Forbes: cryptocurrency is preparing to fundamentally change finance

“Once the demand for physical media in the currency disappears, the possibility of a fundamental change in the financial system will rise sharply. We are entering this era.”

From special vouchers to Pieces-of-Eight to electronic money, imagine what the current disgusting economy will look like in the next decade.

In the 18th century, an adventure in the UK established an outpost in the New World near Hudson Bay. The Hudson Bay Company was licensed by the King to develop the rich resources of the northernmost region of North America and eventually established a trading network to trade fur, timber and mineral resources. The network is mainly represented by a series of fortresses that protect ordinary stores that extend south and west to Oregon, along the Pacific coast, which will sooner or later become cities such as Portland, Vancouver, and Toronto.

- A-share: Bitcoin prices return to the blockchain sector and then rise to the catalyst

- Pivot: Will halving really lead to a rise in the price of the currency?

- lCO six years of concise history: genius, scam and myth

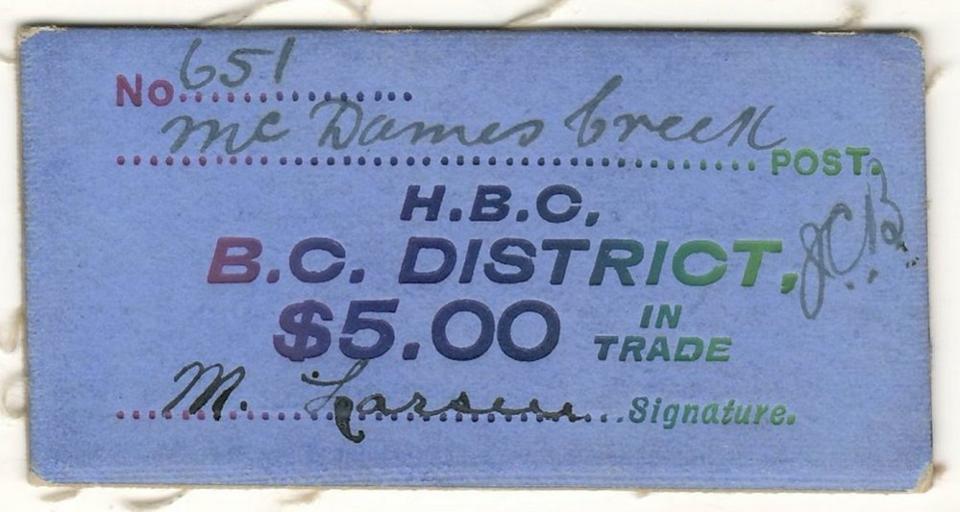

An example of a Hudson Bay Company token

The Hudson's Bay Company uses its own special tokens in its territory. This token is valuable because it can be converted into pounds or more or less standard. When Canada was founded in 1867, it established its own territory by purchasing land from the Bank of Canada and making the Bank of Canada's tokens fully convertible into new Canadian dollars. In fact, privately held tokens become the de facto currency of a country.

For a long time, the empire, the king, and the monarchs all had the right to print their avatars on coins, but until recently, the value of these coins was mainly determined by the test weight of the metals that make them up. In fact, the 16th century Dutchman marked the gold coin so that one person could divide the gold coin into eight equal parts. The popular "Pieces of eight" in the pirate story came from this. They also coined coins from the silver mine in Joachim's Valley (Joachimsthal in Dutch), which were first used extensively by Spanish territory and later used by English-speaking North Americans. This name is often first used. Abbreviated as "Thaler" and then abbreviated as "Dollar" in Spanish.

"Pieces of eight", so named because the 17th century Spanish dollar coins are often broken into eight pieces, later called "piece"

After the death of King Louis XIV of France, the French economy was fragmented due to the financial overvalitation of the Sun King. The Duke of Orleans, the regent of the five-year-old new King Louis XV, sought help from his friend, the Scottish financier John Law. Labor proposed a small-scale proposal that had never really been tried at the national level: creating a banknote backed by the government and theoretically convertible with silver.

Although this experiment was effective for some time, speculators made the currency unstable, and then the government produced a franc that exceeded its level, which exacerbated this instability and caused the currency to collapse, greatly weakening France’s The ability of the North American colonies to compete. It also weakened the influence of the king on the nobility and shaken the stability of the French court. This laid the foundation for the French Revolution decades later.

