The volume of encrypted loans has exploded, and the total volume in the past 4 months is close to the previous 16 months.

Loans based on cryptocurrencies have been around for a few years. However, although the use of smart contracts to build automated loans has its inherent advantages, this volume is still relatively low, at least until recently.

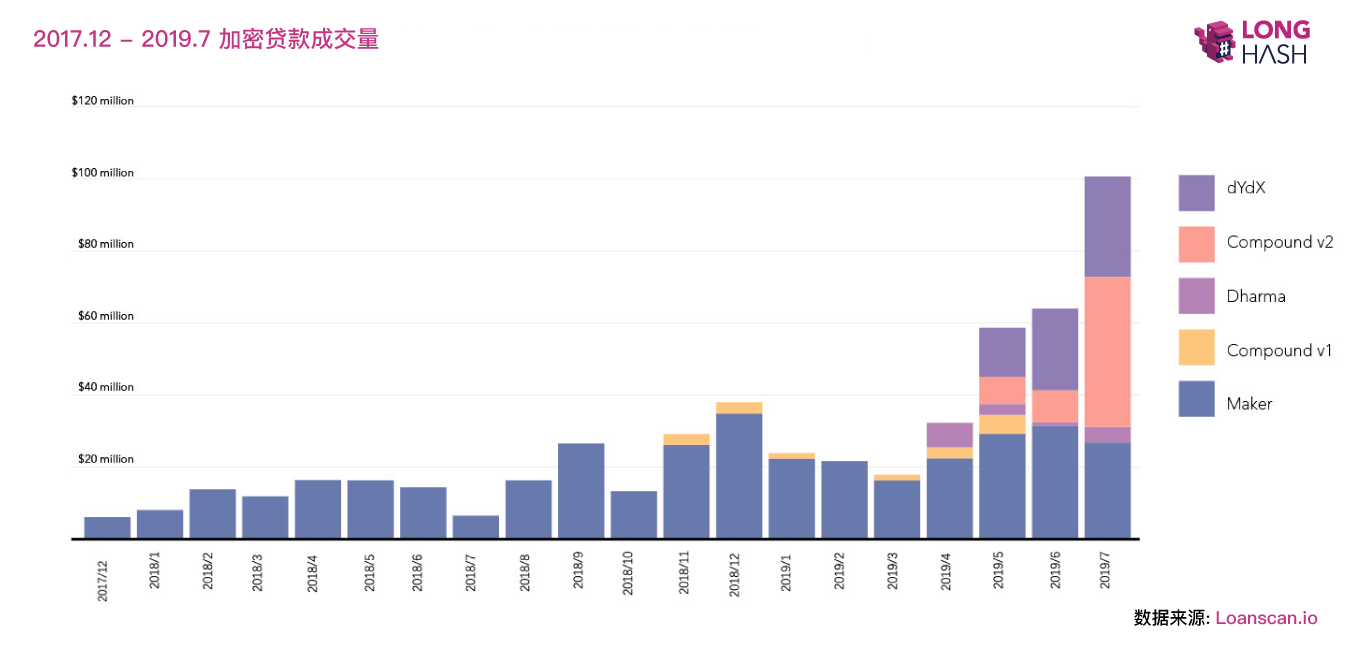

After a four-month decline, the decline in the volume of encrypted loans finally ended in April this year, followed by four consecutive months of growth. In addition, the volume of encrypted loans in July has more than doubled the previous highest volume in a single month.

In fact, according to data from LoanScan.io as of the end of July, the volume of encrypted loans in the past four months (approximately $257 million) was close to the previous 16 months (approximately $284 million) in total volume.

- Analysis and Interpretation of Libra and USDT Hearings

- Getting started with blockchain | Counting 11 commonly used blockchain development tools, engineers with annual salary of one million are using

- MasterCard MasterCard Adds Executive Recruitment Information to Promote Encryption Wallet Development

But relatively speaking, the crypto loan market is still small. To date, the platform tracked by LoanScan has issued loans worth approximately $546 million. However, compared with the traditional loan market: only the US leveraged loan turnover this year reached about 311 billion US dollars .

Despite this, the growth of the crypto loan market is still evident. The question is: Why does this happen? As shown above, this explosion reflects the increased focus and new customer base brought by Dharma, Compound v2 and dYdx new product launches. (Note: Although dYdX provides other forms of transactions other than loans, this article only focuses on its encrypted loan turnover).

In April of this year, Dharma launched its loan platform to the public , becoming the first platform to impact these new platforms. But the introduction of Compound v2 and dYdX (in May and late April respectively) has had a greater impact, and has also managed to maintain stronger volume growth, with sustained monthly increases in June and July. Dharma slowly disappeared. In particular, Compound v2 experienced an explosive growth this month, more than four times that of June.

It remains to be seen whether Compound v2 and dYdX will maintain their impressive growth patterns. But they already have a good start.

LongHash , read the blockchain with data.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- From Algorand to ThunderCore, is the academic aura a token of poison?

- Technical Guide | Ethereum 2.0 Phase 0 V0.8.0 Technical Specifications (1)

- QKL123 market analysis | Forex market smoke, bitcoin broke 12,000 US dollars? (0805)

- Zou Chuanwei: Economics and regulatory issues in blockchain

- Coindesk Senior Analyst: The dollar is coming to an end, bitcoin or become one of the global reserve currencies?

- New Iranian law: the government does not recognize cryptocurrency-related transactions, but allows for conditional mining

- There is no doubt about Bitcoin's safe-haven properties. Will there be spring in the altcoin?