risk and return models, and derivatives markets.

- Paper invoices that are disappearing: from 10,000 to 20, blockchain technology blesses electronic invoice reform

- Zhongxiang Internet won the A + round investment of listed company Jihong, with a valuation of 105 million yuan after the investment

- Opinion | Zhang Yifeng, Dean of China Banking Technology Institute: Do not think Libra will land soon

S2F model

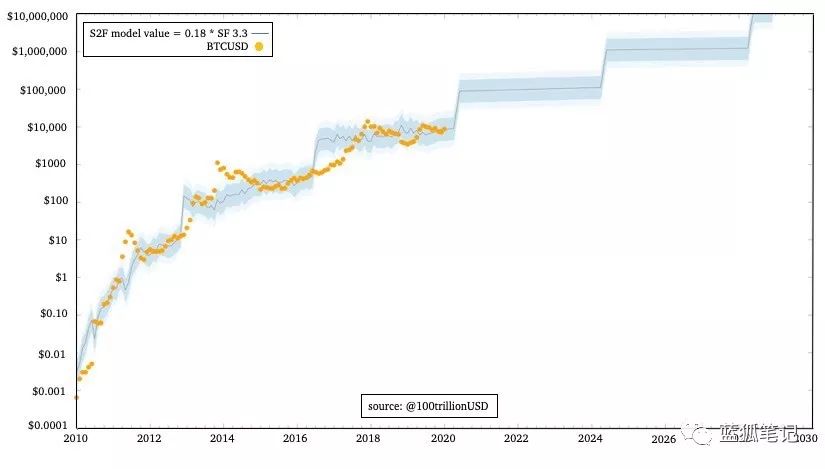

The S2F model was released as a Bitcoin valuation model, inspired by Nick Szabo's unforgeable scarcity concept and Saifedean Ammous's S2F analysis. S2F is a measure of scarcity. Over time, the power-law relationship between S2F and Bitcoin price captures the underlying laws of Bitcoin's complex network effect dynamic system, as mentioned by Trace Mayer.

The S2F model is a power-law function, suitable for monthly data from October 2009 to February 2019: BTC price = 0.4 * S2F ^ 3

, Where S2F = 1 / inflation rate. Newer models of annual data from 2009 to 2019 yield higher forecasts: BTC price = 0.18 * S2F ^ 3.3

Nick Phraudsta was the first to validate (or better "do not fake") the S2F model, adding co-integration analysis to show that this correlation may not be false. Marcel Burger validated the S2F model and co-integration, and performed some other statistical tests. Mannel Andersch was the first institutional investor to validate the S2F model and co-integration.

Efficient market hypothesis

The efficient market hypothesis (EMH) is a well-known theory in financial economics. The efficient market hypothesis is based on the ideas of Hayek et al. According to Hayek (the 1974 Nobel Prize winner), the market is an information processing system that can provide the best possible price discovery. The formal description of the efficient market hypothesis comes from Eugene Fama (Nobel Laureate in 1973) and has the following three types:

* Weak efficient market hypothesis

Historical price data has been included in the price and cannot be used for profit. Technical analysis (TA) and time series analysis (TSA) do not work.

* Semi-strong efficient market hypothesis

Public news from media such as MSNBC, Bloomberg, WSJ, and research companies has been included in the price and cannot be used to make a profit. Fundamental Analysis (FA) does not work.

* Strong efficient market hypothesis

Even inside information cannot be used to monetize. Because all information has been included in the price.

Most investors and economists agree that modern financial markets are fairly efficient (ie, they accept weak and semi-strong efficient market hypotheses), however, they reject the strong efficient market hypothesis. (Blue Fox Note: That is, they believe that historical price data and fundamental analysis have been included in the price, which is difficult to use to make a profit. But internal information does not fall into this category)

Following the efficient market hypothesis, the S2F model should also be included in the price as it is based on publicly available data (S2F).

Risks and rewards

Honestly, in my more than 20 years of experience managing billions of euros in balance sheets as an institutional investor, I have never used the efficient market hypothesis directly. In practice, we assume the efficient market hypothesis and use a risk and return model.

* Assumed efficient market hypothesis

Some people think that the Bitcoin market is not efficient, but I don't agree. In the past, you could use USD to buy Bitcoin on one exchange, then buy it on another exchange, get EUR or JPY, and then exchange it back to USD for profit. At this time, arbitrage is possible. But these days are gone forever, you can take a look at the following picture (price of GMT 2020.1.13 20:00):

BTCUSD = 8100

BTCEUR = 7300

BTCUSD / BTCEUR = 8100/7300 = 1.11

EURUSD = 1.11

BTCJPY = 885.000

BTCJPY / BTCUSD = 885.000 / 8100 = 109

USDJPY = 109

Perhaps money can still be made through mainframe computers, fast communication lines, and high-frequency trading algorithms (HFT), but the opportunity for easy arbitrage is gone. We can safely believe that the $ 150 billion bitcoin market with daily trading volume of $ 10 billion is quite effective.