Nevertheless, when Europe changed from a feudal dependent state to a nation-state, controlling the casting of banknotes based on the status of banknotes as a promissory note became one of the main privileges of all countries. This is one of the reasons. When the first US federal government established after the American Revolution, realized that they needed a stronger government, one thing the federal government reserved for itself rather than allowing states was the exclusive right to coin and currency.

Money has long been a privilege of nations, but as electronic money returns to the commercial roots of most currencies, this situation may be changing.

Fast forward for 250 years, you can see that history is actually repeating itself. The operation of the monetary system has the following basic characteristics:

Banknotes must be unique and cannot be copied.

Money must be redeemable at any time – if not enough people are willing to accept that the currency has a certain value, it cannot be used as a medium of exchange.

Money must be relatively stable – its value is roughly the same over time.

These three conditions constitute some practical constraints on the currency, although this is not always obvious.

For example, if you increase the supply of a currency, you might think that it would dilute the value of the currency. Maybe, maybe not. If the demand for money is high, increasing the money supply may actually accelerate economic growth. If the demand for money is low, increasing the money supply may only lead to inflation. If money can only be exchanged in certain places, its utility as a means of storing value will be reduced. If a currency today is only half the value of yesterday, then people will quickly sell the currency and buy a more stable currency.

In fact, most banknotes do not fully satisfy the above constraints for a long time. Worse, the relationship between money and value may be non-linear. This is because the currency itself represents purchasing power. In 1971, the price of a gallon of gasoline in most places was 29 cents. Today, the same gallon of gasoline is priced at $2.90. Ironically, a loaf of bread costs $0.29 and $2.90. The average wage in 1971 was $10,000, and today it is $50,000.

This is worth emphasizing, but more from an economic perspective than a technical perspective. Simply put, the wages of ordinary workers have risen by 400%, but the price of most commodities has risen by 1000% in the past 50 years (or, compared to the cost of living, you are now earning 60% less than in 1971) . The actual utility of a gallon of gasoline has not changed much during this time, which means that the change is the purchasing power of a given currency and the change in wages relative to the cost of goods. Why? This is another topic.

Electronic currencies such as BitCoin and Ethereum rank high in terms of guaranteeing uniqueness, but their convertibility is poor and they are still heavily influenced by speculators, making them less suitable for stable currencies.

So, what role does cryptocurrency play in it?

At present, among the three points highlighted above, the cryptocurrency can be said to be very, very good on the first point, and getting better and better on the second point (although still not very good), but it is really bad at the last point.

Consider this. One of the biggest arguments for supporting cryptocurrencies is that they are difficult to forge. This is possible – investing enough computing power, you can actually do it, but the point is that the cost of doing so is likely to exceed the value of the coin. The disadvantage of doing this now is that many of the mechanisms that determine uniqueness (such as mine cost) are also very expensive, not only in terms of calculation cycles, but also in terms of energy costs.

That's one of the reasons why some of the main coins themselves are too big to be used as currency – you have to divide a coin into 1000 different small coins to get a cup of coffee and a sweet roll at Starbucks, and this There is still a need for an effective uniqueness algorithm.

However, even with weaker algorithms, the forgery of such miniature coins is still orders of magnitude higher than that of a normal 20-dollar bill. In terms of forgery, $20 is undoubtedly the most popular currency in the world. However, this is actually becoming less and less important for the simple reason that the banknotes themselves are becoming obsolete, except in very poor people (they often have difficulty opening accounts in banks). For most of the second half of the 20th century, credit cards made significant progress in eliminating banknotes. Recently, the advent of chip credit cards (including credit cards and debit cards) has greatly reduced the incidence of fraud.

The bigger problem today is online credit card fraud. However, the introduction of e-wallets (and the growing liability of every hacking incident that retailers face through class actions) is driving advances in data encryption technology, as well as consumption. Better control of the data. This is not to say that credit card fraud is no longer a problem, but that the problem has shown signs of abating.

