Ethereum is becoming more vulnerable, and its power has fallen more than 42% from its highest point in history.

Computational power is an important index for measuring the healthy operation of the Proof of Work (PoW) blockchain. This means that if a potential attacker wants to launch a 51% attack, it must overcome this obstacle. Computation also represents the overall interests of the entire community.

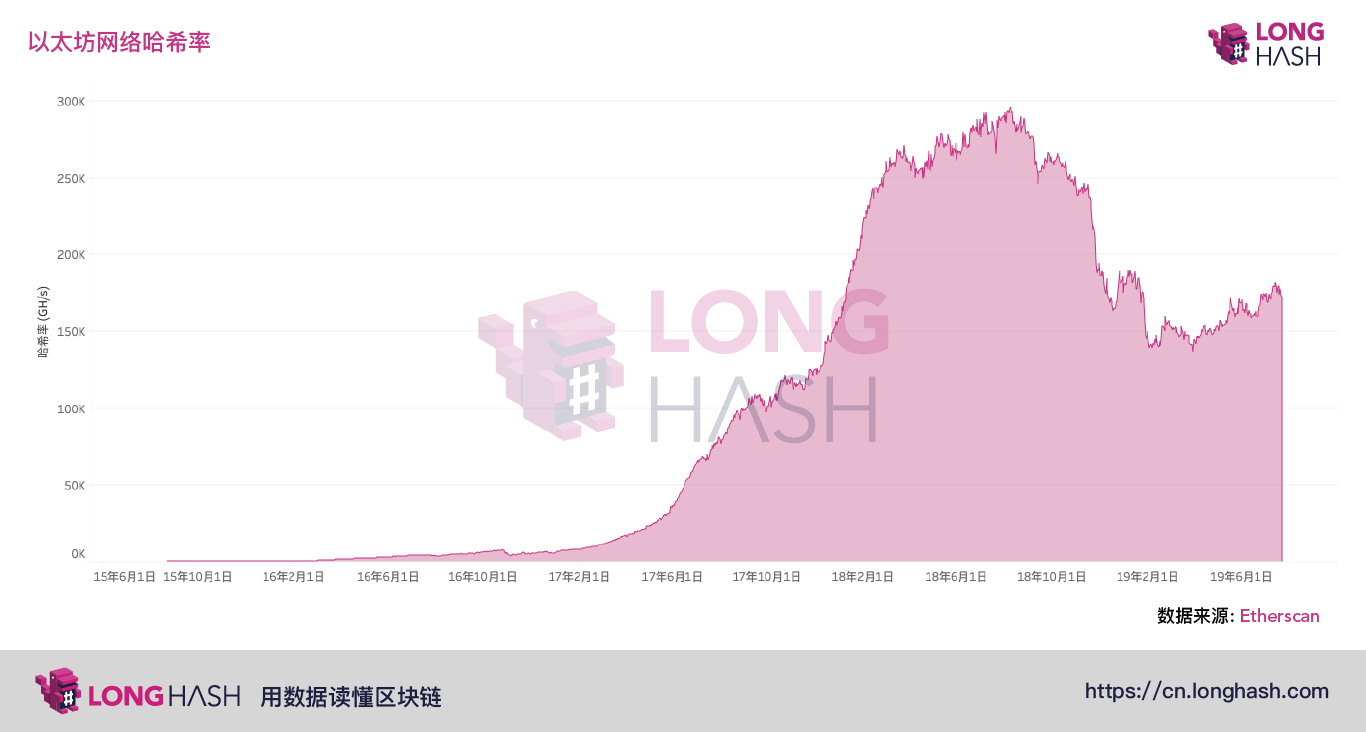

Now, the increase in computing power is part of the missing Ethereum community. Ethereum's computing power has fallen more than 42% from its August 2018 historical high (ATH). To illustrate this, let's take a look at Bitcoin computing power. Bitcoin computing power also reached its all-time high (ATH) in the summer of 2018. After hitting an all-time high, Bitcoin computing power is still above 22%.

As an indicator, computing power witnessed the split of the 2019 cryptocurrency community. In the early years, all cryptocurrency movements tended to be consistent, regardless of whether prices rose or fell, or whether the indicators on the chain were rising or falling. But now, investors seem to have more time to figure out which blockchain project is worth investing in. This divides the market return for the entire industry (about half of the cryptocurrency price is lower than December 2018) and also divides the blockchain power on the PoW chain. So far, only Bitcoin and Litecoin have reached the highest computing power of 2019 in the Workload Proof (PoW) chain.

Bitcoin cash, Bitcoin SV, Ethereum are all below the highest computing power of their network records. On the surface, this is not a big problem. However, these chains open the door to potential attacks (the currencies on these chains are more vulnerable). As of today, the one-hour cost of launching a 51% attack on Bitcoin is more than $850,000, while the 51% attack on Ethereum only costs $100,000. Bitcoin SV is the most vulnerable currency in the Proof of Work (PoW) chain. At the time of this writing, its 51% attack cost was only $11,000.

- Bitcoin will reach $100,000 in 2019? Claiming to be a "time traverser" from 2025

- Introduction | Carl: Punishment in Eth 2.0

- The latest development of the Ethereum Layer-2 protocol: Plasma and state channels go hand in hand

The attack costs described above are not a big problem for countries or large companies, and they can easily attack the main cryptocurrency. If these major cryptocurrencies are intact in the next few years or decades, then these companies must protect their chains and prevent larger, more funded villains from launching attacks.

LongHash , read the blockchain with data.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- The Galaxy Consensus Node plans to add Southeast Asian members – RiveX!

- Centralized Exchange VS Decentralized Exchange Who is the future of cryptocurrency?

- US Presidential Candidate Andrew Yang will accept bitcoin donations from Lightning Network

- Morning market analysis: BTC shock adjustment is still continuing, mainstream currencies are still under strong pressure

- EU: At present, the digital currency market is “anti-competitive”, and the European Central Bank’s digital currency will reshape the competition.

- The market continued to oscillate and shuffle, and prudently waited patiently

- Looking at the DeFi asset management platform from the point of view of the traditional fund: What is the future cap of the DeFi world?