How far can Friend.tech, the new darling of Web3 social, go in the future?

Friend.tech's future potential in the Web3 social space?Friend.tech, as one of the highly anticipated projects on the current Base chain, has shown enormous potential. In less than two weeks, its transaction volume has exceeded 25,633 ETH, attracting well-known individuals and venture capital firms to join. These additions have injected more exposure, social influence, and trust support into Friend.tech, making it a highly sought-after Web3 social darling.

However, behind the popularity of Friend.tech, people are more concerned about its future direction. Past SocialFi applications such as BitClout have proven that the initial success of a product does not guarantee its long-term prospects. Although Friend.tech is excellent, it is still in the early stages of development and has not yet matured. Therefore, we need to analyze the innovative features, competitive advantages, and current drawbacks of Friend.tech in depth to help us more accurately evaluate its future development potential.

What is Friend.tech and why is it popular?

Friend.tech is a DApp based on the Base ecosystem. It allows users to buy and sell shares of other users on Friend.tech using Ethereum on the Base chain, with a strong integration with Twitter. Its main functionality is similar to WeChat groups and Telegram groups, but its core lies in the organic entry and exit of group chats. Users can choose to join a group chat and pay the base price to acquire shares of that group. If they want to exit the group chat, they can sell the shares they hold.

- Is Chainlink (LINK) about to witness a 40% price breakthrough?

- LianGuaiWeb3.0 Daily | Three lawyers from the US SEC withdraw from the lawsuit against Ripple

- Retiring from Unibot Why am I optimistic about Unibot?

Joining a group chat not only satisfies social needs but also has investment potential. As the number of people joining a group chat gradually increases, the total number of shares in the group increases, and the base price of each share also increases. This means that joining a group chat not only satisfies social needs but also allows for investment returns. Therefore, speculative users tend to buy shares of other group chats or their own group chats that they believe have potential in the early stages.

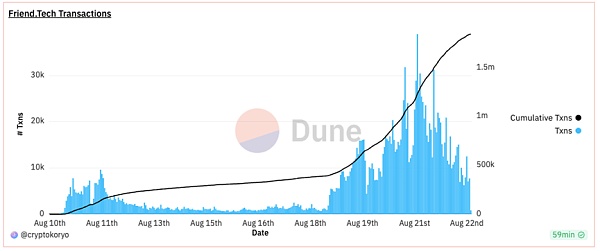

According to data from Dune Analytics, since the launch of the test version of Friend.tech, it has attracted 7,860 users and a trading volume of 4,400 ETH (equivalent to $8.1 million) in less than 24 hours, with over 126,000 transactions. This far exceeds the trading volume of OpenSea during the same period. So far, Friend.tech has attracted the attention of over 100,000 users, and well-known KOLs such as Frank DeGods and Gainzy222, trader RookieXBT, and NBA player Grayson Allen have also joined the trend.

The popularity of Friend.tech is due to both market opportunities and marketing strategies. After the GameFi craze, the entire industry is looking for the next application that can break traditional boundaries. SocialFi, as a field that combines traffic and encryption attributes, is seen as one of the most promising directions for breakthroughs. For a long time, people have been trying to use blockchain to create decentralized versions of Facebook (Meta) or Twitter (X), allowing users to own their data and create an on-chain reputation system for social use cases. Friend.tech has emerged to meet this market opportunity and demand.

Furthermore, as a decentralized social application, Friend.tech has achieved great results in project marketing. Friend.tech’s marketing strategy combines the strengths of many, with a focus on short-term, high-frequency and intensive public relations strategies. Whether it’s content, timing, or community strategies, they are all considered classic. In the early stages, they focused on creating a sense of mystery, which sparked the curiosity of users. Then, they relied on well-known KOLs to promote the product, attracting more users to participate. At the same time, they cleverly used invitation codes for viral marketing, stimulating users’ desire to participate and attracting more people to join. In addition, with the endorsement of top VCs. The skillful use of all these strategies has contributed to the current popularity of Friend.tech.

Friend.tech: Product Features and Gameplay

Friend.tech is an innovative Web3 application that leads the transformation of the social field. It not only has advantages in marketing and promotion, but also showcases its unique charm through carefully crafted product features. When implementing the KOL monetization plan, Friend.tech learned valuable lessons from BitClout. Compared to BitClout, which faced community resistance due to its forced launch and eventually integrated into the Deso project, Friend.tech innovated from the standpoint of protecting user rights and optimizing user experience. It adopts the method of actively inviting KOLs to join and greatly enhances the user experience through the use of Base chain L2 technology.

Friend.tech also demonstrates innovative charm in terms of product features and gameplay. The four innovative features it has launched include “Social Tokenization,” “Share Trading,” “Fan Economy,” etc., which bring users a brand-new social interaction experience. These features are all built on a decentralized basis, quantifying and releasing social value through algorithms and market-oriented means, creating new opportunities for users.

-

Social Tokenization: Friend.tech quantifies the popularity and interaction on users’ Twitter accounts into social tokens. This social tokenization mechanism makes users’ influence a measurable and tradable asset, providing users with a direct way to participate in and benefit from their influence. Through the social tokenization mechanism, users can turn their influence into tradable assets with actual value, further expanding the range of their social influence.

-

Share Trading: Friend.tech allows users to use ETH to purchase social token shares of other users, which represent the popularity and interaction on Twitter. Users can freely decide when to buy or sell shares based on market supply and demand, and profit from it. This share trading mechanism provides users with a way to invest in and trade social influence, enabling them to participate in the economic system of the social network and share the growth value of their social influence.