Another impact of the rise of credit cards, debit cards, digital reward cards, gift cards and e-commerce systems may be far more profound, that is, it is destroying the physical form of money and destroying most countries’ currencies. Final control.

the reason is simple. Now, you can open a foreign exchange account with the specified currency in yen, euro or pound, and then withdraw as much as possible from the US fund account. You can set up a password account in much the same way, and even set up an account with some creative work, allowing you to make currency arbitrage across multiple such accounts.

If Amazon, Google, Microsoft, Apple, or Facebook (or other countries' counterparts) have established their own digital currency, you can do the same. Amazon is actually creating a highly collaborative ecosystem that is itself an almost boring economy.

After 10 to 20 years, your salary is likely to be paid in private electronic money instead of your own national currency, which will cause an uproar in politics.

Put yourself in ten years. Amazon (for example) introduced a cryptocurrency called bezo (a bezo, two bezos, …). You can continue to set up a dollar account for Amazon prime, but you can also create a bezos account based on the blockchain structure under Amazon's control. In dollar terms, prices began to climb, because even during the recession, the US economy showed a large net positive inflation, but the price of bezos remained unchanged.

Other companies have seen this and offer the option of using bezos to pay employees' salaries. Some old employees will resist, but young employees will take risks. After a while, older employees find that their net purchasing power continues to decline, while employees in the Amazon ecosystem see a stable wage, and then you will see a shift as older employees start doing the same thing. .

Other companies did this themselves, but found that there were not enough people in their network to maintain stability, so they took the initiative to join the Amazon network. Banks have noticed this. Suddenly, you see Amazon's currency replacing the dollar in more and more transactions, many of which amount to millions or even billions of dollars.

Then Amazon transferred the Amazon currency network to the Cayman Islands.

Overnight, 35% of the US tax base disappeared. Too many people no longer trade in dollars. For decades, US debt has been a time bomb, and as the United States can no longer pretend to repay the deficit, let alone repay all debt, US debt will explode.

Considering that the central federal government is becoming more hostile and demanding (while providing less and less value for taxes paid to its citizens) and the difficulty of using more stable currencies and more autonomous work, it can only begin to think, At the policy level, it was incredible: opt in to different political alliances to share money based on a common agreement.

A very obvious possibility of the integration of private and public e-money is that it is likely to exacerbate the already widening differences in geopolitics.

Another situation can be envisaged. Recently, Wal-Mart announced that they have a patent for a new blockchain currency, which means they will issue a currency in the near future. Amazon and Walmart are seen as competitors in the commodity sector, and although there are some overlaps, they often serve different regions (and their customers tend to have very different political tendencies).

(Note: On August 2, the US Patent and Trademark Office (USPTO) published a patent application, "Systems and Methods for Building Digital Money Through Blockchain." It is noteworthy that the applicant for this patent is US retail. Giant Wal-Mart. This shows that Wal-Mart is likely to develop its own encrypted digital currency. There are reports that Wal-Mart has about 2.2 million employees worldwide. This is 1.34 million more troops than the United States + 766,000 troops in Russia. Add more together.)

Over time, you will get two competing currencies, Bezo and Walton. They each offer a premium in their respective networks, providing double penalties in the opposite network—the double fact is that in order to turn Bezo into Walton, you have to convert one currency into dollars and then switch to other currencies. Each transaction point is charged (this is often the case with existing currency exchanges, where you must find a common currency to exchange between two different currencies without other exchange rates).

Over time, the two economies have disagreed, Bezo and Walton have responded to different economic strategies, and people’s disappointment has increased. The political power change in Washington, DC has also brought about one currency or another. The obvious preference for a currency, and all of this implies a policy preference.

Trying to link any kind of private currency to the US dollar, the final result is similar to the experience of the EU in 2008. When it is correct for the northern countries with a strong industrial base, it is proved that for the southern countries with agriculture as the mainstay. It is devastating (in fact it is also part of the current problem between red and blue America).

In this case, what is likely to happen is the rise of the contract – agreements between states that are based on specific policies, including economic action, taxation, representation, immigration, public projects, national defense, ecological policy, Education, etc. In other words, the emerging currency network (probably networked, not just a single currency) will begin to become more and more like an autonomous country. What followed was a reduction in the power of the Washington, DC, and federal governments, as states were more closely maintaining their tight alliances.