Risk & Return Model

Assuming the efficient market hypothesis does not mean that you cannot make money. You just have to take risks. The efficient market hypothesis and no arbitrage lead us into the risk & return model.

Harry Markowitz (the 1990 Nobel Prize winner) proposed an early risk & return model based on his well-known portfolio theory (PT). William Sharpe (1990 Nobel Laureate) published his famous Capital Asset Pricing Model (CAPM). According to Markowitz and Sharepe, all benefits can be explained by risk.

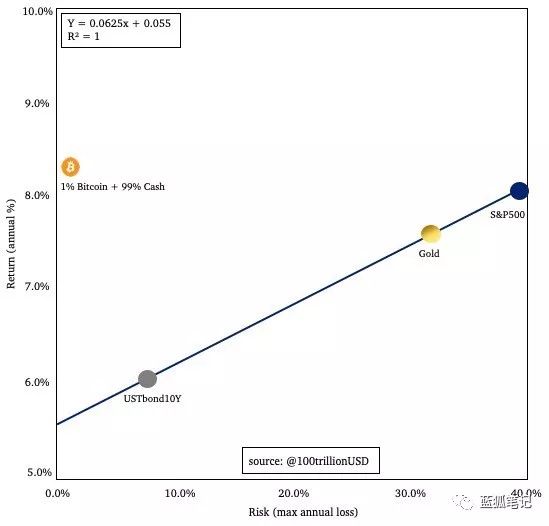

Here is a simplified risk & return model (without correlation and foreign math):

Understanding this chart is crucial, let's dive into it.

The x-axis of the chart is risk (maximum annual loss) and the y-axis is return (average annual return).

The chart shows three classic assets: bonds, gold, and stocks. Bonds have the lowest risk (8%) and the lowest return (6%). Gold has a higher risk (33%) and a higher return (7.5%). The stock has the highest risk (40%) and the highest return (8%).

The key insight is that this is consistent with the efficient market hypothesis, where returns can be explained by risk alone. If you encounter assets beyond the above range, then the first reaction may be a huge investment opportunity. A better response (from the perspective of efficient market hypothesis and no arbitrage) is too good to be incredible.

We may have overlooked risk (or miscalculated the risk) and should try to bring this asset into the normal range. Quantifying risk (volatility) is difficult, and so is the quantitative expert for financial institutions. If the investor's calculation of risk is lower than the market's credited price, and if he knows exactly why the asset is out of range, then only then should he decide to invest.

Bitcoin is actually something "outside the chart": 200% return, 80% risk. Since I couldn't draw it on the chart, I adjusted it to 1% of Bitcoin plus 99% of cash investment. This Bitcoin investment is far beyond the normal range: 8% return, 1% risk (please note that even if Bitcoin drops 99%, you will not lose more than 1%, because you only invested 1%) . So my first reaction was: the market sees risks that are not in the data. Here is a list of some possible risks:

* Bitcoin risk of failure

* Government risks Bitcoin as illegal and prosecutes developers

* Risk of fatal software errors

* Risk of hacking exchanges

* Risk of 51% attack by centralized miners

* Risk of miner's death spiral after halving

* Risk of hard fork

From an efficient market hypothesis and risk & return perspective, all these risks should be included in the price data. However, these risks are not in the data. According to the efficient market hypothesis and the risk & return formula in the chart, a 1% risk should give 5.5% + 6.2% * 1% = 5.6% return. The data shows that in the past 11 years, 1% of Bitcoin + 99% of cash has 8% return.

It seems that these risks have been overvalued by the market and consistent with the S2F model, Bitcoin is indeed a huge investment opportunity.

Derivatives market

Let's see what the derivatives market tells us about the future.

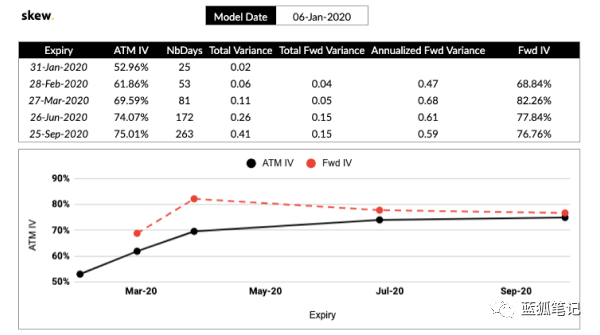

The options market does not peak at or after the next halving:

Source: https://twitter.com/skewdotcom

Source: https://twitter.com/skewdotcom

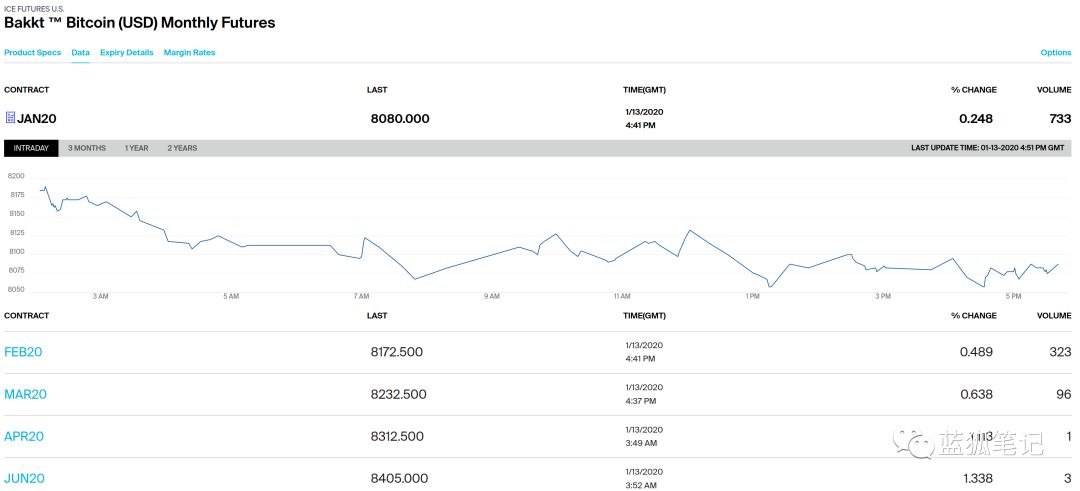

The futures market is the same as the options market: the future price will be slightly higher, but there will be no peak after halving or halving, which indicates that no special situation will occur when halving:

Source: https://www.theice.com/products/72035464/Bakkt-Bitcoin-USD-Monthly-Futures/data?marketId=6137544

Source: https://www.theice.com/products/72035464/Bakkt-Bitcoin-USD-Monthly-Futures/data?marketId=6137544

This is interesting because the S2F model predicts higher prices after halving. How should we explain?

I think the simple answer is that the current market has overestimated future risks, just as it has overestimated risks in the past 11 years. An efficient Bitcoin market not only underestimates the basic value of scarcity (S2F model), but also overestimates all of these risks:

* 42% of investors consider Bitcoin futures to be the greatest risk (whales manipulate bitcoin prices through "paper Bitcoin")

* 16% are still worried about miners surrendering after halving

* 15% are worried about selling pressure from scams

Through discussions with institutional investors, I know that their biggest concern is that the government will make Bitcoin illegal. Another risk that institutional investors often mention is "the next bitcoin," a new (government / central bank-backed) token that will replace bitcoin.

Please note that without these risks, Bitcoin will be more valuable and may be consistent with the S2F model. Over time, some of these risks will not materialize and will not disappear from the list. Take the surrender of miners as an example. I don't think miners' capitulation is a big risk, but 15% of investors think it is a big risk. If the hash rate does not drop after the next halving, then the risk of miners surrender will disappear and the price of Bitcoin will rise because this risk disappears.

Conclusion

The Bitcoin S2F model was launched in March 2019 and has been verified by many people. The efficient market hypothesis implies that S2F and model predictions should already be factored into the market because the S2F model uses publicly available S2F data.

The current Bitcoin market is indeed quite effective, because there is no easy arbitrage opportunity. Historical risk and return data for bonds, gold and stocks and bitcoin indicate that the bitcoin market is overestimating risk. Bitcoin returns are inconsistent with risk, but fit well with the S2F model. The Bitcoin options and futures markets do not expect prices to rise in half or after halving. The market may still overestimate future risks.

My conclusion is that the bitcoin market is indeed quite efficient and includes the price of the S2F model, but it also overestimates the risk. Therefore, rather than using the classic risk and return model, I prefer to use the S2F model to predict the future price of Bitcoin.

Risk Warning: All articles of Blue Fox Notes can not be used as investment advice or recommendations. Investment is risky. Investment should consider personal risk tolerance. It is recommended to conduct in-depth inspection of the project and make good investment decisions.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- 8 asked text version | Conflux Long Fan: Only by reducing the interaction cost with the public chain will there be more applications

- Changsha Blockchain Industry and Park Development Report: Issued housing rent subsidies, special incentives and other policies, with a total of 793 registered companies

- Ethereum: developers continue to advance Ethereum 1.x to ensure interoperability before 2.0

- Is Bitcoin price prediction reliable? EMH theory vs S2F model

- Analysis: Three reasons why altcoin has failed to disrupt Bitcoin

- Sino-US competition escalates, US wants to launch "digital dollar" against DCEP

- December panoramic scan of data on the Bitcoin chain: exchange giants article