-

Fan Economy and Influence Game: Friend.tech, with fan economy at its core, has created a unique influence game. Users can use ETH to purchase shares of other users, gaining the privilege to interact with the purchased user, i.e., a friend slot. Buyers can have one-on-one conversations with the purchased user, supporting and engaging with their favorite social influencers. This design stimulates users to actively participate in the interaction and development of the social network, transforming social influence into actual social interaction, enhancing the connection and activity between users.

-

Transaction Fees and Revenue Sharing: Friend.tech charges additional transaction fees during the trading process, with a portion going to the protocol and the other portion going to the shareholders involved in the transaction. For the social influencers (KOLs) whose shares are being purchased, each transaction of shares can earn them a certain percentage of transaction fees. This design encourages KOLs to increase the frequency of transactions to earn higher profits, promoting the activity and liquidity of the entire social network.

Friend.tech: How Far Can the Future Go Under the Glare of Shadows

With its innovative social + economic model, Friend.tech has brought users a new experience of participation, interaction, and value realization, triggering a revolutionary wave in the Web3 social field. It opens up a dynamic and opportunistic new social world for users, where both KOLs and ordinary users can gain richer social experiences and economic benefits through the platform.

However, beneath the surface prosperity of Friend.tech, we see that there are still significant challenges on its development path. Looking at the product itself, Friend.tech still has many unresolved issues: its sustainability is in doubt, its business model needs further testing, and it lacks attractiveness to top KOLs. These issues will all affect whether Friend.tech can go further in the short term under the glare of shadows.

Firstly, many people have doubts about the sustainability of Friend.tech. They question issues such as the lack of a clear privacy policy, the requirement to deposit Ethereum during registration, and the unclear project roadmap. Due to these factors, there are concerns about the security and long-term development of Friend.tech. In particular, the lack of clear privacy terms has raised concerns about the security of personal information, causing users to hesitate when providing personal information to Friend.tech.

Secondly, Friend.tech’s business model needs further validation. The application relies on the economic interaction between KOLs and fans to achieve monetization, where fans can acquire the right to converse with KOLs by purchasing their shares. However, the problem lies in the fact that owning shares does not guarantee a response from KOLs; it entirely depends on the personal willingness of the KOLs. In this model, KOLs have no obligation to respond to fans. Therefore, Friend.tech faces the dilemma of “paying to send messages but not necessarily receiving a reply,” similar to sending a private message on Twitter but without the obligation for the recipient to reply. This makes Friend.tech’s functionality more like a mere display, and fans can only achieve benefits by continuously buying new shares and waiting for others to take over, raising doubts about the sustainability of the entire monetization model.

Additionally, there are significant doubts about whether Friend.tech can attract enough KOLs to join. Although many KOLs are sharing Friend.tech invitation codes on Twitter, top-tier KOLs themselves do not lack monetization channels. Rather than making money, they are more concerned that the extreme volatility of tokens after joining Friend.tech may lead to dissatisfaction among fans, thereby affecting their influence on other platforms (such as Twitter). As for medium and small-sized KOLs, their influence is limited, and even if they join Friend.tech, it is difficult for them to obtain substantial profits through the platform.

In addition to the above-mentioned issues, Friend.tech also has a potential hidden danger:

-

Lack of competitive product features: Friend.tech has serious interface malfunctions and insufficient features, directly affecting the user experience. For example, problems with loading chat content and the lack of common features (such as photo sharing) restrict users from obtaining a comprehensive social experience on Friend.tech. Although Friend.tech has subsequently expanded its community features and provided KOL-exclusive VIP content, in reality, traditional platforms such as Telegram, WeChat, and Discord groups can already meet these needs and have more mature and comprehensive features, making users more sticky to them. Compared to these platforms, Friend.tech does not have any obvious advantages.

-

Lack of transparency and planning: Friend.tech has been online for nearly two weeks, but the project has not yet released its whitepaper and roadmap. This leaves people with an impression of vagueness and lack of transparency, weakening their confidence in the future development of Friend.tech. Users and investors hope to have a clear understanding of Friend.tech’s vision, plans, and development direction, and the lack of this information triggers doubts and uncertainties.

-

Compliance risks: With the rapid development of Web3, regulatory agencies are paying increasing attention to cryptocurrencies and blockchain technology. Friend.tech’s business model is somewhat similar to the stock market, where crypto influencers can share profits with buyers to increase trading volume and prices. This raises the possibility of Friend.tech facing compliance risks of being considered an unregistered security by the U.S. Securities and Exchange Commission.

In summary, as a Web3 social application, Friend.tech’s pricing model for personal influence tokens exhibits a trend of FOMO (Fear Of Missing Out). With high expectations for airdrops and marketing promotions by KOLs (Key Opinion Leaders), Friend.tech may be able to maintain a certain level of popularity in the short term. However, in the long run, this hype driven solely by sentiment is not sustainable. Once the hype cools down, users will return to focusing on the product itself and begin to notice the flaws of Friend.tech. If Friend.tech fails to successfully establish a genuine connection between fans and KOLs, and optimize its product structure and business model, its future growth potential will be greatly limited. In the future, Friend.tech may suffer the same fate as BitClout and fail to achieve sustainable development.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Bitstamp will terminate its Ethereum staking service for US customers.

- THORChain Research Report More than just a DEX, revolutionizing DeFi

- Cypher announces a solution to address the loss of funds, and will accelerate the IDO process.

- Understanding MEV through On-Chain Data and Transactions

- Alameda Engineer SBF stole my life savings

- US Department of the Treasury Arrest and Sanction Tornado Cash Co-founder

- Binance Labs invests in DeFi yield protocol Pendle Finance.