One of the main problems facing most ecosystems is that they are still highly unstable due to the relatively small number of investors, the speculative activity that may be volatile, and the government’s potential to violate such transactions.

The main mitigating factor in this situation is the lack of stability of the cryptocurrency, which is a chicken or egg. Stability ultimately depends on the number of participants, and the number of participants determines how much speculative activity can go in a currency. Speculation and stability are back-weighted – most speculators prefer a more volatile asset class because this volatility can achieve higher returns with less capital, but it can also result in higher losses. You can speculate in a stable currency (as George Soros did successfully with the pound in the 1970s), but it requires a lot of financial resources and a lot of leverage, which would be ruined without success. you.

Bitcoin and other cryptocurrencies are still very unstable, mainly because they lack both a large user base and because they are not fully redeemable or redeemable. Whether the first generation of ICOs will meet this standard alone is controversial, but once you start to see the merger and adoption of ICOs with large financial or networking companies, the situation will change.

This also raises another major selling point that ICO promoters are trying to raise. If the transaction in this currency remains anonymous, then any currency will cease to exist and it will become more and more difficult to keep this transaction anonymized over time. The reason is relatively simple— any transaction has a real-world meaning that can be tracked, and once a thread of a transaction begins to be detached, it is possible to determine how these threads connect to other transactions.

Government opacity (which is a form of anonymity) will make many existing icos never be recognized as legitimate, and is likely to be seen as the perfect channel for money laundering and black market transactions, allowing these icos to be thoroughly reviewed. Money based on (semi)transparent blockchains (you are increasingly seeing currencies developed by financial institutions) may exceed the anonymous blockchain currently in use.

The future of finance (and bank accounts) is likely to be that a typical account is actually an index of different electronic currencies, including public and private currencies.

In the long run (15 to 20 years), the average consumer may not interact too much with ICOs at all. Instead, what I see is that banks (and similar bank entities, such as credit unions) will control the currency portfolio, and the account will consist of a basket of different coins on different networks. Consumers can then decide which combination of coins they hold and can specify the default currency they want to receive (or pay) when making a financial transaction.

However, at the micro level, these monetary networks and currency baskets will be handled in much the same way as current national currencies, and the pull of these private currencies on national currencies may reach an unprecedented level to date, which also increases. The problem. What happens when Bezo replaces the yen (or US dollar) as the main tool for arbitrage trading? If Iran's eDinar becomes the currency of choice for oil pricing, or an international event causes investors to buy Chinese eYuan, sell dollars, increase What is the possibility of rising US oil prices (and vice versa)?

It is almost certain that over time, the differences between already ambiguous multinational companies and countries will be further narrowed. Companies will increasingly find that they must develop a comprehensive foreign policy and send security forces to deal with issues that traditionally belong to countries. At the same time, some fundamental issues, including seemingly difficult issues that constitute citizenship, will become urgent sooner than we think.

As a result, bitcoin and related e-currency are likely to continue to exist, and as they become more stable, their influence on political and economic policies will grow larger and will almost certainly bring the global economy throughout the 21st century. Come to stress and potential crash points.

Author: Kurt Cagle Kurt Cagle is an author, information architect and futurist, focusing on cross-computer technology and society. It is also the founder of intelligent data company Semantical LLC.

The article was published on August 5, 2019 by Forbes.

Compile: Sharing Finance Neo

Original link:

Https://www.forbes.com/sites/cognitiveworld/2019/08/05/crypto-currencies-are-poised-to-radically-change-finance–and-reshape-nations/#1da4e96368fa

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Bloomberg: Bitcoin is not an ideal safe-haven asset

- Charlie Lee: Litecoin needs more substitutability and privacy to make a bigger breakthrough in market capitalization

- China and the United States upgrade each other, BTC welcomes golden moments

- Supermarket giant Wal-Mart's "money war", want to bitcoin, Libra to the world?

- Why do you even hold some bitcoins even if you don't like it?

- US SEC Commissioner: The United States can learn from these countries for cryptocurrency policy

- Blockchain Weekly | In July, there were many security incidents in the exchanges and wallets. What happened to the market after the Litecoin was halved?